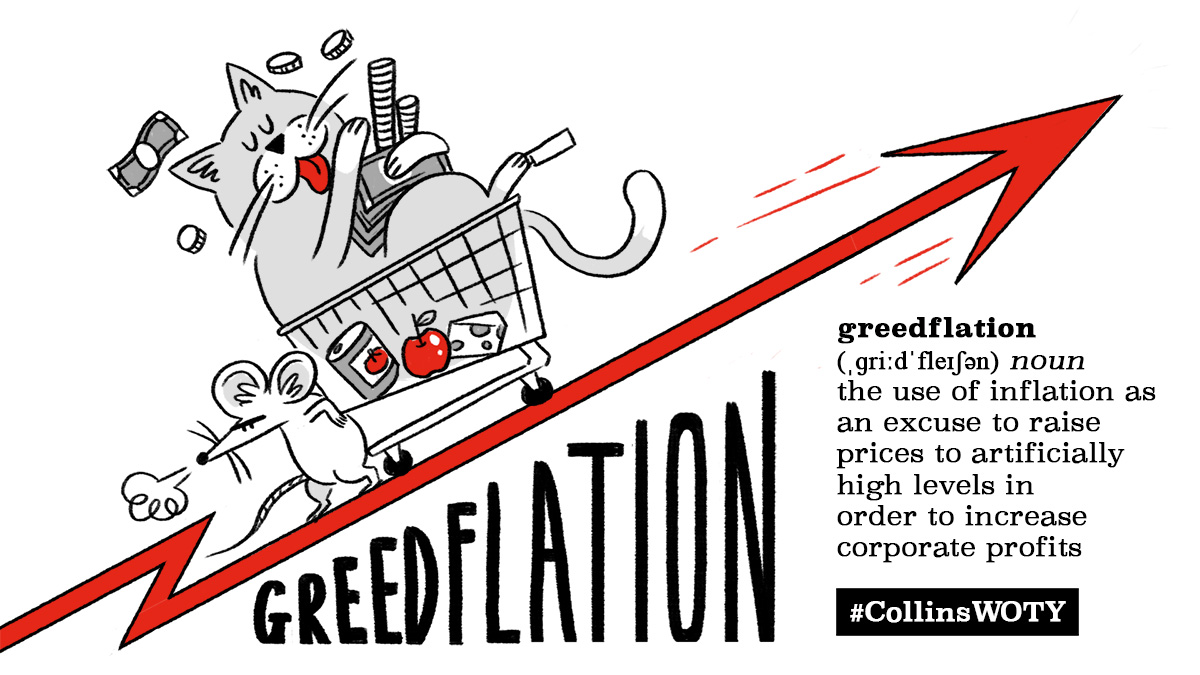

Greedflation: Is Economics Being Rewritten?

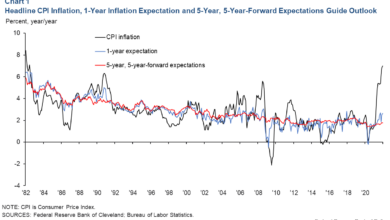

Is greedflation rewriting economics or do old rules still apply – Greedflation: Is economics being rewritten, or do the old rules still apply? This question is increasingly relevant as we witness a growing disconnect between traditional economic theory and the reality of rising prices fueled by corporate greed. While inflation has always been a part of economic cycles, the current situation presents a unique challenge.

The traditional narrative of inflation being driven by supply chain disruptions or excessive consumer demand seems inadequate to explain the recent surge in prices across various sectors.

Many argue that the current inflation is driven by a deliberate strategy of corporations to maximize profits by exploiting their market power. They point to record-breaking corporate profits, alongside price increases that outpace the rise in input costs, as evidence of this phenomenon.

This begs the question: is greedflation a new economic paradigm, or is it merely a temporary aberration in a market system that still functions fundamentally as it always has?

Policy Responses to Greedflation: Is Greedflation Rewriting Economics Or Do Old Rules Still Apply

The question of whether “greedflation” is a significant factor in the current inflationary environment has sparked debate. While the traditional economic framework attributes inflation to factors like supply chain disruptions and strong demand, some argue that corporate profiteering and price gouging are exacerbating the situation.

Addressing this alleged “greedflation” requires exploring policy interventions that can curb corporate greed and control inflation.

Antitrust Measures

Antitrust policies are designed to prevent monopolies and promote competition in the market. In the context of greedflation, antitrust measures could be employed to address concerns about excessive market concentration and potential price manipulation by dominant firms.

- Increased Enforcement:Strengthening the enforcement of existing antitrust laws can deter companies from engaging in anti-competitive practices, such as price fixing and market manipulation. This involves proactive investigations, robust penalties for violations, and a more aggressive stance against mergers and acquisitions that could lead to market dominance.

