Mortgage Rates Rise Ahead of Fed Meeting

Mortgage rates move higher ahead of federal reserve meeting – Mortgage Rates Rise Ahead of Fed Meeting: The housing market is in a state of flux, with mortgage rates steadily climbing in recent weeks. This upward trend has many homebuyers and sellers wondering what the future holds, especially with the Federal Reserve’s upcoming meeting looming large.

The Fed’s decisions on interest rates and monetary policy have a direct impact on mortgage rates, and the market is anxiously awaiting their next move. This article delves into the current state of mortgage rates, the potential implications of the Fed’s meeting, and strategies for both buyers and sellers navigating this dynamic environment.

Current Mortgage Rate Trends

Mortgage rates have been on an upward trajectory in recent months, making homeownership more expensive for potential buyers. This trend has been driven by a combination of factors, including inflation, economic outlook, and Federal Reserve policy.

Current Average Mortgage Rates

The average rates for various mortgage types are as follows:

- 30-Year Fixed-Rate Mortgage:7.00% (as of October 26, 2023)

- 15-Year Fixed-Rate Mortgage:6.25% (as of October 26, 2023)

- Adjustable-Rate Mortgage (ARM):6.00% (as of October 26, 2023)

Factors Driving Rate Increases

Several factors are contributing to the recent rise in mortgage rates.

It’s a wild week for news, with mortgage rates climbing higher ahead of the Federal Reserve meeting. But even amidst the economic uncertainty, the news of a possible noose found near a CIA facility, as reported here , is a stark reminder of the threats facing our nation.

It’s a sobering reminder that while we grapple with financial concerns, the fight for safety and security continues, making the Fed’s decisions all the more crucial.

- Inflation:High inflation has led to increased borrowing costs for lenders, which they pass on to borrowers in the form of higher interest rates. The Federal Reserve has been aggressively raising interest rates to combat inflation, further driving up mortgage rates.

It’s a tough time to be a homeowner with mortgage rates climbing, especially as the Federal Reserve prepares to make its next decision. But the news cycle is full of stories that remind us of the bigger picture, like the heartbreaking case of a Columbia graduate student brutally beaten in Manhattan, with his mother desperately seeking answers.

columbia graduate student brutally beaten in manhattan mother struggles for answers While we grapple with economic anxieties, it’s important to remember that human tragedies like this are happening every day, and we must stay informed and compassionate.

- Economic Outlook:Concerns about a potential recession are also weighing on mortgage rates. If the economy weakens, lenders may become more cautious about lending, leading to higher interest rates to compensate for the increased risk.

