Investors: Avoid Cash in This Bear Market

Investors please avoid cash during this bear market – Investors: Avoid Cash in This Bear Market is a bold statement, but it’s one that holds significant weight in the current market climate. As we navigate a period of economic uncertainty, many investors find themselves questioning their strategies and seeking ways to protect their hard-earned capital.

The truth is, holding onto cash during a bear market can be a risky move. Inflation erodes the value of your savings, and you miss out on the potential for growth in other asset classes. So, what should you do?

This article explores the reasons why cash is not your friend in a bear market and Artikels alternative investment strategies that can help you weather the storm.

Alternative Investment Strategies: Investors Please Avoid Cash During This Bear Market

Bear markets present a unique challenge for investors, as traditional asset classes like stocks and bonds often experience significant declines. However, this period also presents opportunities for those willing to explore alternative investment strategies. These strategies can offer potential for capital preservation and even growth during market downturns.

Identifying Asset Classes That Perform Well During Bear Markets

Bear markets typically see a shift in investor sentiment, favoring assets that offer stability and potential for capital appreciation.

While investors might be tempted to hold onto cash during this bear market, it’s important to remember that inflation is eroding its value. Consider investing in sectors with long-term potential, even if they’re facing short-term headwinds. For example, India’s impressive growth hasn’t translated into widespread job creation, as explored in this analysis , but the country’s digital infrastructure and young population offer significant opportunities for future growth.

By diversifying your portfolio and investing in sectors with strong fundamentals, you can weather the storm and emerge stronger on the other side.

- Gold:Historically, gold has served as a safe haven asset during periods of economic uncertainty. Its price tends to rise when investors seek to preserve capital, as it is not tied to the performance of any particular economy or company.

Gold can act as a hedge against inflation and currency devaluation, making it an attractive option during times of economic turmoil.

- Real Estate:Real estate can provide a hedge against inflation and offer consistent rental income, which can be particularly valuable during a bear market. While the real estate market may slow down during a downturn, it is typically less volatile than stocks and bonds, providing some stability for investors.

However, it’s important to consider the specific characteristics of the real estate market in your area, including local economic conditions and demand.

- Fixed Income Securities:While bonds are generally considered less risky than stocks, some fixed income securities, such as high-yield bonds or bonds with longer maturities, can offer higher returns and potentially perform better during a bear market. However, it’s crucial to remember that these securities carry higher risks, and their performance can be affected by interest rate fluctuations and credit risk.

- Commodities:Certain commodities, such as oil and agricultural products, can benefit from supply and demand dynamics during economic downturns. For example, rising demand for energy and food can drive up prices, offering potential for investment gains. However, commodity prices can be highly volatile and influenced by geopolitical events and other factors, making them a risky investment.

Comparing and Contrasting the Risks and Rewards of Different Investment Strategies

Each alternative investment strategy comes with its own set of risks and rewards, which investors need to carefully consider.

- Gold:The main advantage of gold is its potential to preserve capital during economic downturns. However, it does not generate income and its price can fluctuate significantly, making it a risky investment in the long term.

- Real Estate:Real estate offers potential for capital appreciation, rental income, and inflation hedging. However, it can be illiquid, meaning it can be difficult to sell quickly, and it requires significant upfront capital. Additionally, real estate values can be affected by local economic conditions and government policies.

- Fixed Income Securities:Fixed income securities offer predictable income streams and can provide some stability during market downturns. However, they are subject to interest rate risk, meaning their value can decline when interest rates rise. High-yield bonds, while potentially offering higher returns, carry greater credit risk, meaning there is a higher chance that the issuer may default on its debt obligations.

- Commodities:Commodities can provide exposure to different sectors of the economy, potentially offering diversification and inflation hedging. However, they are highly volatile and subject to supply and demand fluctuations, making them a risky investment. Additionally, commodities do not generate income and can be difficult to store and manage.

