Americas Super Hot Inflation: What You Need to Know

Heres what you need to know about americas super hot inflation – America’s Super Hot Inflation: What You Need to Know sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The current state of inflation in the US is a hot topic, affecting everything from our grocery bills to our savings accounts.

It’s a complex issue with far-reaching consequences, but understanding the basics can empower you to navigate this economic landscape.

This blog post will dive into the core concepts of inflation, exploring its causes, impacts, and potential solutions. We’ll delve into the historical context of inflation in the US, analyze the factors driving the current surge, and examine its effects on both consumers and businesses.

We’ll also discuss the tools used by the Federal Reserve to combat inflation and explore the potential long-term implications of this economic phenomenon.

Understanding Inflation

Inflation is a term that gets thrown around a lot, especially when prices are rising. But what exactly is it? In simple terms, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

This means that your money buys less than it used to.

Types of Inflation

Inflation can be caused by a variety of factors, leading to different types.

- Demand-Pull Inflation: This occurs when there is too much money chasing too few goods. Think of it like a bidding war. When demand for goods and services outpaces supply, prices rise as consumers compete for limited resources.

- Cost-Push Inflation: This type of inflation happens when the cost of production increases, leading businesses to raise prices to maintain their profit margins. For example, rising oil prices can lead to higher transportation costs, which can then be passed on to consumers in the form of higher prices for goods and services.

While we’re grappling with the economic fallout of soaring inflation, it’s a stark reminder of the power of misinformation and its devastating impact. It’s hard to imagine anything more callous than spreading lies about a tragedy like the Sandy Hook shooting, as Alex Jones is now facing the consequences for in the alex jones damages trial begins over his false claims sandy hook shooting was a hoax.

The trial serves as a sobering reminder of the responsibility we all have to combat misinformation, especially when it comes to sensitive and tragic events. As we navigate these turbulent economic times, we must also be vigilant against the spread of falsehoods that can further erode trust and sow discord.

Inflation’s Impact on Everyday Life, Heres what you need to know about americas super hot inflation

Inflation affects everyone, but the impact can vary depending on your income and spending habits. Here are a few examples:

- Reduced Purchasing Power: The most direct impact of inflation is that your money buys less. If prices increase by 5%, you need 5% more money to buy the same amount of goods and services. This can be particularly challenging for people on fixed incomes, like retirees, who may find it harder to keep up with rising costs.

- Increased Interest Rates: Central banks often raise interest rates to combat inflation. This makes it more expensive to borrow money, which can impact individuals and businesses. Higher interest rates can also lead to slower economic growth.

- Uncertainty and Instability: High and unpredictable inflation can create uncertainty in the economy, making it difficult for businesses to plan and invest. This can lead to job losses and economic instability.

The Current Inflationary Situation in the US

The US has experienced a significant surge in inflation in recent years, impacting the purchasing power of consumers and raising concerns about economic stability. This section delves into the recent history of inflation in the US, pinpointing the key factors driving the current high inflation and comparing the current inflation rate to historical trends.

Recent History of Inflation in the US

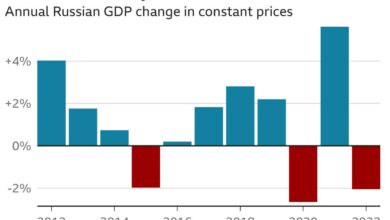

Inflation in the US has fluctuated over the past several decades. The period between 1980 and 2020 witnessed relatively low and stable inflation rates, generally below 4%. However, the COVID-19 pandemic and its aftermath triggered a sharp increase in inflation, reaching levels not seen in decades.

- Pre-Pandemic Era (1980-2020):During this period, inflation remained relatively low and stable, with the average annual inflation rate hovering around 2.5%. This period saw steady economic growth, a stable job market, and moderate consumer spending.

- Post-Pandemic Era (2020-Present):The COVID-19 pandemic disrupted global supply chains, increased demand for goods and services, and led to unprecedented government stimulus measures. These factors contributed to a sharp rise in inflation, which reached a 40-year high in 2022.

Key Factors Contributing to High Inflation

Several factors have contributed to the current high inflation in the US. These include:

- Supply Chain Disruptions:The pandemic-induced lockdowns and travel restrictions caused significant disruptions to global supply chains, leading to shortages of goods and materials. This shortage, in turn, increased prices for consumers.

- Increased Demand:The pandemic-related government stimulus packages and pent-up consumer demand fueled spending, driving up prices for goods and services.

- Labor Shortages:The pandemic led to labor shortages, particularly in industries like hospitality and manufacturing. The shortage of workers gave employees more bargaining power, leading to wage increases that businesses passed on to consumers in the form of higher prices.

- Energy Price Increases:The war in Ukraine and other geopolitical tensions have led to significant increases in energy prices, including oil and gas. These increases have impacted the cost of transportation and production, contributing to higher prices for consumers.

- Monetary Policy:The Federal Reserve’s expansionary monetary policy during the pandemic, including low interest rates and asset purchases, helped to stimulate the economy but also contributed to inflation.

