Forex Trading Tips for Beginners: Your Guide to Success

Forex trading tips for beginners can seem overwhelming at first, but with the right guidance, you can navigate the exciting world of currency trading and potentially turn it into a profitable endeavor. This comprehensive guide is designed to equip you with the essential knowledge and skills needed to embark on your forex trading journey.

From understanding the basics of currency pairs to implementing effective risk management strategies, we’ll cover everything you need to know to get started.

The forex market is the largest and most liquid financial market in the world, offering a wide range of opportunities for traders of all levels. However, it’s crucial to approach forex trading with a solid understanding of the underlying principles and a well-defined strategy.

This guide will delve into the intricacies of forex trading, empowering you to make informed decisions and maximize your chances of success.

Understanding Forex Trading

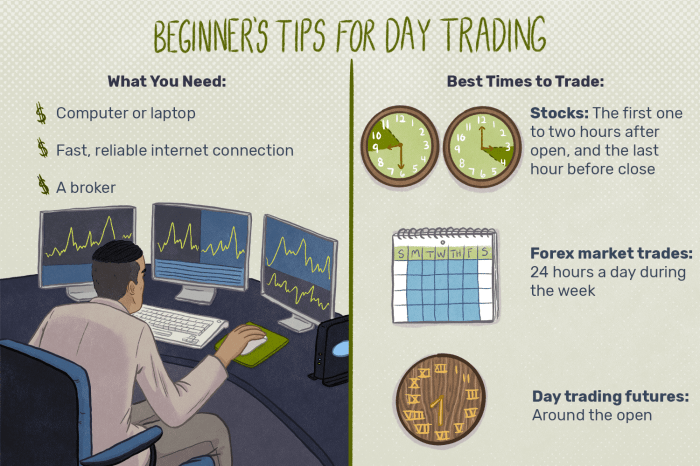

Forex trading, short for foreign exchange trading, is the simultaneous buying of one currency and selling of another. It’s the world’s largest and most liquid financial market, with trillions of dollars changing hands every day. This global market operates 24 hours a day, five days a week, making it accessible to traders around the world.

Currency Pairs

Currency pairs represent the exchange rate between two currencies. The first currency in the pair is called the “base currency,” while the second is the “quote currency.” For example, the EUR/USD pair indicates the exchange rate between the Euro (base currency) and the US Dollar (quote currency).

A quote of 1.1000 means that one Euro can be exchanged for 1.1000 US Dollars.

The Forex Market

The forex market is a decentralized global marketplace where currencies are traded. It’s not governed by a central authority, and trading occurs between banks, financial institutions, and individual traders. The market’s vast size and liquidity ensure that trades are executed quickly and efficiently, with minimal price fluctuations.

Factors Influencing Exchange Rates

Various factors influence currency exchange rates, including:

- Economic Indicators:Economic data releases, such as GDP growth, inflation rates, and unemployment figures, can significantly impact currency values. Strong economic indicators often lead to a currency’s appreciation, while weak indicators may cause it to depreciate.

- Interest Rates:Central banks’ monetary policies and interest rate decisions play a crucial role in currency movements. Higher interest rates attract foreign investment, leading to increased demand for the currency and its appreciation.

- Political Stability:Political events, such as elections, wars, or social unrest, can influence currency exchange rates. Political instability can lead to a currency’s depreciation, while stability tends to boost its value.

- Government Policies:Government policies, including trade agreements, taxes, and regulations, can impact currency exchange rates. For example, trade restrictions may lead to a currency’s depreciation.

- Market Sentiment:Market sentiment, or the overall feeling of investors towards a particular currency, can influence its value. Positive sentiment can lead to appreciation, while negative sentiment may cause depreciation.

