ECBs Lagarde Predicts Inflation to Hit 2% Target Next Year

Ecbs lagarde predicts inflation to hit 2 target next year – ECB’s Lagarde Predicts Inflation to Hit 2% Target Next Year: The European Central Bank (ECB) is closely watching inflation as it aims to maintain a stable Eurozone economy. Christine Lagarde, the ECB President, has recently made a prediction that has sparked considerable interest within the financial world.

Lagarde has stated that inflation is expected to reach the ECB’s target of 2% in the coming year. This statement has significant implications for the Eurozone economy, potentially influencing interest rates, monetary policy, and overall economic growth. Understanding the factors driving this prediction and its potential impact on markets is crucial for investors and businesses alike.

Lagarde’s prediction is based on a complex interplay of economic factors, including geopolitical events, supply chain disruptions, and energy prices. The ECB’s goal is to maintain price stability in the Eurozone, and achieving a 2% inflation rate is seen as a healthy balance for economic growth.

However, reaching this target comes with its own set of challenges and potential risks. The impact of achieving this target on interest rates and monetary policy remains to be seen, and the potential for volatility in financial markets is a key concern.

Understanding the intricacies of these factors is essential for navigating the economic landscape in the coming year.

ECB’s Inflation Target

The European Central Bank (ECB) has a primary mandate to maintain price stability in the Eurozone. This is achieved through a specific inflation target, which serves as a guide for the ECB’s monetary policy decisions. Understanding the ECB’s inflation target is crucial for comprehending the bank’s actions and their potential impact on the Eurozone economy.

The ECB’s Inflation Target

The ECB aims to maintain inflation at a level of “below, but close to, 2%” in the medium term. This target has been in place since the Eurozone’s inception in 1999. The 2% target is not an absolute ceiling but rather a flexible objective that allows for some deviation, particularly in response to unforeseen economic shocks or temporary fluctuations.

Significance of the 2% Inflation Target

The 2% inflation target is considered optimal for the Eurozone economy for several reasons:* Stimulates economic growth:A low, stable level of inflation encourages businesses to invest and consumers to spend, ultimately contributing to economic growth.

With the ECB’s Lagarde predicting inflation to hit the 2% target next year, it’s clear that the economic landscape is shifting. This kind of stability can be a boon for investors, especially those like Laurene Powell Jobs, who are actively seeking out the next big thing.

She’s betting big on AI, as evidenced by her investments in these 11 AI startups. Whether it’s the automation of tasks or the development of new solutions, AI is poised to play a significant role in shaping the future, even as the ECB navigates the path to a stable economy.

Prevents deflation

Deflation, a sustained decrease in prices, can lead to a vicious cycle of falling demand, lower investment, and economic stagnation. A 2% inflation target helps to mitigate this risk.

The ECB’s prediction of inflation hitting 2% next year is a glimmer of hope, but the economic landscape remains uncertain. The recent red card given to Leandro Trossard in Arsenal’s match against Man City, which sparked outrage from Mikel Arteta , highlights the unpredictable nature of events that can impact economic stability.

Ultimately, the ECB’s inflation target hinges on a complex interplay of factors, including global events and domestic policy decisions.

Flexibility in monetary policy

The 2% target provides the ECB with some leeway to adjust interest rates and other monetary policy tools in response to changing economic conditions.

Stability and predictability

A clear inflation target provides businesses and consumers with a sense of stability and predictability, facilitating long-term planning and investment decisions.

Historical Context of ECB Inflation Targets

The ECB’s inflation target has remained largely consistent since its inception, with a few notable adjustments:* Early years:In the initial years of the Eurozone, the ECB focused on maintaining price stability, emphasizing the importance of keeping inflation low and stable.

The Global Financial Crisis

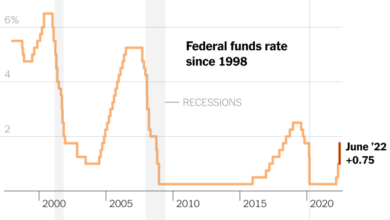

During the 2008 financial crisis, the ECB adopted a more accommodative monetary policy stance, including lowering interest rates and implementing quantitative easing measures to stimulate economic growth. This period saw a temporary deviation from the 2% target as the ECB prioritized stabilizing the economy.

