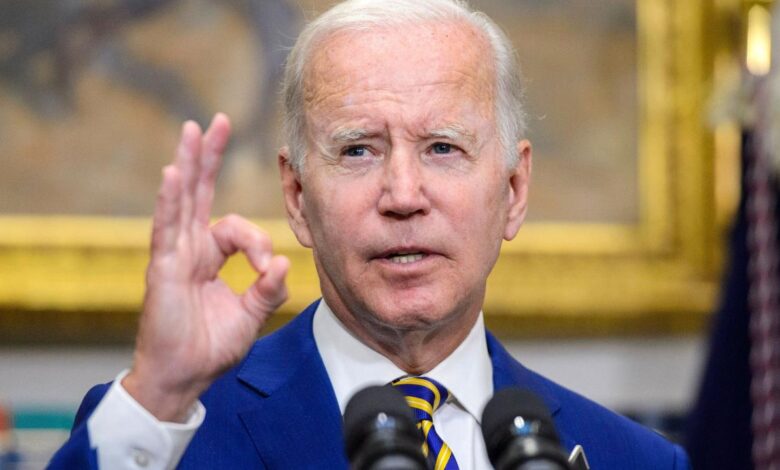

Who Benefits from Bidens $10,000 Student Loan Forgiveness?

Heres who could benefit if biden cancels 10000 in student loan debt per borrower – Here’s who could benefit if Biden cancels $10,000 in student loan debt per borrower: It’s a hot topic, and for good reason. Millions of Americans are burdened by student loan debt, and the potential for forgiveness has sparked a national conversation.

But who would actually see the most benefit from this policy? Let’s delve into the demographics and potential impact of this move.

The groups most likely to benefit include those with lower incomes, recent graduates, and those who attended expensive private or graduate schools. For many, the relief could be substantial, freeing up cash flow for other priorities like homeownership, starting a family, or simply building a more secure financial future.

Beyond the individual impact, the potential economic and social ramifications are vast, potentially boosting consumer spending, promoting social mobility, and even impacting the job market.

Potential Beneficiaries

Student loan cancellation would provide significant relief to a broad range of borrowers, but certain demographic groups stand to benefit disproportionately. These groups face unique financial challenges, and loan cancellation could have a transformative impact on their lives.

Borrowers of Color

Borrowers of color, particularly Black and Hispanic borrowers, carry a heavier burden of student loan debt compared to their white counterparts. This disparity is rooted in systemic inequalities that have historically disadvantaged these groups in accessing quality education and financial resources.

- Higher Debt Loads:Black borrowers hold an average of $37,000 in student loan debt, while Hispanic borrowers carry an average of $30,000, compared to $28,000 for white borrowers.

- Lower Completion Rates:Lower completion rates for Black and Hispanic students contribute to higher debt burdens as they are more likely to take out loans without completing their degrees.

- Financial Disparities:Systemic racial and ethnic disparities in wealth and income make it more difficult for borrowers of color to repay their loans.

Loan cancellation could help to level the playing field by reducing the financial burden on borrowers of color, allowing them to build wealth, invest in their futures, and contribute more fully to the economy.

Low-Income Borrowers

Low-income borrowers are disproportionately burdened by student loan debt. They often have limited access to resources and face significant challenges in managing their finances.

- Higher Default Rates:Low-income borrowers have higher default rates on their student loans, often due to factors such as job instability, unexpected expenses, and limited access to financial counseling.

- Lower Repayment Options:Low-income borrowers may not qualify for income-driven repayment plans, which can make it difficult to manage their debt.

- Financial Stress:Student loan debt can contribute to financial stress, making it challenging for low-income borrowers to save for retirement, purchase a home, or start a family.

Student loan cancellation would provide much-needed financial relief to low-income borrowers, enabling them to improve their financial security and achieve greater economic stability.

Public Servants

Teachers, nurses, social workers, and other public servants often face significant financial challenges, including high student loan debt. They are crucial to our communities, yet their salaries often do not reflect the vital services they provide.

- High Debt Loads:Public servants often have high debt loads due to the cost of education in fields like healthcare and education.

- Lower Salaries:Public sector salaries are often lower than those in the private sector, making it difficult to manage debt payments.

- Limited Repayment Options:Public service loan forgiveness programs are complex and difficult to navigate, leaving many borrowers struggling to repay their loans.

Student loan cancellation would provide significant financial relief to public servants, allowing them to focus on their careers and continue serving their communities without being weighed down by debt.

Borrowers with Disabilities

Borrowers with disabilities often face significant challenges in repaying their student loans due to barriers to employment, healthcare costs, and other factors.

- Higher Unemployment Rates:Individuals with disabilities face higher unemployment rates, making it more difficult to find stable employment and repay their loans.

- Higher Healthcare Costs:Individuals with disabilities often incur higher healthcare costs, which can strain their budgets and make it difficult to manage their debt.

- Limited Access to Resources:Individuals with disabilities may have limited access to financial counseling and other resources that can help them manage their debt.

Loan cancellation would provide much-needed financial relief to borrowers with disabilities, allowing them to focus on their well-being and achieving their full potential.