Comparison to Historical Trends

The current inflation rate in the US is significantly higher than historical averages. While the average annual inflation rate in the US has been around 2.5% over the past several decades, inflation has exceeded 4% for the past two years.

This level of inflation is considered high and has not been seen in the US since the early 1980s.

The Impact of Inflation on Consumers

Inflation erodes the purchasing power of consumers, meaning that their money buys less over time. This can have a significant impact on individuals and families, especially those with fixed incomes or limited financial resources.

The Impact of Inflation on Purchasing Power

Inflation directly impacts consumers’ purchasing power by reducing the amount of goods and services they can buy with the same amount of money. As prices rise, the value of money declines, making it necessary to spend more to maintain the same standard of living.

For example, if the price of a gallon of milk increases from $3 to $4, a consumer can now purchase 25% fewer gallons of milk with the same amount of money.

The Impact of Inflation on Different Income Groups

Inflation affects different income groups differently. Low-income households are often disproportionately impacted by inflation, as a larger portion of their income is spent on essential goods and services, such as food and housing.

- High-income households, with greater financial flexibility, may be able to absorb price increases more easily. They can often adjust their spending patterns or rely on savings and investments to mitigate the effects of inflation.

- Middle-income households often face a difficult balancing act, as they may struggle to maintain their standard of living while also saving for the future.

The Impact of Inflation on Savings and Investments

Inflation can significantly impact savings and investments. As prices rise, the real value of savings declines, meaning that the purchasing power of savings decreases over time.

- In periods of high inflation, savings may not keep pace with rising prices, leading to a loss of real value. For example, if the inflation rate is 5%, a savings account earning 2% interest will see a decline in the real value of savings.

- Inflation can also impact investment returns, as rising prices can erode the value of investments, especially those with fixed returns, such as bonds.

The Impact of Inflation on Businesses

Inflation significantly impacts businesses across various sectors, influencing their operational costs, pricing strategies, and overall growth prospects. As the cost of raw materials, labor, and other inputs increases, businesses face the challenge of maintaining profitability while navigating the changing economic landscape.

The Impact of Inflation on Production Costs

Rising inflation directly impacts production costs for businesses. As the prices of raw materials, energy, and labor rise, businesses face increased expenses to manufacture or produce their goods and services.

- Raw Materials:Businesses rely on raw materials to produce their products. When the prices of these materials increase due to inflation, the cost of production rises accordingly. For example, the rising price of oil impacts the cost of producing plastics, which are used in various products, from packaging to automobiles.

- Energy:Energy costs are a significant expense for many businesses, particularly those involved in manufacturing and transportation. As energy prices increase, businesses face higher costs for electricity, gas, and fuel, impacting their bottom line.

- Labor:Inflation can lead to increased wages and salaries to compensate for the rising cost of living. Businesses may need to raise wages to attract and retain skilled employees, adding to their labor costs.

Inflation Affects Pricing Strategies

Businesses must carefully consider their pricing strategies in an inflationary environment. They need to balance the need to cover rising costs with the desire to remain competitive and avoid alienating customers.

- Price Increases:Businesses may need to raise prices to offset increased production costs. However, price increases can lead to reduced demand if customers are unwilling or unable to pay higher prices.

- Cost-Plus Pricing:Some businesses may adopt a cost-plus pricing strategy, where they calculate their costs and add a markup to determine their selling price. This strategy helps to ensure that businesses cover their expenses, but it can also make their products less competitive if their markups are too high.

- Value Pricing:Businesses may focus on value pricing, emphasizing the quality and benefits of their products or services to justify higher prices. This strategy can be effective in retaining customers who are willing to pay a premium for value.

Inflation’s Effects on Business Investment and Growth

Inflation can impact business investment and growth in several ways.

- Reduced Investment:High inflation can discourage businesses from investing in new projects or expanding their operations. This is because the rising cost of capital and the uncertainty surrounding future inflation make it more difficult to justify investments.

- Increased Borrowing Costs:Inflation can lead to higher interest rates, making it more expensive for businesses to borrow money. This can make it challenging for businesses to finance growth initiatives or expansion plans.

- Reduced Consumer Spending:Inflation can reduce consumer spending as people have less disposable income due to rising prices. This can lead to lower demand for goods and services, slowing down business growth.

Measures to Combat Inflation

The Federal Reserve, the central bank of the United States, plays a crucial role in managing inflation. It employs a variety of tools to influence the money supply and credit conditions, ultimately aiming to stabilize prices and maintain a healthy economy.

The Federal Reserve’s Tools

The Federal Reserve utilizes several tools to combat inflation, each with its own mechanism and potential impact.

It’s hard to focus on anything else when inflation is skyrocketing, but the news about a possible noose found near a CIA facility is definitely concerning. It’s a reminder that while we’re grappling with economic anxieties, we also face a complex and often unsettling political climate.

And, unfortunately, it seems like the news cycle just keeps churning out more of these headlines, making it even harder to figure out how to navigate the financial storm we’re all in.

