Disneys Special District Revocation: A $1 Billion Debt Bomb for Florida Taxpayers?

Florida taxpayers could face a 1 billion disney debt bomb if its special district status is revoked – The potential for Florida taxpayers to shoulder a $1 billion debt bomb if Disney’s special district status is revoked has become a hot-button issue. This situation stems from the Florida legislature’s decision to dissolve the Reedy Creek Improvement District, a special district that granted Disney significant autonomy and tax benefits.

The move has sparked a wave of legal challenges, financial uncertainty, and heated political debate, leaving many wondering about the long-term implications for Disney, the state of Florida, and its residents.

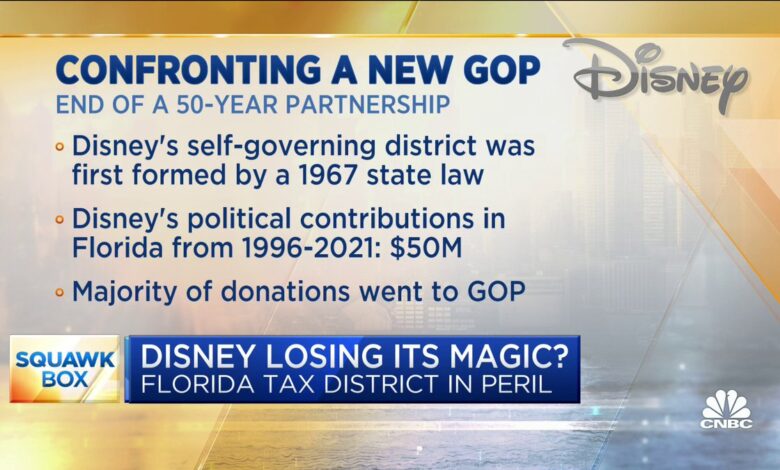

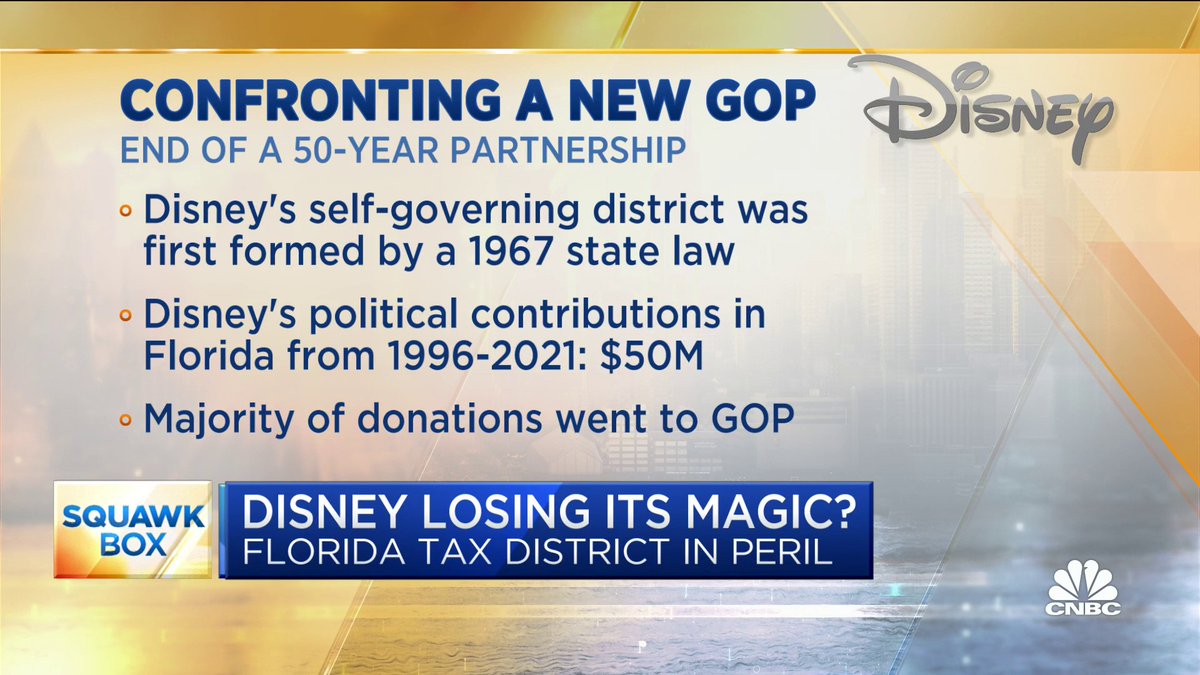

The Reedy Creek Improvement District, established in 1967, gave Disney the authority to govern its own land, including infrastructure, zoning, and even fire and police services. This special status allowed Disney to operate with greater flexibility and control over its sprawling theme park complex, but it also came with unique financial responsibilities.

The decision to revoke this status, driven by a political clash between Disney and Florida Governor Ron DeSantis, has created a complex web of legal and financial ramifications. The question now is: who will ultimately be responsible for Disney’s financial obligations, and what impact will this have on the state’s budget and taxpayers?

The Revoking of Disney’s Special District Status: Florida Taxpayers Could Face A 1 Billion Disney Debt Bomb If Its Special District Status Is Revoked