Economic Impact: Heres Who Could Benefit If Biden Cancels 10000 In Student Loan Debt Per Borrower

Canceling student loan debt could have a significant impact on the US economy, potentially boosting consumer spending and stimulating economic growth. The ripple effects could be felt across various sectors, including the job market and entrepreneurship.

Impact on Consumer Spending

A substantial amount of disposable income could be freed up for borrowers if student loan debt is canceled. This could lead to a surge in consumer spending, as individuals would have more money available for discretionary purchases, such as housing, automobiles, and leisure activities.

- A study by the Federal Reserve Bank of New York found that borrowers with student loan debt spend less on housing, transportation, and other goods and services compared to those without such debt.

- The freed-up income could also boost spending on healthcare, education, and retirement savings, further stimulating the economy.

Impact on the Job Market

Student loan debt can be a significant financial burden for many borrowers, hindering their ability to pursue job opportunities, particularly in fields that require relocation or further education.

- Loan cancellation could incentivize borrowers to pursue careers that align with their passions and interests, regardless of salary expectations, leading to a more skilled and motivated workforce.

- Additionally, borrowers may be more likely to start their own businesses or pursue entrepreneurial ventures, contributing to job creation and economic growth.

Impact on Entrepreneurship

The prospect of student loan cancellation could empower individuals to take greater risks and pursue entrepreneurial ventures.

- Many aspiring entrepreneurs are deterred by the financial burden of student loan debt, which can limit their access to capital and make it difficult to secure funding.

- Loan cancellation could create a more favorable environment for entrepreneurship, leading to increased innovation and job creation.

Overall Impact on the US Economy

The economic impact of student loan cancellation is a complex issue with both potential benefits and drawbacks.

- Proponents argue that it could boost consumer spending, stimulate economic growth, and improve the overall well-being of borrowers.

- Opponents, however, argue that it could lead to higher inflation and increase the national debt.

Social Impact

Student loan cancellation could have a significant impact on social mobility and equality in the United States. By eliminating or reducing the burden of student debt, individuals could experience greater financial freedom, leading to improved access to opportunities and a more equitable society.

Impact on Access to Higher Education and Career Opportunities

The high cost of higher education is a major barrier for many individuals, particularly those from low-income backgrounds. Student loan cancellation could help to reduce this barrier, making higher education more accessible to a wider range of individuals. This, in turn, could lead to greater social mobility, as individuals from disadvantaged backgrounds would have a better chance of pursuing higher education and securing well-paying jobs.

“Student loan cancellation could help to reduce this barrier, making higher education more accessible to a wider range of individuals.”

For example, a study by the Institute for College Access & Success found that borrowers from lower-income families are more likely to default on their student loans than borrowers from higher-income families. This is because lower-income borrowers are more likely to have lower-paying jobs and less access to financial resources to repay their loans.

The potential economic boost from canceling student loan debt is huge, with millions of Americans poised to benefit. But while we’re discussing big economic changes, it’s important to remember the broader political landscape. The fight to control elections is heating up, fueled by influential election deniers who are actively seeking to undermine our democracy, as outlined in this recent article on how influential election deniers have fueled a fight to control elections.

These challenges highlight the need for a strong and resilient democracy, where the voices of all citizens are heard. And with that in mind, the potential benefits of student loan forgiveness for millions of Americans can’t be ignored.

Student loan cancellation could help to address this disparity by reducing the burden of student debt for lower-income borrowers.

Impact on Family Structures and Communities

Student loan cancellation could also have a positive impact on family structures and communities. For example, many individuals with student loan debt delay marriage and starting a family due to the financial burden. By reducing or eliminating this burden, student loan cancellation could encourage individuals to start families sooner, leading to stronger family structures and communities.

Imagine the impact of a $10,000 student loan forgiveness plan on teachers. Not only would they benefit directly, but they could also have more financial freedom to invest in their own well-being, like accessing programs like Ripple Effects’ Educator Ally Program , which provides support for teachers’ social-emotional needs.

This, in turn, could lead to a more engaged and effective teaching force, ultimately benefiting students across the board.

“Student loan cancellation could encourage individuals to start families sooner, leading to stronger family structures and communities.”

Furthermore, student loan cancellation could also have a positive impact on the economy. A study by the Federal Reserve Bank of New York found that student loan cancellation could boost the economy by $86 billion over the next decade. This is because individuals with less student debt would have more disposable income, which they could spend on goods and services, thereby stimulating economic growth.

A potential student loan forgiveness plan could benefit millions of Americans struggling with debt, potentially boosting their purchasing power and contributing to a stronger economy. Sen. Kevin Cramer would likely have strong opinions on this, sen kevin cramer would , and his perspective could be crucial in shaping any future legislation.

The impact of such a plan on individuals and the overall economy is a topic worth exploring further.

Political Implications

Student loan cancellation is a highly politicized issue with the potential to significantly impact the political landscape. The decision to cancel debt, or not, could have far-reaching consequences for both political parties and voter demographics.

