ECB Rate Cut Precedes Fed Decision

European central bank set to cut interest rates just days before the feds big decision – The European Central Bank (ECB) is set to cut interest rates just days before the Federal Reserve (Fed) makes its own big decision. This move has sparked considerable speculation about the future direction of global monetary policy and the potential impact on economies worldwide.

The ECB’s decision comes amidst a backdrop of economic uncertainty, with the Eurozone facing sluggish growth and the US grappling with trade tensions and a weakening manufacturing sector.

Analysts believe that the ECB’s decision to lower rates is intended to stimulate economic activity and combat deflationary pressures. The Fed, meanwhile, faces a more complex situation, as it must balance concerns about inflation with the need to support a strong economy.

The divergence in monetary policy between these two central banks could have significant implications for global financial markets and currency valuations.

The ECB’s Decision

The European Central Bank (ECB) has surprised markets by cutting interest rates just days before the Federal Reserve’s highly anticipated monetary policy decision. This move signals a divergence in monetary policy between the two major economic blocs and raises questions about the ECB’s outlook for the Eurozone economy.

Reasons Behind the Interest Rate Cut

The ECB’s decision to cut interest rates is likely driven by a combination of factors. The Eurozone economy is facing a number of challenges, including weak growth, low inflation, and geopolitical uncertainty. These factors have led to concerns that the Eurozone economy is at risk of slipping into recession.

- Weak Economic Growth:The Eurozone economy has been growing at a sluggish pace in recent quarters, with GDP growth slowing to just 0.2% in the second quarter of 2023. This weakness is partly due to the ongoing war in Ukraine, which has disrupted supply chains and increased energy prices.

The ECB’s rate cut is intended to stimulate economic activity and boost growth.

- Low Inflation:Inflation in the Eurozone has been declining in recent months, but it remains above the ECB’s target of 2%. However, the ECB is concerned about the possibility of deflation, which is a sustained decline in prices. Cutting interest rates can help to prevent deflation by making it cheaper for businesses to borrow money and invest.

- Geopolitical Uncertainty:The war in Ukraine and other geopolitical tensions have created uncertainty for businesses and consumers. This uncertainty has led to a decline in investment and spending, which has further dampened economic growth. The ECB’s rate cut is seen as a way to provide support to the Eurozone economy during this period of uncertainty.

Impact on the Eurozone Economy

The ECB’s decision to cut interest rates is expected to have a positive impact on the Eurozone economy. Lower interest rates will make it cheaper for businesses to borrow money and invest, which could lead to increased economic activity. This could also lead to higher employment levels as businesses expand their operations.

However, the impact of the rate cut on the Eurozone economy will depend on a number of factors, including the severity of the economic challenges facing the region and the response of businesses and consumers to the rate cut.

Timeline for the Interest Rate Cut

The ECB has not provided a specific timeline for the interest rate cut. However, it is likely that the rate cut will take effect in the near future. The ECB’s next monetary policy meeting is scheduled for September 14, 2023, and it is possible that the rate cut will be announced at that meeting.

Historical Context

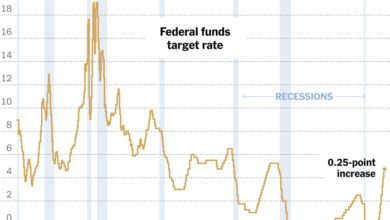

The ECB’s current monetary policy stance is a departure from its previous policy of raising interest rates. The ECB had been raising interest rates in response to rising inflation, but it has now reversed course in light of the weakening economic outlook.

This change in policy reflects the ECB’s commitment to supporting the Eurozone economy, even in the face of challenges.

The Fed’s Decision

The Federal Reserve (Fed) is scheduled to make its next interest rate decision in the coming days, following the European Central Bank’s (ECB) surprise rate cut. This decision will be closely watched by markets and policymakers worldwide, as it could have significant implications for the US economy and global financial markets.The Fed’s decision will be influenced by a number of factors, including inflation, economic growth, and the labor market.

The European Central Bank’s decision to cut interest rates just days before the Fed’s big decision has sent ripples through the markets. While economists debate the impact on global economies, it’s hard to ignore the excitement building for the US Open, where Frances Tiafoe and Taylor Fritz have advanced to the semifinals.

You can catch all the action and get the latest news on the 49ers’ return to the field and NFL predictions right here. Back to the ECB, the move suggests a cautious approach to inflation, which could influence the Fed’s decision and ultimately impact both US and European markets.