Setting Up Your Trading Account

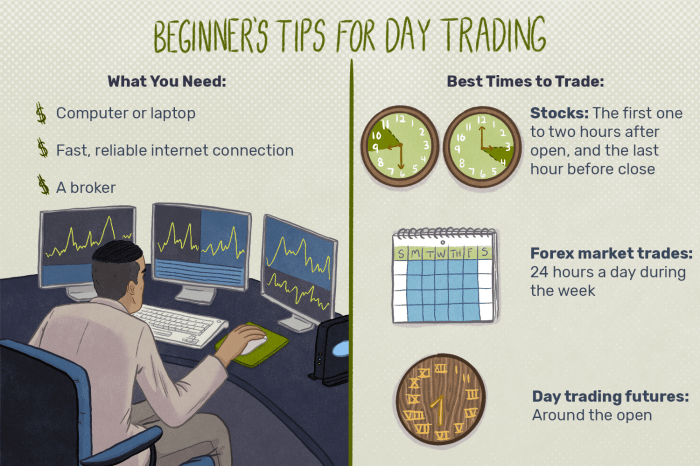

The next step in your forex trading journey is setting up a trading account. This is where you’ll deposit funds, execute trades, and manage your account. Choosing the right broker and understanding the different account types are crucial to your success.

Choosing a Reputable Forex Broker

Selecting a reliable forex broker is paramount for a smooth and secure trading experience. Here’s what you should consider:

- Regulation:Ensure the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. This provides a layer of protection for your funds.

- Trading Platform:The trading platform should be user-friendly, offer a wide range of features, and provide real-time market data. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Spreads and Commissions:Compare the spreads and commissions charged by different brokers. Lower spreads and commissions translate to higher profits.

- Customer Support:Look for a broker with responsive and knowledgeable customer support available 24/5. This is essential for resolving any issues you might encounter.

- Educational Resources:A good broker will offer educational resources, such as webinars, tutorials, and market analysis, to help you improve your trading skills.

Types of Trading Accounts

Forex brokers offer various account types to cater to different trading needs and levels of experience.

- Standard Account:This is the most common account type, typically with fixed spreads and commissions. It’s suitable for beginners and those with moderate trading activity.

- ECN Account:Electronic Communication Network (ECN) accounts offer raw spreads, which are usually tighter than standard accounts. They are ideal for experienced traders who execute high-volume trades.

- Micro Account:These accounts allow traders to start with small deposits and trade with smaller lot sizes, making them suitable for beginners with limited capital.

- Islamic Account:This account type adheres to Islamic principles, eliminating interest charges and allowing traders to trade without overnight fees.

Setting Up a Secure and Functional Trading Platform

Once you’ve chosen a broker and account type, you’ll need to set up your trading platform.

- Download and Install:Download the trading platform software from your broker’s website and install it on your computer. Ensure you download from the official website to avoid malware.

- Security Measures:Enable two-factor authentication for your account and keep your login credentials secure. Avoid sharing your account details with anyone.

- Platform Customization:Customize the platform to suit your trading style. This includes setting up charts, indicators, and alerts. Use the platform’s demo account to experiment with different settings.

- Fund Your Account:Deposit funds into your account using the available payment methods. Ensure you understand the minimum deposit requirements and any associated fees.

Forex Trading Strategies for Beginners

Now that you understand the basics of forex trading, it’s time to delve into strategies that can help you make informed trading decisions. There are two primary approaches to forex trading: fundamental analysis and technical analysis. Both strategies provide valuable insights, and you can choose to use one or both depending on your preferences and trading style.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, news events, and political factors that can influence currency values. By analyzing these factors, traders can identify potential opportunities and make predictions about future price movements.

- Economic Indicators:These are statistical data that reflect the health of a country’s economy, such as GDP growth, inflation rates, unemployment rates, and interest rates. Changes in these indicators can impact a currency’s value. For example, a strong GDP growth rate might suggest a strong economy, leading to a stronger currency.

- News Events:Major news events, such as political elections, central bank announcements, or geopolitical tensions, can significantly influence currency markets. Traders need to stay informed about these events and their potential impact on currencies.

- Political Factors:Political stability, government policies, and international relations can also affect currency values. For instance, a country with a stable political environment and favorable economic policies might see its currency appreciate.

