Forgiving $20,000 in Student Debt: A $519 Billion Cost?

Forgiving up to 20000 in student debt could cost the u s 519 billion – Forgiving up to $20,000 in student debt could cost the U.S. $519 billion, a staggering figure that has ignited a heated debate. The potential benefits for borrowers, like reduced monthly payments and increased disposable income, are undeniable. But the economic implications, particularly the impact on the budget deficit and inflation, are causing serious concerns.

This debate extends beyond the immediate financial implications, touching on broader societal issues like income inequality, access to education, and the future of higher education itself.

The Economic Impact

The potential forgiveness of up to $20,000 in student debt is a significant policy proposal with wide-ranging economic implications. It could affect the U.S. budget deficit and national debt, influence inflation and economic growth, and have long-term consequences for government spending and financial markets.

Impact on the U.S. Budget Deficit and National Debt

Forgiving student debt would directly impact the U.S. budget deficit and national debt. The Congressional Budget Office (CBO) estimates that forgiving up to $20,000 in student debt would cost the U.S. $519 billion over a decade. This cost would be added to the existing budget deficit, which is the difference between the government’s spending and its revenue.

The national debt is the total amount of money that the government owes to its creditors. The cost of forgiving student debt would increase the national debt, which could have long-term implications for the U.S. economy.

Impact on Inflation and Economic Growth

The impact of student debt forgiveness on inflation and economic growth is a complex issue. Some economists argue that forgiving student debt would boost consumer spending and stimulate economic growth. This is because borrowers would have more disposable income, which they could spend on goods and services.

This increased spending could lead to higher demand and, consequently, higher prices, potentially contributing to inflation. Other economists argue that the economic impact of student debt forgiveness would be minimal, as borrowers may use their additional income to pay down other debts or save.

The idea of forgiving up to $20,000 in student debt might sound appealing, but the cost to the US could be a staggering $519 billion. It’s a complex issue, and it’s important to consider all sides of the argument.

For example, Paul Merson, a former professional footballer, recently said that Liverpool’s safer style of play is playing into Manchester United’s hands in the Premier League. merson says liverpools safer style plays into man utds hands While that might seem unrelated, it highlights the importance of strategy and risk assessment, something that applies equally to economic policy as it does to football.

Ultimately, the decision to forgive student debt is a big one with far-reaching consequences, and it’s crucial to weigh the potential benefits against the potential costs.

The overall impact on inflation and economic growth would depend on various factors, including the size of the debt forgiveness program, the economic conditions at the time of implementation, and the behavior of borrowers.

Long-Term Consequences for Government Spending and Financial Markets

Forgiving student debt could have long-term consequences for government spending and financial markets. If the government were to forgive student debt on a large scale, it would need to find ways to offset the cost. This could involve raising taxes, cutting spending in other areas, or borrowing more money.

Each of these options has its own potential consequences. For example, raising taxes could discourage investment and economic growth. Cutting spending in other areas could lead to reductions in essential government services. Borrowing more money could increase interest rates and make it more expensive for businesses and individuals to borrow.

The impact on financial markets would depend on how investors perceive the government’s ability to manage its debt and its commitment to fiscal responsibility.

The Impact on Borrowers

Forgiving up to $20,000 in student debt could have a significant impact on borrowers, both positive and negative. This section explores the potential benefits and challenges for borrowers, considering the potential impact on different demographic groups.

Potential Benefits for Borrowers

Forgiving student debt could provide borrowers with significant financial relief, leading to increased disposable income, reduced monthly payments, and improved credit scores.

- Reduced Monthly Payments:Borrowers with forgiven debt would experience a significant reduction in their monthly payments, freeing up funds for other expenses such as housing, food, healthcare, and savings. This could have a positive impact on their overall financial well-being and ability to manage their finances effectively.

- Increased Disposable Income:A decrease in monthly payments would result in increased disposable income, allowing borrowers to spend more on essential needs or invest in their future. This could lead to improved financial stability and a higher quality of life.

- Improved Credit Scores:Forgiving student debt could improve credit scores for many borrowers, as it would reduce their debt-to-income ratio. A higher credit score can lead to better interest rates on future loans, making it easier to access credit for housing, cars, or other needs.

