ING Pledges to Stop Financing New Oil and Gas Projects

Ing pledges to stop financing new upstream oil and gas projects – ING, a major global financial institution, has made a bold move by pledging to stop financing new upstream oil and gas projects. This decision comes at a pivotal time, as the world grapples with the urgent need to transition to a low-carbon economy and mitigate the devastating impacts of climate change.

ING’s commitment signals a growing trend among financial institutions to align their investments with sustainability goals and prioritize renewable energy sources.

This decision has far-reaching implications for both ING and the broader energy landscape. It underscores the growing recognition that fossil fuels are no longer a viable long-term solution for our energy needs. As ING shifts its focus to renewable energy and sustainable finance, it faces both challenges and opportunities.

The company will need to navigate pressure from stakeholders, find alternative investments, and adapt its business model to a rapidly evolving energy sector.

Background and Context

ING’s pledge to stop financing new upstream oil and gas projects is a significant step in the fight against climate change. This decision reflects the growing global consensus that transitioning to renewable energy sources is crucial to mitigate the effects of climate change.

ING’s pledge aligns with the broader context of the global shift towards renewable energy. The world is increasingly moving away from fossil fuels and towards cleaner energy sources. This transition is driven by a number of factors, including:

The Growing Concerns About Climate Change

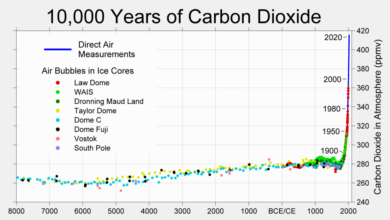

The scientific consensus on climate change is overwhelming. The Intergovernmental Panel on Climate Change (IPCC), the leading international body for the assessment of climate change, has concluded that human activities are the dominant cause of observed warming since the mid-20th century.

The IPCC’s Fifth Assessment Report (AR5) stated that:

“It is extremely likely that human influence has been the dominant cause of the observed warming since the mid-20th century.”

The IPCC’s findings have been endorsed by numerous scientific organizations, including the American Meteorological Society, the National Academy of Sciences, and the Royal Society.

ING’s Involvement in the Oil and Gas Sector

ING has a long history of involvement in the oil and gas sector. The bank has provided financing for a range of oil and gas projects, including exploration, production, and transportation. However, in recent years, ING has been facing increasing pressure from investors, environmental groups, and the public to reduce its exposure to the fossil fuel industry.ING’s pledge to stop financing new upstream oil and gas projects is a significant departure from its previous approach.

Pledges to stop financing new upstream oil and gas projects are gaining traction, but it’s a complex issue. As Sri Lanka is yearning to turn a page as the country votes in a presidential election , their future energy policy will be a critical factor in their economic recovery.

These pledges highlight the need for global collaboration to accelerate the transition to clean energy and ensure a sustainable future for all.

This decision reflects the bank’s commitment to aligning its business with the goals of the Paris Agreement, which aims to limit global warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

The Pledge and Its Implications: Ing Pledges To Stop Financing New Upstream Oil And Gas Projects

ING’s pledge to stop financing new upstream oil and gas projects represents a significant shift in the bank’s approach to fossil fuel investments. The pledge, announced in 2021, Artikels the bank’s commitment to align its business activities with the goals of the Paris Agreement, aiming to limit global warming to well below 2 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.This pledge carries substantial implications for ING’s operations, financial performance, and reputation within the financial sector.

ING’s Pledge and Its Specifics

ING’s pledge is multifaceted, encompassing a range of actions and commitments.

- No New Financing for Upstream Oil and Gas Projects:ING will not provide any new financing for projects directly involved in the exploration, development, or production of oil and gas. This includes loans, bonds, equity investments, and other forms of financial support.

- Exceptions for Certain Projects:While the pledge generally excludes upstream oil and gas projects, ING will consider financing projects that contribute to the transition to a low-carbon economy. This includes projects that focus on renewable energy, carbon capture and storage, and energy efficiency.

