Federal Student Loans: Getting More Expensive, Heres Why

Its about to get more expensive to take out federal student loans heres why – It’s about to get more expensive to take out federal student loans, here’s why. The cost of higher education is already a major burden for many students and families, and now, with interest rates on the rise, the financial strain is only going to increase.

This shift is a significant development in the world of student financing, and it’s crucial to understand the implications for both current and future borrowers.

The recent announcement regarding interest rate hikes on federal student loans has sent shockwaves through the education and financial sectors. This change, driven by a complex interplay of economic factors and government policies, will directly impact the cost of borrowing for millions of students.

The rising cost of education, coupled with the increasing cost of borrowing, is creating a perfect storm for students struggling to finance their education.

Rising Student Loan Costs: Its About To Get More Expensive To Take Out Federal Student Loans Heres Why

The cost of federal student loans is about to increase, making it more expensive for students to finance their education. This change will impact millions of borrowers, particularly those who will be taking out new loans or refinancing existing ones.

The recent announcement from the Department of Education regarding the upcoming interest rate adjustment has sent ripples through the student loan community, raising concerns about the affordability of higher education.

Reasons for Rising Student Loan Costs

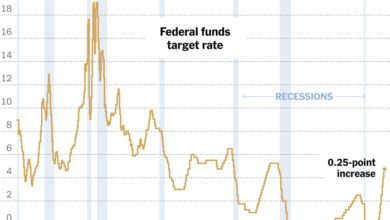

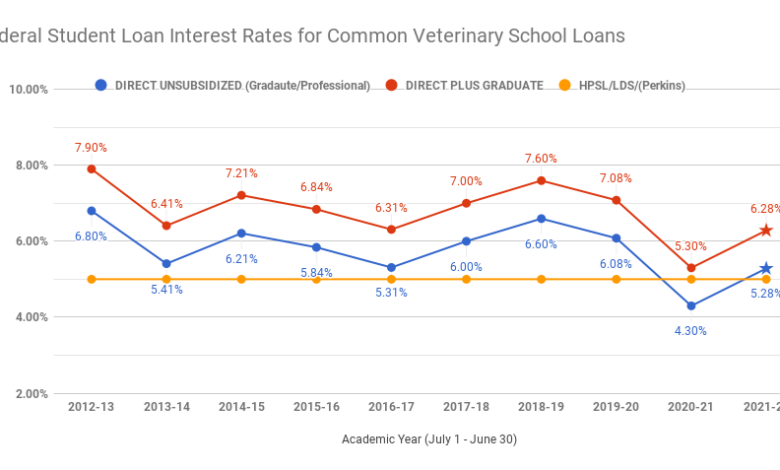

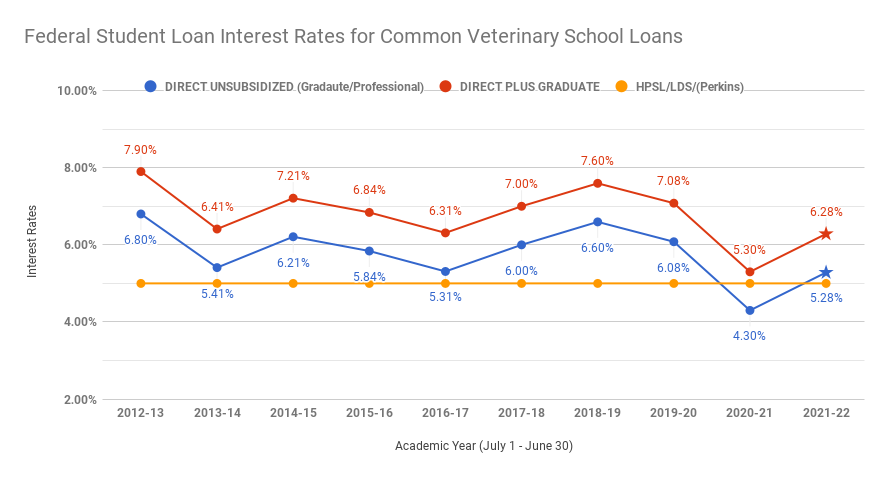

The increase in student loan interest rates is a consequence of several factors. The Federal Reserve’s efforts to combat inflation have led to higher interest rates across the board, including those on federal student loans. The current economic climate, characterized by rising inflation and a strong job market, has prompted the Federal Reserve to implement a series of interest rate hikes.

The rising cost of living is hitting everyone hard, and for students, that includes the price of education. The interest rates on federal student loans are about to increase, adding to the already heavy burden of debt. This is happening at a time when the global economy is experiencing some serious turbulence, as evidenced by the analysis of why Japan’s yen is the weakest it’s been in 20 years.

The combination of these factors is creating a perfect storm for students, making it even harder to afford the education they need to succeed.