Post-crisis era

Following the financial crisis, the ECB returned to its focus on price stability, emphasizing the importance of achieving the 2% inflation target in the medium term.

Recent developments

In recent years, the ECB has faced challenges in reaching its inflation target due to factors such as the COVID-19 pandemic and the war in Ukraine. However, the ECB remains committed to achieving its 2% target in the medium term.

Lagarde’s Prediction

Christine Lagarde, the President of the European Central Bank (ECB), has predicted that inflation in the Eurozone will fall to the ECB’s target of 2% by the end of next year. She made this prediction during a speech at the European Parliament on October 26, 2023.

Lagarde’s prediction is based on a number of factors, including the expectation that energy prices will continue to fall, supply chain disruptions will ease, and the impact of the ECB’s monetary policy tightening will become more apparent. She also acknowledged that the inflation outlook remains uncertain, and that the ECB will continue to monitor the situation closely.

It’s wild to think that while the ECB’s Lagarde predicts inflation hitting the 2% target next year, a burglar stabbed in Chelmsford prison’s kitchen was awarded over £5 million in compensation. This case raises questions about the balance between justice and the allocation of resources, especially when considering the broader economic landscape and the impact of inflation on everyday lives.

Factors Considered by Lagarde

Lagarde likely considered the following factors when making her prediction:

- Falling Energy Prices:Energy prices have been a major driver of inflation in the Eurozone. However, these prices have started to fall in recent months, due to factors such as increased energy supplies and lower demand. Lagarde likely expects this trend to continue, contributing to a decline in overall inflation.

- Easing Supply Chain Disruptions:The COVID-19 pandemic led to significant disruptions in global supply chains, contributing to higher prices for goods and services. However, these disruptions have begun to ease, and Lagarde likely expects this trend to continue, further contributing to a decline in inflation.

- Impact of ECB’s Monetary Policy:The ECB has been raising interest rates in an effort to curb inflation. These rate hikes are expected to have a cooling effect on the economy, leading to lower demand and eventually lower prices. Lagarde likely believes that the full impact of these rate hikes will be felt in the coming months and years, contributing to a decline in inflation.

Economic Implications

If inflation indeed reaches the ECB’s 2% target next year, it would have significant implications for the Eurozone economy. While achieving the target is generally considered a positive sign for economic stability, the path to reaching it and its potential consequences deserve careful consideration.

Impact on Interest Rates and Monetary Policy

The ECB’s primary tool for managing inflation is its monetary policy, which involves setting interest rates and controlling the money supply. If inflation hits the 2% target, the ECB would likely continue its current path of raising interest rates to ensure that inflation doesn’t overshoot the target.

This could lead to higher borrowing costs for businesses and consumers, potentially slowing down economic growth. However, the ECB would need to carefully assess the impact of rising interest rates on the economy, considering factors like the strength of the Eurozone’s recovery and the potential for financial market instability.

Impact on Economic Growth

Inflation can have a mixed impact on economic growth. While moderate inflation can stimulate spending and investment, high inflation can create uncertainty and discourage investment, leading to slower growth. If inflation reaches the 2% target, it is expected to have a relatively modest impact on economic growth, as it would likely be driven by strong demand and a healthy labor market.

However, if inflation were to rise above the target, it could pose a significant risk to economic growth.

Risks and Opportunities

Achieving the inflation target presents both risks and opportunities for the Eurozone economy. One risk is that the ECB might tighten monetary policy too aggressively, leading to a recession. Another risk is that inflation could become entrenched, leading to a spiral of rising prices and wages.

On the other hand, achieving the inflation target could lead to a more stable and predictable economic environment, attracting investment and boosting economic growth.

“The ECB’s primary objective is to maintain price stability in the Eurozone, and achieving the inflation target is a key step in that direction. However, the path to reaching the target and its potential consequences need to be carefully considered.”

Factors Influencing Inflation

Inflation in the Eurozone is a complex phenomenon influenced by a multitude of factors, both internal and external. While the ECB aims to maintain inflation at 2%, various economic forces can push it above or below this target. Understanding these factors is crucial for policymakers and businesses alike to navigate the economic landscape.

