ECB Rate Cut: A Big Decision Days Before the Fed

European central bank set to cut interest rates just days before the feds big decision – The European Central Bank (ECB) is poised to cut interest rates just days before the Federal Reserve’s (Fed) big decision on interest rates. This move has the potential to shake up global markets and economies, creating a ripple effect that could impact everything from consumer spending to international trade.

The ECB’s decision is fueled by concerns about slowing economic growth in Europe, with inflation remaining stubbornly low. The ECB is hoping that a rate cut will stimulate borrowing and investment, ultimately boosting economic activity. Meanwhile, the Fed is facing a different set of challenges.

The US economy is performing relatively well, but there are growing concerns about rising inflation and the potential for a trade war with China. The Fed’s decision will likely depend on how these factors play out in the coming weeks.

The ECB’s Decision

The European Central Bank (ECB) is on the verge of making a crucial decision: whether to cut interest rates just days before the Federal Reserve’s own monetary policy announcement. This move, if executed, would have significant implications for the European economy, and its potential impact is being closely scrutinized by market analysts and economists alike.

The Current Economic Situation in Europe

The European economy is facing a number of challenges, including slowing growth, rising inflation, and the ongoing war in Ukraine. These factors have combined to create a complex and uncertain economic landscape. The ECB’s decision to potentially cut interest rates reflects its efforts to address these challenges and stimulate economic growth.

The ECB’s Rationale for a Potential Rate Cut

The ECB’s rationale for a potential rate cut is rooted in its assessment of the current economic conditions. The bank is concerned about the slowdown in economic growth, particularly in light of the ongoing war in Ukraine and its impact on energy prices and supply chains.

The ECB believes that a rate cut could help to stimulate economic activity by making it cheaper for businesses to borrow money and invest.

Potential Impact of the ECB’s Decision on European Economies

A rate cut by the ECB could have a number of potential impacts on European economies. On the one hand, it could help to boost economic growth by making it cheaper for businesses to borrow money and invest. This could lead to increased investment, job creation, and higher consumer spending.

The European Central Bank is set to cut interest rates just days before the Fed makes its big decision. It’s a time of economic uncertainty, and these moves could have significant implications for both sides of the Atlantic. Meanwhile, across the pond, England is facing off against Australia in a crucial cricket match.

As England’s stand-in captain, Harry Brook has a chance to show his leadership skills, according to legendary cricketer Nasser Hussain, who says, “This is a real test for him, and he needs to step up.” While the cricket match unfolds, the global financial markets will be watching closely to see how the ECB and the Fed respond to the challenges facing the world economy.

On the other hand, a rate cut could also lead to higher inflation, as it could make it more expensive for businesses to import goods and services.

Potential Risks and Benefits Associated with the Rate Cut

There are both risks and benefits associated with the ECB’s decision to potentially cut interest rates. On the one hand, a rate cut could help to stimulate economic growth, but it could also lead to higher inflation. On the other hand, a rate cut could make it more difficult for the ECB to control inflation in the future.

The Fed’s Perspective

The recent decision by the European Central Bank (ECB) to cut interest rates, just days before the Federal Reserve (Fed) is set to make its own crucial decision, raises important questions about the diverging economic paths of the US and Europe.

While the ECB seeks to stimulate growth in a sluggish European economy, the Fed faces a more complex situation, balancing the need for economic stability with concerns about inflation.

A Comparative Analysis of Economic Situations

The US and Europe are facing distinct economic realities. The US economy, while showing signs of slowing growth, remains relatively robust, with a strong labor market and healthy consumer spending. In contrast, Europe is grappling with a weaker economic outlook, driven by factors such as the ongoing energy crisis, geopolitical tensions, and lingering effects of the pandemic.

This disparity in economic conditions underscores the rationale behind the ECB’s decision to ease monetary policy.

The European Central Bank’s decision to cut interest rates just days before the Fed’s big decision is a major event in the global financial landscape. It’s interesting to contrast this with a story that’s a bit closer to home, like the recent release of an injured loggerhead turtle found in Cumbria back into the wild.

Both events highlight the interconnectedness of our world, from financial markets to the natural environment. We’ll be watching closely to see how the ECB’s move impacts the Fed’s decision and what the long-term consequences will be for both the global economy and the environment.

