Nearly 80,000 More Borrowers Get Student Loan Debt Canceled

Nearly 80000 more borrowers will get all their student loan debt canceled – Nearly 80,000 more borrowers will get all their student loan debt canceled, a move that has sent ripples through the financial world. This latest wave of loan forgiveness is a significant development in the ongoing saga of student debt in the United States, offering a glimmer of hope for many struggling to repay their loans.

This decision marks a shift in the government’s approach to student loan debt, potentially impacting the lives of thousands of borrowers and sparking debate about the future of student loan policy.

The decision to cancel loans for this specific group is rooted in a combination of factors, including the recognition of the crippling burden of student debt and the desire to promote economic mobility. While this move provides immediate relief for the fortunate recipients, it raises questions about the long-term sustainability of such programs and the potential impact on the government’s budget.

This latest development is a crucial step in the ongoing dialogue about student loan debt, a complex issue that touches the lives of millions of Americans.

Impact on Borrowers

The cancellation of student loan debt for 80,000 borrowers represents a significant financial relief for those individuals. This act has the potential to significantly improve their financial well-being, opening up new possibilities for financial planning and future investments.

Financial Implications of Loan Cancellation

The cancellation of student loan debt will have a direct impact on the financial situation of the 80,000 borrowers. They will no longer be burdened with monthly loan payments, freeing up a substantial portion of their income. This extra cash flow can be used to address other financial priorities, such as saving for retirement, purchasing a home, or paying off other debts.

The news that nearly 80,000 more borrowers will get all their student loan debt canceled is definitely a positive development, especially considering the economic challenges many are facing. This comes at a time when asia pacific markets mostly rise after south koreas inflation rate hits 42 month low , indicating some global economic stability.

Hopefully, this positive trend continues, and more people can find relief from the burden of student loan debt.

Benefits and Challenges, Nearly 80000 more borrowers will get all their student loan debt canceled

Benefits

The cancellation of student loan debt brings several potential benefits to the borrowers.

- Increased Disposable Income:Borrowers will have more disposable income available for other expenses, such as housing, food, transportation, and healthcare. This can lead to improved financial stability and a higher standard of living.

- Improved Credit Score:By eliminating student loan debt, borrowers can see an improvement in their credit score. This can lead to lower interest rates on future loans and credit cards.

- Reduced Financial Stress:The burden of student loan debt can be a significant source of financial stress. The cancellation of this debt can alleviate this stress and improve overall well-being.

- Increased Financial Flexibility:With the weight of student loan payments lifted, borrowers will have greater financial flexibility to pursue their goals, such as starting a business, investing in their education, or traveling.

Challenges

While the cancellation of student loan debt offers significant benefits, it also presents some potential challenges.

It’s great news that nearly 80,000 more borrowers will get all their student loan debt canceled! It’s a reminder that sometimes, even when things seem unfair, there’s a chance for change. Just like the NYC mom who’s challenging the ban on mothers in top beauty pageants, proving that being a parent isn’t a crime, nyc mom challenges ban on mothers in top beauty pageants being a parent is not a crime , we can all work towards making the world a more equitable place.

Hopefully, the positive momentum of these stories will lead to more progress on the student loan front as well.

- Financial Planning Adjustments:Borrowers may need to adjust their financial plans to account for the sudden increase in disposable income. They may need to re-evaluate their budget, saving goals, and investment strategies.

- Temptation to Overspend:The extra income from not having to make loan payments could lead to overspending. Borrowers need to be mindful of their spending habits and ensure they use the extra income responsibly.

- Lack of Financial Literacy:Some borrowers may lack the financial literacy to effectively manage their increased income. It’s essential to seek guidance from financial advisors or educational resources to make informed financial decisions.

Comparison of Financial Situations

The following table highlights the key differences in the financial situations of borrowers before and after loan cancellation:

| Financial Aspect | Before Loan Cancellation | After Loan Cancellation |

|---|---|---|

| Monthly Loan Payments | Significant portion of income | $0 |

| Disposable Income | Limited | Increased |

| Credit Score | Potentially lower due to loan burden | Improved |

| Financial Stress | High | Reduced |

| Financial Flexibility | Limited | Increased |

Government’s Role: Nearly 80000 More Borrowers Will Get All Their Student Loan Debt Canceled

The government’s decision to cancel student loans for a specific group of borrowers is a complex issue with significant implications. This policy aims to address the growing burden of student debt and its impact on individuals and the economy.

