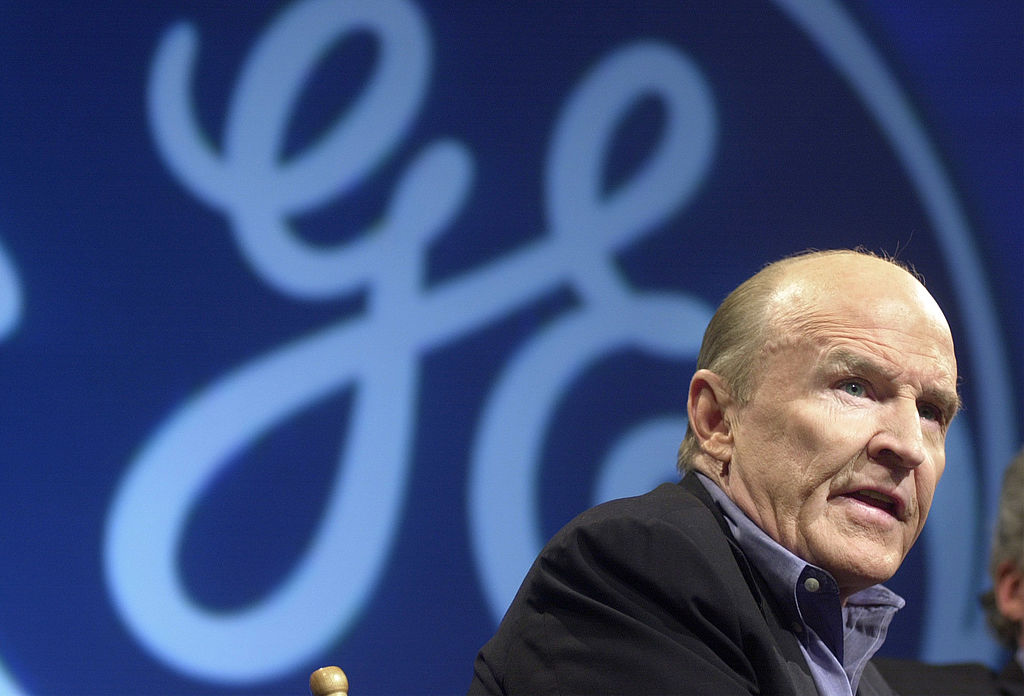

Jack Welch: The Man Who Broke Capitalism?

Jack welch the man who broke capitalism – Jack Welch: The Man Who Broke Capitalism? This title might sound provocative, but it captures the essence of the debate surrounding one of the most influential business leaders of the 20th century. Welch, the former CEO of General Electric, revolutionized corporate America, driving a relentless focus on shareholder value and aggressive restructuring that reshaped industries and the lives of countless employees.

His legacy, however, is a complex one. While Welch’s strategies delivered impressive financial results for GE and its investors, they also came at a cost. His approach to leadership, often characterized as “ruthless” and “cutthroat,” led to widespread layoffs and a culture of fear within the company.

This raises a fundamental question: did Welch’s methods, while successful in the short term, ultimately undermine the long-term health of both GE and the broader economy?

Jack Welch’s Legacy: A Disruptive Force

Jack Welch, the former CEO of General Electric (GE), is widely considered one of the most influential business leaders of the 20th century. His impact on GE and the broader business landscape is undeniable, leaving behind a legacy that continues to shape corporate culture and management practices today.

Welch’s Impact on General Electric, Jack welch the man who broke capitalism

Welch’s tenure at GE, spanning from 1981 to 2001, marked a period of dramatic transformation for the company. He arrived at a time when GE was struggling with bureaucracy and inefficiency. Welch’s vision was to create a leaner, more agile organization that could compete effectively in the global marketplace.

He implemented a series of bold strategies that fundamentally changed GE’s structure and culture.