Geopolitical Events

Geopolitical events, particularly those involving energy supplies, have a significant impact on inflation. The ongoing war in Ukraine has disrupted energy markets, driving up energy prices and contributing to inflation. The conflict has also led to uncertainty and supply chain disruptions, further exacerbating inflationary pressures.

For instance, the war has caused significant increases in natural gas prices, which in turn have affected energy-intensive industries and household energy bills. This has contributed to higher consumer prices across the Eurozone.

Supply Chain Disruptions

Supply chain disruptions, exacerbated by the pandemic and geopolitical events, have also played a role in inflation. These disruptions have led to shortages of goods and services, driving up prices. For example, the semiconductor shortage has impacted the production of cars and other electronic devices, leading to higher prices for consumers.

The pandemic-related lockdowns and border closures have also caused delays in the transportation of goods, contributing to supply chain bottlenecks and higher prices.

Energy Prices

Energy prices are a significant component of inflation, particularly in the Eurozone, where many countries rely heavily on imported energy. Rising energy prices, driven by factors such as geopolitical events, supply chain disruptions, and increased demand, directly impact consumer prices and business costs.

For example, the recent surge in oil and gas prices has significantly increased the cost of transportation and production, contributing to inflation in various sectors.

Consumer Spending

Consumer spending plays a crucial role in driving inflation. When consumers have higher disposable income and are confident about the economy, they tend to spend more, leading to increased demand for goods and services. This increased demand can push prices higher.

However, consumer confidence and spending patterns can be influenced by factors such as interest rates, unemployment, and inflation expectations.

Wage Growth

Wage growth can also contribute to inflation. When wages rise faster than productivity, businesses may pass on these increased labor costs to consumers in the form of higher prices. However, wage growth can also stimulate economic activity and increase consumer spending, leading to a virtuous cycle of economic growth.

Government Policies

Government policies can also have a significant impact on inflation. Fiscal policies, such as government spending and tax cuts, can stimulate demand and lead to higher prices. Monetary policies, such as interest rate adjustments, can influence the cost of borrowing and investment, affecting inflation.

For example, the ECB’s monetary policy tools, such as interest rate adjustments and quantitative easing, are aimed at controlling inflation by influencing the cost of borrowing and the amount of money in circulation.

Market Reactions

Lagarde’s prediction of inflation hitting the ECB’s 2% target next year sent ripples through financial markets, prompting a range of reactions across different asset classes. Investors, analysts, and economists closely scrutinized the implications of this statement, seeking to understand its impact on their portfolios and the broader economic outlook.

Impact on Bond Yields

Bond yields, which move inversely to prices, generally rose following Lagarde’s announcement. This suggests that investors anticipate higher interest rates in the future, leading them to demand higher returns on their fixed-income investments. For example, the yield on Germany’s 10-year Bund, a benchmark for eurozone government bonds, climbed by several basis points in the days after Lagarde’s speech.

This increase in yields reflected market expectations of tighter monetary policy as the ECB seeks to control inflation.

Impact on Stock Prices

The reaction of stock prices to Lagarde’s prediction was more nuanced. While some sectors, such as energy and materials, which tend to benefit from inflation, saw gains, others, like technology and consumer discretionary, experienced declines. This suggests that investors were weighing the potential benefits of a stronger economy with the risks of higher interest rates, which could dampen corporate earnings growth.

For instance, the Euro Stoxx 50 index, a broad measure of European stock market performance, initially dipped but recovered somewhat as investors digested the implications of Lagarde’s statement.

Impact on Currency Exchange Rates

The euro, the currency of the eurozone, generally strengthened against other major currencies, including the US dollar and the Japanese yen. This indicates that investors are more optimistic about the eurozone’s economic outlook, given the expectation of inflation returning to the ECB’s target.

For instance, the euro-dollar exchange rate rose to its highest level in several months following Lagarde’s speech.

Implications for Investor Sentiment and Market Volatility

Lagarde’s prediction has the potential to influence investor sentiment and market volatility. Increased expectations of inflation and tighter monetary policy could lead to greater uncertainty among investors, potentially resulting in increased market fluctuations. For example, a sudden surge in inflation or a more hawkish stance from the ECB could trigger a sell-off in risk assets, such as stocks and bonds.

However, if inflation moderates as expected and the ECB manages the transition to a more restrictive policy smoothly, investor sentiment could remain relatively stable.