Technical Analysis

Technical analysis uses historical price data and charts to identify patterns and trends that can predict future price movements. This approach focuses on price action, volume, and other technical indicators.

Trading Indicators, Forex trading tips for beginners

Technical indicators are mathematical calculations based on historical price data that provide signals about potential price movements. These indicators can help traders identify trends, overbought or oversold conditions, and potential support and resistance levels.

- Moving Averages:These indicators calculate the average price of a currency over a specific period. Traders use moving averages to identify trends and potential support and resistance levels. A commonly used moving average is the 200-day moving average, which can indicate long-term trends.

Forex trading can be intimidating for beginners, but it doesn’t have to be! Start with a solid understanding of fundamental analysis and learn to read charts effectively. Remember, it’s crucial to manage your risk and never invest more than you can afford to lose.

While you’re navigating the world of finance, it’s also important to stay informed about issues like the one highlighted in this recent article, vestager slams capitals lack of efforts in naming women commissioners , which shows the importance of diversity and representation in leadership roles.

Once you have a solid grasp of these key concepts, you’ll be well on your way to making informed decisions in the forex market.

- Relative Strength Index (RSI):The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI reading above 70 suggests that a currency is overbought, while a reading below 30 suggests it is oversold.

- MACD (Moving Average Convergence Divergence):The MACD indicator identifies trend changes and potential momentum shifts. It compares two moving averages to generate a signal line, which can indicate buy or sell signals.

Trading Strategies

Once you understand fundamental and technical analysis, you can start exploring different trading strategies.

Trend Following

Trend following, also known as momentum trading, involves identifying and trading in the direction of a prevailing trend. This strategy relies on the assumption that trends tend to continue. Traders use technical indicators, such as moving averages, to identify trends and enter trades when the price is moving in a clear direction.

Breakout Trading

Breakout trading involves entering a trade when the price breaks through a significant support or resistance level. This strategy is based on the idea that a breakout signals a change in market sentiment and a potential continuation of the move in the direction of the breakout.

For example, if a currency pair breaks above a key resistance level, breakout traders might buy the currency, expecting the price to continue rising.

Managing Risk in Forex Trading

Forex trading, while potentially lucrative, is inherently risky. Understanding and managing risk is crucial for success. Effective risk management not only protects your capital but also helps you make informed trading decisions. It’s a critical aspect of trading, ensuring you can navigate the market’s volatility and stay in the game for the long haul.

Stop-Loss Orders

Stop-loss orders are essential tools for managing risk in forex trading. They automatically close your position when the price reaches a predetermined level, limiting your potential losses. By setting a stop-loss order, you’re essentially telling your broker to sell your currency pair if the price falls below a specific point.

This helps to protect your capital from significant losses, especially in volatile market conditions.

Risk Management Techniques

Effective risk management involves implementing strategies to minimize potential losses and maximize your chances of success. Here are some common techniques:

- Position Sizing:This involves determining the appropriate amount of capital to allocate to each trade. A good rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. This approach helps to prevent significant losses if a trade goes against you.

For example, if you have $10,000 in your trading account, you would risk $100-$200 per trade.

- Diversification:Diversification involves spreading your risk across multiple currency pairs or assets. This helps to mitigate the impact of any single trade going against you. For example, instead of focusing solely on EUR/USD, you could diversify your portfolio by trading other pairs like GBP/USD or USD/JPY.

- Risk-Reward Ratio:The risk-reward ratio is the relationship between the potential profit and the potential loss of a trade. A good risk-reward ratio is typically 1:2 or higher, meaning you aim to make at least twice as much profit as you could potentially lose.

For example, if you risk $100 on a trade, you would aim to make at least $200 in profit.

Setting Profit Targets and Managing Losses

Setting realistic profit targets and managing losses effectively are essential for successful forex trading. You should determine a specific profit target for each trade based on your risk-reward ratio and market conditions. Once your profit target is reached, you should close the position and take profits.

Similarly, you should have a plan for managing losses. This might involve closing a position at a predetermined stop-loss level or scaling out of a position gradually as the market moves against you.

