Global Growth Choked: Inflation and War Impact, Says World Bank

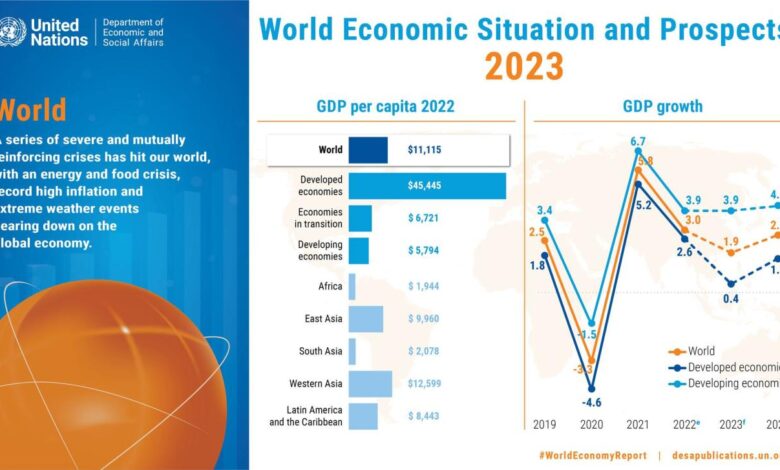

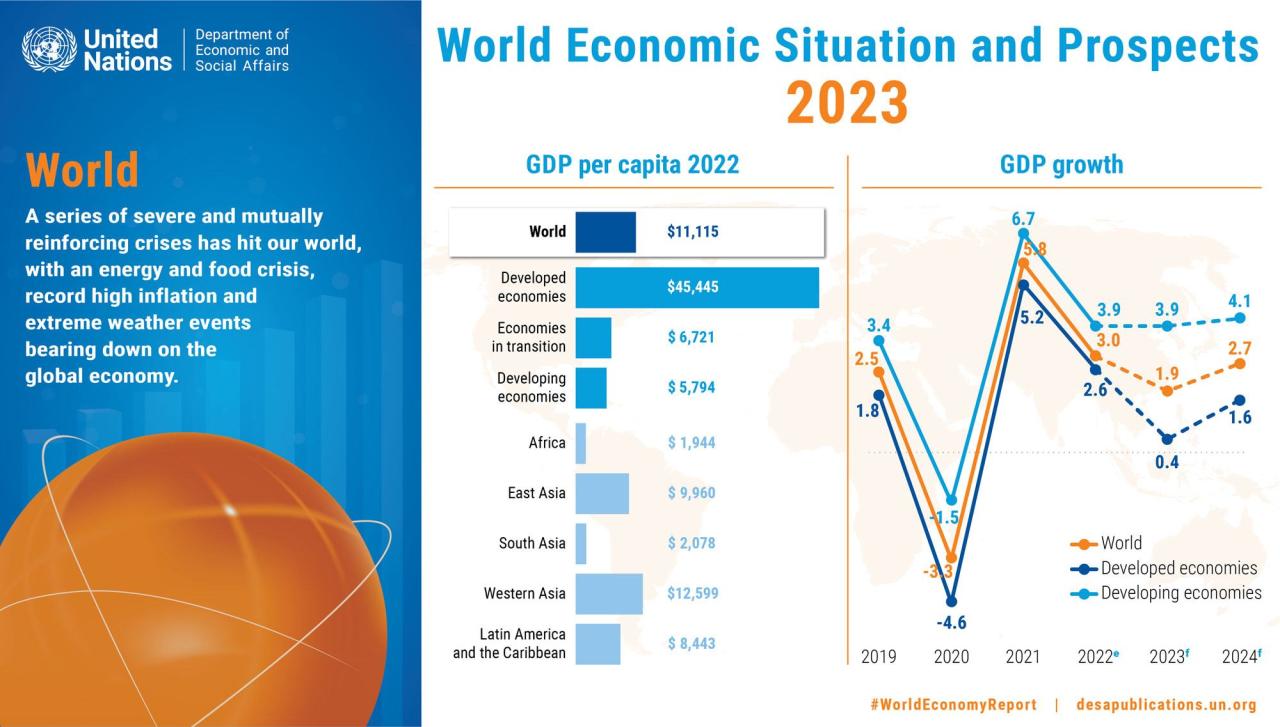

Global growth will be choked amid inflation and war says world bank – Global Growth Choked: Inflation and War Impact, Says World Bank. The World Bank has issued a stark warning, predicting that global economic growth will be significantly stifled by the combined forces of inflation and the ongoing war in Ukraine. This grim outlook paints a picture of a world grappling with a perfect storm of economic challenges, with far-reaching consequences for individuals, businesses, and entire nations.