The Florida legislature’s decision to revoke Disney’s special district status has ignited a firestorm of controversy, raising questions about the future of the entertainment giant’s presence in the state. This move, stemming from a long-standing power struggle between Disney and Florida Governor Ron DeSantis, has significant implications for both the company and the surrounding community.

To understand the complexities of this situation, it’s crucial to delve into the history of the Reedy Creek Improvement District and the motivations behind its dissolution.

The History of the Reedy Creek Improvement District

The Reedy Creek Improvement District was established in 1967, granting Disney significant autonomy over its properties within the district. This special status allowed Disney to function as a quasi-governmental entity, responsible for managing its own infrastructure, utilities, and even its own fire department.

The district’s creation was a strategic move by Florida lawmakers to attract Disney to the state, recognizing the economic benefits that a major entertainment company would bring. Disney, in turn, gained significant control over its operations, streamlining development and minimizing bureaucratic hurdles.

This mutually beneficial arrangement allowed Disney to build its iconic theme parks and resorts, transforming a rural area into a global tourist destination.

The potential for Florida taxpayers to shoulder a $1 billion Disney debt if the special district status is revoked is a serious issue, but it’s not the only one making headlines. Meanwhile, turkey hill dairy issues voluntary recall and allergy alert for undeclared peanut in select chocolate marshmallow premium ice cream containers , highlighting the importance of food safety and clear labeling.

The Disney situation reminds us that complex legal and financial issues can have far-reaching consequences, just as food recalls can impact consumer health and trust.

