Mortgage Rates Spike to Highest Level in Nearly 13 Years

Mortgage rates spike to their highest level in nearly 13 years, sending shockwaves through the housing market. This dramatic rise, fueled by inflation, the Federal Reserve’s monetary policy, and investor sentiment, has created a complex landscape for both prospective homebuyers and current homeowners.

The impact of these rising rates is undeniable. For potential homebuyers, affordability is a major concern, with higher monthly payments making homeownership a less attainable goal for many. The increased cost of borrowing could also lead to a decrease in demand for homes, potentially impacting prices and market activity.

Existing homeowners, particularly those with adjustable-rate mortgages, are also feeling the pressure as their monthly payments rise.

Current Mortgage Rate Landscape

Mortgage rates have surged to their highest level in nearly 13 years, a significant development that is impacting borrowers and the housing market. This recent spike follows a period of historically low rates, making it crucial to understand the current landscape and its implications.

Historical Context of Mortgage Rates

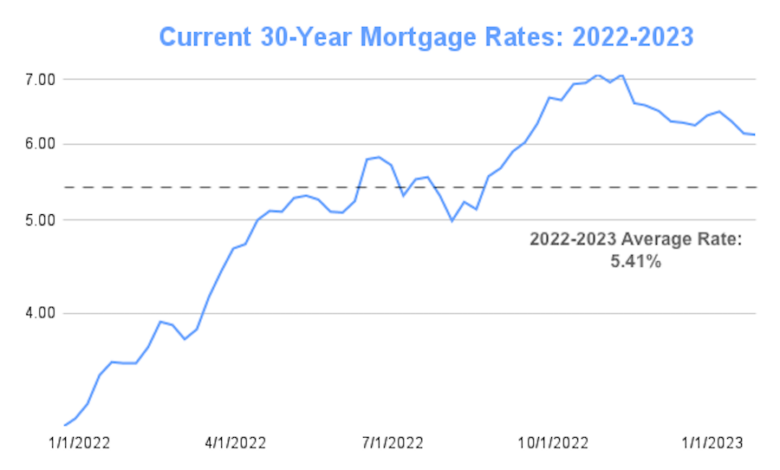

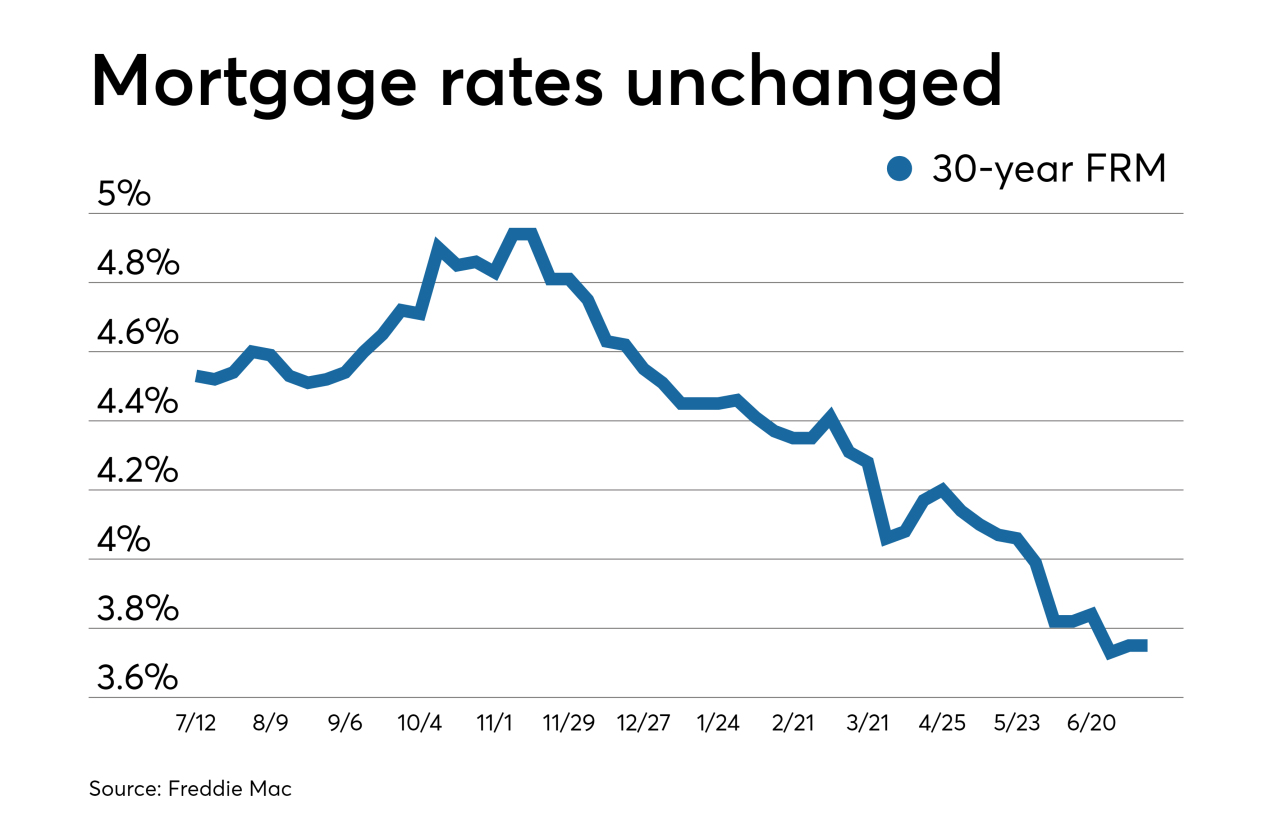

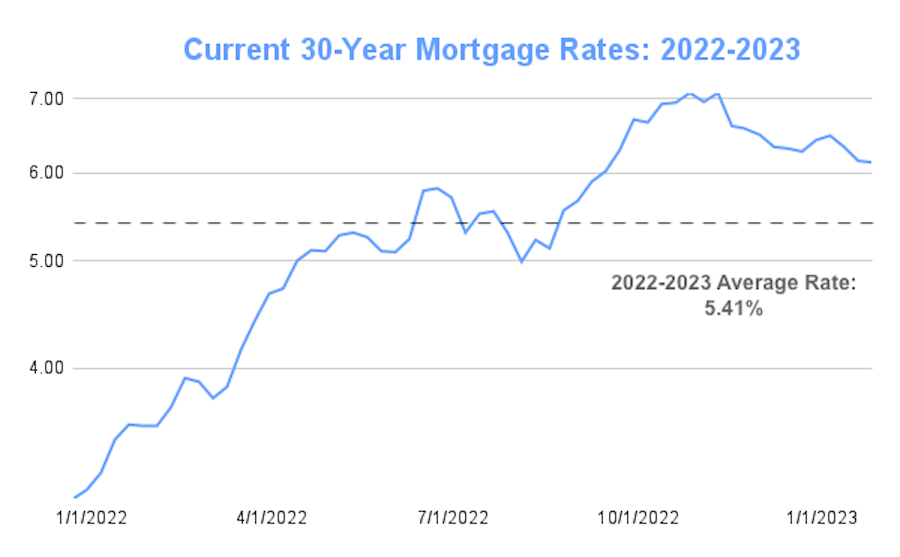

To grasp the magnitude of the recent rate increase, it’s essential to compare current rates to previous peaks and troughs over the past decade. The average 30-year fixed-rate mortgage, a benchmark for home loans, reached a low of 2.65% in January 2021, following the Federal Reserve’s efforts to stimulate the economy during the COVID-19 pandemic.

This rate was significantly lower than the average of 3.84% seen in 2019. However, since then, rates have been steadily climbing, surpassing 7% in October 2022.

Factors Contributing to the Rise in Mortgage Rates

Several factors have contributed to the recent surge in mortgage rates.

- Inflation:The U.S. economy has experienced a period of high inflation, driven by factors such as supply chain disruptions and increased consumer demand. The Federal Reserve has been raising interest rates to combat inflation, and these increases directly impact mortgage rates.

- Federal Reserve Monetary Policy:The Federal Reserve has been aggressively raising interest rates to cool down the economy and curb inflation. These rate hikes have pushed up borrowing costs across the board, including mortgage rates.

- Investor Sentiment:Investor sentiment plays a role in mortgage rates. When investors are optimistic about the economy, they are more likely to invest in mortgage-backed securities, driving down rates. However, when economic uncertainty rises, investors tend to move away from these securities, leading to higher rates.

Impact on Homebuyers: Mortgage Rates Spike To Their Highest Level In Nearly 13 Years

The recent surge in mortgage rates has created a challenging landscape for prospective homebuyers. The increased borrowing costs have significantly impacted affordability, potentially leading to a decrease in demand for homes. This shift in the mortgage landscape has implications for both home prices and overall market activity.