The report highlights the complex interplay of these factors, with inflation eroding purchasing power, disrupting supply chains, and dampening investment. Meanwhile, the war in Ukraine has unleashed a cascade of economic disruptions, including soaring energy prices, food shortages, and heightened geopolitical tensions.

The World Bank emphasizes that these challenges are not isolated events, but rather interconnected forces that are collectively pushing the global economy toward a precarious state.

Inflation’s Impact on Growth: Global Growth Will Be Choked Amid Inflation And War Says World Bank

Inflation, a persistent rise in the general price level of goods and services, is a significant economic challenge that can stifle growth. It erodes purchasing power, distorts economic decision-making, and creates uncertainty for businesses and consumers.

Mechanisms of Inflation’s Impact on Growth

Inflation can negatively impact economic activity through various mechanisms. Rising prices reduce the purchasing power of consumers, leading to a decline in consumer spending. This decline in demand can force businesses to cut back on production, leading to job losses and a decrease in overall economic output.

Furthermore, inflation can create uncertainty for businesses, making it difficult to plan for the future and invest in new projects. This uncertainty can discourage investment, further hindering economic growth.

Impact on Consumer Spending and Business Investment

Inflation’s impact on consumer spending is multifaceted. As prices rise, consumers have less disposable income to spend on goods and services. This can lead to a decline in consumer confidence, further reducing spending. Additionally, inflation can encourage consumers to spend more in the present to avoid future price increases, leading to a short-term boost in spending but ultimately contributing to higher inflation.The impact of inflation on business investment is also significant.

Rising input costs, including labor, raw materials, and energy, can reduce profit margins for businesses. This can discourage investment in new projects, expansion, and research and development. Furthermore, inflation can make it more difficult for businesses to borrow money, as lenders demand higher interest rates to compensate for the erosion of the value of their loans.

Inflation Situation in Different Regions, Global growth will be choked amid inflation and war says world bank

The inflation situation varies significantly across different regions. Developed economies, such as the United States and Europe, have experienced higher inflation rates in recent years due to supply chain disruptions, energy price increases, and strong consumer demand. Emerging markets, particularly in Asia and Latin America, have also faced inflationary pressures, driven by factors such as commodity price increases and currency depreciation.

Policy Responses to Mitigate Inflation

Central banks play a crucial role in mitigating the negative effects of inflation. They can raise interest rates to reduce borrowing and spending, thus slowing down economic activity and cooling down inflation. Governments can also implement fiscal policies, such as reducing government spending or raising taxes, to reduce aggregate demand and curb inflation.

Concluding Remarks

The World Bank’s sobering assessment serves as a stark reminder of the interconnected nature of the global economy. The confluence of inflation and war has created a complex and volatile environment, demanding decisive action from policymakers worldwide. While the path ahead is uncertain, understanding the interconnectedness of these challenges is crucial for navigating the turbulent waters of the global economy.

The World Bank’s grim prediction of choked global growth amid inflation and war paints a bleak picture, but it’s a picture that’s increasingly familiar. We’re living in what some call “the bad vibes economy” the bad vibes economy , where uncertainty and fear are driving economic decisions.

It’s a stark reminder that while economic forecasts are important, it’s the human element, the collective mood, that can ultimately shape the future.

The World Bank’s grim prediction of choked global growth due to inflation and war feels all too real, especially when you consider the domestic issues we’re facing. Amidst this backdrop, the House just approved gun control bills, including raising the age for purchasing assault rifles, a move that’s sparked a lot of debate.

It’s hard to see how these internal struggles won’t further impact the global economy, making the World Bank’s forecast even more worrying.

The World Bank’s grim prediction of choked global growth amid inflation and war is a stark reminder of the interconnectedness of our world. It’s a stark contrast to the domestic political turmoil we saw unfold on January 6th, 2021, where former Attorney General William Barr, in a televised hearing, called the stolen election claim “bullshit” , exposing the fragility of our democratic institutions.

As we face these global challenges, it’s crucial to remember that our individual actions, both domestically and internationally, have a profound impact on the future of our planet.