Fed Meeting This Week: Interest Rate Hike Expected

Interest rate hike expected as federal reserve officials gather in washington this week sets the stage for a pivotal moment in the US economy. The Federal Reserve, tasked with managing inflation and promoting maximum employment, is expected to make a decision that could significantly impact our financial landscape.

The current economic landscape is a complex mix of challenges and opportunities, with inflation remaining stubbornly high despite recent cooling, unemployment hovering at a low rate, and GDP growth showing signs of slowing.

The Federal Reserve’s decision on interest rates will be a delicate balancing act, weighing the need to curb inflation against the potential risks of slowing economic growth. This week’s meeting will be closely watched by investors, businesses, and individuals alike, as the outcome could have far-reaching implications for our financial futures.

The Current Economic Landscape: Interest Rate Hike Expected As Federal Reserve Officials Gather In Washington This Week

The Federal Reserve’s upcoming meeting this week has the market on edge, with investors eagerly anticipating a potential interest rate hike. This decision comes amidst a complex economic landscape, characterized by persistent inflation, a resilient job market, and a slowing economy.

Understanding the current state of the US economy is crucial for comprehending the Federal Reserve’s decision-making process and its potential impact on financial markets.

Key Economic Indicators

The US economy is currently navigating a challenging environment. Inflation, a persistent concern, has shown signs of moderation in recent months, but remains elevated above the Federal Reserve’s target of 2%. The Consumer Price Index (CPI), a key measure of inflation, rose by 3% year-over-year in June 2023, down from a peak of 9.1% in June 2022.

However, core inflation, which excludes volatile food and energy prices, remains stubbornly high, indicating that price pressures are still present across the economy.The unemployment rate, another important economic indicator, remains at historically low levels, suggesting a robust job market. The unemployment rate stood at 3.6% in June 2023, indicating a strong demand for labor.

The Federal Reserve’s decision on interest rates this week will have a significant impact on the economy, and it’s a reminder that sometimes, even when things seem unfair, it’s crucial to stay true to your values and principles. If you find yourself in a situation where you’ve been wronged, remember that how to stay right when you’ve been wronged can guide you through difficult times.

Ultimately, the Federal Reserve’s decision will shape the economic landscape, but staying true to ourselves is what truly defines our character.

However, the pace of job growth has slowed in recent months, reflecting the broader economic slowdown.The US economy’s growth trajectory has also moderated, with GDP growth slowing in the first quarter of 2023. The Bureau of Economic Analysis reported a 1.3% annualized growth rate for the first quarter, down from a 2.6% growth rate in the fourth quarter of 2022.

This slowdown is attributed to a number of factors, including rising interest rates, persistent inflation, and waning consumer confidence.

The Federal Reserve’s Dual Mandate

The Federal Reserve, the central bank of the United States, operates under a dual mandate: to promote price stability and maximum employment. These two objectives are often intertwined, as a strong economy typically leads to lower unemployment, while a stable price environment fosters economic growth and investment.

The Federal Reserve’s Decision-Making

The Federal Reserve’s decision on interest rates is influenced by a multitude of factors, including the current economic conditions, inflation expectations, and the potential impact of its actions on the economy. The current economic landscape presents a challenging environment for the Federal Reserve, as it seeks to balance the need to curb inflation with the desire to maintain a healthy labor market.The Federal Reserve’s recent interest rate hikes have been aimed at cooling down the economy and bringing inflation back to its target level.

It’s a tough week for news. While we’re all watching to see if the Fed raises interest rates, it’s hard to ignore the heartbreaking story of a Columbia graduate student brutally beaten in Manhattan, with his mother desperately searching for answers.

Read more about this tragic incident here. Hopefully, the Fed’s decisions will bring some stability to the economy, but the human cost of violence is always a heavy burden to bear.

