Bidens New Tool: Fighting Inflation and the Deficit

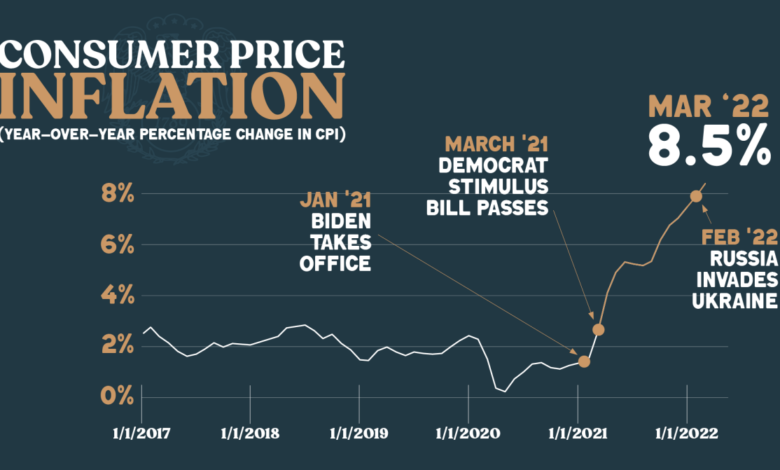

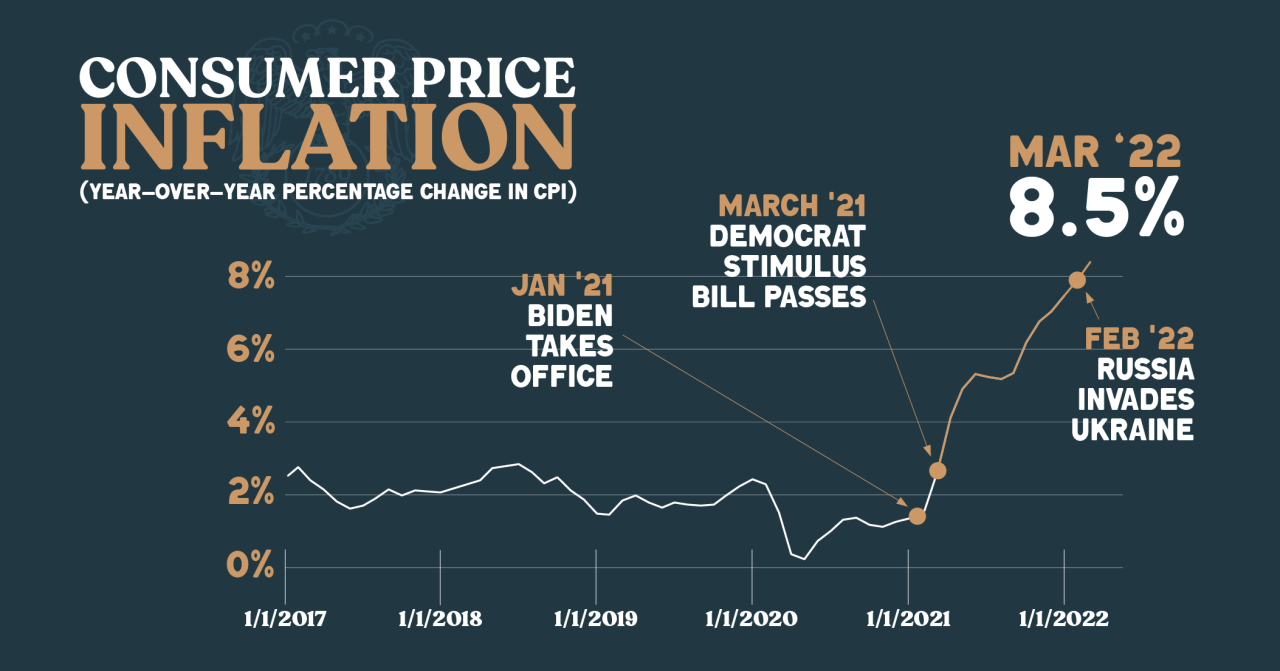

Joe bidens new go to tool to fight inflation the deficit – Biden’s new go to tool to fight inflation and the deficit, a strategy that has become a hot topic in economic circles, aims to tackle two of the most pressing issues facing the nation. While the details of this approach are complex, its impact on everyday Americans is undeniable.

