BPs Record Profits: Greed While People Suffer?

Its the greed bp reports record profits while people suffer – It’s the greed: BP reports record profits while people suffer. While the world grapples with a cost-of-living crisis fueled by soaring energy prices, oil and gas giants like BP are reaping record profits. This stark contrast raises critical questions about corporate responsibility and the ethical implications of profiting from a global crisis.

BP’s recent financial performance reflects the current economic climate, where demand for energy has outpaced supply, leading to skyrocketing oil and gas prices. The company’s record profits are a testament to the lucrative nature of the energy sector during this period, but they also highlight the stark disparity between corporate gains and the hardship faced by ordinary people struggling to make ends meet.

BP’s Response to Criticism: Its The Greed Bp Reports Record Profits While People Suffer

BP, like other energy companies, has faced significant public criticism for its record profits amidst a global energy crisis and rising inflation. While some argue that these profits are a natural consequence of market forces and reflect the company’s efficient operations, others view them as a sign of profiteering at the expense of consumers struggling with increased energy costs.

It’s infuriating to see corporations like BP raking in record profits while people struggle to afford basic necessities. Meanwhile, Old Navy is tapping into nostalgia with their limited edition ’94 reissue collection, offering a blast from the past for those who remember the era.

It’s a stark reminder of the widening gap between the wealthy and the rest of us, and it’s hard to ignore the disconnect between the lavish profits of some companies and the everyday struggles of so many.

The company has responded to these criticisms with a combination of statements and actions, aiming to address concerns and highlight its contributions to the energy transition.

BP’s Statements and Actions, Its the greed bp reports record profits while people suffer

BP has acknowledged the public’s concerns about its record profits, stating that it understands the financial strain many people are facing. In response, the company has announced plans to increase investment in renewable energy projects, aiming to accelerate the transition to a low-carbon future.

It’s infuriating to see BP reporting record profits while people struggle to afford basic necessities. It’s a stark reminder that greed knows no bounds, and the system is rigged against the average person. Even the entertainment industry is rife with exploitation, as seen in the recent Oasis concert chaos, where a ticketing system executive admitted the system was broken.

ticketing system broken after oasis chaos executive of resale site says The fact that these issues persist, while corporations like BP rake in record profits, is a clear indication that we need a fundamental shift in our priorities. We need to prioritize people over profits, and hold those in power accountable for their actions.

BP has also emphasized its commitment to providing affordable energy solutions, including initiatives to support energy efficiency and expand access to renewable energy in developing countries. Furthermore, the company has highlighted its efforts to reduce its carbon footprint and invest in technologies that will enable a more sustainable energy system.

It’s just plain greed, BP reporting record profits while people struggle to afford basic necessities. And now, with the news that Chancellor Rachel Reeves is being urged to impose a pay-per-mile scheme on electric cars , it seems like the government is more interested in squeezing every last penny out of us than actually helping.

It’s a shame that in a time of crisis, those in power are prioritizing profits over people.

BP’s Communication Strategies

BP’s communication strategies have focused on emphasizing its commitment to sustainability, innovation, and social responsibility. The company has used various channels, including press releases, social media, and public appearances, to communicate its message. BP has also engaged with stakeholders, including investors, policymakers, and environmental groups, to address concerns and build trust.

However, some critics argue that BP’s messaging has been insufficient, with some questioning the sincerity of the company’s commitment to a green transition.

Comparison with Other Energy Companies

BP’s response to criticism is broadly similar to that of other major energy companies. Many have faced calls for windfall taxes and other measures to address the profits they have made from high energy prices. Companies like Shell and ExxonMobil have also announced increased investments in renewable energy, while emphasizing their contributions to energy security and economic growth.

However, the effectiveness of these responses in addressing public concerns has varied, with some companies facing more intense scrutiny than others. The public’s perception of these companies is influenced by a range of factors, including their past performance, their communication strategies, and the overall political and economic context.

The Ethical and Societal Implications

The juxtaposition of record profits for BP amidst a backdrop of rising energy costs and societal struggles raises significant ethical and societal concerns. While BP’s shareholders might be pleased with the financial performance, the impact on ordinary people is far from positive.

This disparity highlights the complex relationship between corporations, their profits, and the well-being of society.

The Ethical Considerations of Corporate Profits During Economic Hardship

The ethical considerations surrounding BP’s record profits while people struggle with rising costs are multifaceted. On one hand, BP, as a publicly traded company, has a fiduciary responsibility to its shareholders to maximize profits. On the other hand, the company operates within a society and has a responsibility to consider the broader social and environmental implications of its actions.

The ethical dilemma arises when these two responsibilities clash, as they seem to do in this case.

The Future of Energy and Corporate Responsibility

The recent record profits of energy giants like BP, amidst global economic hardships and energy crises, have raised crucial questions about the future of the energy sector and the role of corporate responsibility. As the world transitions towards a more sustainable energy future, the potential for energy price fluctuations and the need for ethical corporate behavior in the industry become even more prominent.

