Cramers Week Ahead: Retail Giants Report, Consumer in Focus

Cramers week ahead retail giants report with all eyes on the consumer – Cramer’s Week Ahead: Retail Giants Report, Consumer in Focus sets the stage for an exciting week in the retail world. With major players like Walmart, Target, and Amazon set to release their earnings reports, all eyes will be on the consumer.

The reports will offer a glimpse into the health of the US economy and how consumers are navigating the current inflationary environment.

Analysts will be closely watching key metrics such as sales growth, profit margins, and inventory levels to understand how these companies are managing their businesses. Consumer sentiment and spending patterns will be under intense scrutiny, as they are critical indicators of the broader economic outlook.

The upcoming reports will provide valuable insights into the future direction of the retail sector and the overall market.

Retail Giants’ Earnings Reports

The upcoming earnings reports from major retail giants are set to provide valuable insights into the state of the consumer and the overall health of the retail sector. Investors will be closely watching these reports to gauge the impact of inflation, supply chain disruptions, and changing consumer spending patterns on these companies’ performance.

Cramer’s week ahead retail giants report with all eyes on the consumer is a hot topic, but it’s hard to ignore the stark contrast with the struggles faced by veterans who served our country. A recent article titled ” This is What a Loophole Looks Like Says Veteran Who Does Not Qualify for Help Under New Burn Pit Law ” highlights the injustice of the new burn pit law, leaving many veterans without the support they deserve.

While we analyze retail giants’ earnings, it’s important to remember the human stories behind these headlines, especially when it comes to those who have sacrificed so much for our freedom.

Key Players and Reporting Dates

These reports are expected to provide crucial insights into consumer spending habits and the broader economic landscape.

It’s going to be a big week for retail giants as they report earnings, and all eyes will be on the consumer. The market is already feeling the pressure of inflation, and this week’s reports will give us a clearer picture of how much consumers are willing to spend.

While the world watches the economic landscape shift, it’s important to remember that global conflicts like the ongoing struggle in the West Bank, where Israeli outpost settlers are rapidly seizing land , also have a profound impact on the global economy.

These events, while seemingly distant, can ripple outward and affect the very spending habits we’re analyzing this week.

- Walmart (WMT): The retail giant is scheduled to release its second-quarter earnings report on Tuesday, August 15, 2023, before the market opens.

- Target (TGT): Target is expected to release its second-quarter earnings report on Wednesday, August 16, 2023, before the market opens.

- Amazon (AMZN): Amazon will release its second-quarter earnings report on Thursday, July 27, 2023, after the market closes.

Key Metrics to Watch, Cramers week ahead retail giants report with all eyes on the consumer

Investors will be focusing on several key metrics to assess the health of these retail giants and the broader consumer landscape.

- Sales Growth:Analysts will be scrutinizing sales growth figures to gauge the strength of consumer demand and the impact of inflation on spending patterns. A strong sales growth rate would indicate that consumers are still willing to spend despite economic headwinds.

- Profit Margins:Profit margins are crucial indicators of a company’s profitability and efficiency. Investors will be looking for signs of margin compression due to rising costs, particularly for labor and inventory.

- Inventory Levels:Inventory levels are a critical factor for retailers, as they can impact profitability and cash flow. Investors will be monitoring inventory levels for signs of overstocking or shortages, which can signal challenges in managing supply chains and meeting consumer demand.

Key Themes and Trends

The retail landscape is undergoing a rapid transformation, driven by a confluence of factors including the rise of e-commerce, evolving consumer preferences, and ongoing supply chain disruptions. As we move into the coming weeks and months, several key themes and trends will shape the industry’s trajectory.

E-commerce and Digital Transformation

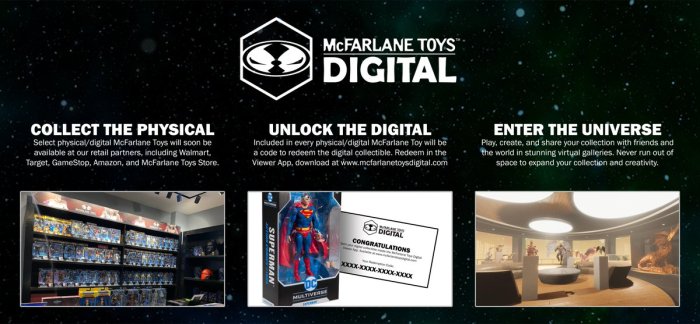

E-commerce continues to be a dominant force in retail, accelerating growth in recent years. The COVID-19 pandemic spurred a surge in online shopping, and this trend is expected to persist. Retailers are increasingly investing in digital capabilities, such as omnichannel strategies, personalized experiences, and advanced analytics, to cater to the evolving needs of digitally savvy consumers.

- Omnichannel strategies:Retailers are integrating their online and offline channels to create a seamless customer experience. This includes offering click-and-collect options, in-store pickup, and personalized recommendations across all touchpoints. For example, Target has been successful in leveraging its physical stores as fulfillment centers for online orders, enabling faster delivery times and increased customer satisfaction.

- Personalized experiences:Retailers are leveraging data and technology to provide personalized product recommendations, targeted promotions, and customized content. This allows them to create more engaging and relevant shopping experiences for individual customers. For instance, Amazon utilizes its vast customer data to recommend products based on past purchases, browsing history, and user preferences.

- Advanced analytics:Retailers are using data analytics to gain insights into customer behavior, optimize pricing strategies, and improve supply chain efficiency. This data-driven approach helps them make better decisions and stay ahead of the competition. Walmart, for example, uses advanced analytics to forecast demand, optimize inventory levels, and personalize marketing campaigns.