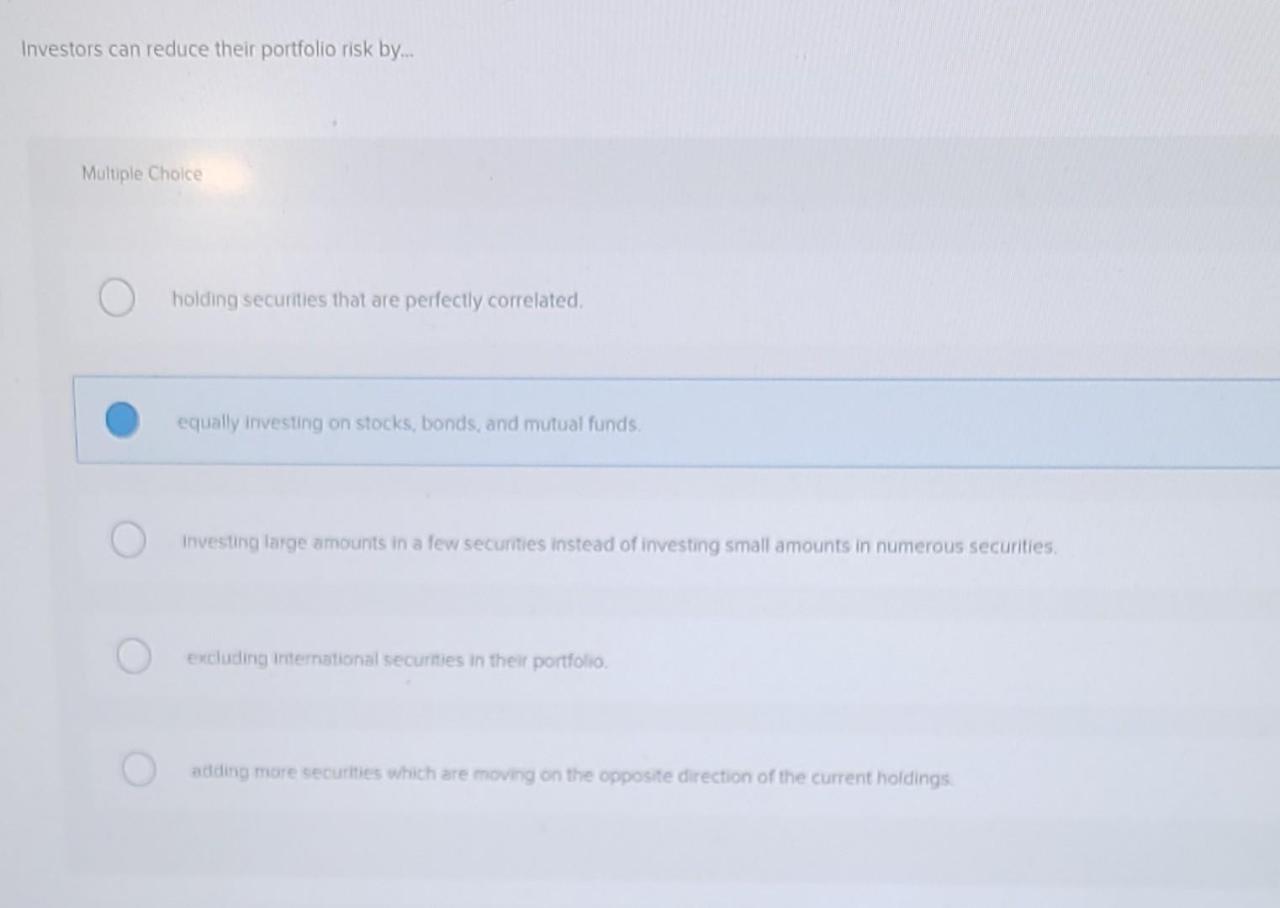

Designing a Diversified Portfolio That Mitigates Risk During a Bear Market

A well-diversified portfolio can help mitigate risk during a bear market.

Right now, holding onto cash feels like a safe haven, but in a bear market, it’s actually a losing game. Inflation is eroding your purchasing power, and you’re missing out on potential growth. Instead of sitting on the sidelines, consider investing in assets that can weather the storm.

To make smart investment decisions, it’s crucial to have strong leadership skills, like adaptability and strategic thinking. Check out this insightful article on 10 most important leadership skills for the 21st century workplace and how to develop them to empower yourself to navigate this volatile market.

Remember, a well-informed investor is a successful investor, and the right leadership skills can help you make those crucial decisions.

- Asset Allocation:Allocate assets across different asset classes, including traditional investments like stocks and bonds, as well as alternative investments like gold, real estate, and commodities. This diversification can help reduce the overall volatility of your portfolio and protect your capital during market downturns.

Holding onto cash during a bear market might seem like a safe bet, but it can actually hurt your returns in the long run. Remember, cash doesn’t grow on its own! Instead, consider exploring opportunities in the market, like those discussed in the transcript dr henning tiemeier on investment strategies.

Investing wisely during a bear market can set you up for success when the market inevitably rebounds.

For example, you might allocate a portion of your portfolio to gold, which could potentially perform well during a bear market, while maintaining a core holding in stocks and bonds for long-term growth potential.

- Risk Management:Implement risk management strategies to protect your portfolio from significant losses. This could include setting stop-loss orders on your investments, which automatically sell your investments if they fall below a certain price, or using options contracts to hedge against market volatility.

- Investment Horizon:Remember that bear markets are temporary, and the market will eventually recover. Therefore, it’s important to maintain a long-term investment horizon and avoid making rash decisions based on short-term market fluctuations. Instead, focus on your long-term financial goals and stick to your investment plan.