Affordability Challenges

Rising mortgage rates directly impact affordability for homebuyers. With higher interest rates, monthly mortgage payments increase, leaving less disposable income for other expenses. This affordability crunch can discourage potential buyers, particularly first-time homebuyers who may be more sensitive to changes in interest rates.

Mortgage rates are soaring, hitting their highest point in nearly 13 years, making homeownership a less attainable dream for many. Meanwhile, the legal drama surrounding Hunter Biden continues to unfold, as an attorney revealed that federal investigators have subpoenaed his paternity documents, including tax returns.

attorney says feds subpoenaed hunter biden paternity documents including tax returns This news adds another layer to the ongoing investigation, and it remains to be seen how it will impact the housing market, already grappling with rising interest rates.

For example, a $300,000 mortgage at a 4% interest rate would result in a monthly payment of approximately $1,350. However, if the interest rate rises to 7%, the monthly payment jumps to over $2,000, a significant increase that could make homeownership unaffordable for many.

Decreased Demand for Homes

The affordability challenges posed by rising mortgage rates can lead to a decrease in demand for homes. As buyers face higher borrowing costs, they may choose to delay their purchase decisions or adjust their search criteria to find more affordable properties.

This decline in demand can affect market activity and potentially slow down home price appreciation.

For instance, in the first quarter of 2023, the number of pending home sales declined by 14% compared to the previous quarter, reflecting the impact of rising mortgage rates on buyer demand.

Impact on Home Prices and Market Activity

The interplay between rising mortgage rates and affordability can influence home prices and overall market activity. If demand for homes weakens due to higher borrowing costs, sellers may need to adjust their asking prices to attract buyers. This could lead to a slowdown in home price appreciation or even a decline in some markets.

In areas where affordability is already a concern, such as major metropolitan areas, the impact of rising mortgage rates on home prices could be more pronounced.

Economic Implications

The recent surge in mortgage rates has significant implications for the broader economy, particularly in terms of overall economic growth and consumer spending. As mortgage rates rise, the cost of borrowing money to purchase a home increases, which can lead to a slowdown in housing market activity and, consequently, have ripple effects across various sectors of the economy.

Impact on Economic Growth and Consumer Spending

Rising mortgage rates can dampen economic growth by reducing consumer spending. When interest rates rise, individuals and families have to allocate a larger portion of their income towards debt payments, leaving less disposable income for other goods and services. This reduction in consumer spending can slow down economic growth, as businesses experience a decrease in demand for their products and services.

For instance, the rise in mortgage rates in 2022 contributed to a decline in home sales and construction activity, impacting the broader economy. The National Association of Realtors reported a 17.8% year-over-year drop in existing home sales in December 2022, reflecting the impact of higher mortgage rates.

With mortgage rates spiking to their highest level in nearly 13 years, many people are feeling the financial strain. It’s a tough time to be a homeowner, and it’s also a tough time to be an employer trying to retain valuable employees.

As Adam Grant suggests in his recent article, want to hang on to veteran employees nows the time for retention raises says adam grant , now is the time to consider retention raises to keep your best people. With the economy in flux, it’s more important than ever to show your employees that you value them and that you’re committed to their long-term success.

If you can do that, you’ll be well-positioned to weather the storm and come out stronger on the other side.

This slowdown in housing activity affected employment in construction, real estate, and related industries, ultimately contributing to a broader economic slowdown.

Relationship Between Mortgage Rates and Housing Market Activity

Mortgage rates play a crucial role in determining housing market activity. When mortgage rates rise, the cost of borrowing money to purchase a home increases, making it less affordable for potential buyers. This can lead to a decrease in demand for housing, resulting in a slowdown in home sales and construction activity.

The relationship between mortgage rates and housing market activity is inverse; as mortgage rates rise, housing market activity tends to decline.

For example, the sharp increase in mortgage rates in the early 2000s led to a significant decline in home sales and contributed to the housing bubble that burst in 2008. Similarly, the recent surge in mortgage rates in 2022 has already resulted in a slowdown in the housing market, with home sales and construction activity declining.

Impact of Housing Market Slowdown on Other Sectors

A slowdown in the housing market can have a cascading effect on other sectors of the economy. The construction industry, which relies heavily on new home construction, is directly affected by a decline in housing demand. This can lead to job losses in the construction sector, reducing overall economic activity.

