JPMorgan Economist: Chinas Housing Crash Isnt Over Yet

Jpmorgan economist says chinas housing market crash is still not over – JPMorgan Economist: China’s Housing Crash Isn’t Over Yet. This statement, echoing a growing concern among analysts, has sent ripples through the global financial world. The news comes as China’s housing market struggles to recover from a prolonged downturn, raising questions about the potential impact on the global economy.

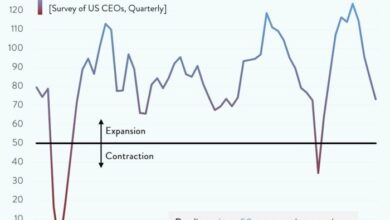

The economist’s warning highlights the fragility of China’s housing market, a sector that has been a key driver of economic growth for decades. With prices declining, sales slowing, and inventory levels rising, the market is showing signs of distress.

This situation is further exacerbated by government policies aimed at cooling the market, economic uncertainty, and a decline in consumer confidence.

Impact on the Global Economy: Jpmorgan Economist Says Chinas Housing Market Crash Is Still Not Over

A potential Chinese housing market crash could have significant ripple effects on the global economy, impacting international investors, businesses, and financial markets. The interconnectedness of the global financial system means that a downturn in China could trigger a chain reaction, potentially leading to a global economic slowdown.

Implications for International Investors

A Chinese housing market crash could significantly impact international investors who have exposure to Chinese real estate or financial institutions. This could lead to substantial losses on their investments, potentially triggering a wave of sell-offs in global financial markets.

- For example, investors holding Chinese real estate bonds or equities could experience significant losses if the value of these assets plummets.

- Furthermore, banks and other financial institutions with substantial exposure to Chinese real estate could face significant losses, potentially leading to a financial crisis.

Implications for Businesses

Businesses with operations in China or that rely on Chinese consumers could be negatively affected by a housing market crash.

- A downturn in the Chinese economy could lead to decreased demand for goods and services, impacting businesses’ profitability.

- Furthermore, a decline in real estate values could also affect businesses’ access to credit, making it more difficult to secure financing for expansion or operations.

Implications for Financial Markets

A Chinese housing market crash could lead to increased volatility in global financial markets.

- Investors might lose confidence in emerging markets, potentially leading to capital flight and a decline in asset prices.

- This could trigger a global sell-off, further exacerbating the economic downturn.

Spillover Effects on Other Major Economies, Jpmorgan economist says chinas housing market crash is still not over

A Chinese housing market crash could have significant spillover effects on other major economies, particularly the United States and Europe.

- For example, a decline in Chinese demand for US goods and services could impact US economic growth.

- Furthermore, European businesses with significant operations in China could also face challenges due to decreased demand and reduced access to credit.

The JPMorgan economist’s warning about China’s housing market crash being far from over is a sobering reminder of the global economic uncertainties we face. It’s almost as dramatic as the news that Halle Berry has seen the jokes about her characters’ “jacked up” wigs, and is actually laughing along with them! halle berry has seen the jokes about her characters jacked up wigs exclusive The impact of China’s housing market on the global economy is undeniable, and we’ll all be watching closely to see how things unfold.

The news about JPMorgan’s warning on China’s housing market crash is a sobering reminder of the global economic uncertainties we face. But hey, at least we can still find some joy in the nostalgia of fashion! Old Navy is bringing back the 90s vibes with their limited-edition “94 Reissue” collection, which is sure to be a hit with anyone who remembers the era of grunge and oversized silhouettes.

While the global economy may be shaky, at least we can still find some comfort in remembering the good old days through fashion! I guess the housing market crash and fashion trends aren’t completely unrelated, right? Maybe a good dose of 90s style will bring some good vibes to the global economy!

The news about the JPMorgan economist’s warning on China’s housing market crash is certainly sobering. It’s a reminder that even amidst the excitement of the American League’s win in the MLB All-Star game, and the buzz surrounding the upcoming NFL season and The Open preview , global economic realities persist.

The potential for a prolonged downturn in China’s housing market could have ripple effects across the world, impacting everyone from investors to everyday consumers.