Investor Psychology and Behavior

Bear markets are periods of significant decline in stock prices, often accompanied by fear, uncertainty, and panic among investors. During these challenging times, understanding investor psychology and behavior is crucial for making sound investment decisions. This section explores the emotional factors that influence investment decisions during a bear market, emphasizes the importance of maintaining a long-term investment perspective, and provides a step-by-step guide to managing investment emotions during a bear market.

The Impact of Fear and Greed on Investment Decisions

Fear and greed are powerful emotions that can significantly influence investor behavior. Fear can lead investors to sell assets prematurely, locking in losses, while greed can encourage investors to chase returns in risky investments, leading to potential losses. During a bear market, fear often dominates, causing investors to overreact to negative news and market volatility.

This can lead to selling decisions based on emotion rather than sound financial principles.

Maintaining a Long-Term Investment Perspective

Maintaining a long-term investment perspective is essential during a bear market. Investors should remember that market cycles are inevitable, and downturns are a natural part of the investment process. Focusing on the long-term goals and staying disciplined can help investors weather market storms and emerge with positive returns.

Managing Investment Emotions During a Bear Market

Managing investment emotions during a bear market requires a conscious effort to stay rational and disciplined. The following steps can help investors navigate market volatility and make informed decisions:

- Acknowledge and Understand Your Emotions:Recognize that fear and anxiety are normal reactions to market downturns. Accepting these emotions allows you to address them constructively.

- Develop a Solid Investment Plan:Having a well-defined investment plan based on your financial goals, risk tolerance, and time horizon can provide a framework for decision-making during volatile periods.

- Focus on the Long Term:Remember that market fluctuations are temporary, and long-term investments are designed to weather market cycles. Avoid making impulsive decisions based on short-term market movements.

- Seek Professional Advice:Consulting with a financial advisor can provide valuable guidance and support during a bear market. They can help you assess your portfolio, adjust your strategy, and make informed decisions based on your individual circumstances.

- Stay Informed:Keep yourself updated on market developments and economic news, but avoid excessive information consumption. Stick to reliable sources and avoid speculation and rumors.

- Avoid Emotional Decisions:During a bear market, it’s crucial to avoid making impulsive decisions based on fear or greed. Instead, rely on your investment plan and your long-term financial goals.

Professional Advice and Guidance

Navigating the complex world of investments can be overwhelming, especially during volatile market conditions. Seeking professional advice from a qualified financial advisor can provide valuable insights and guidance, helping you make informed decisions and achieve your financial goals.

The Value of Consulting a Financial Advisor

A financial advisor acts as a trusted guide, providing personalized financial advice tailored to your specific needs and circumstances. They can help you:

- Develop a comprehensive financial plan:A financial advisor will work with you to define your financial goals, assess your current financial situation, and create a roadmap to achieve your objectives.

- Manage your investments:They can provide expert guidance on asset allocation, portfolio diversification, and investment strategies, helping you manage risk and maximize returns.

- Optimize your tax strategy:A financial advisor can help you minimize your tax liability by leveraging tax-efficient investment strategies and maximizing tax deductions.

- Provide ongoing support and guidance:They are available to answer your questions, address your concerns, and adjust your financial plan as your circumstances change.

Questions to Ask a Financial Advisor

When considering a financial advisor, it’s crucial to ask the right questions to ensure they are a good fit for your needs. Here’s a checklist of questions to consider:

- What are your credentials and experience?Look for advisors with relevant certifications and experience in managing investments similar to yours.

- What is your investment philosophy and approach?Understand their investment style and how it aligns with your risk tolerance and goals.

- How do you charge for your services?Be clear about the fees involved and how they are structured.

- What are your performance track records?Ask for details on their past performance and compare it to relevant benchmarks.

- How do you handle conflicts of interest?Ensure they are transparent about any potential conflicts that could impact your investment decisions.

- What is your communication style?Choose an advisor who communicates effectively and keeps you informed about your investments.

- Do you have any references?Ask for references from previous clients to gain insights into their experience with the advisor.

Resources for Seeking Professional Financial Advice, Investors please avoid cash during this bear market

Finding a reputable financial advisor can be a daunting task. Here are some resources to help you in your search:

- Professional organizations:Organizations like the Certified Financial Planner Board of Standards (CFP Board) and the National Association of Personal Financial Advisors (NAPFA) provide resources and directories of certified financial planners.

- Online platforms:Websites like SmartAsset and Personal Capital offer tools and resources to connect you with financial advisors in your area.

- Referrals:Ask your friends, family, and colleagues for recommendations on financial advisors they trust.

Final Thoughts

The bear market is a time for investors to think strategically and adapt their portfolios. While cash may seem like a safe haven, it’s crucial to recognize the opportunity cost and potential for erosion. By understanding the dynamics of a bear market and exploring alternative investment strategies, you can position yourself for long-term success.

Remember, this is not a time to panic; it’s a time to be proactive and make informed decisions that align with your financial goals.