- Federal Funds Rate:The Federal Reserve sets the federal funds rate, the interest rate at which banks lend reserves to each other overnight. By raising the federal funds rate, the Fed makes it more expensive for banks to borrow money, which in turn discourages lending and slows down economic activity.

This reduction in borrowing and spending can help to curb inflation.

- Discount Rate:The discount rate is the interest rate at which commercial banks can borrow money directly from the Federal Reserve. Similar to the federal funds rate, raising the discount rate makes borrowing more expensive, leading to a slowdown in economic activity and potentially reducing inflationary pressures.

It’s hard to ignore the impact of inflation on our daily lives. From grocery bills to gas prices, everything seems to be costing more. But while we’re all feeling the pinch, it’s interesting to consider how some of the world’s most successful investors are navigating these turbulent waters.

For example, it’s worth reading analysis did buffett and munger see byds one problem to see how Warren Buffett and Charlie Munger are approaching the current market. Understanding their perspectives can provide valuable insights as we try to make sense of America’s super-hot inflation.

- Reserve Requirements:The Federal Reserve sets reserve requirements, which determine the percentage of deposits that banks must hold in reserve. Increasing reserve requirements reduces the amount of money that banks can lend out, thus tightening credit conditions and slowing down economic growth.

This can help to control inflation.

- Open Market Operations:The Federal Reserve buys and sells government securities in the open market. When the Fed buys securities, it injects money into the economy, increasing the money supply. Conversely, when the Fed sells securities, it removes money from circulation, reducing the money supply.

By adjusting the amount of money in circulation, the Fed can influence interest rates and inflation.

- Quantitative Easing:Quantitative easing (QE) is a non-traditional monetary policy tool that involves the Federal Reserve purchasing large amounts of government securities or other assets to increase the money supply. This can help to lower interest rates and stimulate economic growth, but it also carries the risk of fueling inflation.

Potential Effects of Inflation Control Measures

The Federal Reserve’s actions to combat inflation can have both positive and negative effects on the economy.

- Reduced Inflation:The primary goal of the Fed’s measures is to reduce inflation. By slowing down economic growth, the Fed aims to lower demand for goods and services, which can put downward pressure on prices.

- Slower Economic Growth:The Fed’s actions can also lead to slower economic growth. As borrowing becomes more expensive and credit conditions tighten, businesses may invest less and consumers may spend less, resulting in a slowdown in economic activity.

- Increased Unemployment:A slowdown in economic growth can lead to job losses as businesses reduce their operations or lay off workers. This can increase unemployment rates.

- Reduced Investment:Higher interest rates can make it more expensive for businesses to borrow money for investments. This can discourage investment and hinder long-term economic growth.

- Currency Appreciation:When interest rates rise, investors may be attracted to the higher returns available in the U.S. This can lead to an increase in demand for the U.S. dollar, causing the currency to appreciate against other currencies.

Comparing Approaches to Inflation Management

Different economists and policymakers have different views on the best approach to managing inflation. Some favor a more aggressive approach, aiming to quickly reduce inflation even if it means risking a recession. Others prefer a more gradual approach, prioritizing stable economic growth and avoiding sharp changes in interest rates.

- Monetarist Approach:This approach emphasizes controlling the money supply as the primary means of managing inflation. Proponents argue that inflation is primarily caused by excessive money printing, and that controlling the money supply can effectively curb inflation. This approach often involves setting specific targets for monetary growth.

- Keynesian Approach:This approach focuses on managing aggregate demand through government spending and taxation. Proponents argue that inflation can be controlled by adjusting government spending and taxes to influence overall demand in the economy. For example, increasing taxes or reducing government spending can help to reduce demand and control inflation.

- Supply-Side Approach:This approach emphasizes policies that aim to increase the supply of goods and services. Proponents argue that inflation can be reduced by lowering taxes, reducing regulations, and promoting investment, which can increase productivity and lower costs. This approach aims to address inflation by increasing the supply of goods and services, rather than by reducing demand.

Long-Term Implications of Inflation: Heres What You Need To Know About Americas Super Hot Inflation

Inflation, if left unchecked, can have significant and lasting effects on the economy, government finances, and social stability. While short-term fluctuations in inflation are relatively normal, prolonged periods of high inflation can erode purchasing power, distort investment decisions, and lead to economic instability.

Impact on Economic Growth

Sustained high inflation can negatively impact economic growth by creating uncertainty and discouraging investment. Businesses may become hesitant to invest in new projects or expand operations due to the unpredictable nature of future costs and returns. Consumers may also delay major purchases, such as cars or homes, as they anticipate higher prices in the future.

This reduction in investment and consumption can lead to slower economic growth.

Final Summary

Inflation is a complex economic issue with no easy answers. Understanding its causes and impacts is crucial for navigating this challenging economic landscape. By staying informed and engaging in thoughtful discussions, we can work towards a more stable and prosperous future.

Remember, knowledge is power, and understanding the intricacies of inflation empowers us to make informed decisions about our finances and investments.