- Phased Implementation:The pledge will be implemented gradually, with ING aiming to phase out financing for upstream oil and gas projects by 2030. This phased approach allows the bank to manage its existing commitments and facilitate a smooth transition to a more sustainable portfolio.

Impact on ING’s Business and Financial Performance

ING’s pledge is expected to have a significant impact on its business and financial performance.

- Reduced Revenue Streams:The exclusion of upstream oil and gas projects from ING’s financing portfolio will lead to a reduction in potential revenue streams. However, ING anticipates offsetting this loss by expanding its financing activities in renewable energy and other sustainable sectors.

- Increased Investment in Sustainable Sectors:By focusing on renewable energy, carbon capture and storage, and energy efficiency, ING aims to capitalize on the growing demand for sustainable investments. This shift in investment strategy is expected to contribute to long-term profitability and sustainability.

- Reputational Benefits:ING’s pledge aligns with the increasing global focus on climate change and the transition to a low-carbon economy. This commitment is likely to enhance the bank’s reputation among investors, customers, and stakeholders, potentially attracting a wider pool of investors and clients seeking sustainable investment options.

Comparison with Other Financial Institutions

ING’s pledge is part of a growing trend among financial institutions to align their activities with the goals of the Paris Agreement. Several other banks, insurance companies, and asset managers have made similar commitments to reduce or eliminate their financing of fossil fuel projects.

The pledges to stop financing new upstream oil and gas projects are a step in the right direction, but we need to remember that the fight against climate change is intertwined with other global issues. For example, the impact of climate change on vulnerable communities can exacerbate existing health challenges, such as the spread of diseases like HIV/AIDS.

It’s crucial to consider the interconnectedness of these challenges and work towards solutions that address both the climate crisis and the needs of those most affected by it, like the communities battling the HIV/AIDS epidemic, as explained in this article about aids around the world.

By taking a holistic approach, we can build a more sustainable and equitable future for all.

- BNP Paribas:In 2021, BNP Paribas announced its commitment to reach net-zero emissions across its portfolio by 2050, including a gradual phase-out of financing for upstream oil and gas projects.

- HSBC:HSBC has pledged to achieve net-zero emissions across its financing activities by 2050, with a focus on supporting the transition to a low-carbon economy. The bank has also committed to phasing out financing for coal-fired power plants.

- Allianz:The German insurance company Allianz has announced its intention to divest from coal-fired power plants and to reduce its investments in other fossil fuel projects. Allianz aims to achieve net-zero emissions across its investment portfolio by 2050.

Environmental and Social Impacts

ING’s pledge to halt financing for new upstream oil and gas projects carries significant environmental and social implications, prompting discussions about its potential benefits and challenges.

Environmental Benefits

The environmental benefits of ING’s pledge are multifaceted, primarily focused on mitigating climate change and protecting ecosystems.

- Reduced Greenhouse Gas Emissions:By curbing investments in oil and gas extraction, ING aims to reduce the carbon footprint of its portfolio. This aligns with global efforts to limit global warming to well below 2 degrees Celsius, as Artikeld in the Paris Agreement.

- Preservation of Ecosystems:Oil and gas exploration and production often lead to habitat destruction, biodiversity loss, and pollution of air, water, and soil. ING’s pledge could help protect sensitive ecosystems, such as forests, wetlands, and marine environments, from the adverse impacts of fossil fuel extraction.

Social Implications

The social implications of ING’s pledge are complex and require careful consideration, particularly for communities heavily reliant on oil and gas production.

- Impact on Communities:The transition away from fossil fuels could lead to job losses in oil and gas-producing regions. However, ING’s pledge emphasizes the importance of supporting a just transition, which includes investing in alternative energy sources and creating new job opportunities in renewable energy sectors.

- Energy Security:Some argue that reducing investments in oil and gas could compromise energy security, particularly in regions heavily dependent on fossil fuels. However, proponents of the pledge argue that transitioning to renewable energy sources will ultimately enhance energy security by diversifying energy portfolios and reducing reliance on volatile global fossil fuel markets.