While inflation has cooled slightly in recent months, it remains elevated above the Fed’s target of 2%. Economic growth has also slowed, with concerns about a potential recession growing. However, the labor market remains strong, with low unemployment and strong job growth.

Impact of the Fed’s Decision on the US Economy

The Fed’s decision on interest rates could have a significant impact on the US economy. Raising interest rates would make it more expensive for businesses and consumers to borrow money, which could slow economic growth. Conversely, lowering interest rates would make it cheaper to borrow money, which could stimulate economic activity.The Fed’s decision will also influence the value of the US dollar.

The European Central Bank’s decision to cut interest rates just days before the Fed’s big announcement comes at a time when Europe’s economy is facing a new set of challenges. While Europe has weathered recent economic storms, as discussed in this insightful article europes economy survived terrible prophecies but must now tackle trade with china eus gentiloni , navigating the complexities of trade with China and the broader geopolitical landscape is a crucial task ahead.

The ECB’s move could be a sign of their willingness to provide further support to the Eurozone economy as it faces these new challenges.

Raising interest rates would make the dollar more attractive to foreign investors, which could strengthen the dollar. Conversely, lowering interest rates would make the dollar less attractive, which could weaken the dollar.

Comparison of Monetary Policy Stances

The ECB’s recent decision to cut interest rates signals a more dovish stance on monetary policy compared to the Fed. The ECB is concerned about the economic outlook in the Eurozone, which is facing headwinds from the war in Ukraine and high energy prices.

The Fed, on the other hand, is still focused on combating inflation, even though economic growth has slowed.

Implications of Divergent Monetary Policies, European central bank set to cut interest rates just days before the feds big decision

The divergent monetary policies of the ECB and the Fed could have a number of implications. For example, a stronger dollar could make US exports more expensive and hurt US businesses. It could also make it more difficult for emerging market economies to repay their dollar-denominated debts.The divergent monetary policies could also lead to increased volatility in global financial markets.

Investors may shift their investments from the Eurozone to the US in search of higher returns, which could put upward pressure on the dollar and create uncertainty in the markets.

Global Economic Context

The decisions of both the ECB and the Fed are heavily influenced by the current state of the global economy. The global economic landscape is characterized by a complex interplay of factors, including inflation, growth, and geopolitical uncertainties. Both central banks are carefully monitoring these trends to assess the appropriate monetary policy stance.

Key Economic Indicators

The ECB and the Fed are likely considering a range of key economic indicators, including:

- Inflation:Both central banks are focused on bringing inflation back down to their respective targets. Inflation in the Eurozone and the US has been stubbornly high, driven by supply chain disruptions, energy price increases, and strong consumer demand.

- Economic Growth:The global economy is facing headwinds from the war in Ukraine, rising interest rates, and persistent inflation. Both the Eurozone and the US are experiencing slowing growth, although the US economy is generally considered more resilient.

- Labor Market:The labor market is another crucial indicator. While the US labor market remains strong, with low unemployment and strong wage growth, the Eurozone labor market is facing challenges, with higher unemployment and slower wage growth.

- Geopolitical Risks:The war in Ukraine, the ongoing trade tensions between the US and China, and other geopolitical risks are creating uncertainty and volatility in the global economy. These risks can impact economic growth, inflation, and financial markets.

Impact of Global Economic Trends

Global economic trends have significant implications for both the Eurozone and the US.

The European Central Bank’s decision to cut interest rates just days before the Federal Reserve’s own big decision has created a ripple effect across global markets. Asian Pacific markets opened higher today, tracking the rises in the Dow and S&P 500, as reported by this news source.

It will be interesting to see how the Fed’s decision ultimately impacts the ECB’s move and the global economy as a whole.

- Eurozone:The Eurozone is particularly vulnerable to the global economic slowdown, given its reliance on exports and its exposure to the energy crisis. The ECB’s decision to cut interest rates reflects its concern about the slowing growth outlook and the potential for a recession.

- US:The US economy is more resilient, but it is also facing headwinds from rising interest rates and inflation. The Fed’s decision to raise interest rates is aimed at curbing inflation, but it could also slow economic growth.

Market Reactions: European Central Bank Set To Cut Interest Rates Just Days Before The Feds Big Decision

The decisions by the ECB and the Fed will likely send ripples through global financial markets, influencing asset prices and investor sentiment. Understanding these potential reactions is crucial for investors and market participants alike.