Forgiving up to $20,000 in student debt could cost the US $519 billion, a hefty price tag for sure. But when you consider the 192 billion gender gap in art , a gap that’s been steadily widening for decades, the cost of student debt forgiveness starts to seem less daunting.

It’s a reminder that investing in our future, whether it’s through education or creative expression, is a worthy expenditure.

Potential Challenges for Borrowers, Forgiving up to 20000 in student debt could cost the u s 519 billion

While forgiving student debt could provide significant benefits, it also presents potential challenges for borrowers.

- Higher Interest Rates on Future Loans:Some economists argue that forgiving student debt could lead to higher interest rates on future loans. This is because lenders may need to charge higher interest rates to compensate for the potential loss of revenue from forgiven loans.

- Reduction in Government Funding for Future Education:Forgiving student debt could also lead to a reduction in government funding for future education. This is because policymakers may be less willing to allocate funds to education if they believe that the government will be responsible for forgiving future student loans.

Impact on Different Demographic Groups

The impact of student loan forgiveness would vary depending on the borrower’s demographic group.

The idea of forgiving up to $20,000 in student debt might seem like a good idea on the surface, but the potential cost of $519 billion is a hefty price tag. It’s like a game of high-stakes poker, where the government is betting big on a gamble that could have significant consequences.

It’s almost as controversial as the recent story about a fine arts competition where an artist used AI to create their winning entry – he used AI to win a fine arts competition was it cheating – sparking a debate about the role of technology in art.

Ultimately, the decision to forgive student debt is a complex one, and we need to carefully weigh the potential benefits against the costs.

- Low-Income Borrowers:Low-income borrowers would likely benefit the most from student loan forgiveness, as they often struggle with high debt burdens and limited financial resources. Forgiving their debt could significantly improve their financial well-being and provide them with greater opportunities for economic advancement.

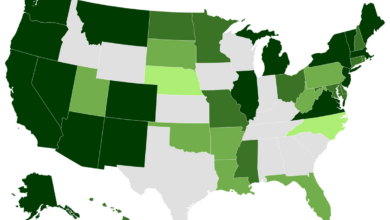

- Minority Borrowers:Minority borrowers are disproportionately affected by student debt, often carrying higher debt burdens than their white counterparts. Forgiving student debt could help to address this racial wealth gap and provide minority borrowers with greater access to financial resources.

- Borrowers with High Debt Burdens:Borrowers with high debt burdens would also experience significant benefits from student loan forgiveness. Forgiving their debt could reduce their monthly payments, increase their disposable income, and improve their credit scores, leading to a more stable financial future.

The Impact on Higher Education: Forgiving Up To 20000 In Student Debt Could Cost The U S 519 Billion

Forgiving student debt could have a significant impact on higher education, influencing its cost, accessibility, and the overall demand for degrees. This section explores the potential ramifications for institutions and students alike, examining how this policy might affect the future of higher education in the United States.

The Cost of Higher Education

The potential impact of student debt forgiveness on the cost of higher education is a complex issue with varying perspectives. Some argue that it could lead to increased tuition costs, as institutions might feel less pressure to keep costs down if the government is covering a portion of student debt.

This perspective assumes that institutions would view debt forgiveness as a signal that they can raise tuition without negatively impacting enrollment. Others argue that debt forgiveness could actually reduce the cost of higher education. This argument centers on the idea that a reduction in student debt could lead to a decrease in the demand for student loans, potentially lowering interest rates and making education more affordable.

This perspective assumes that the government’s action would be viewed as a signal that it is committed to making education more accessible, thereby incentivizing institutions to offer lower tuition.The reality is likely somewhere between these two extremes. The impact of debt forgiveness on tuition costs would depend on a variety of factors, including the specific details of the forgiveness program, the overall economic climate, and the response of individual institutions.

The potential impact of student debt forgiveness on the cost of higher education is complex and could vary depending on various factors.

Alternative Solutions

While forgiving up to $20,000 in student debt is a significant proposal, it’s not the only approach to tackling the student debt crisis. Several alternative solutions exist, each with its own set of advantages and disadvantages.