Comparison with Other Forecasts

Lagarde’s prediction that inflation will hit the ECB’s 2% target next year has sparked debate among economists and analysts, with some sharing her optimism while others remain cautious. Comparing Lagarde’s forecast with those from other institutions and analysts reveals a range of perspectives on the future trajectory of inflation.

Discrepancies in Forecasts

Several factors contribute to the differences in inflation forecasts.

- Economic Models and Assumptions:Different institutions and analysts use various economic models with varying assumptions about key variables like growth, unemployment, and energy prices. These assumptions can significantly influence their inflation predictions.

- Weighting of Economic Indicators:Each institution may place different weights on specific economic indicators when constructing their forecasts. For instance, some may give more weight to consumer confidence surveys, while others prioritize manufacturing data.

- Interpretations of Recent Economic Data:The interpretation of recent economic data, such as inflation figures, can also lead to divergent forecasts. Some analysts may view recent data as a sign of a sustained inflationary trend, while others may see it as temporary volatility.

Potential Implications of Differing Forecasts, Ecbs lagarde predicts inflation to hit 2 target next year

Disagreements in inflation forecasts have significant implications for economic policy and market expectations.

- Monetary Policy Decisions:Central banks, like the ECB, closely monitor inflation forecasts to guide their monetary policy decisions. If a central bank believes inflation is likely to remain elevated, it may consider raising interest rates to cool the economy. Conversely, if forecasts suggest a faster return to the target, the bank may hold off on tightening.

- Market Expectations:Divergent forecasts can also influence market expectations, particularly for asset prices. Investors may adjust their investment strategies based on their views on inflation. For example, if they expect high inflation, they might invest in assets that are likely to benefit from rising prices, such as commodities or inflation-linked bonds.

Future Outlook: Ecbs Lagarde Predicts Inflation To Hit 2 Target Next Year

The trajectory of inflation in the Eurozone remains uncertain, with a range of factors potentially influencing its future direction. While Lagarde’s prediction of inflation hitting the 2% target next year offers a glimmer of hope, several factors could lead to deviations from this forecast.

Factors Affecting Future Inflation

The future trajectory of inflation in the Eurozone is contingent upon a complex interplay of factors, including:

- Energy Prices:The recent decline in energy prices has provided some relief, but continued volatility in global energy markets could impact inflation. If energy prices surge again, it could push inflation higher. However, a sustained decline in energy prices could help bring inflation down more quickly.

- Supply Chain Disruptions:While supply chain disruptions have eased somewhat, lingering bottlenecks could continue to exert upward pressure on prices. The ongoing war in Ukraine and geopolitical tensions could also exacerbate these disruptions, leading to higher inflation.

- Wage Growth:Wage growth is a key driver of inflation. If wages rise significantly, businesses may pass on these costs to consumers in the form of higher prices. However, if wage growth remains moderate, it could help to contain inflation.

- Monetary Policy:The ECB’s monetary policy stance will play a crucial role in shaping inflation. Further interest rate hikes could help to cool demand and bring inflation down. However, aggressive rate hikes could also stifle economic growth and lead to a recession.

- Government Policies:Fiscal policies, such as government spending and taxation, can also influence inflation. Expansionary fiscal policies could fuel demand and lead to higher inflation. Conversely, contractionary policies could dampen demand and help to curb inflation.

Implications of Sustained Inflation or Deflation

The Eurozone economy could face significant consequences if inflation remains persistently high or if deflation sets in.

- Sustained Inflation:

- Erosion of Purchasing Power:High inflation erodes the purchasing power of consumers, leading to a decline in living standards.

- Uncertainty and Investment:High inflation creates uncertainty for businesses, making it difficult to plan for the future and invest. This could lead to lower economic growth.

- Increased Interest Rates:Central banks may need to raise interest rates aggressively to combat high inflation, which could further dampen economic activity.

- Deflation:

- Economic Stagnation:Deflation can lead to a vicious cycle of falling prices, declining demand, and lower economic growth.

- Debt Burden:Deflation increases the real value of debt, making it more difficult for individuals and businesses to repay their loans.

- Investment Disincentive:Deflation can discourage investment, as businesses may anticipate further price declines, leading to lower profits.