“Risk management is not about avoiding risk, it’s about taking calculated risks.”

Learning the ropes of forex trading can be a bit like navigating a complex medical landscape. Just as researchers are working to minimize the toxic side effects of cancer drugs, researchers take aim at cancer drugs toxic side effects , forex traders need to manage their risk and understand the potential downsides of every trade.

It’s about finding a balance between potential rewards and the potential for losses, just like finding the right balance between treatment effectiveness and side effects.

Warren Buffet

Essential Forex Trading Tools

Successful forex trading requires more than just knowledge of strategies. You need the right tools to analyze markets, execute trades, and manage your risk effectively. This section explores some essential tools that can significantly enhance your trading experience.

Forex Trading Platforms

Forex trading platforms are the foundation of your trading journey. These platforms provide a user interface for accessing market data, placing orders, and managing your trading positions.

- MetaTrader 4 (MT4): One of the most popular platforms, MT4 offers a user-friendly interface, advanced charting capabilities, and a wide range of technical indicators. It also supports automated trading through Expert Advisors (EAs).

- MetaTrader 5 (MT5): MT5 is the successor to MT4, offering enhanced features like more technical indicators, expanded order types, and support for multiple asset classes.

- cTrader: cTrader is a popular platform known for its speed, depth of market data, and advanced charting capabilities. It also supports algorithmic trading and copy trading.

- TradingView: While not a full-fledged trading platform, TradingView is a powerful charting and analysis tool used by many traders. It offers a wide range of charting tools, indicators, and real-time data.

Charting Software

Charting software is essential for technical analysis, which involves identifying patterns and trends in price movements to predict future price action.

- Technical Indicators: Charting software provides a wide range of technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands. These indicators help traders identify potential buy or sell signals, confirm trends, and gauge market momentum.

- Chart Patterns: Charting software allows traders to recognize and analyze various chart patterns, such as head and shoulders, double tops, and triangles. These patterns can provide insights into potential price reversals or continuations.

- Trendlines: Traders can draw trendlines on charts to identify the direction of price movement and potential support and resistance levels. Trendlines can help traders identify potential entry and exit points.

Economic Calendars and News Sources

Economic data releases and major news events can significantly impact currency movements. Economic calendars and news sources provide crucial information for making informed trading decisions.

- Economic Calendars: Economic calendars list upcoming economic data releases, such as inflation rates, unemployment figures, and interest rate decisions. These releases can cause significant price fluctuations, creating trading opportunities.

- News Sources: Stay updated on major news events that can influence currency markets. News sources can provide insights into geopolitical tensions, central bank policies, and other factors that impact currency valuations.

Understanding Forex Trading Psychology

Forex trading is a challenging endeavor that requires not only technical skills but also a strong understanding of trading psychology. While mastering charts, indicators, and strategies is crucial, emotional control plays a vital role in achieving consistent success. The psychological challenges of forex trading can be significant, and neglecting them can lead to poor decision-making and ultimately, financial losses.

Managing Fear and Greed

Fear and greed are two of the most powerful emotions that can influence trading decisions. Fear can lead to hesitation and missed opportunities, while greed can cause overtrading and excessive risk-taking. Understanding how these emotions affect your trading and developing strategies to manage them is essential.

Forex trading can be a thrilling and potentially lucrative venture, but it’s crucial to remember that it’s a complex market. One of the most important tips for beginners is to learn how to manage risk effectively, which means understanding the potential losses associated with each trade.

This can be a bit like navigating the unpredictable delays at Kings Cross Station, which have been causing chaos for commuters for the second day in a row. Just like you need to plan for unexpected disruptions on your commute, you need to have a solid risk management strategy in place when trading forex.

- Fear of Loss:This fear can lead to holding onto losing trades for too long, hoping for a recovery, or exiting winning trades prematurely, fearing that the market will reverse.

- Greed for Profits:This can lead to taking on too much risk, chasing unrealistic profits, and ignoring stop-loss orders.

