Is It Time to Limit State Pensions?

Is it time to limit the state pension to those who actually need it? This question has become increasingly relevant as the UK grapples with an aging population and rising government spending. The current state pension system, designed decades ago, may no longer be sustainable in its current form.

The debate over potential limitations raises complex questions about fairness, social responsibility, and the future of our social safety net.

The UK’s state pension system provides a vital lifeline for millions of retirees, ensuring a basic level of income after they leave the workforce. However, as life expectancy increases and birth rates decline, the financial burden of supporting an aging population grows.

This has led some to argue that the current system is unsustainable and needs to be reformed. A key point of contention is whether the state pension should be available to all, or only to those who genuinely require it.

The Current State of State Pensions

The UK state pension is a vital lifeline for many people in retirement, providing a guaranteed income stream to help cover living costs. It’s a complex system with various aspects that impact how much people receive and when they become eligible.

This article delves into the current state of the UK state pension, exploring its structure, eligibility criteria, and the different types available.

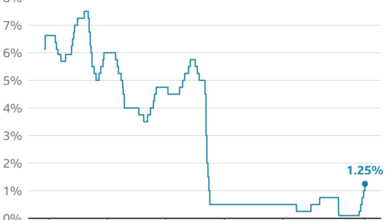

State Pension Statistics

The state pension system in the UK provides financial support to millions of individuals who have reached retirement age. Here are some key statistics:

- As of 2023, there are approximately 12.6 millionpeople receiving a state pension in the UK.

- The average weekly state pension payment is £190.00(as of April 2023).

These figures highlight the significant role the state pension plays in supporting the financial well-being of a large segment of the UK population.

Eligibility Criteria for State Pensions

To be eligible for the full basic state pension, individuals must meet the following criteria:

- They must have reached the state pension age. This age varies depending on your date of birth, but is currently 66 for most people. It is gradually increasing to 67 by 2028.

- They must have made sufficient National Insurance contributions throughout their working life. This is calculated based on the number of qualifying years of contributions, with a minimum of 35 years required for the full basic state pension.

Types of State Pensions

The UK state pension system offers two main types of pensions:

- Basic State Pension: This is the standard state pension payment available to individuals who have met the necessary contribution requirements. The amount received depends on the number of qualifying years of contributions.

- State Pension Credit: This is a top-up payment for individuals who have a low income in retirement. It can be used to increase their weekly income up to a certain level. This is not a pension in itself, but a benefit designed to top up existing pensions.

There are also additional benefits available, such as the Pensioner Premium, which can be added to the state pension for those with a low income and certain other conditions.

Arguments for Limiting State Pensions

The debate surrounding state pensions often centers on their sustainability and fairness. One prominent perspective argues that limiting state pensions to those who “need” them could address these concerns. This approach aims to ensure that the system remains financially viable while prioritizing those who rely on it the most.

It’s definitely a hot topic – is it time to limit the state pension to those who actually need it? The news cycle is always changing though, and right now, everyone’s buzzing about Keke Palmer revealing she’s pregnant on Saturday Night Live ! It’s a big moment for her, and I can’t wait to see what the future holds.

But back to the pension debate, I think it’s a complex issue that needs to be discussed with care and understanding.

Financial Benefits and Reduced Government Spending

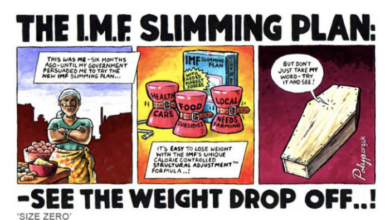

Restricting state pensions to individuals demonstrating genuine need could potentially generate substantial financial benefits. By targeting support towards those who truly require it, governments could reduce overall spending on pensions. This could free up resources for other essential public services, such as healthcare, education, and infrastructure.

Potential Impact on the Economy and Labor Market

Limiting state pensions could also influence the economy and labor market. Some argue that it might incentivize individuals to remain in the workforce for longer, contributing to economic growth and productivity. This could potentially offset any negative impact on consumer spending caused by reduced pension benefits.

However, the potential impact on the labor market is complex and requires careful consideration.

Determining Who “Needs” a State Pension

Establishing a system for determining who “needs” a state pension presents a significant challenge. Several factors could be considered, such as income, assets, and health status. A potential approach could involve a means-testing system that assesses an individual’s financial situation and determines their eligibility for a full, partial, or no pension.

For example, a system could be designed where individuals with low income and limited assets would receive a full state pension, while those with higher incomes or significant assets would receive a reduced or no pension.

Arguments Against Limiting State Pensions

Limiting state pensions to those who “need” them is a controversial policy proposal that has sparked debate about the future of social security in the UK. While there are arguments in favor of this approach, focusing on efficiency and fairness, there are also compelling reasons to oppose it.

This section will explore the arguments against limiting state pensions, examining the potential social and economic consequences of such a policy.

Potential Social and Economic Consequences

Limiting state pensions could have significant social and economic consequences, potentially leading to increased poverty and inequality. By reducing the income of individuals who rely on the state pension, it could push more people into poverty, particularly vulnerable groups like the elderly, those with disabilities, and those who have worked in low-paying jobs.

The debate about limiting state pensions to those who truly need them is a complex one, with valid arguments on both sides. While some argue it’s necessary to ensure fairness and resource allocation, others emphasize the importance of providing a safety net for all senior citizens.

In a completely different realm, the upcoming England vs. Australia test series has generated excitement, with young Harry Brook taking on the captaincy role. As Nasser Hussain has noted , this presents a unique opportunity for Brook to showcase his leadership skills.