Impact on Political Parties

The potential political consequences of student loan cancellation are multifaceted and could impact both major political parties differently.

- Democrats:Democrats, generally supportive of student loan forgiveness, could benefit from the positive sentiment among younger voters who are heavily burdened by student loan debt. This policy could mobilize young voters and increase their turnout in elections, potentially strengthening the Democratic Party’s base.

However, there could be internal disagreements within the party regarding the scale and implementation of forgiveness, with some advocating for more targeted relief and others pushing for broader cancellation.

- Republicans:Republicans, generally opposed to widespread debt cancellation, could face backlash from younger voters who view the policy as a necessary step to address the student debt crisis. The issue could also become a point of contention within the Republican Party, with some members potentially supporting targeted forms of relief while others remain staunchly opposed.

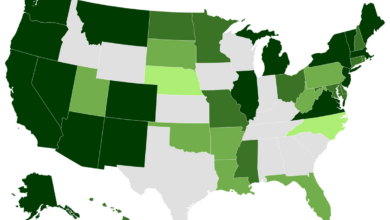

Impact on Voter Demographics

Student loan cancellation could significantly impact different voter demographics, particularly young voters and those with higher levels of student loan debt.

- Young Voters:Young voters, who are disproportionately affected by student loan debt, are likely to be highly supportive of cancellation. This could lead to increased voter turnout among young people, potentially influencing the outcome of elections, especially in competitive races.

- Voters with Higher Student Loan Debt:Voters with higher levels of student loan debt, particularly those in specific demographic groups like Black and Hispanic borrowers, could be motivated to vote for candidates who support cancellation. This could lead to increased political engagement among these groups, potentially influencing election outcomes.

Potential for Political Polarization or Unity

The issue of student loan cancellation has the potential to exacerbate existing political divisions or, conversely, create opportunities for political unity.

- Increased Polarization:The issue could further polarize political discourse, with Republicans and Democrats taking opposing stances on the matter. This could lead to increased partisan gridlock and difficulty in reaching consensus on other policy issues.

- Potential for Unity:Despite the potential for polarization, there could also be opportunities for political unity. If both parties agree on targeted forms of relief, such as income-based repayment or forgiveness for specific groups, it could create a sense of bipartisanship and encourage cooperation on other policy issues.

Use in Political Campaigns and Debates

Student loan cancellation is likely to be a prominent issue in political campaigns and debates, with candidates using it to appeal to different voter demographics.

- Appealing to Young Voters:Candidates seeking to appeal to young voters will likely emphasize their support for student loan cancellation as a way to address the economic challenges facing this demographic.

- Targeting Specific Groups:Candidates may also target specific groups, such as Black and Hispanic borrowers, by highlighting their support for policies that provide relief to these communities.

- Using it as a Wedge Issue:Candidates may use student loan cancellation as a wedge issue to divide voters and mobilize their base. This could involve framing the issue as a matter of fairness or economic justice, depending on the candidate’s political stance.

Alternative Solutions

While canceling student loan debt has been a prominent policy proposal, there are alternative approaches to addressing the issue of student loan burden. These alternatives aim to make repayment more manageable and accessible for borrowers, without resorting to blanket cancellation.

Income-Driven Repayment Plans, Heres who could benefit if biden cancels 10000 in student loan debt per borrower

Income-driven repayment (IDR) plans are designed to make student loan payments more affordable by tying monthly payments to a borrower’s income. Under IDR plans, borrowers typically pay a percentage of their discretionary income, with the remaining balance forgiven after a set period, usually 20 or 25 years.

- Types of IDR plans:There are several types of IDR plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). Each plan has slightly different eligibility requirements and payment calculations.

- Benefits:IDR plans offer significant benefits for borrowers, including lower monthly payments, potential for loan forgiveness, and protection from default.

- Drawbacks:Despite their benefits, IDR plans have drawbacks. One concern is that the forgiveness provisions can take a long time to kick in, potentially extending the repayment period significantly. Additionally, some borrowers may face challenges in accurately reporting their income, which can lead to unexpected payment increases.

Loan Forgiveness Programs

Loan forgiveness programs offer the opportunity for borrowers to have all or a portion of their student loan debt forgiven. These programs are typically targeted at specific groups, such as teachers, public service workers, or those working in underserved areas.

- Examples of loan forgiveness programs:The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 10 years of qualifying public service employment. The Teacher Loan Forgiveness Program forgives up to $17,500 in federal student loans for teachers who work in low-income schools for five consecutive years.

- Benefits:Loan forgiveness programs provide immediate debt relief, reducing financial stress and allowing borrowers to focus on their careers or personal goals.

- Drawbacks:Loan forgiveness programs often have strict eligibility requirements and may not be accessible to all borrowers. Additionally, the process for applying for forgiveness can be complex and time-consuming.

Last Recap

The potential for student loan forgiveness is a complex issue with far-reaching implications. While it could offer significant relief to millions of Americans, there are also questions about its long-term impact on the economy, higher education, and future generations. Ultimately, the decision of whether or not to forgive student loan debt is a political one, and the debate is likely to continue for some time.