The Fed’s Recent Decisions and Their Potential Impact on the US Economy

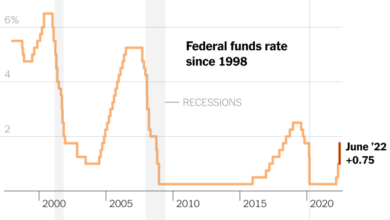

The Fed has been gradually raising interest rates in recent months, aiming to curb inflation and bring it back to its 2% target. This tightening of monetary policy has already had a noticeable impact on the US economy, with mortgage rates rising and businesses becoming more cautious about investments.

The Fed’s next decision will be closely watched by markets, as investors try to gauge the central bank’s stance on inflation and its willingness to continue raising rates.

It’s a wild week in the world of finance, with the European Central Bank poised to cut interest rates just days before the Federal Reserve makes its own big decision. But while the financial world grapples with these weighty matters, a disturbing story is unfolding in Springfield, Ohio, where schools have been forced to ramp up security after false claims about Haitian immigrants prompted bomb threats.

This incident highlights the importance of responsible reporting and the dangers of spreading misinformation, especially in a time of heightened anxieties. It’s a reminder that while the financial markets may be focused on interest rates, there are other important stories unfolding that deserve our attention.

Potential Consequences of a Diverging Monetary Policy

The divergence in monetary policy between the ECB and the Fed could have significant consequences for global markets. A weaker euro could make US exports more competitive, potentially benefiting the US economy. However, it could also lead to increased volatility in currency markets and potentially disrupt global trade flows.

Furthermore, the diverging monetary policies could create challenges for international investors, as they navigate different interest rate environments and currency fluctuations.

A Comparative Table of Key Economic Indicators, European central bank set to cut interest rates just days before the feds big decision

| Indicator | US | Europe ||—|—|—|| Current Interest Rate | 5.25-5.50% | 3.75% || GDP Growth (Q2 2023) | 2.4% | 0.6% || Inflation Rate (July 2023) | 3.2% | 5.3% || Unemployment Rate (July 2023) | 3.8% | 6.4% |

Global Market Reactions: European Central Bank Set To Cut Interest Rates Just Days Before The Feds Big Decision

The ECB’s decision to cut interest rates just days before the Fed’s announcement is likely to send shockwaves through global financial markets. The move could trigger a cascade of reactions, impacting currency values, investment flows, and asset prices.

Impact on the Euro and Other Currencies

The ECB’s rate cut could weaken the Euro against other major currencies, particularly the US Dollar. This is because lower interest rates make it less attractive for investors to hold Euro-denominated assets, leading to a decrease in demand for the Euro.

The potential depreciation of the Euro could benefit exporters within the Eurozone by making their goods more competitive in international markets. However, it could also lead to higher import costs for European consumers. The impact on other currencies will depend on their relative attractiveness compared to the Euro and the US Dollar.

Implications for Global Trade and Investment Flows

The ECB’s decision could impact global trade and investment flows in several ways. Firstly, a weaker Euro could boost exports from the Eurozone, leading to increased trade activity. However, it could also make imports more expensive, potentially impacting consumer spending.

Secondly, the rate cut could attract foreign investment into the Eurozone, as investors seek higher returns in a low-interest rate environment. However, this could also lead to increased competition for resources and capital within the Eurozone.

Potential Consequences for Different Asset Classes

The ECB’s decision could have varying impacts on different asset classes.

- Stocks:A rate cut could lead to a short-term rally in stock markets, as investors anticipate lower borrowing costs and increased corporate earnings. However, the long-term impact depends on the overall economic outlook and the potential for inflation.

- Bonds:Bond yields are likely to decline as investors seek safer investments in a low-interest rate environment. This could lead to higher bond prices, particularly for longer-term bonds.

- Commodities:The impact on commodities is uncertain. A weaker Euro could increase demand for commodities, particularly for energy and raw materials. However, a slowing global economy could lead to lower demand, putting downward pressure on commodity prices.

Economic Implications

The ECB’s decision to cut interest rates just days before the Fed’s announcement has significant economic implications, both in the short term and long term. This move is likely to influence inflation, growth, and employment in the Eurozone and globally.

Short-Term Economic Implications

The ECB’s decision to cut interest rates is expected to have a short-term impact on inflation, growth, and employment in the Eurozone.

- Inflation:The rate cut could lead to a slight increase in inflation in the short term. This is because lower interest rates encourage borrowing and spending, which can lead to increased demand for goods and services, ultimately pushing prices higher.