The news about nearly 80,000 more borrowers getting their student loan debt canceled is certainly welcome, but it’s also a reminder that we need to address the bigger picture of climate change. It’s encouraging to see the EU taking action by requiring airlines to monitor their vapor trails, as outlined in this article airlines must monitor vapour trails under new eu climate rules.

These efforts, combined with student loan relief, are steps in the right direction towards a more sustainable and equitable future.

Rationale for Student Loan Cancellation

The government’s decision to cancel student loans for this specific group is likely based on a combination of factors, including:

- Addressing Economic Inequality:Student loan debt disproportionately affects low-income and minority borrowers, exacerbating existing economic disparities. Canceling debt for this group could help level the playing field and provide them with greater economic opportunity.

- Stimulating Economic Growth:By freeing up borrowers from debt payments, they can spend more on goods and services, boosting economic activity and creating jobs.

- Improving Social Mobility:High student loan debt can hinder borrowers’ ability to pursue higher education, start families, and buy homes, limiting their upward mobility. Cancelling debt could help alleviate these burdens and improve social mobility.

- Addressing Systemic Issues:The government may be acknowledging the systemic problems within the student loan system, such as rising tuition costs and limited access to affordable financing. Cancelling debt for certain groups could be a step towards addressing these broader issues.

Potential Economic and Social Impacts

The economic and social impacts of this policy are multifaceted and can be both positive and negative:

- Positive Impacts:

- Increased Consumer Spending:Borrowers with cancelled debt will have more disposable income, potentially leading to increased consumer spending and economic growth.

- Improved Credit Scores:Removing student loan debt can significantly improve borrowers’ credit scores, allowing them easier access to loans and other financial products.

- Increased Homeownership:With less debt burden, borrowers may be able to afford homeownership, contributing to housing market stability.

- Enhanced Labor Force Participation:Relieved from debt payments, borrowers may be more likely to pursue higher education or enter the workforce, increasing labor force participation.

- Negative Impacts:

- Moral Hazard:The policy could create a “moral hazard” where future borrowers may expect similar debt forgiveness, potentially leading to irresponsible borrowing.

- Increased Tuition Costs:Colleges and universities may raise tuition costs if they perceive the government will continue to bail out borrowers.

- Taxpayer Burden:Cancelling student loans will likely involve significant taxpayer costs, potentially impacting government budgets and other priorities.

- Fairness Concerns:Some argue that the policy is unfair to borrowers who have already repaid their loans or those who chose not to pursue higher education.

Long-Term Implications for the Government’s Budget and Student Loan System

The long-term implications of this program for the government’s budget and student loan system are complex and require careful consideration:

- Budgetary Impact:The cost of cancelling student loans could be substantial, potentially requiring significant tax increases or cuts to other government programs.

- Student Loan System Reform:The government may need to implement reforms to the student loan system to prevent future debt crises and ensure affordability.

- Future Policy Decisions:This policy could set a precedent for future debt forgiveness programs, potentially leading to further government intervention in the student loan market.

The Broader Context

The recent announcement of student loan forgiveness for nearly 80,000 borrowers adds to the ongoing conversation about the role of the government in addressing student loan debt. While this initiative is a significant step for those directly impacted, it’s essential to consider its place within the broader landscape of student loan forgiveness programs and the complex issues surrounding student debt in the United States.

Comparing This Initiative to Other Programs

This loan cancellation program is not the first attempt to address student loan debt. Several other initiatives, both existing and proposed, aim to provide relief to borrowers. These include:

- Income-Driven Repayment (IDR) Plans:These plans tie monthly payments to a borrower’s income, with the remaining balance forgiven after a set period (typically 20 or 25 years).

- Public Service Loan Forgiveness (PSLF):This program forgives the remaining balance of federal loans after 10 years of qualifying public service employment.

- The Biden Administration’s “One-Time” Forgiveness Program:This program, announced in 2022, provided up to $20,000 in forgiveness for eligible borrowers.

This new program differs from previous initiatives in its targeted approach. While IDR plans and PSLF offer long-term relief based on income or employment, the recent program directly cancels debt for a specific group of borrowers. The “One-Time” forgiveness program, although broader in scope, had income limits and other eligibility requirements.