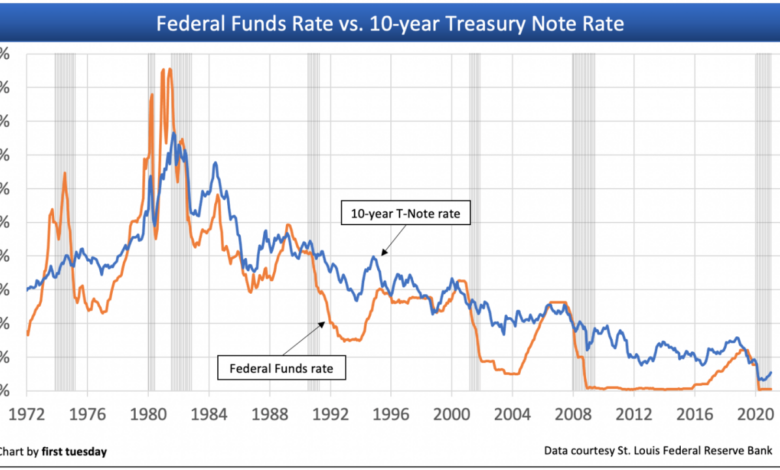

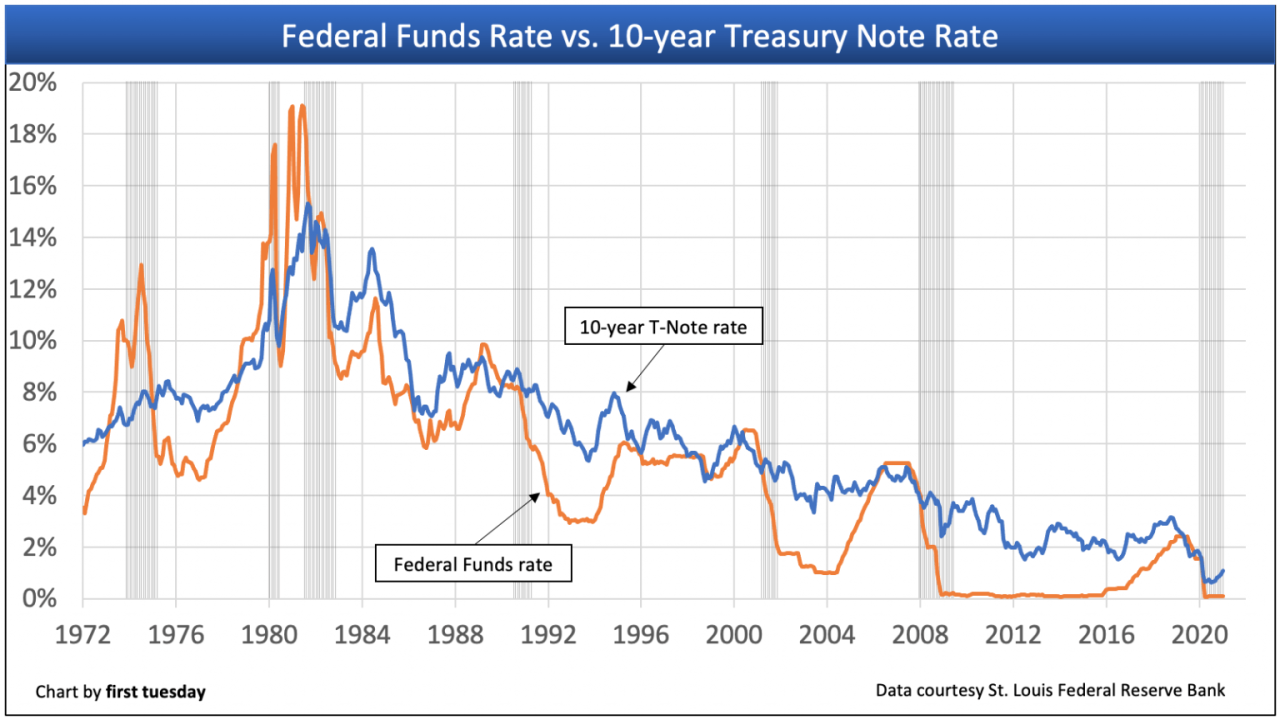

- Federal Reserve Policy:The Federal Reserve’s monetary policy has a significant impact on mortgage rates. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, which leads to higher mortgage rates for borrowers. The Fed has been raising interest rates in recent months to combat inflation, contributing to the upward trend in mortgage rates.

Impact of Federal Reserve Meeting

The upcoming Federal Reserve meeting is a significant event that could have a substantial impact on mortgage rates. The Fed’s decisions regarding interest rates and monetary policy directly influence the cost of borrowing money, which, in turn, affects mortgage rates.

Historical Examples of Fed Meetings and Mortgage Rates, Mortgage rates move higher ahead of federal reserve meeting

The Federal Reserve’s actions have historically influenced mortgage rates. Here are a few examples:

- In 2022, the Fed raised interest rates multiple times, leading to a significant increase in mortgage rates. This increase was driven by the Fed’s efforts to combat inflation, which had reached its highest level in decades. As the Fed raised rates, borrowing became more expensive, leading to higher mortgage rates.

- During the 2008 financial crisis, the Fed lowered interest rates to near zero to stimulate the economy. This move helped to lower mortgage rates, making it easier for people to buy homes. The Fed’s actions during this period played a crucial role in helping the economy recover from the crisis.

Mortgage Market Outlook

Predicting the future of mortgage rates is a complex endeavor, influenced by a multitude of factors. While recent increases have been driven by the Federal Reserve’s tightening monetary policy, the trajectory of rates in the coming months remains uncertain.