Returning to the pension debate, perhaps a nuanced approach is needed, considering individual circumstances and offering targeted support where it’s most needed.

This could exacerbate existing inequalities and lead to a further decline in living standards for those already struggling.

Challenges in Determining “Need”

One of the major challenges in implementing a system to determine who “needs” a state pension is the difficulty in defining and measuring need. What constitutes a “need” for a state pension can vary greatly depending on individual circumstances, such as health, housing costs, and family support.

It’s a tough question, isn’t it? Should the state pension be limited to those who truly need it? While some argue it’s a vital safety net, others point to the growing cost of living and the fact that many pensioners are already well-off.

Perhaps a solution lies in adjusting the system, like making it more needs-based, or focusing on other ways to help those who struggle. In the meantime, it’s good to know that some essentials are getting cheaper, like those delicious chocolates! Check out tesco exact dates as quality street cadbury lindt and more to drop in price for some sweet deals.

But back to the pension, I think it’s a conversation we need to have, and one that requires careful consideration of all sides.

It would be difficult to create a system that accurately assesses need and avoids arbitrary exclusions.

Comparison with Other Social Safety Net Programs, Is it time to limit the state pension to those who actually need it

The state pension is a cornerstone of the UK’s social safety net, providing a basic income for individuals in their retirement. While other social safety net programs, such as housing benefits and disability benefits, exist to address specific needs, the state pension provides a universal safety net for all.

Limiting the state pension could undermine this universal principle and create a more complex and fragmented system of support.

Alternative Solutions

Instead of limiting state pensions to those who “need” them, which raises ethical and practical concerns, a more holistic approach is needed to address the challenges facing pension systems. This section explores alternative solutions to ensure the long-term sustainability and fairness of state pensions, including reforms to the current system and examples from other countries.

Raising the Retirement Age

Raising the retirement age is a common strategy to address the increasing longevity of populations and the rising costs of pensions. This approach aims to increase the number of working years, contributing to the pension system and reducing the burden on taxpayers.

For example, in the United Kingdom, the state pension age is gradually increasing to 67 for both men and women by 2028, and is projected to rise further in the future.

However, raising the retirement age can have negative consequences, particularly for those in physically demanding jobs or those who have health conditions that limit their ability to work longer. It can also exacerbate existing inequalities, as individuals with lower levels of education and income often have shorter life expectancies and may be less able to work longer.

Increasing Contributions

Increasing contributions to the state pension system can help ensure its long-term sustainability. This can be achieved by raising the contribution rate for both employers and employees or by introducing new contribution mechanisms, such as a dedicated “pension tax” or a national savings scheme.

For instance, in Singapore, the Central Provident Fund (CPF) requires both employers and employees to contribute a percentage of their salary towards retirement savings. This system has been credited with contributing to Singapore’s high savings rates and financial security in retirement.

However, increasing contributions can place a significant burden on workers, particularly those with lower incomes. It can also lead to a reduction in disposable income, potentially impacting consumption and economic growth.

Reforming the Pension System

Reforming the pension system can involve a range of measures, such as introducing a “defined contribution” system, where individuals receive a pension based on their contributions, rather than a “defined benefit” system, where pensions are based on a predetermined formula.

The Netherlands has a defined contribution system, where individuals are responsible for managing their own retirement savings. This system provides greater flexibility and control over retirement planning but can also lead to greater risk and uncertainty.

Other reforms could include introducing a “means-tested” system, where pension benefits are reduced or eliminated for higher earners, or implementing a “notional defined contribution” system, which combines elements of defined benefit and defined contribution systems.

Examples of Other Countries

Several countries have implemented successful pension reforms that can provide valuable lessons.

- Chile:In the 1980s, Chile introduced a fully funded individual account system, where individuals are responsible for managing their own retirement savings. This system has been credited with improving the long-term sustainability of the pension system and increasing individual retirement savings.

- Sweden:Sweden has a mixed system that combines a basic state pension with a voluntary individual account system. This approach allows individuals to supplement their state pension with private savings, providing greater flexibility and control over their retirement planning.

Comparison of Solutions

| Solution | Pros | Cons |

|---|---|---|

| Raising the Retirement Age | Increases the number of working years, reducing the burden on taxpayers. | Can have negative consequences for those in physically demanding jobs or with health limitations. Can exacerbate existing inequalities. |

| Increasing Contributions | Ensures the long-term sustainability of the pension system. | Places a significant burden on workers, particularly those with lower incomes. Can lead to a reduction in disposable income. |

| Reforming the Pension System | Provides greater flexibility and control over retirement planning. Can improve the long-term sustainability of the pension system. | Can lead to greater risk and uncertainty. May require significant changes to existing systems and could be politically challenging. |

Ethical Considerations: Is It Time To Limit The State Pension To Those Who Actually Need It

Limiting state pensions raises significant ethical questions about the role of the state in providing social security and the responsibility it owes to its citizens. This policy shift potentially impacts the lives of millions, requiring a careful examination of its implications.

Potential Biases and Discrimination

Restricting state pensions based on factors like wealth or income could lead to unintended biases and discrimination. For example, individuals with lower incomes or those who have not accumulated significant wealth may be disproportionately affected. This could exacerbate existing inequalities and create a two-tier system where some individuals are denied essential support, while others continue to receive it.

The State’s Role in Providing Social Security

The state has a fundamental role in providing social security to its citizens. This includes ensuring a basic standard of living for those who are unable to work due to age, disability, or other circumstances. Limiting state pensions undermines this fundamental principle, potentially leaving vulnerable individuals without adequate financial support in their later years.