Key Initiatives

- Downsizing and Restructuring:Welch aggressively shed non-core businesses and eliminated layers of management, streamlining GE’s operations and focusing resources on its most profitable areas. This resulted in the sale of over 200 businesses and the elimination of tens of thousands of jobs, making him a controversial figure in some circles.

- Performance-Driven Culture:Welch introduced a performance-based culture that emphasized accountability and results. He implemented a “rank and yank” system, where employees were ranked on their performance and those at the bottom were let go. This approach, while controversial, pushed employees to excel and fostered a culture of high performance.

- Global Expansion:Recognizing the importance of global markets, Welch aggressively expanded GE’s international presence. He invested heavily in emerging markets, such as China and India, and established GE as a global leader in various industries.

- Focus on Innovation:Welch prioritized innovation and technology, investing heavily in research and development. He established GE’s renowned “Imagination Breakthroughs” program, which fostered a culture of experimentation and creativity.

Welch’s Management Techniques

Welch’s management style, known as “Neutron Jack” for its ruthless efficiency, was characterized by a combination of charisma, decisiveness, and a relentless pursuit of excellence. He believed in empowering employees and pushing them to their limits, but he also expected unwavering loyalty and commitment.

Notable Management Techniques

- “Rank and Yank”:This system, as mentioned earlier, involved ranking employees based on their performance and eliminating those who consistently underperformed. This approach, while controversial, fostered a culture of high performance and accountability.

- “20/70/10 Rule”:This rule, developed by Welch, suggests that the top 20% of employees should be rewarded and encouraged, the middle 70% should be managed effectively, and the bottom 10% should be let go. This rule emphasized the importance of identifying and nurturing top talent while addressing underperformance.

- “Six Sigma”:Welch embraced the Six Sigma methodology, a data-driven approach to process improvement. This approach aimed to reduce defects and improve efficiency throughout the organization, leading to significant cost savings and improved quality.

Welch’s Challenge to Traditional Business Models

Welch’s approach to leadership and management challenged traditional business models and profoundly influenced corporate culture. His focus on shareholder value, globalization, and performance-driven culture transformed the way companies operated and competed.

Key Takeaways

- Shareholder Value:Welch placed a strong emphasis on shareholder value, prioritizing profits and growth over long-term investments. This approach became a dominant paradigm in the business world, with companies increasingly focusing on maximizing returns for their shareholders.

- Globalization:Welch’s aggressive global expansion strategy demonstrated the importance of international markets for business success. This shift towards globalization became a defining characteristic of the modern business landscape.

- Performance-Driven Culture:Welch’s emphasis on performance and accountability challenged the traditional hierarchical structures of many organizations. This focus on results-oriented culture has become increasingly common in the business world, with companies prioritizing performance and innovation.

The Rise of Shareholder Value

The concept of shareholder value, which prioritizes maximizing returns for investors, became a dominant force in business during the late 20th century. Jack Welch, the CEO of General Electric (GE) from 1981 to 2001, played a pivotal role in popularizing and implementing this philosophy.

Shareholder value is the idea that the primary goal of a company is to increase the wealth of its shareholders. This is typically achieved by maximizing profits, increasing the company’s stock price, and paying dividends. The origins of this concept can be traced back to the work of economists like Milton Friedman, who argued that businesses have a moral obligation to maximize profits for their owners.

Welch’s Impact on Shareholder Value at GE

Welch’s focus on shareholder value profoundly impacted GE’s strategic decisions. He implemented a series of initiatives designed to increase profitability and enhance shareholder returns. These included:* Cost Cutting:Welch aggressively pursued cost reductions across all divisions of GE, eliminating jobs and streamlining operations.

Divestment

He sold off underperforming businesses and focused on core areas where GE could achieve market leadership.

Jack Welch, the man who redefined corporate culture, famously implemented a “rank and yank” system that ruthlessly eliminated underperforming employees. While this approach might have boosted profits in the short term, it also led to a culture of fear and a loss of valuable institutional knowledge.