To manage fear and greed, consider the following:

- Develop a Trading Plan:A well-defined trading plan will help you make decisions based on objective criteria rather than emotional impulses.

- Use Stop-Loss Orders:Stop-loss orders are essential for limiting potential losses and preventing emotional trading decisions.

- Focus on Risk Management:Understanding and managing risk is crucial for trading success. Set realistic profit targets and risk limits.

- Practice Emotional Discipline:Learning to control your emotions is a continuous process. Practice mindfulness techniques, such as meditation, to help calm your mind and make rational decisions.

Overtrading

Overtrading is a common mistake that many novice traders make. It involves trading too frequently and often leads to excessive risk-taking and a decrease in overall profitability. Overtrading can stem from boredom, a desire to make quick profits, or a lack of a well-defined trading plan.

- Boredom:Traders may feel the need to be constantly active in the market, even when there are no clear trading opportunities.

- Chasing Profits:The desire for quick profits can lead to taking trades without proper analysis or risk management.

- Lack of a Trading Plan:Without a clear plan, traders may be more prone to impulsive decisions and overtrading.

To avoid overtrading, consider these strategies:

- Stick to Your Trading Plan:Only take trades that meet your pre-defined criteria.

- Set Realistic Trading Goals:Don’t expect to get rich quickly. Focus on achieving consistent, long-term profitability.

- Take Breaks:Step away from the charts periodically to avoid emotional fatigue and overtrading.

Getting Started with Forex Trading

The excitement of entering the forex market can be overwhelming, especially for beginners. But with a structured approach and the right resources, you can navigate the world of currency trading with confidence. This section will guide you through the essential steps to open your first trading account and make your initial trade.

We’ll also explore valuable resources and techniques for practicing your skills before committing real money.

Opening a Forex Trading Account

Opening a forex trading account is the first step in your journey. Here’s a detailed guide to get you started:

- Choose a Forex Broker:Select a reputable broker that aligns with your trading needs and risk tolerance. Consider factors like fees, platform features, customer support, and regulatory compliance. Many online resources offer broker reviews and comparisons to help you make an informed decision.

- Complete the Account Application:Once you’ve chosen a broker, you’ll need to fill out an application form. This usually involves providing personal details, financial information, and trading experience. The broker will verify your identity and financial status to ensure compliance with regulations.

- Fund Your Account:After your account is approved, you can deposit funds to start trading. Most brokers offer various deposit methods, such as bank transfers, credit/debit cards, and e-wallets. Choose a method that’s convenient and secure for you.

- Select a Trading Platform:Forex brokers provide trading platforms that allow you to execute trades, analyze charts, and manage your account. Familiarize yourself with the platform’s features and tools before making your first trade.

Making Your First Trade

Now that you have a funded trading account and a platform, you’re ready to make your first trade. Here’s a step-by-step process:

- Choose a Currency Pair:Select a currency pair to trade based on your analysis and trading strategy. Consider factors like market volatility, economic indicators, and your risk appetite.

- Set Your Order Type:Forex trades are typically executed through market orders, which are placed at the current market price, or limit orders, which are placed at a specific price. Choose the order type that best suits your trading style and risk tolerance.

- Specify the Trade Size:Determine the amount of currency you want to trade. This is known as the trade size or lot size. Start small and gradually increase your trade size as you gain experience and confidence.

- Place the Order:Once you’ve chosen the currency pair, order type, and trade size, you can place your order through the trading platform. The platform will execute your order at the specified price or market price.

Learning Forex Trading Fundamentals

To become a successful forex trader, it’s essential to have a solid understanding of the fundamentals. Here are some resources and tutorials that can help you learn:

- Online Courses and Tutorials:Many online platforms offer comprehensive courses and tutorials on forex trading, covering topics such as technical analysis, fundamental analysis, risk management, and trading psychology.

- Forex Books:Several books provide in-depth knowledge on forex trading strategies, market analysis, and risk management. Look for books written by experienced traders and analysts.

- Forex Forums and Communities:Engage with experienced traders and learn from their insights and experiences. Participate in discussions, ask questions, and share your own trading knowledge.