The Potential for Future Energy Price Fluctuations

The energy sector is inherently volatile, susceptible to a multitude of factors influencing prices. These factors include geopolitical events, technological advancements, and environmental regulations. The current energy crisis, triggered by the war in Ukraine and global supply chain disruptions, has highlighted the vulnerability of energy markets.

The reliance on fossil fuels, coupled with limited alternative energy sources, has exacerbated price volatility.

- Geopolitical instability: Conflicts, sanctions, and political tensions can disrupt energy production and supply chains, leading to price spikes. The ongoing war in Ukraine has significantly impacted global energy markets, particularly for natural gas and oil.

- Technological advancements: The development and deployment of renewable energy technologies, such as solar and wind power, can potentially lower energy prices in the long term. However, the initial investment costs and infrastructure development can create short-term price fluctuations.

- Environmental regulations: Stricter environmental regulations, aimed at reducing carbon emissions, can increase the cost of fossil fuel production and incentivize the adoption of cleaner energy sources. This can lead to price fluctuations as companies adapt to new regulations.

These factors suggest that energy price fluctuations will likely continue to be a significant feature of the energy landscape in the future.

A Framework for Responsible Corporate Behavior in the Energy Sector

In the face of these challenges, the energy sector needs to embrace responsible corporate behavior to ensure sustainable and equitable energy access for all. A framework for responsible corporate behavior in the energy sector could include the following key elements:

- Transparency and Accountability: Companies should be transparent about their operations, environmental impact, and financial performance. This includes disclosing their emissions, investments in renewable energy, and community engagement initiatives.

- Sustainable Energy Transition: Companies should actively invest in and transition towards a more sustainable energy future. This involves reducing their reliance on fossil fuels, developing and deploying renewable energy technologies, and promoting energy efficiency.

- Community Engagement: Companies should engage with local communities, considering their needs and concerns related to energy development and environmental impact. This includes providing opportunities for participation in decision-making processes and addressing potential risks.

- Fair Labor Practices: Companies should ensure fair labor practices throughout their supply chains, respecting workers’ rights and promoting safe working conditions. This is particularly important in the extraction and production of fossil fuels, where human rights violations are often a concern.

Financial Performance and Social Responsibility Initiatives

The following table compares the financial performance of several major energy companies with their social responsibility initiatives:

| Company | 2022 Revenue (USD Billion) | Net Income (USD Billion) | Social Responsibility Initiatives |

|---|---|---|---|

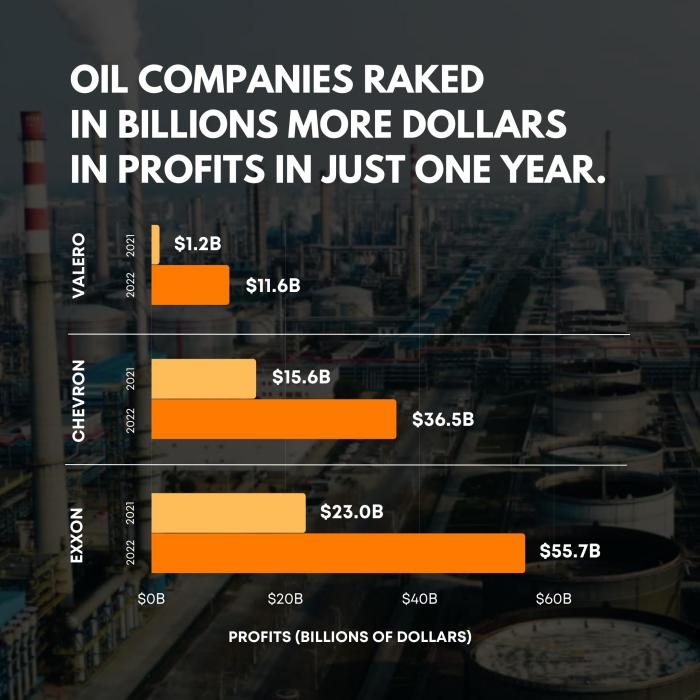

| ExxonMobil | 413.6 | 55.7 | Investing in carbon capture and storage technologies, supporting STEM education, and promoting energy efficiency programs. |

| Chevron | 246.3 | 36.4 | Investing in renewable energy projects, supporting community development programs, and promoting biodiversity conservation. |

| Shell | 382.4 | 39.9 | Investing in offshore wind energy, promoting energy access in developing countries, and supporting environmental conservation initiatives. |

| BP | 276.9 | 23.2 | Investing in low-carbon technologies, supporting renewable energy development, and promoting climate change awareness. |

| TotalEnergies | 228.3 | 20.5 | Investing in solar and wind energy, promoting sustainable transportation, and supporting biodiversity conservation. |

It is important to note that this table provides a snapshot of the financial performance and social responsibility initiatives of these companies. The specific details and impact of their initiatives may vary depending on the region and project.