In today’s competitive job market, organizations are realizing the importance of retaining experienced employees. As Adam Grant argues in his recent article, want to hang on to veteran employees nows the time for retention raises says adam grant , offering retention raises can be a powerful tool for keeping valuable talent.

Perhaps Welch’s legacy serves as a cautionary tale, reminding us that prioritizing long-term sustainability over short-term gains is crucial for building a thriving organization.

Mergers and Acquisitions

Welch actively pursued strategic acquisitions to expand GE’s market reach and diversify its portfolio.

Jack Welch, the man who many say “broke capitalism,” championed a ruthless efficiency that prioritized shareholder value above all else. This focus on the bottom line, while it may have boosted profits in the short term, also contributed to a culture of short-sightedness and disregard for long-term sustainability.

It’s interesting to see this same disregard for facts and truth manifest in the current political climate, as evidenced by the recent Jan. 6 hearings, where Trump’s own Attorney General, William Barr, called the stolen election claims “bullshit” ( jan 6 hearing opens with trumps ag william barr calling stolen election claim bullshit ).

Perhaps, the “win at all costs” mentality that Welch championed has seeped into our political system, leading to a dangerous disregard for truth and democratic principles.

Performance-Based Compensation

He introduced a system of performance-based compensation for managers, tying their rewards directly to profitability and shareholder returns.

Comparison with Previous Business Practices

Welch’s approach to shareholder value contrasted sharply with previous business practices. Before his arrival at GE, companies often prioritized other objectives, such as long-term stability, employee welfare, and social responsibility. Welch’s emphasis on maximizing shareholder value led to a shift in corporate priorities, with a greater focus on short-term profits and financial performance.

“The purpose of a corporation is to make money for its owners, and that’s the only thing that matters.”

Jack Welch

The Impact on Labor and Employees

Jack Welch’s relentless pursuit of shareholder value came at a significant cost to GE’s workforce. His restructuring efforts, while boosting profits, led to massive layoffs, changes in working conditions, and a shift in the company’s culture.

The Restructuring of GE’s Workforce

Welch’s restructuring efforts involved a series of aggressive cost-cutting measures, including mass layoffs and outsourcing. He believed that by streamlining operations and reducing bureaucracy, GE could become more efficient and profitable. This approach, known as “rank and yank,” involved evaluating employees based on performance and eliminating those who didn’t meet the company’s standards.

While this strategy led to increased productivity and profitability in the short term, it also created a culture of fear and insecurity among employees.

- Layoffs:Welch’s “rank and yank” system led to the elimination of thousands of jobs across GE’s various divisions. Between 1981 and 2001, GE’s workforce shrank from 411,000 to 110,000, a reduction of over 70%. These layoffs were often swift and brutal, with employees receiving little notice or support.

This created a sense of anxiety and instability among those who remained, as they constantly worried about their own job security.

- Outsourcing:Welch also implemented a strategy of outsourcing many of GE’s operations to lower-cost countries. This decision, while saving the company money, led to job losses in the United States and a decline in the company’s commitment to its domestic workforce.

- Increased Workload:As the workforce was reduced, the remaining employees were expected to take on more responsibilities. This led to increased workloads, longer hours, and a feeling of being overworked and undervalued. The pressure to perform and meet increasingly demanding targets created a stressful work environment for many employees.

Ethical Implications of Welch’s Management Decisions

Welch’s focus on shareholder value at the expense of employees raised significant ethical concerns. His approach was criticized for prioritizing short-term profits over the long-term well-being of the company and its workforce.

- Moral Responsibility:Critics argued that Welch had a moral responsibility to consider the impact of his decisions on his employees, many of whom had dedicated their careers to GE. They believed that the company’s success should not come at the cost of its employees’ livelihoods and well-being.

Jack Welch, the legendary CEO of General Electric, was known for his ruthless efficiency and his belief in “rank and yank,” a system that ruthlessly eliminated underperformers. This approach, while successful for GE, has been criticized for its impact on the broader economy, creating a culture of short-term gains and sacrificing long-term investment.