Furthermore, a slowdown in the housing market can also impact the furniture, appliance, and home improvement industries, as consumers delay or cancel purchases related to their homes. The decline in home sales can also reduce property taxes, impacting local government revenue and potentially leading to cuts in public services.

Mortgage rates hitting a 13-year high is definitely a hot topic right now, and it’s making a lot of people anxious about buying a home. It’s a big shift in the market, and it’s interesting to see how it will play out.

It’s also a reminder that things can change quickly in the economy, and it’s important to be prepared for those changes. In a different realm, we’re seeing a shift in the Supreme Court with the arrival of Justice Jackson, a former law clerk returning to a transformed court.

Justice Jackson a former law clerk returns to a transformed supreme court It’s going to be fascinating to see how she impacts the court’s decisions in the years to come. Anyway, back to those mortgage rates, I’m not sure what the future holds for the housing market, but I’m sure it will be an interesting ride!

Strategies for Navigating the Market

The current mortgage rate environment presents both challenges and opportunities for homebuyers and existing homeowners. Whether you’re looking to purchase a new home or refinance your existing mortgage, understanding the market dynamics and employing strategic approaches can help you navigate the landscape successfully.

Strategies for Homebuyers, Mortgage rates spike to their highest level in nearly 13 years

Navigating the current mortgage rate environment as a homebuyer requires a strategic approach to secure a favorable loan. Here are some key strategies:

- Get pre-approved for a mortgage.A pre-approval demonstrates your financial readiness to lenders, strengthens your negotiating position, and allows you to shop for the best rates and terms. It also provides a realistic estimate of how much you can afford to borrow.

- Consider a shorter loan term.Opting for a 15-year mortgage, compared to a 30-year mortgage, may result in higher monthly payments but will lead to significantly lower interest costs over the life of the loan. This can be particularly advantageous in a high-rate environment, as it can help you save substantial amounts on interest.

- Shop around for the best rates.Compare rates from multiple lenders to ensure you secure the most competitive offer. Consider factors like closing costs, loan fees, and lender reputation when evaluating different options.

- Negotiate with the seller.In a competitive market, consider negotiating with the seller to cover some of your closing costs or offer a lower purchase price. This can help offset the impact of higher mortgage rates.

- Consider a fixed-rate mortgage.A fixed-rate mortgage provides stability and predictability, protecting you from potential future rate increases. While variable-rate mortgages may offer lower initial rates, they can be more volatile and may result in higher payments if rates rise.

Strategies for Existing Homeowners

Existing homeowners may also need to adapt their mortgage strategies in response to rising rates. Here are some considerations:

- Refinance if it makes sense.If your current mortgage rate is significantly higher than current rates, refinancing could save you money on interest payments. However, consider closing costs and the length of your current loan term before making a decision. Refinancing may not be beneficial if you plan to sell your home in the near future.

- Explore payment options.If you are struggling to make your mortgage payments, contact your lender to discuss potential payment options. They may be able to offer a temporary forbearance, loan modification, or other solutions to help you manage your debt.

- Consider a cash-out refinance.If you have equity in your home, a cash-out refinance can allow you to borrow against that equity for home improvements, debt consolidation, or other financial needs. However, it’s crucial to carefully evaluate the associated costs and interest rates before proceeding.

Managing Financial Risks

Rising mortgage rates can impact financial planning and investment strategies. Here are some ways to manage the associated risks:

- Review your budget.Assess your current expenses and identify areas where you can reduce spending to offset the impact of higher mortgage payments.

- Consider a financial advisor.Consulting a financial advisor can provide personalized guidance on managing your finances in a high-rate environment. They can help you develop a plan to address potential challenges and explore investment opportunities.

- Diversify your investments.Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and potentially generate returns even in a volatile market.

- Build an emergency fund.Having a readily available emergency fund can provide a safety net to cover unexpected expenses, such as job loss or medical bills, and help you navigate potential financial challenges.

Epilogue

Navigating this shifting mortgage landscape requires a strategic approach. Homebuyers need to carefully consider their financial situation and explore strategies to secure favorable loan terms. Existing homeowners may want to explore refinancing options or adjust their mortgage payments to mitigate the impact of higher rates.

Understanding the current market conditions and seeking professional guidance can help both buyers and sellers make informed decisions in this dynamic environment.