Income-Based Repayment Plans

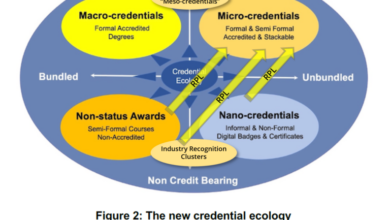

Income-based repayment (IBR) plans allow borrowers to make monthly payments based on their income and family size. These plans typically cap monthly payments at a percentage of discretionary income, with remaining balances forgiven after a certain number of years. IBR plans are designed to make repayment more manageable for borrowers with lower incomes, but they can also lead to longer repayment terms and higher overall interest costs.

Loan Forgiveness Programs for Specific Professions

Several loan forgiveness programs target specific professions, such as teaching, nursing, and public service. These programs offer partial or full loan forgiveness in exchange for working in these fields for a specified period. Loan forgiveness programs for specific professions incentivize individuals to pursue careers in high-demand fields, but they can also create inequities and raise concerns about the cost of these programs.

Increased Funding for Affordable Higher Education

Investing in affordable higher education can address the root causes of student debt by reducing the need for loans in the first place. This can be achieved through increased government funding for public colleges and universities, tuition assistance programs, and scholarships.

Increased funding for affordable higher education can make higher education more accessible and affordable for a wider range of students, but it requires significant public investment and can take time to yield results.

Social and Political Implications

Forgiving student debt is a complex issue with significant social and political implications. It is a policy that could impact income inequality, social mobility, and access to opportunity, potentially leading to increased political polarization and social unrest.

Potential Impact on Income Inequality

Forgiving student debt could potentially reduce income inequality by alleviating the financial burden on borrowers, particularly those from low-income backgrounds. This could lead to increased spending power and economic mobility for individuals and families, potentially narrowing the wealth gap.

“A 2021 study by the Federal Reserve Bank of New York found that student loan debt disproportionately affects borrowers with lower incomes and less education. These borrowers are more likely to default on their loans, which can have a negative impact on their credit scores and future financial opportunities.”

Potential Impact on Social Mobility

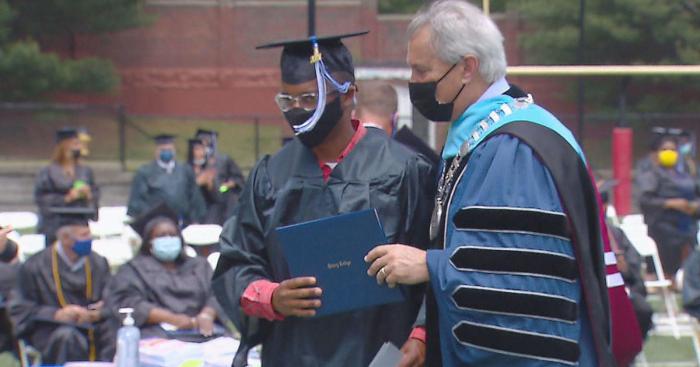

Forgiving student debt could enhance social mobility by removing a significant financial barrier for individuals seeking higher education. This could provide opportunities for individuals from disadvantaged backgrounds to pursue higher education and potentially increase their earning potential, thereby improving their socioeconomic status.

“A 2019 study by the Pew Research Center found that individuals with a college degree are more likely to be employed and earn higher salaries than those without a college degree. Forgiving student debt could help to level the playing field and increase opportunities for individuals from all socioeconomic backgrounds to pursue higher education.”

Potential Impact on Access to Opportunity

Forgiving student debt could increase access to opportunity for individuals by reducing the financial burden associated with higher education. This could allow individuals to pursue careers in fields that require advanced degrees, such as healthcare, education, and technology, thereby contributing to a more skilled and diverse workforce.

“A 2022 study by the Institute for College Access & Success found that student loan debt can have a significant impact on borrowers’ ability to make major life decisions, such as buying a home, starting a family, or launching a business. Forgiving student debt could free up borrowers to pursue these opportunities, potentially leading to economic growth and social progress.”

Potential for Increased Political Polarization and Social Unrest

Forgiving student debt could potentially lead to increased political polarization and social unrest, particularly among those who do not benefit from the policy. This could be exacerbated by the perception that the policy unfairly benefits certain groups, such as college graduates, at the expense of others.

“A 2020 study by the Pew Research Center found that there is a significant partisan divide in public opinion on student loan forgiveness. Democrats are more likely to support student loan forgiveness than Republicans.”