Practicing with a Demo Account

Before risking real money, it’s highly recommended to practice trading with a demo account. Demo accounts allow you to trade with virtual funds, simulating real-market conditions. This allows you to experiment with different strategies, learn the platform, and develop your trading skills without risking your capital.

Building a Successful Forex Trading Career: Forex Trading Tips For Beginners

Congratulations! You’ve taken the first steps towards a potentially lucrative and exciting career in forex trading. While the allure of quick profits might be tempting, building a successful forex trading career is a marathon, not a sprint. It requires dedication, discipline, and a commitment to continuous learning.

This section delves into the crucial aspects of building a sustainable and profitable trading career.

The Importance of Continuous Learning

The forex market is constantly evolving, influenced by global economic events, political developments, and shifts in market sentiment. To stay ahead of the curve and make informed trading decisions, it’s essential to engage in continuous learning. This involves:

- Staying Updated with Market Trends:Follow financial news sources, economic calendars, and market analysis reports to understand current market conditions and anticipate potential shifts.

- Mastering Technical Analysis:Learn to interpret charts, identify patterns, and use technical indicators to identify potential trading opportunities.

- Expanding Fundamental Knowledge:Gain a deep understanding of macroeconomic factors, monetary policy, and geopolitical events that influence currency movements.

- Staying Abreast of New Trading Strategies:Explore different trading approaches, including scalping, day trading, swing trading, and long-term investing, to find strategies that align with your risk tolerance and investment goals.

Building a Profitable Trading Strategy

A well-defined trading strategy is the cornerstone of successful forex trading. It provides a structured approach to identifying trading opportunities, managing risk, and maximizing potential profits. Here are some key elements of a profitable trading strategy:

- Define Your Trading Style:Determine whether you’re a scalper, day trader, swing trader, or long-term investor. This will shape your trading timeframe, risk tolerance, and preferred trading instruments.

- Develop a Clear Entry and Exit Strategy:Establish specific criteria for entering and exiting trades based on technical and fundamental analysis. This helps to avoid emotional decision-making and ensure consistency.

- Use Stop-Loss Orders:Limit potential losses by setting stop-loss orders to automatically exit a trade if the price moves against your position. This helps to protect your capital and prevent significant losses.

- Manage Your Risk:Implement a risk management plan that defines your maximum risk per trade, overall risk exposure, and profit targets. This helps to control losses and maintain a sustainable trading approach.

Managing Your Trading Portfolio

Managing your trading portfolio involves monitoring your trades, adjusting your strategy as needed, and ensuring your portfolio aligns with your overall investment goals. Key aspects include:

- Diversify Your Portfolio:Spread your risk across multiple currency pairs to mitigate losses and increase the potential for gains. This helps to reduce the impact of any single currency’s volatility.

- Monitor Your Trades:Regularly review your open positions and adjust your strategy based on market conditions and your trading plan.

- Rebalance Your Portfolio:Periodically review your portfolio’s allocation and make adjustments to ensure it remains aligned with your risk tolerance and investment objectives.

- Record and Analyze Your Trades:Keep a detailed trading journal to track your performance, identify areas for improvement, and refine your trading strategy over time.

Developing a Sustainable and Long-Term Approach

Building a successful forex trading career is a journey that requires patience, discipline, and a commitment to continuous improvement. Here are some tips for developing a sustainable and long-term approach:

- Focus on Consistent Profits:Aim for small, consistent profits over time rather than chasing big wins. This helps to build a sustainable trading career and avoid emotional decision-making.

- Avoid Overtrading:Restrict the number of trades you take to avoid unnecessary risk and emotional fatigue. Focus on high-quality trading opportunities rather than rushing into every potential move.

- Stay Disciplined:Adhere to your trading plan and avoid deviating from your strategy based on emotions or market noise. This helps to maintain consistency and minimize losses.

- Seek Professional Guidance:Consider working with a forex mentor or joining a trading community to gain insights, learn from experienced traders, and receive feedback on your trading strategy.