- Growth:The rate cut is expected to stimulate economic growth in the Eurozone. Lower borrowing costs can encourage businesses to invest and expand, leading to increased production and job creation. This can boost overall economic activity.

- Employment:The rate cut could lead to an increase in employment in the short term. As businesses invest and expand, they may need to hire more workers to meet the growing demand for their products and services.

Long-Term Economic Consequences

The long-term consequences of the ECB’s decision are more uncertain and depend on various factors.

- Inflation:In the long term, the rate cut could lead to higher inflation if it encourages excessive borrowing and spending, which can lead to a sustained increase in demand for goods and services.

- Growth:The rate cut could potentially lead to higher economic growth in the long term if it encourages sustained investment and innovation. However, if the rate cut is not accompanied by structural reforms to boost productivity and competitiveness, its long-term impact on growth may be limited.

- Employment:The rate cut could lead to a sustained increase in employment in the long term if it fosters economic growth and encourages businesses to expand their operations. However, if the rate cut leads to excessive borrowing and a bubble in asset prices, it could ultimately lead to a financial crisis and job losses.

Potential Scenarios for the Global Economy

The ECB’s decision could have various implications for the global economy in the coming months and years.

- Scenario 1: Coordinated Global Stimulus:If the Fed also cuts interest rates, it could lead to a coordinated global stimulus, boosting economic growth and potentially mitigating the risks of a global recession.

- Scenario 2: Diverging Monetary Policies:If the Fed maintains its current stance while the ECB continues to ease monetary policy, it could lead to a widening interest rate differential between the Eurozone and the US. This could weaken the euro and make it more expensive for Eurozone businesses to borrow in dollars, potentially hindering growth and investment.

- Scenario 3: Increased Volatility:The ECB’s decision could increase volatility in global financial markets as investors react to the changing economic landscape. This could lead to uncertainty and risk aversion, potentially slowing down investment and economic growth.

Potential Impacts of the ECB’s Decision

| Impact | Short-Term | Long-Term |

|---|---|---|

| Inflation | Slight increase | Potential for higher inflation if excessive borrowing and spending occur |

| Growth | Stimulation of economic growth | Potential for higher growth if accompanied by structural reforms; limited impact if reforms are absent |

| Employment | Increase in employment due to business expansion | Sustained increase in employment if economic growth is fostered; potential for job losses if financial crisis occurs due to excessive borrowing |

The Impact on Consumers and Businesses

The ECB’s decision to cut interest rates could have a significant impact on consumers and businesses in Europe. While the intention is to stimulate economic growth, the consequences could be both positive and negative, depending on individual circumstances.

The Potential Impact on Consumer Spending

The lower interest rates could encourage consumers to spend more. With cheaper borrowing costs, individuals might be more inclined to take out loans for major purchases like cars or homes. This increased spending could boost demand for goods and services, leading to economic growth.

However, it’s important to note that this effect might be limited if consumer confidence remains low due to other economic factors.

The Potential Impact on Business Investment

Lower interest rates can make it cheaper for businesses to borrow money for investment projects. This could lead to increased investment in new equipment, expansion of operations, or research and development. However, businesses might be hesitant to invest if they are uncertain about the future economic outlook or if they face other challenges, such as limited access to credit or regulatory hurdles.

The Potential Impact on Borrowers and Lenders in Europe

Lower interest rates are generally beneficial for borrowers, as they can secure loans at a lower cost. This could benefit homeowners with mortgages, businesses with loans, and individuals with credit card debt. However, lenders, such as banks, could see their profits decline as the interest they earn on loans decreases.

The Potential Impact on the Cost of Living and Doing Business in Europe

The ECB’s decision could potentially lead to a decrease in the cost of borrowing, which could benefit both consumers and businesses. This could translate to lower interest rates on mortgages, car loans, and business loans, making it more affordable for individuals to purchase homes and for businesses to invest.

However, it’s crucial to consider the potential impact on inflation. If the rate cuts lead to excessive inflation, the cost of living and doing business could actually increase.

The Potential Impact on Specific Sectors of the European Economy

The impact of the ECB’s decision on different sectors of the European economy could vary. For example, the construction sector might benefit from lower interest rates, as this could lead to increased demand for housing. The tourism sector could also see a boost, as lower borrowing costs could make it easier for individuals to travel.

However, sectors heavily reliant on exports might face challenges if the euro weakens against other currencies, making their products less competitive in international markets.