- Enhanced Scrutiny of Mergers:Thorough scrutiny of proposed mergers and acquisitions, particularly in industries where consolidation has already occurred, can help prevent the formation of monopolies that could stifle competition and lead to higher prices. This involves examining the potential impact on market concentration, consumer prices, and innovation.

- Expansion of Antitrust Laws:Expanding antitrust laws to address emerging business models and practices, such as digital platforms and data monopolies, can help ensure a level playing field and prevent anti-competitive behavior in the digital economy.

Price Controls

Price controls involve government-imposed limits on the prices that businesses can charge for goods and services. This approach aims to directly control inflation by preventing businesses from raising prices beyond a predetermined level.

- Temporary Price Caps:Implementing temporary price caps on essential goods and services, particularly during periods of high inflation, can provide short-term relief to consumers and prevent excessive price increases. However, such measures can also create shortages, discourage investment, and distort market signals.

- Targeted Price Controls:Instead of broad-based price controls, targeted price controls on specific goods or services that are deemed essential or subject to excessive price increases can be more effective. For example, price controls on gasoline or pharmaceuticals could be considered during periods of supply disruptions or excessive price increases.

- Price Monitoring and Enforcement:Effective price control measures require robust monitoring and enforcement mechanisms to ensure compliance and prevent black markets. This involves establishing clear guidelines, providing mechanisms for reporting violations, and imposing penalties for non-compliance.

Progressive Taxation

Progressive taxation systems impose higher tax rates on higher earners, with the aim of redistributing wealth and reducing income inequality. In the context of greedflation, progressive taxation could be used to address concerns about excessive corporate profits and ensure that corporations contribute a fair share to the public good.

- Higher Corporate Tax Rates:Increasing corporate tax rates, particularly for companies with high profits, can help reduce corporate greed and generate revenue for government programs. This can be achieved through a combination of higher marginal tax rates and a minimum corporate tax rate.

- Windfall Profit Taxes:Imposing windfall profit taxes on companies that experience sudden and unexpected increases in profits, such as those in the energy sector during a global energy crisis, can help capture excess profits and redistribute wealth. This approach can be temporary and targeted at specific industries.

- Taxing Stock Buybacks:Taxing stock buybacks, which are often seen as a way for companies to return profits to shareholders rather than invest in growth or pay employees higher wages, can encourage companies to use their profits for more productive purposes. This can help to reduce corporate greed and promote long-term economic growth.

Comparison of Policy Options, Is greedflation rewriting economics or do old rules still apply

| Policy Option | Pros | Cons |

|---|---|---|

| Antitrust Measures | Promotes competition, reduces market power, prevents price manipulation | Enforcement can be complex and time-consuming, may stifle innovation, potential for regulatory capture |

| Price Controls | Provides short-term relief from high prices, can prevent price gouging | Can create shortages, distort market signals, discourage investment, may lead to black markets |

| Progressive Taxation | Reduces income inequality, generates revenue for government programs, can discourage corporate greed | Can discourage investment, may lead to job losses, can be difficult to implement effectively |

Last Recap

The debate over greedflation is far from settled. While some argue that the old economic rules still apply, others contend that the rise of corporate power and the erosion of competition are fundamentally altering the way our economy operates.

The consequences of this shift are far-reaching, potentially impacting everything from household budgets to the stability of our financial system. As we navigate this new economic landscape, it’s crucial to understand the forces at play and consider the potential policy interventions that might be necessary to ensure a fairer and more sustainable future.

Is greedflation a symptom of a broken economic system, or just a temporary blip? It’s hard to say, but the question is certainly a hot topic. Perhaps a little perspective can help – check out this article on what’s so great about online teaching.

The flexibility and accessibility of online teaching could be a great way to address some of the economic challenges we’re facing, allowing people to pursue new opportunities and adapt to changing circumstances. Whether it’s greedflation or a broader economic shift, we need to be thinking about solutions that work for everyone, and online education might just be a piece of the puzzle.

It’s a fascinating time to be watching the economy, with so many arguing about whether “greedflation” is rewriting the rules or if we’re just seeing a temporary blip. It’s almost like the recent discovery of a Galapagos tortoise thought extinct for 100 years , reminding us that even when things seem lost, there’s always the chance for a surprise.

Perhaps, just as the tortoise has proven its resilience, the old economic principles will reassert themselves, but maybe this time, the landscape will be permanently altered.

It’s fascinating to see how the economic landscape is shifting, with debates raging about whether “greedflation” is rewriting the rules or if old economic principles still hold true. Meanwhile, the Alex Jones damages trial, which begins today, focused on his false claims about the Sandy Hook shooting being a hoax , highlights the dangers of spreading misinformation and the potential consequences for those who do.

Ultimately, understanding the interplay between economic forces and the spread of misinformation is crucial for navigating the complexities of our current world.