Reasons for the Revoking of Disney’s Special District Status

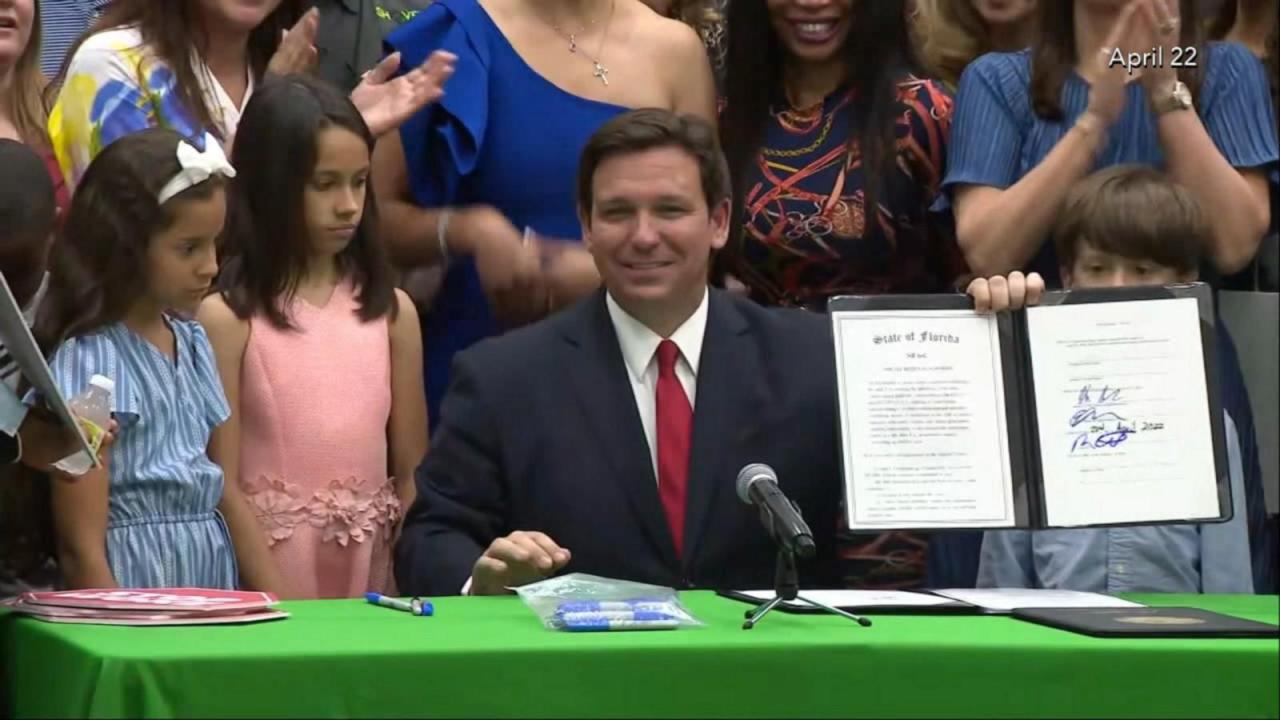

The decision to revoke Disney’s special district status was primarily driven by political tensions between the company and Florida Governor Ron DeSantis. The conflict escalated after Disney publicly criticized a controversial law passed by the Florida legislature, dubbed the “Don’t Say Gay” bill, which restricts classroom instruction on sexual orientation and gender identity.

Governor DeSantis, a vocal supporter of the bill, retaliated by spearheading the effort to dissolve the Reedy Creek Improvement District, accusing Disney of using its special status to advance its political agenda.

Potential Consequences of the Revoking of Disney’s Special District Status

The consequences of dissolving the Reedy Creek Improvement District are far-reaching and complex, affecting both Disney and the surrounding community.

The potential for Florida taxpayers to shoulder a $1 billion debt bomb if Disney’s special district status is revoked is a complex issue, much like the debate over abortion rights. While americans favor abortion rights but its complicated , the question of whether to hold Disney accountable for its political stances through financial repercussions is equally nuanced.

It’s a situation where political ideology and economic realities collide, forcing Floridians to grapple with the potential consequences of their choices.

Consequences for Disney

- Increased Costs and Bureaucracy:Disney will likely face increased costs and bureaucratic hurdles as it transitions from a self-governing entity to operating under the oversight of local governments. This could impact development projects, infrastructure maintenance, and overall operational efficiency.

- Tax Liability:Disney could face significant tax increases as it loses its special status. The company will no longer be exempt from property taxes and other levies, potentially impacting its profitability and financial stability.

- Legal Challenges:Disney has hinted at legal challenges to the state’s decision, potentially leading to protracted litigation and uncertainty. This could further complicate the company’s operations and cast a shadow over its future in Florida.

Consequences for the Surrounding Community

- Tax Burden:The dissolution of the Reedy Creek Improvement District could shift the burden of providing essential services to local taxpayers. This could lead to higher taxes and a strain on local budgets.

- Infrastructure Challenges:The transition to local government oversight could disrupt the smooth operation of essential infrastructure, such as roads, water systems, and emergency services, potentially impacting the quality of life for residents and visitors.

- Economic Uncertainty:The ongoing legal battle and uncertainty surrounding Disney’s future in Florida could impact the local economy, potentially leading to job losses and reduced investment.