However, these hikes have also raised concerns about potentially triggering a recession. The Federal Reserve’s decision on interest rates this week will be closely watched by investors and economists alike, as it will provide insights into the central bank’s assessment of the economy and its commitment to achieving its dual mandate.

The Federal Reserve’s Role

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. Its primary responsibility is to maintain the stability of the financial system and promote economic growth. The Fed accomplishes this through various monetary policy tools, including adjusting interest rates and managing the money supply.

The Federal Reserve’s Tools for Influencing Interest Rates

The Fed utilizes several tools to influence interest rates, impacting the cost of borrowing and lending in the economy. These tools are designed to control the amount of money circulating in the economy, ultimately affecting inflation and economic activity.

- Federal Funds Rate:This is the target rate at which banks lend reserves to each other overnight. The Fed sets this rate through open market operations, buying or selling government securities. By increasing the supply of reserves, the Fed lowers the federal funds rate, making it cheaper for banks to borrow money.

Conversely, reducing the supply of reserves increases the federal funds rate, making it more expensive to borrow.

- Quantitative Easing:This involves the Fed purchasing large quantities of government securities or other assets, injecting liquidity into the financial system. This can lower long-term interest rates, encouraging investment and economic activity.

The Potential Impact of an Interest Rate Hike on the Economy

An interest rate hike can have significant implications for the economy, affecting inflation, economic growth, and employment.

- Inflation:Raising interest rates can help curb inflation by making borrowing more expensive, slowing down consumer spending and business investment. This reduces demand in the economy, leading to a decrease in prices.

- Economic Growth:Higher interest rates can slow down economic growth by discouraging investment and consumer spending. This can lead to a decrease in production and employment.

- Employment:An interest rate hike can impact employment in various ways. While it may slow down economic growth and lead to job losses in some sectors, it can also encourage investment in areas where interest rates are crucial, potentially creating jobs in those sectors.

The Potential Risks and Benefits of an Interest Rate Hike, Interest rate hike expected as federal reserve officials gather in washington this week

An interest rate hike is a complex decision with both potential risks and benefits.

- Risks:Raising interest rates too quickly or aggressively can lead to a recession by slowing down economic growth too rapidly. It can also create financial market volatility and make it more difficult for businesses to access capital.

- Benefits:An interest rate hike can help control inflation and stabilize the economy in the long run. It can also encourage savings and investment, leading to sustainable economic growth.

Market Reactions and Implications

The Federal Reserve’s decision to raise interest rates will have a significant impact on financial markets and the broader economy. Investors and businesses will closely watch how these changes ripple through various sectors, influencing investment decisions, spending patterns, and overall economic activity.

The news cycle is buzzing this week with a double dose of serious topics. While Federal Reserve officials gather in Washington to discuss a possible interest rate hike, a different kind of gathering is taking place in Texas – the damages trial for Alex Jones, who faces repercussions for his false claims about the Sandy Hook shooting being a hoax.

This trial is a stark reminder of the power of words and the consequences of spreading misinformation, a sobering thought as we consider the economic impact of potential interest rate increases.

Impact on Financial Markets

The market’s reaction to an interest rate hike is often complex and multifaceted.

- Stock Prices:Higher interest rates can make borrowing more expensive for companies, potentially leading to slower growth and lower profits. This could result in a decline in stock prices, particularly for companies heavily reliant on debt financing or those in sectors sensitive to economic growth.

However, in some cases, rising rates might signal a stronger economy, potentially supporting stock prices.

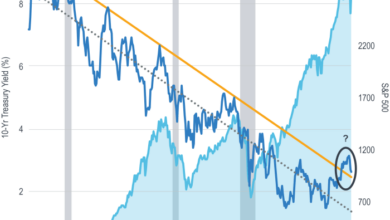

- Bond Yields:As interest rates rise, existing bonds become less attractive, leading to a decrease in their prices. This results in higher bond yields, as investors demand a greater return for their investment. This relationship between interest rates and bond yields is inversely proportional.