Perspectives of Environmental Groups and Advocates

Environmental groups and advocates have largely praised ING’s pledge, recognizing it as a significant step towards a sustainable future.

It’s inspiring to see individuals like Joakim Noah, a former NBA star, dedicate themselves to community initiatives like the NBA Africa program, as he discussed in a recent interview. His commitment to making a positive impact reminds us that we all have the power to contribute to a better world, even in small ways.

And that includes supporting pledges to stop financing new upstream oil and gas projects, which are crucial for tackling climate change and building a sustainable future.

“ING’s commitment to stop financing new upstream oil and gas projects is a bold and necessary move in the fight against climate change. It sends a clear signal to the financial sector that the era of fossil fuels is coming to an end.”

[Name of Environmental Group]

Challenges and Opportunities

ING’s pledge to stop financing new upstream oil and gas projects presents both challenges and opportunities. While it aligns with the global transition towards a low-carbon economy, it also requires navigating complex considerations and leveraging emerging possibilities.

Challenges of Implementing the Pledge, Ing pledges to stop financing new upstream oil and gas projects

ING’s pledge to stop financing new upstream oil and gas projects will undoubtedly face challenges. One significant challenge is pressure from stakeholders who may be heavily invested in the oil and gas industry. These stakeholders could include investors, clients, and even employees who might perceive the pledge as a threat to their interests.

Another challenge is the availability of alternative investments. While the renewable energy sector is growing, it may not be as readily available or financially attractive as traditional fossil fuel investments.

Opportunities Presented by the Pledge

Despite the challenges, ING’s pledge also presents several opportunities. The most significant opportunity is the potential to expand its portfolio in renewable energy and sustainable finance. By shifting its investments towards these sectors, ING can capitalize on the growing demand for clean energy solutions and contribute to a more sustainable future.

This shift can also enhance ING’s reputation as a responsible and forward-thinking financial institution, attracting investors and clients who are increasingly prioritizing sustainability.

ING’s Role in Promoting a Low-Carbon Economy

ING’s pledge is a significant step towards promoting a transition to a low-carbon economy. By reducing its financing of new oil and gas projects, ING is sending a strong signal to the market that it is committed to supporting a sustainable future.

This commitment can inspire other financial institutions to follow suit, leading to a broader shift in investment priorities. Moreover, ING can leverage its expertise and resources to support the development of renewable energy projects and other sustainable initiatives. This can include providing financing, advisory services, and technical assistance to companies and organizations that are working to reduce their carbon footprint.

Future Outlook

The ING pledge to stop financing new upstream oil and gas projects presents a pivotal moment in the financial landscape, with significant implications for the future of the oil and gas industry and the transition to a low-carbon economy. It is crucial to analyze potential future scenarios and the factors that could influence the pledge’s success or failure.

Potential Future Scenarios

The following table Artikels potential future scenarios for ING’s pledge, considering various factors that could impact its success or failure:

| Scenario | Factors | Outcome |

|---|---|---|

| Successful Implementation |

|

|

| Partial Implementation |

|

|

| Failure to Implement |

|

|

Unanswered Questions

The pledge’s implementation and long-term impact raise several key questions that require further investigation:

- How will ING measure and track the effectiveness of its pledge?

- What specific criteria will ING use to determine which oil and gas projects are considered “upstream”?

- How will ING address the potential financial risks associated with divesting from oil and gas investments?

- What role will ING play in supporting the development of alternative energy sources and technologies?

- How will ING engage with its clients to facilitate a smooth transition away from fossil fuels?

Potential Trajectory of ING’s Involvement

A visual representation of ING’s potential trajectory in the oil and gas sector following the pledge could be depicted as a gradual decline in its financing of upstream oil and gas projects over time, accompanied by an increase in investments in renewable energy and sustainable technologies.

The trajectory would be influenced by the factors discussed in the previous scenarios, including regulatory support, investor pressure, and the development of alternative energy solutions.