These hikes, aimed at slowing down economic growth and curbing inflation, have a direct impact on the cost of borrowing, including student loans.

The interest rate on federal student loans is determined by a formula that considers the 10-year Treasury note yield, a benchmark for long-term borrowing costs. As the 10-year Treasury note yield increases, so too does the interest rate on federal student loans.

It’s a tough time to be a student, with the rising cost of living and now the added burden of higher interest rates on federal student loans. It’s a reminder that financial burdens can feel even heavier when layered on top of the emotional toll of events like the recent Buffalo shooting, where experts say African Americans are experiencing trauma.

The weight of these issues can feel overwhelming, but it’s important to remember that there are resources available to help navigate these challenges. Hopefully, these financial burdens will ease in the future, but for now, we have to find ways to manage and cope.

Another factor contributing to the rise in student loan costs is the increasing demand for higher education. The pursuit of higher education has become increasingly prevalent, leading to a surge in the number of students seeking financial aid. This increased demand puts upward pressure on the cost of borrowing, as lenders compete for a larger pool of borrowers.Furthermore, the growing student debt burden has also contributed to the increase in interest rates.

The average student loan debt per borrower has been steadily increasing in recent years, reaching record highs. This trend has raised concerns about the sustainability of the student loan market, prompting lenders to adjust interest rates to reflect the perceived higher risk associated with lending to students.

Impact on Borrowers

The increase in interest rates for federal student loans will have a direct impact on borrowers, making it more expensive to repay their debt. This means higher monthly payments and a larger overall repayment amount.

Higher Monthly Payments

The impact of higher interest rates on monthly payments is significant. For example, a borrower with a $10,000 loan at a 5% interest rate would have a monthly payment of approximately $188. However, if the interest rate increases to 7%, the monthly payment would jump to $214.

This increase of $26 per month might seem small, but it can add up over the life of the loan.

Total Repayment Amount

Higher interest rates also impact the total amount borrowers will repay over the life of their loans. The higher the interest rate, the more money borrowers will pay in interest charges. In the example above, a borrower with a 5% interest rate would pay approximately $2,250 in interest over the life of the loan.

However, with a 7% interest rate, the total interest paid would increase to $3,200. This means borrowers will end up paying significantly more than their initial loan amount due to interest charges.

Consequences for Borrowers Struggling with Debt

For borrowers already struggling to manage their student loan debt, higher interest rates can be particularly challenging. The increase in monthly payments could make it even more difficult to make ends meet, potentially leading to missed payments and delinquency. Higher interest rates also increase the risk of default, which can have serious consequences for borrowers, including damage to their credit score, difficulty obtaining future loans, and potential wage garnishment.

Government Policies and Regulations

The federal government plays a significant role in regulating and managing student loans. These policies directly impact the cost of borrowing and the overall accessibility of higher education. Recent changes in interest rates, driven by economic conditions and political considerations, have significantly affected student loan borrowers.

Understanding the rationale behind these changes is crucial to assess the potential implications for the future of federal student loan programs.

Interest Rate Adjustments

The interest rates on federal student loans are not fixed and are subject to adjustments based on market conditions. The government sets a base interest rate, which is typically linked to the 10-year Treasury note. This base rate is then adjusted annually to reflect the current economic climate.

For example, if inflation rises, the interest rate on student loans may also increase to compensate lenders for the reduced purchasing power of their investment. This adjustment mechanism aims to maintain a balance between the cost of borrowing for students and the financial sustainability of the federal student loan program.

Impact of Interest Rate Changes

Higher interest rates on student loans translate to increased borrowing costs for students. This means that borrowers will need to pay back more money over the life of their loan, potentially increasing their overall debt burden. The impact of these changes can be particularly significant for students with high loan balances or those who choose to pursue longer repayment plans.

Additionally, higher interest rates can discourage students from pursuing higher education, particularly those from low-income backgrounds who may be more sensitive to the cost of borrowing.

Future Implications

The recent changes in interest rates on federal student loans have raised concerns about the future of the program. Some argue that the current system is unsustainable and that interest rates may need to be further adjusted to ensure the program’s financial stability.

Others advocate for policy changes to make student loans more affordable, such as capping interest rates or providing greater access to income-driven repayment plans. The debate surrounding these issues is likely to continue, with significant implications for future generations of borrowers.

It’s about to get more expensive to take out federal student loans, and the reasons are complex. Interest rates are rising, and the government is looking for ways to reduce the deficit. It’s a tough situation, and it feels like we’re seeing a repeat of the “buy the rumor, sell the news” phenomenon we saw with Dogecoin, as described in this article: buy the rumour sell the news dogecoin erases recent gains.

The news of increased loan costs is already causing a stir, and it’s likely to have a significant impact on borrowers in the near future.