- US Dollar:Higher interest rates in the US can make the dollar more attractive to foreign investors, leading to an appreciation of the dollar. This can make US exports more expensive and imports cheaper, impacting trade balances and the competitiveness of American businesses in the global market.

Impact on Economic Sectors

Interest rate hikes can have a ripple effect across various sectors of the economy, influencing consumer behavior, business investment, and overall economic growth.

- Housing:Higher interest rates make it more expensive to borrow money for mortgages, potentially slowing down the housing market. This could lead to lower demand for homes, a decrease in home prices, and a slowdown in construction activity.

- Consumer Spending:Increased borrowing costs can affect consumer spending, as individuals might become more cautious about taking on debt for major purchases. This could lead to a decline in consumer spending, potentially impacting industries reliant on discretionary spending.

- Business Investment:Higher interest rates can discourage businesses from investing in new projects, as the cost of borrowing increases. This could lead to a slowdown in economic growth, as businesses delay expansion plans and investment in capital goods.

Impact on Individuals and Businesses

The impact of an interest rate hike extends to individuals and businesses, influencing their borrowing costs, investment decisions, and financial planning.

- Borrowing Costs:Individuals and businesses will face higher borrowing costs for mortgages, loans, and credit cards. This can make it more expensive to finance major purchases, such as homes or equipment, potentially impacting their financial planning and spending decisions.

- Investment Decisions:Higher interest rates can make traditional savings accounts and fixed-income investments more attractive, potentially diverting capital away from riskier assets like stocks. This can influence investment decisions and overall asset allocation strategies.

Historical Context and Future Outlook

The current economic landscape, marked by inflation and potential recession, has led to widespread anticipation of an interest rate hike by the Federal Reserve. Understanding the historical context of past interest rate increases and their impact on the economy is crucial for discerning the potential implications of the upcoming decision.

Historical Comparisons and Trends

A comparative analysis of past periods of interest rate hikes provides valuable insights into the potential effects of the current decision. For example, the Federal Reserve’s aggressive interest rate increases in the early 1980s under Chairman Paul Volcker, aimed at curbing rampant inflation, resulted in a severe recession.

However, the economic landscape in the 1980s differed significantly from the current situation, with factors like the oil crisis and the collapse of the Bretton Woods system playing a significant role.

Potential Impact of the Interest Rate Decision

The impact of the upcoming interest rate decision on the economy will depend on several factors, including the magnitude of the hike, the pace of future rate increases, and the overall health of the economy.

The Federal Reserve’s dual mandate of price stability and maximum employment is a critical consideration in its decision-making process.

The Federal Reserve’s objectives, as Artikeld in its dual mandate, are to maintain price stability and achieve maximum employment. Striking a balance between these objectives while navigating the current economic challenges is a complex task.

Interest Rate Trajectory in the Coming Months and Years

Predicting the trajectory of interest rates in the coming months and years is inherently challenging, as it depends on various economic factors, including inflation, unemployment, and consumer spending. However, based on the current economic outlook and the Federal Reserve’s stated objectives, it is reasonable to anticipate a gradual increase in interest rates in the near term.

The Federal Reserve’s commitment to achieving price stability suggests that it will continue to raise interest rates until inflation shows signs of cooling down.

The Federal Reserve’s commitment to achieving price stability suggests that it will continue to raise interest rates until inflation shows signs of cooling down. However, the pace of future rate increases will likely be influenced by the economic data and the evolving economic outlook.

Summary

The upcoming Federal Reserve meeting promises to be a defining moment for the US economy. As the Fed navigates the intricate balance between controlling inflation and maintaining economic growth, their decision on interest rates will shape the course of our financial future.

The market’s reaction will provide a clear signal of how investors perceive the Fed’s strategy and the potential impact on their portfolios. Ultimately, the success of the Fed’s actions will hinge on their ability to manage inflation effectively while fostering a sustainable and robust economic environment.