It’s interesting to consider how Welch’s legacy might relate to the frustration expressed in this post about job sharing , where the writer feels undervalued and exploited. Could Welch’s approach, focused on individual performance, have contributed to a workplace culture where collaborative efforts are less valued?

- Fairness and Justice:Welch’s “rank and yank” system was also criticized for its lack of fairness and justice. The system was seen as arbitrary and subjective, with employees’ performance often being judged based on factors beyond their control. This created a culture of fear and resentment among employees, who felt that their jobs were constantly at risk.

- Long-Term Sustainability:Welch’s focus on short-term profits also raised concerns about the long-term sustainability of GE. By cutting costs and reducing the workforce, the company was potentially sacrificing its future competitiveness and innovation. Critics argued that Welch’s approach would eventually lead to a decline in GE’s ability to compete in the global marketplace.

Impact on Employee Morale and Motivation

Welch’s leadership style had a profound impact on employee morale and motivation. While some employees thrived in the competitive environment he created, others found it stressful and demoralizing.

- Fear and Insecurity:The constant threat of layoffs and the pressure to perform created a culture of fear and insecurity among GE employees. This led to a decline in morale and a reluctance to take risks or innovate.

- Loss of Trust:Many employees felt that Welch did not have their best interests at heart and that he was more concerned with maximizing profits than with the well-being of his workforce. This loss of trust contributed to a decline in employee engagement and a sense of alienation from the company.

- Lack of Loyalty:Welch’s aggressive restructuring efforts also eroded employee loyalty to GE. Many employees felt that the company had abandoned them and that they could no longer count on it for long-term employment. This led to a decline in employee commitment and a willingness to leave the company for better opportunities elsewhere.

The Legacy of Jack Welch: Jack Welch The Man Who Broke Capitalism

Jack Welch, the legendary CEO of General Electric (GE) from 1981 to 2001, is widely recognized for his transformative leadership and his impact on the business world. His aggressive approach to restructuring, cost-cutting, and shareholder value maximization earned him the moniker “Neutron Jack” and solidified his reputation as a ruthless and effective leader.

However, Welch’s legacy is not without its controversies, and his methods have been criticized for their impact on employees, the broader economy, and the long-term health of GE itself.

Criticism of Welch’s Leadership Style

Welch’s leadership style was characterized by a relentless focus on performance, a willingness to make tough decisions, and a belief in the power of competition. He implemented a series of aggressive strategies that transformed GE into a leaner, more profitable company, but also resulted in significant job losses and a culture of fear and intimidation.

- Rank and Yank:One of Welch’s most controversial practices was the “rank and yank” system, which required managers to rank their employees from top to bottom and then fire the bottom 10%. This system created a highly competitive and cutthroat environment, where employees were constantly under pressure to perform at their best.

While it may have driven performance in the short term, it also created a culture of fear and anxiety, which some argue ultimately hurt GE’s long-term success.

- Downsizing and Restructuring:Welch was a master of downsizing and restructuring, aggressively shedding assets and businesses that did not meet his strict performance criteria. This led to significant job losses and a decline in GE’s presence in certain industries, such as the consumer electronics and appliance markets.

While this strategy initially boosted profits, it also weakened GE’s long-term competitiveness and left it vulnerable to market shifts.

- Focus on Shareholder Value:Welch’s relentless focus on shareholder value maximization had a profound impact on the broader economy. It fueled the rise of short-term thinking and a focus on quarterly earnings at the expense of long-term investment and innovation. This emphasis on shareholder value is often cited as a contributing factor to the decline of American manufacturing and the rise of financialization in the US economy.

Wrap-Up

Jack Welch’s legacy is a testament to the power of leadership and the enduring impact of business decisions. His focus on shareholder value and his aggressive restructuring strategies fundamentally reshaped corporate America. While his methods were controversial, they undeniably left an indelible mark on the world of business.

The question remains, however, whether his approach, with its emphasis on short-term gains and its disregard for the human cost of change, ultimately served the best interests of the companies he led and the broader economy.