The Broader Conversation on Student Loan Debt

The issue of student loan debt in the United States is complex and multifaceted. Several factors contribute to the problem, including:

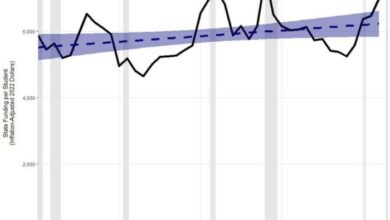

- Rising College Costs:Tuition and fees at both public and private institutions have increased significantly over the past few decades, making college increasingly unaffordable for many.

- Stagnant Wages:While college costs have risen, wages for many graduates have not kept pace, making it challenging to repay loans.

- Aggressive Lending Practices:Some lenders have encouraged borrowers to take on more debt than they can afford, often without adequate financial counseling.

The impact of student loan debt is widespread, affecting borrowers’ financial well-being, career choices, and overall quality of life. It can delay major life milestones such as homeownership, starting a family, or saving for retirement.

Approaches to Addressing Student Loan Debt

There is no single solution to the problem of student loan debt. Various approaches have been proposed, each with its own set of advantages and disadvantages:

| Approach | Pros | Cons |

|---|---|---|

| Loan Forgiveness Programs | Directly reduces debt burden, can provide immediate relief | Expensive for the government, may not address underlying causes of debt |

| Income-Driven Repayment Plans | Makes repayment more manageable for borrowers with lower incomes | Can lead to longer repayment periods, may not fully address the issue of rising college costs |

| Increased Funding for Public Colleges | Reduces tuition costs for students, makes college more affordable | Requires significant government investment, may not be feasible in the short term |

| Reforms to the Higher Education System | Addresses the underlying causes of rising college costs, promotes transparency and accountability | Complex and challenging to implement, may take time to see results |

Future Implications

This unprecedented student loan forgiveness program carries significant implications for the future of student loan policies, the higher education landscape, and the broader economy. Its impact will be felt for years to come, prompting adjustments in policy and shifting the dynamics of student loan markets.

Potential Policy Changes

The success or failure of this program will likely influence future student loan policies. If the program achieves its goals of reducing borrower burdens and promoting economic growth, it could serve as a model for future forgiveness initiatives. Conversely, if it faces significant challenges or incurs substantial costs, it might lead to a more cautious approach to future forgiveness programs.

- Increased focus on income-driven repayment (IDR) plans:This program could accelerate the adoption and expansion of IDR plans, which tie monthly payments to a borrower’s income. IDR plans are already gaining traction, and this program could further encourage their use as a more sustainable approach to student loan repayment.

- Reforms to the student loan interest rate structure:The program’s impact on interest rates could prompt a review of the current interest rate structure. This could lead to policies that aim to lower interest rates for borrowers, making repayment more affordable.

- Expansion of targeted forgiveness programs:The success of this program could inspire the development of targeted forgiveness programs for specific groups, such as borrowers in high-demand fields or those who serve in public service.

Future Student Loan Forgiveness Programs

This program could set a precedent for future student loan forgiveness programs, potentially leading to:

- More frequent forgiveness opportunities:The program could encourage the implementation of more frequent forgiveness programs, perhaps on a smaller scale or targeted to specific groups, to address ongoing concerns about student loan debt.

- Higher forgiveness amounts:If this program proves successful, future programs might consider offering larger forgiveness amounts to address the increasing burden of student loan debt.

- Expansion of eligibility criteria:Future programs could expand eligibility criteria to include more borrowers, potentially encompassing those with higher incomes or who did not attend specific types of institutions.

Impact on Higher Education Landscape

The program could have a profound impact on the higher education landscape, influencing:

- Tuition costs:The program’s impact on student loan debt could influence tuition costs. If borrowers perceive reduced debt burdens, they might be willing to pay higher tuition fees, potentially leading to an upward pressure on tuition costs.

- Enrollment patterns:The program could encourage more students to pursue higher education, knowing that they will have access to forgiveness opportunities. This could lead to increased enrollment in higher education institutions.

- Institution accountability:The program could incentivize higher education institutions to become more accountable for the affordability of their programs and the outcomes for their graduates.