From rising grocery bills to concerns about the future of Social Security, the ramifications of inflation and the deficit are felt across all sectors of society.

This strategy involves a multifaceted approach, encompassing fiscal policy, monetary policy, and social programs. The Biden administration has implemented a series of measures aimed at stimulating the economy while simultaneously seeking to control spending and reduce the national debt. These measures have sparked debate among economists, with some praising their potential to boost growth and others expressing concerns about their long-term consequences.

Impact on the American People: Joe Bidens New Go To Tool To Fight Inflation The Deficit

The ongoing battle against inflation and the ballooning deficit is not a theoretical economic debate; it’s a lived reality for millions of Americans. The impact of these economic challenges is felt across all socioeconomic groups, but it is often most acutely experienced by those who are already struggling to make ends meet.

Joe Biden’s new go-to tool to fight inflation and the deficit is a controversial one: raising taxes. While some argue it’s necessary to balance the budget, others fear it will stifle economic growth. Meanwhile, the House of Representatives just approved a set of gun control bills, including raising the age to purchase assault rifles to 21, as reported on this blog.

It’s unclear how these bills will affect Biden’s tax plans, but it’s a reminder that the political landscape is constantly shifting, and the debate over how to address the country’s economic challenges is far from over.

Impact on Everyday Americans

The rising cost of living is a major concern for many Americans. The price of essential goods and services, such as food, housing, and healthcare, has been steadily increasing, eroding purchasing power and making it difficult for families to maintain their standard of living.

Joe Biden’s new go-to tool to fight inflation and the deficit is a bit of a mixed bag. While some economists applaud the focus on infrastructure spending, others worry about the potential for increased borrowing. Meanwhile, across the country in Alaska, a unique special election is taking place, with a whopping 48 candidates vying for a House seat in a first-of-its-kind ranked-choice voting system.

The outcome of this election could have implications for the future of democracy in the United States, and it will be interesting to see how it impacts the national conversation on fiscal policy.

- For example, the average price of groceries has increased by over 13% in the past year, putting a strain on household budgets. This has forced many families to make difficult choices, such as cutting back on other expenses or skipping meals.

- Similarly, the cost of housing has risen sharply in recent years, making it increasingly difficult for people to find affordable places to live. This is particularly challenging for low-income families and individuals who are already struggling to make ends meet.

It’s fascinating to see how Biden’s focus on deficit reduction is playing out, especially when you consider the news about Binance’s ties to an FSB-linked agency, as reported in this article. While the administration is pushing for fiscal responsibility, the complexities of global finance and the potential for regulatory loopholes raise questions about how effective these measures will be in the long run.

- The rising cost of healthcare is another major concern for many Americans. As healthcare costs continue to escalate, many people are finding it difficult to afford the care they need.

Long-Term Consequences of Inflation and the Deficit

The long-term consequences of inflation and the deficit are complex and far-reaching. While the immediate impact is felt in the form of higher prices and reduced purchasing power, these challenges can have a significant impact on the economy and society as a whole.

- One of the most significant consequences of inflation is a decline in the standard of living. As prices rise, people’s purchasing power decreases, meaning they can buy less with the same amount of money. This can lead to a decrease in consumer spending, which can have a negative impact on the economy.

- Another concern is the potential for a wage-price spiral. This occurs when rising prices lead to demands for higher wages, which in turn lead to further price increases, creating a vicious cycle.

- The growing national debt can also have a significant impact on the economy. As the government borrows more money, it faces increasing interest payments, which can crowd out other spending and reduce the government’s ability to invest in infrastructure and other important programs.

