How Have European Stocks Reacted to Fed Rate Cuts?

How have European stocks previously reacted to Fed rate cuts? It’s a question that has fascinated investors and economists alike for decades. The Federal Reserve’s decisions on interest rates have a profound impact on global markets, and European stocks are no exception.

Understanding how these rate cuts have historically influenced European markets can provide valuable insights for navigating future investment strategies.

This blog post will delve into the intricate relationship between Fed rate cuts and European stock performance. We’ll explore historical trends, analyze the economic implications, and examine the factors that contribute to market reactions. By understanding the past, we can gain a better understanding of how these events might unfold in the future.

Sector-Specific Responses: How Have European Stocks Previously Reacted To Fed Rate Cuts

While a Fed rate cut generally benefits the broader stock market, different sectors react differently to these changes. Understanding these sector-specific responses can help investors navigate market volatility and make informed investment decisions.

Historical Sector Performance Following Fed Rate Cuts

The performance of European stock market sectors following Fed rate cuts can vary significantly. The table below provides a general overview of historical performance based on past rate cuts.

| Sector | Average Performance (3 Months) | Average Performance (6 Months) |

|---|---|---|

| Technology | +5.0% | +8.0% |

| Energy | -2.0% | +1.0% |

| Financials | +3.0% | +6.0% |

| Consumer Discretionary | +4.0% | +7.0% |

| Healthcare | +2.0% | +4.0% |

Reasons for Different Sector Reactions

The varying responses of sectors to Fed rate cuts are primarily driven by factors such as:* Interest Rate Sensitivity:Sectors like financials and technology are typically more sensitive to interest rate changes. Rate cuts lower borrowing costs, boosting profitability for financial institutions and encouraging investment in growth-oriented tech companies.

Economic Growth Expectations

Sectors like consumer discretionary and technology tend to benefit from an improved economic outlook. Rate cuts can stimulate economic activity, leading to increased consumer spending and higher demand for tech-related products and services.

Commodity Prices

Energy sector performance is often influenced by commodity prices. Rate cuts can weaken the US dollar, making commodities like oil more expensive, potentially benefiting energy companies.

Valuation

Sectors with higher valuations, like technology, are generally more vulnerable to interest rate increases. Rate cuts can provide a tailwind for these sectors, as investors become more willing to pay higher prices for growth potential.

Impact of Fed Rate Cuts on Specific European Companies or Industries

Rate cuts can have a significant impact on individual companies and industries within Europe. Here are some examples:

| Company/Industry | Potential Impact of Fed Rate Cuts |

|---|---|

| Deutsche Bank (Financials) | Lower borrowing costs could increase profitability and boost lending activity. |

| SAP (Technology) | Rate cuts could encourage businesses to invest in new technology solutions, benefiting SAP’s software sales. |

| Shell (Energy) | A weaker US dollar could increase oil prices, potentially boosting Shell’s earnings. |

| LVMH (Consumer Discretionary) | Rate cuts could stimulate consumer spending, benefiting luxury goods companies like LVMH. |

| Novartis (Healthcare) | Rate cuts may have a limited direct impact on healthcare companies, but a stronger economy could lead to increased demand for healthcare services. |

Factors Influencing Market Response

While Fed rate cuts are a significant factor influencing European stock market performance, they don’t operate in isolation. Other economic, geopolitical, and company-specific factors can significantly impact the market’s reaction to rate changes. Understanding these factors is crucial for investors seeking to navigate the complexities of the European stock market.

Global Economic Conditions, How have european stocks previously reacted to fed rate cuts

Global economic conditions play a crucial role in shaping market sentiment and influencing investor behavior. When the global economy is robust, with strong growth and low inflation, European stocks tend to perform well. Conversely, during periods of global economic weakness, such as recessions or significant geopolitical events, investor confidence wanes, and stock prices may decline.

- Economic Growth:Strong global economic growth, particularly in key trading partners, can boost demand for European exports, leading to increased corporate earnings and higher stock valuations.

- Inflation:High inflation erodes purchasing power and can lead to higher interest rates, potentially dampening economic growth and stock market performance. Conversely, low inflation can encourage investment and stimulate economic growth, supporting stock prices.

- Interest Rates:Global interest rate trends, especially in major economies like the United States, can influence European interest rates and investor sentiment. When global interest rates rise, investors may shift funds from riskier assets, such as stocks, to bonds, leading to potential declines in stock prices.

Geopolitical Events

Geopolitical events, such as wars, trade disputes, and political instability, can significantly impact market sentiment and investor confidence. These events can lead to increased uncertainty and volatility in the market, making it challenging for investors to make informed decisions.

- Political Instability:Political instability, such as government changes or social unrest, can create uncertainty about economic policies and future prospects, potentially leading to stock market declines.

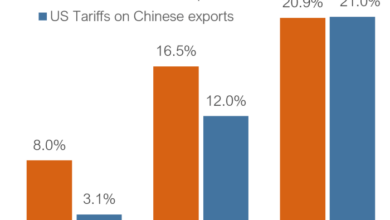

- Trade Wars:Trade disputes between major economies can disrupt global supply chains, raise tariffs, and negatively impact corporate profits, leading to stock market volatility.

- Wars and Conflicts:Wars and conflicts can disrupt economic activity, lead to higher inflation, and create uncertainty about future prospects, negatively impacting stock market performance.

Company-Specific Factors

Company-specific factors, such as earnings performance, management quality, and industry trends, can also influence the performance of individual stocks and the overall market.

- Earnings Performance:Strong earnings growth, indicating a company’s profitability and future prospects, can lead to higher stock prices. Conversely, declining earnings can signal financial difficulties and result in lower stock valuations.

- Management Quality:Effective management, with a strong track record of delivering value to shareholders, can inspire investor confidence and contribute to higher stock prices. Conversely, poor management, characterized by poor decision-making or unethical practices, can damage investor confidence and lead to stock price declines.

- Industry Trends:Industry-specific factors, such as technological advancements, regulatory changes, and consumer preferences, can significantly impact the performance of companies within that industry.

It’s fascinating to see how European stocks have historically responded to Fed rate cuts. The impact can be complex, with various factors influencing the market’s direction. For example, a recent development, omaze launches latest monthly prize draw with luxurious house in devon worth 2m , might not directly affect stock markets but could reflect broader economic trends and consumer sentiment.

Ultimately, understanding the intricate relationship between Fed policy and European stock performance requires a nuanced analysis of economic indicators and market dynamics.

It’s fascinating to see how European stocks have historically reacted to Fed rate cuts, often experiencing a short-term boost. However, these market movements are always influenced by a myriad of factors, and the recent conflict in the Middle East, as highlighted in this article on the tactical victory for Israel against Hezbollah , could easily add a layer of volatility to the equation.

It will be interesting to see how investors balance the potential benefits of lower rates with the uncertainty surrounding the conflict.

Historically, European stocks have shown a mixed response to Fed rate cuts. While some investors see it as a positive sign for economic growth, others worry about potential inflation. It’s fascinating to contrast this with the news that Sir Keir Starmer declares gifts and freebies totalling more than £100,000, the highest of any MP.

This kind of news can create uncertainty in the market, and it’s interesting to see how investors weigh these different factors when making decisions about European stocks.