Impact on Asset Classes

The decisions by the ECB and the Fed are likely to have significant impacts on various asset classes. The following table summarizes potential reactions:

| Asset Class | ECB Rate Cut | Fed Rate Hike |

|---|---|---|

| Stocks | Potentially positive, as lower interest rates can boost corporate earnings and investment. | Potentially negative, as higher interest rates can increase borrowing costs and slow economic growth. |

| Bonds | Potentially positive, as lower interest rates can increase bond prices. | Potentially negative, as higher interest rates can decrease bond prices. |

| Currencies | Potentially negative for the Euro, as a rate cut could weaken the currency. | Potentially positive for the US Dollar, as a rate hike could strengthen the currency. |

Timeline of Market Reactions

The market’s response to the ECB and Fed decisions will likely unfold in a series of stages:

- Immediate Reaction (Days 1-3):Markets will react swiftly to the announcements, with initial price movements reflecting the surprise element and the perceived implications of the decisions. For example, if the ECB cuts rates more aggressively than expected, the Euro could weaken sharply in the initial days.

Conversely, if the Fed’s rate hike is smaller than anticipated, the US Dollar might weaken against other major currencies.

- Short-Term Volatility (Days 3-7):The following days will likely see increased volatility as investors digest the implications of the decisions and adjust their positions. This period could be marked by significant price swings in various asset classes. For instance, if the ECB’s rate cut leads to concerns about the Eurozone’s economic health, we might see a sell-off in European stocks.

- Long-Term Adjustment (Weeks 1-4):Over the subsequent weeks, markets will likely settle into a new equilibrium, reflecting the adjusted risk perceptions and expectations. This phase will involve assessing the long-term impact of the decisions on economic growth, inflation, and interest rates. For example, if the Fed’s rate hikes effectively control inflation, we could see a gradual rebound in the US stock market.

Long-Term Implications

The coordinated actions of the ECB and the Fed, while seemingly aimed at mitigating immediate economic pressures, could have far-reaching consequences for the global financial landscape. These decisions might trigger a chain reaction, influencing inflation, economic growth, and global trade in ways that are difficult to predict with certainty.

Impact on Inflation

The ECB’s decision to cut interest rates, while seemingly counterintuitive given the persistent inflation, could potentially exacerbate price pressures in the Eurozone. Lower interest rates can stimulate borrowing and spending, leading to increased demand and potentially higher prices. However, the Fed’s decision to raise rates, if executed effectively, could help to cool the US economy and dampen inflationary pressures globally.

The interplay between these contrasting monetary policies could lead to a complex and unpredictable global inflation environment.

Impact on Economic Growth

The ECB’s rate cut aims to stimulate economic growth in the Eurozone by making borrowing cheaper and encouraging investment. However, this strategy could be hampered by the ongoing energy crisis and geopolitical uncertainties, which might dampen investor confidence and limit the effectiveness of the rate cut.

Conversely, the Fed’s rate hikes, while intended to curb inflation, could potentially slow down US economic growth. The combined effect of these contrasting policies could lead to a divergence in economic growth trajectories across different regions, potentially impacting global trade flows.

Scenario Analysis

A scenario analysis exploring the potential consequences of different policy outcomes is crucial to understand the potential long-term implications of these decisions.

- Scenario 1: Successful Inflation Control– If the Fed’s rate hikes effectively control inflation in the US, global inflationary pressures might ease, potentially leading to a stabilization of the Eurozone economy. This scenario could result in a more balanced global economic growth trajectory, with both the US and the Eurozone experiencing moderate expansion.

However, this scenario hinges on the effectiveness of the Fed’s policies and the ability of the Eurozone to navigate its energy crisis and geopolitical challenges.

- Scenario 2: Persistent Inflation– If inflation remains stubbornly high despite the Fed’s efforts, it could lead to a global recession, potentially triggered by a sharp increase in borrowing costs and a decline in consumer spending. This scenario would likely lead to a decline in global trade and investment, with the Eurozone potentially facing even greater economic difficulties.

- Scenario 3: Diverging Monetary Policies– The contrasting monetary policies of the ECB and the Fed could lead to a widening interest rate differential between the US and the Eurozone, potentially causing significant volatility in exchange rates. This scenario could impact global trade flows, as businesses adjust to changing currency values and potential trade barriers.