- These economic challenges can also have a profound impact on different socioeconomic groups. For example, low-income families are often hit hardest by inflation, as they have less disposable income to absorb price increases. The elderly are also particularly vulnerable, as they rely heavily on fixed incomes that are not adjusted for inflation.

Impact of Biden’s Policies on Various Sectors

| Sector | Potential Impact of Biden’s Policies |

|---|---|

| Housing | Increased availability of affordable housing through investments in public housing and rental assistance programs. |

| Healthcare | Expansion of access to affordable healthcare through the Affordable Care Act and other initiatives. |

| Education | Increased funding for public education, including early childhood education and higher education. |

| Infrastructure | Significant investments in infrastructure, including roads, bridges, and broadband internet access. |

| Climate Change | Aggressive action to combat climate change, including investments in renewable energy and green technologies. |

Alternative Approaches

While President Biden’s policies aim to address inflation and the deficit, other economic approaches have been proposed by economists and policymakers. These alternatives offer different perspectives on the causes of inflation and the best ways to manage the economy.

Monetary Policy Tightening

This approach focuses on controlling the money supply and interest rates to curb inflation. The Federal Reserve (Fed), the central bank of the United States, is responsible for implementing monetary policy.

- Raising Interest Rates:Increasing interest rates makes borrowing more expensive, discouraging spending and investment. This can help slow down economic growth and reduce demand-pull inflation.

- Reducing Asset Purchases:The Fed can reduce its purchases of government bonds and other assets, which injects liquidity into the economy.

By slowing down asset purchases, the Fed can tighten monetary conditions.

The potential benefits of monetary tightening include controlling inflation and maintaining price stability. However, this approach can also lead to slower economic growth, potentially causing job losses and a recession.

Fiscal Policy Adjustments

This approach focuses on government spending and taxation to influence the economy. Fiscal policy can be used to stimulate economic growth or to curb inflation.

- Spending Cuts:Reducing government spending can help reduce the deficit and potentially lower inflation by decreasing demand.

- Tax Increases:Increasing taxes can reduce disposable income, leading to lower consumption and potentially slowing down inflation.

Fiscal policy adjustments can be effective in managing the economy, but they can also have unintended consequences. For example, spending cuts can lead to job losses and reduced economic activity, while tax increases can discourage investment and economic growth.

Supply-Side Policies

These policies aim to increase the supply of goods and services in the economy, thereby reducing inflationary pressures.

- Deregulation:Reducing government regulations can lower business costs and encourage investment, potentially leading to increased production and supply.

- Tax Incentives:Providing tax breaks for businesses and investors can stimulate investment and productivity, boosting supply.

Supply-side policies can be effective in increasing economic output and reducing inflation. However, they can also lead to environmental damage, income inequality, and reduced consumer protection.

Targeted Interventions, Joe bidens new go to tool to fight inflation the deficit

This approach focuses on addressing specific factors contributing to inflation, such as rising energy prices or supply chain disruptions.

- Price Controls:Setting price limits on essential goods can help prevent excessive price increases, but they can also lead to shortages and black markets.

- Strategic Reserves:Maintaining stockpiles of essential goods can help stabilize prices during times of supply disruptions.

Targeted interventions can be effective in addressing specific inflationary pressures, but they can also be costly and difficult to implement.

Table Comparing Approaches

| Approach | Benefits | Drawbacks |

|---|---|---|

| Monetary Policy Tightening | Controls inflation, maintains price stability | Slower economic growth, potential job losses, recession risk |

| Fiscal Policy Adjustments | Manages deficit, potentially lowers inflation | Job losses, reduced economic activity, discouragement of investment |

| Supply-Side Policies | Increases economic output, reduces inflation | Environmental damage, income inequality, reduced consumer protection |

| Targeted Interventions | Addresses specific inflationary pressures | Costly, difficult to implement, potential shortages |

End of Discussion

The fight against inflation and the deficit is a marathon, not a sprint. While there are no easy solutions, understanding the intricacies of Biden’s approach and its potential impact on our lives is crucial. Whether this strategy will ultimately prove successful remains to be seen, but its implications for the future of the American economy are undeniable.