Supply Chain Disruptions and Resilience

The global supply chain has been under immense pressure in recent years, with disruptions caused by factors such as the pandemic, geopolitical tensions, and natural disasters. Retailers are facing challenges related to raw material shortages, transportation delays, and increased costs.

To navigate these disruptions, retailers are focusing on building more resilient supply chains, diversifying their sourcing, and investing in technology to improve visibility and agility.

- Building resilience:Retailers are taking steps to mitigate the impact of future disruptions by diversifying their sourcing, building strategic inventory reserves, and developing alternative transportation routes. For example, Nike has been working to reduce its reliance on single suppliers and build a more geographically diverse supply chain.

- Improving visibility:Technology plays a crucial role in enhancing supply chain visibility. Retailers are implementing real-time tracking systems, data analytics platforms, and predictive modeling tools to monitor inventory levels, track shipments, and identify potential disruptions. This allows them to make proactive decisions and minimize delays.

- Agile operations:Retailers are adopting agile practices to adapt quickly to changing market conditions. This includes flexible production models, modular supply chains, and collaborative partnerships with suppliers. For instance, Zara is known for its fast-fashion model, which enables it to respond quickly to trends and adjust its production accordingly.

Labor Shortages and Automation

The retail industry is facing a persistent labor shortage, driven by factors such as low unemployment rates, wage pressures, and changing demographics. Retailers are exploring automation solutions to address labor shortages, improve efficiency, and enhance the customer experience.

- Automation technologies:Retailers are implementing automation technologies, such as self-checkout kiosks, robotic fulfillment systems, and automated inventory management, to streamline operations and reduce reliance on human labor. For example, Amazon has been heavily investing in robotics to automate tasks in its warehouses, leading to faster order fulfillment and improved efficiency.

- Employee training and development:Retailers are also focusing on attracting and retaining talent by offering competitive wages, benefits, and opportunities for professional development. They are investing in employee training programs to enhance skills and create a more engaged workforce. For instance, Walmart has implemented a comprehensive training program called “Live Better U,” which offers employees the opportunity to earn college degrees and certifications.

- Focus on employee well-being:Retailers are prioritizing employee well-being by offering flexible work schedules, mental health support, and a positive work environment. This helps to improve employee satisfaction and reduce turnover. For example, Costco is known for its generous employee benefits, including competitive wages, healthcare coverage, and retirement plans.

Technology and Innovation

Technology is playing a transformative role in the retail industry, enabling retailers to enhance customer experiences, optimize operations, and gain a competitive edge. Retailers are leveraging technologies such as artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) to create innovative shopping experiences and drive growth.

- AI-powered personalization:AI is being used to personalize product recommendations, target marketing campaigns, and provide customized customer service. For example, Sephora uses AI to analyze customer data and provide personalized product recommendations based on their preferences and past purchases.

- AR and VR experiences:AR and VR technologies are transforming the way consumers shop. Retailers are using these technologies to create immersive shopping experiences, allowing customers to virtually try on clothes, visualize furniture in their homes, and explore products in 3D. For example, IKEA has developed an AR app that allows customers to place virtual furniture in their homes using their smartphones.

- Voice commerce and conversational AI:Voice assistants and chatbots are becoming increasingly popular for shopping. Retailers are integrating these technologies into their websites and mobile apps to provide customers with a convenient and personalized shopping experience. For example, Amazon’s Alexa allows customers to order products using voice commands.

Potential Market Reactions: Cramers Week Ahead Retail Giants Report With All Eyes On The Consumer

The upcoming earnings reports from retail giants will be closely scrutinized by investors, as they provide insights into the health of the consumer and the broader economy. The reports will likely trigger significant market reactions, affecting stock prices and investor sentiment.

Stock Price Impact

The impact on stock prices will depend on whether the earnings reports meet or exceed analysts’ expectations. Positive surprises, such as higher-than-expected sales and profits, will likely lead to stock price appreciation. Conversely, disappointing results could result in sell-offs, especially if the company’s outlook for the future is pessimistic.

For example, if a retailer reports strong sales growth but also indicates that inflation is eroding profit margins, investors might react negatively, fearing a decline in future earnings.

Investor Sentiment

Investor sentiment towards the retail sector will be influenced by the overall tone of the earnings reports. Positive earnings announcements, coupled with optimistic outlooks, will likely boost investor confidence. However, if retailers express concerns about the economic environment, such as rising interest rates or consumer spending weakness, investor sentiment could turn negative.

Opportunities and Risks

The earnings reports present both opportunities and risks for investors. For investors seeking growth opportunities, companies that demonstrate strong sales growth and profitability could be attractive investments. However, investors should be cautious of companies facing headwinds, such as declining margins or slowing sales growth.

For instance, investors might be wary of retailers heavily reliant on discretionary spending, as consumer confidence is susceptible to economic fluctuations.

Cramer’s week ahead report is all about the retail giants and how they’re navigating a consumer landscape that’s shifting faster than ever. It’s a reminder that even amidst the macro-economic pressures, stories like the one where a Compton restaurant defended Kendrick Lamar after his “Not Like Us” music video shoot was blamed for their loss in revenue compton restaurant defends kendrick lamar after not like us shoot was blamed for loss in revenue are a microcosm of the complexities that these companies are facing.

The retail giants are having to be nimble and understand the nuances of their consumer base to succeed in this unpredictable environment.