Borrower Strategies and Options

The rising cost of federal student loans can put a significant strain on borrowers’ finances. It’s crucial to understand the different strategies and options available to manage your debt effectively. This section will explore practical advice for borrowers, discuss the benefits and drawbacks of various repayment plans, and examine the potential benefits of refinancing.

Income-Driven Repayment Plans, Its about to get more expensive to take out federal student loans heres why

Income-driven repayment (IDR) plans are designed to make student loan payments more affordable by basing your monthly payment on your income and family size. There are several IDR plans available, each with its own eligibility requirements and payment calculation methods.

- Income-Contingent Repayment (ICR) Plan:Your monthly payment is calculated as a percentage of your discretionary income (income exceeding 150% of the poverty guideline for your family size). This plan caps your repayment period at 25 years.

- Income-Based Repayment (IBR) Plan:Your monthly payment is calculated as 10% of your discretionary income. This plan caps your repayment period at 20 years for undergraduate loans and 25 years for graduate loans.

- Pay As You Earn (PAYE) Plan:Your monthly payment is calculated as 10% of your discretionary income. This plan caps your repayment period at 20 years.

- Revised Pay As You Earn (REPAYE) Plan:Your monthly payment is calculated as 10% of your discretionary income. This plan caps your repayment period at 20 years for undergraduate loans and 25 years for graduate loans.

Refinancing Student Loans

Refinancing your student loans can be a viable option to lower your monthly payments and reduce your overall interest costs. When you refinance, you take out a new loan to pay off your existing student loans. The new loan typically has a lower interest rate, which can save you money over the life of the loan.

- Benefits:

- Lower interest rates: This can result in significant savings over the life of the loan.

- Lower monthly payments: This can free up cash flow for other financial goals.

- Shorter repayment terms: This can help you pay off your loans faster.

- Drawbacks:

- Loss of federal loan benefits: Refinancing to a private loan can make you ineligible for certain federal loan benefits, such as income-driven repayment plans and loan forgiveness programs.

- Higher interest rates: While you may get a lower interest rate than your existing federal loans, private loans may still have higher interest rates than some federal loans.

- Origination fees: Some lenders charge origination fees, which are a percentage of the loan amount. These fees can add to the overall cost of refinancing.

Economic Implications

The rising cost of federal student loans has significant economic implications that ripple across individual borrowers, households, and the broader economy. Understanding these implications is crucial for policymakers, lenders, and borrowers alike, as they navigate the complex landscape of student debt.

Impact on Borrowers and Households

The increasing cost of student loans directly impacts borrowers’ financial well-being and household budgets. Higher interest rates translate into larger monthly payments, leaving less disposable income for other essential needs, such as housing, healthcare, and savings. This financial strain can delay major life decisions, such as homeownership, starting a family, or investing in retirement.

- Reduced Spending Power:Higher student loan payments eat into disposable income, limiting spending on goods and services, potentially slowing consumer spending and economic growth.

- Delayed Major Life Decisions:The burden of student loan debt can delay significant life decisions, such as buying a home, starting a family, or pursuing further education. This delay can have ripple effects on the economy, impacting housing markets, birth rates, and workforce skills.

- Increased Financial Stress:High student loan payments can lead to increased financial stress and anxiety, impacting mental health and overall well-being.

Impact on the Overall Economy

The rising cost of student loans can have a significant impact on the overall economy, potentially affecting consumer spending, economic growth, and the education sector.

- Consumer Spending:Higher student loan payments can reduce consumer spending, impacting economic growth. This is because borrowers have less disposable income to spend on goods and services, leading to a decline in demand.

- Economic Growth:The impact of reduced consumer spending and delayed major life decisions can negatively affect economic growth. This is because the economy relies on consumer spending as a key driver of growth.

- Education Sector:The rising cost of student loans could potentially discourage individuals from pursuing higher education, impacting the quality and availability of skilled workers in the labor market. This could have long-term implications for economic productivity and innovation.

Impact on the Education Sector

The rising cost of student loans can create a challenging environment for the education sector.

- Enrollment Trends:Higher student loan costs could deter potential students from pursuing higher education, impacting enrollment rates and the financial viability of educational institutions.

- Tuition Increases:Institutions may feel pressure to increase tuition rates to offset the rising costs of providing education, creating a cycle of increasing debt for students.

- Access and Equity:The rising cost of student loans could exacerbate existing inequalities in access to higher education, disproportionately impacting students from low-income backgrounds.

Ending Remarks

The rising cost of federal student loans is a complex issue with far-reaching consequences. It’s crucial for students and borrowers to be aware of these changes and explore their options for managing debt. From understanding repayment plans to considering refinancing, there are strategies available to help navigate this challenging financial landscape.

As we move forward, it’s important to advocate for policies that make education more affordable and accessible for all.