Financial Implications of the Revoking

The potential revocation of Disney’s special district status in Florida raises significant financial implications. It could result in Disney being responsible for various obligations previously handled by the Reedy Creek Improvement District, potentially leading to a significant financial burden for the state.

Potential Impact on Disney’s Financial Responsibilities

The revocation of the special district status would likely shift responsibility for infrastructure maintenance, debt repayment, and other obligations currently managed by the Reedy Creek Improvement District to Disney. This could have substantial financial repercussions for the company.

Estimated Financial Burden on Florida Taxpayers

The financial burden on Florida taxpayers is a subject of much debate. Some estimates suggest that the state could be responsible for billions of dollars in debt and infrastructure obligations. This could potentially lead to higher taxes or cuts in other state services.

The exact financial impact is difficult to predict, as it depends on the specific terms of the revocation and the financial status of the Reedy Creek Improvement District.

Legal and Constitutional Challenges

The decision to revoke Disney’s special district status has sparked significant legal and constitutional questions. Disney, a powerful corporation with considerable legal resources, is likely to challenge this move through various legal avenues.

Potential Legal Arguments

Disney could argue that the revocation of its special district status violates various legal principles, including contractual agreements, property rights, and constitutional protections.

- Breach of Contract:Disney could argue that the revocation of its special district status constitutes a breach of contract, as it undermines the original agreement between the company and the state. This argument hinges on the specific terms of the agreements governing the creation and operation of the special district.

- Violation of Property Rights:Disney could claim that the revocation of its special district status constitutes a taking of its property without just compensation, violating the Fifth Amendment of the U.S. Constitution. This argument centers on the idea that the special district status is an integral part of Disney’s property rights and its value.

The potential for Florida taxpayers to shoulder a $1 billion debt bomb if Disney’s special district status is revoked is a serious issue. While that unfolds, it’s interesting to see how Apple is starting to connect the dots for its next big thing, as reported on this blog.

It’s a reminder that even in the face of complex challenges, innovation and progress continue to move forward. Hopefully, the Florida situation will be resolved in a way that benefits both the state and its taxpayers.

- Due Process Concerns:Disney could argue that the revocation of its special district status was carried out without proper notice and an opportunity to be heard, violating the Due Process Clause of the Fourteenth Amendment.

- Equal Protection Clause:Disney could argue that the revocation of its special district status is discriminatory and violates the Equal Protection Clause of the Fourteenth Amendment, as other special districts remain in place.

Legal Precedents

Several legal precedents could be relevant to this case. For example, the Supreme Court’s decision in Penn Central Transportation Co. v. New York City(1978) established a framework for determining whether a government action constitutes a “taking” of private property. The Court considered factors such as the economic impact of the regulation, the extent to which the regulation interferes with distinct investment-backed expectations, and the character of the government action.Another relevant precedent is Home Builders Association of Northern California v. City of Livermore(1976), where the Supreme Court upheld a city’s moratorium on development permits, finding that the city had a legitimate interest in regulating growth and protecting the environment.

Contracts and Property Rights, Florida taxpayers could face a 1 billion disney debt bomb if its special district status is revoked

The legal challenges are likely to center around the specific contracts and agreements governing the creation and operation of Disney’s special district. The extent to which these agreements are legally binding and enforceable will be a crucial factor in determining the outcome of any legal challenge.

Political and Social Impact

The decision to revoke Disney’s special district status has ignited a heated debate, with political motivations at its core and far-reaching implications for the relationship between the entertainment giant and the state of Florida.

Political Motivations Behind the Decision

The decision to revoke Disney’s special district status can be viewed as a culmination of several political factors. The move was initiated by Florida Governor Ron DeSantis, who has been a vocal critic of Disney’s opposition to a controversial education law, dubbed the “Don’t Say Gay” bill.

DeSantis’s actions can be seen as a response to Disney’s public stance against the legislation, which he perceived as an attack on Florida values. This incident highlights the increasing politicization of corporate social responsibility and the potential for retaliation by state governments.

Impact on the Relationship Between Disney and the State of Florida

The revocation of Disney’s special district status has strained the relationship between the entertainment giant and the state of Florida. Disney has expressed concerns about the financial implications of the decision, arguing that it could lead to increased costs for taxpayers.