Key Factors Influencing Future Rate Movements

Several factors will play a crucial role in shaping the future of mortgage rates. Understanding these factors is essential for making informed decisions about homeownership.

Mortgage rates are on the rise again, putting a strain on potential homebuyers and causing a ripple effect through the economy. The Federal Reserve’s upcoming meeting is sure to bring more volatility, as the central bank weighs the delicate balance between taming inflation and avoiding a recession.

While the Fed focuses on financial stability, it’s worth asking, as the article will the pro abortion rights billionaires please stand up points out, who will step up to address the social and economic issues facing millions of Americans?

The answer to this question will likely impact the housing market, as well as countless other aspects of our lives.

- Inflation:The Federal Reserve’s primary objective is to control inflation. If inflation remains stubbornly high, the Fed may continue raising interest rates, pushing mortgage rates higher. Conversely, if inflation cools, the Fed may become more accommodative, potentially leading to lower rates.

- Economic Growth:Strong economic growth can lead to higher inflation and potentially higher interest rates. Conversely, a slowing economy could prompt the Fed to ease monetary policy, potentially resulting in lower rates.

- Housing Market Conditions:Demand for housing plays a significant role in mortgage rate movements. A strong housing market can push rates higher, while a weakening market could lead to lower rates.

- Global Economic Events:Global economic events, such as geopolitical tensions or financial crises, can also influence mortgage rates. These events can create uncertainty and volatility in the financial markets, impacting interest rates.

Different Perspectives on the Future of Mortgage Rates

Experts hold varying perspectives on the future trajectory of mortgage rates. Some believe that rates will continue to rise in the coming months, driven by persistent inflation and the Fed’s ongoing tightening cycle. Others are more optimistic, predicting that rates may stabilize or even decline slightly as inflation cools and the economy slows.

“The path of mortgage rates is likely to be volatile in the coming months, as the Fed navigates a complex economic landscape.”

[Name of Expert], [Source of Quote]

Impact on Homebuyers and Sellers

Rising mortgage rates have a significant impact on the housing market, influencing both buyers and sellers. The affordability of homes changes, impacting buyer demand, and sellers may need to adjust their pricing strategies.

Impact on Homebuyers

Rising mortgage rates directly impact home affordability. With higher rates, the monthly mortgage payments increase, reducing the amount of money a buyer can borrow and decreasing the purchasing power. This can lead to a decline in buyer demand as potential buyers are forced to reconsider their budget or delay their purchase.For example, a buyer who could afford a $400,000 home with a 3% mortgage rate might only be able to afford a $350,000 home with a 6% rate.

This reduced purchasing power can lead to a slowdown in the housing market as fewer buyers can afford to enter the market.

Impact on Sellers

Sellers also face challenges in a rising interest rate environment. The reduced buyer demand can lead to fewer offers and potentially lower selling prices. Sellers may need to adjust their pricing expectations to remain competitive in the market. For instance, if a seller listed their home for $500,000 during a period of low interest rates, they may need to lower the price to $480,000 in a market with higher rates to attract buyers.

This adjustment can be significant, especially in areas where home prices have already appreciated significantly.

Impact on the Housing Market

The overall impact of rising mortgage rates on the housing market is a combination of the effects on both buyers and sellers. A decrease in buyer demand and potential price adjustments by sellers can lead to a slowdown in home sales and a decrease in home price appreciation.

In some cases, rising rates can even lead to a decline in home prices, especially in markets that were already experiencing rapid price growth. However, the extent of the impact depends on various factors, including the overall economic conditions, local market dynamics, and the availability of inventory.

Conclusive Thoughts: Mortgage Rates Move Higher Ahead Of Federal Reserve Meeting

As mortgage rates continue to fluctuate, staying informed about the latest trends and the Fed’s actions is crucial for making sound financial decisions. Whether you’re a prospective homebuyer, a current homeowner, or a real estate professional, understanding the forces at play in the mortgage market is essential for navigating this complex landscape.

Keep an eye on the Fed’s decisions and consult with financial and real estate experts to make informed choices that align with your individual circumstances.