The company has also raised legal challenges, questioning the constitutionality of the move. The strained relationship could have significant consequences for both parties, potentially impacting future investments, economic development, and tourism in the state.

Perspectives of Different Stakeholders

The decision to revoke Disney’s special district status has sparked diverse reactions from various stakeholders, including residents, businesses, and political figures.

- Residents: Some residents have expressed support for the decision, arguing that it will help to ensure greater accountability and transparency from Disney. Others have voiced concerns about the potential negative impact on property values and local services.

- Businesses: Businesses in the area, particularly those reliant on tourism, have expressed concerns about the potential economic consequences of the decision. They fear that the uncertainty surrounding the situation could discourage investment and impact local businesses.

- Political Figures: The decision has also divided political figures, with Republicans largely supporting the move and Democrats expressing concerns about its implications for local governance and the separation of powers.

Potential Solutions and Alternatives

The revocation of Disney’s special district status has created a complex financial situation for Florida taxpayers. Addressing this issue requires careful consideration of various solutions and alternative arrangements. This section explores potential paths forward, examining their feasibility and impact on Disney’s operations.

Potential Solutions to Address the Financial Burden

The financial burden on Florida taxpayers stemming from the Reedy Creek Improvement District’s dissolution requires practical solutions. These solutions should aim to minimize the impact on taxpayers while ensuring the continued efficient operation of the district’s essential services.

- State Takeover:The state of Florida could assume direct responsibility for the Reedy Creek Improvement District’s assets and liabilities. This would involve the state government taking over the district’s infrastructure, debt obligations, and operational responsibilities. While this approach could alleviate the immediate burden on local taxpayers, it would require significant state resources and potentially raise concerns about government involvement in private enterprise.

- Taxpayer-Funded Bailout:A direct bailout of the Reedy Creek Improvement District could be funded by Florida taxpayers through increased taxes or budget reallocations. This option would effectively shift the financial burden from Disney to the broader taxpayer base. However, it would likely face strong public opposition due to the perception of bailing out a wealthy corporation.

- Asset Sale:Selling off assets of the Reedy Creek Improvement District could generate revenue to offset some of the debt. This could involve selling infrastructure like roads, utilities, or even portions of the district’s land. However, finding buyers for these assets may be challenging, and the sale process could be lengthy and complex.

- Debt Restructuring:Restructuring the Reedy Creek Improvement District’s debt could involve extending repayment terms, reducing interest rates, or seeking a loan from a third party. This would require negotiations with creditors and could potentially impact the district’s credit rating.

Alternative Arrangements for Managing the Reedy Creek Improvement District

Alternative arrangements can be explored to manage the Reedy Creek Improvement District without significantly impacting Disney’s operations. These options aim to balance the need for local control with the efficient provision of essential services.

- Creation of a New Special District:A new special district could be created with a smaller geographic scope, focusing solely on the essential services currently provided by Reedy Creek. This would allow for more targeted governance and potentially reduce the overall financial burden. However, establishing a new district would involve legal and administrative hurdles.

- Contractual Arrangements:Disney could enter into contractual agreements with local governments or private entities to provide specific services, such as fire protection, wastewater treatment, or road maintenance. This would shift responsibility for these services away from the district while allowing Disney to retain control over its own operations.

However, negotiating and enforcing these contracts could be complex.

- Public-Private Partnerships:Public-private partnerships could be formed to manage and operate certain district assets, such as the utility infrastructure. This would combine the expertise of private companies with the resources and oversight of local governments. However, these partnerships require careful planning and coordination to ensure equitable benefits for all parties involved.

Closure

The potential for Florida taxpayers to bear the brunt of Disney’s financial obligations if its special district status is revoked presents a significant challenge. This complex situation raises questions about the balance of power between corporations and government, the role of special districts, and the potential impact on taxpayers.

The legal and financial ramifications of this decision are still unfolding, and the outcome will likely have far-reaching consequences for Disney, the state of Florida, and its residents.