CNBC Daily Open: Tech Might Not Be the Biggest Rate Cut Winner

Cnbc daily open tech might not be the biggest beneficiary of rate cuts – CNBC Daily Open: Tech Might Not Be the Biggest Beneficiary of Rate Cuts, a statement that might surprise some. While rate cuts are often seen as a boon for the tech sector, a closer look reveals that other industries might stand to gain more.

This article explores the nuanced relationship between rate cuts and tech performance, considering historical trends, current economic conditions, and the factors that drive growth in the tech sector beyond interest rates.

We’ll examine how CNBC Daily Open typically covers the tech sector and how their perspectives might align with the broader market sentiment. By understanding the interplay of various factors, we can gain a more comprehensive understanding of the potential impact of rate cuts on tech companies and the broader economy.

The Impact of Rate Cuts on Tech

Rate cuts, a tool employed by central banks to stimulate economic growth, often have a significant impact on the technology sector. While the immediate effect might not always be positive, the long-term implications can be substantial, influencing investment, innovation, and overall market performance.

CNBC’s Daily Open highlighted that tech might not be the biggest beneficiary of rate cuts, but I can’t help but think about the larger picture. Sometimes, the biggest wins come from challenging outdated norms, like the NYC mom challenging the ban on mothers in top beauty pageants.

She’s proving that being a parent isn’t a disqualifier, and that’s a victory that resonates far beyond the world of pageants. Similarly, maybe the biggest gains from rate cuts will come from unexpected places, challenging our assumptions about who benefits most.

Understanding the historical relationship between rate cuts and tech stock performance provides valuable insights into how this sector navigates these economic shifts.

The Historical Relationship Between Rate Cuts and Tech Stock Performance, Cnbc daily open tech might not be the biggest beneficiary of rate cuts

Rate cuts generally create a favorable environment for tech companies, as they tend to benefit from lower borrowing costs and increased investor confidence. This can lead to higher valuations and increased investment in research and development. The historical relationship between rate cuts and tech stock performance is generally positive, but not always linear.

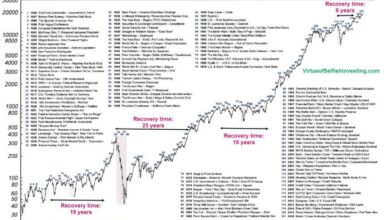

For example, during the dot-com bubble in the late 1990s, tech stocks soared despite rising interest rates. This was due to the exuberance surrounding the internet and the belief that tech companies were immune to economic cycles. However, when the bubble burst in 2000, tech stocks crashed, even though the Federal Reserve was cutting interest rates.This historical relationship can be further analyzed by examining specific periods of rate cuts and their impact on tech:

- The 2001-2002 Recession:Following the dot-com bubble burst, the Federal Reserve cut interest rates aggressively to stimulate the economy. While this helped to stabilize the market, tech stocks were still heavily impacted by the recession and did not fully recover until several years later.

- The 2008-2009 Financial Crisis:During the financial crisis, the Federal Reserve implemented a series of rate cuts and quantitative easing programs to support the economy. This helped to stabilize the financial system and ultimately led to a rebound in tech stocks.

- The COVID-19 Pandemic:In response to the pandemic, the Federal Reserve cut interest rates to near zero and implemented quantitative easing programs. This provided much-needed liquidity to the economy and helped to support tech stocks, which benefited from the surge in demand for digital services.

Ultimately, the impact of rate cuts on tech will depend on a complex interplay of factors, including global economic trends and consumer confidence.

3>The Current Economic Climate and Its Impact on Tech

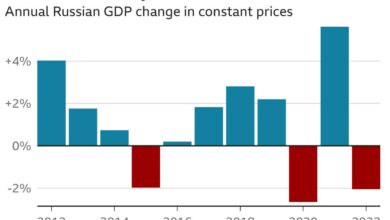

The current economic climate is characterized by high inflation, rising interest rates, and concerns about a potential recession. The Federal Reserve has been raising interest rates to combat inflation, which has led to a decline in tech stock valuations. However, it is important to note that the current rate hike cycle is different from previous periods in several key ways:

- The pace of rate hikes:The current rate hike cycle has been more aggressive than previous cycles, which could lead to a more significant impact on tech stocks.

- The level of inflation:Inflation is currently at its highest level in decades, which is putting pressure on businesses to raise prices, potentially impacting consumer spending and demand for tech products and services.

- The global economic outlook:The global economic outlook is uncertain, with concerns about a potential recession in major economies. This could lead to a slowdown in tech spending and a decline in valuations.

The impact of rate cuts on tech can vary significantly depending on the specific economic climate and the individual characteristics of companies. While rate cuts can create a favorable environment for tech companies, they are not a guaranteed path to success.

While the CNBC Daily Open discussed the potential impact of rate cuts, it’s worth considering how these changes might affect different sectors. For instance, tech companies may not be the biggest beneficiaries, especially when you consider the varying hiring expectations across Europe.

A recent study highlights the significant differences in hiring plans across the continent, which could influence the tech sector’s response to rate cuts. Ultimately, the impact of rate cuts on tech will likely depend on a range of factors, including these regional hiring trends.

It is important to consider the broader economic context and the individual factors that affect each company when assessing the impact of rate cuts on the technology sector.

CNBC Daily Open and Tech’s Performance: Cnbc Daily Open Tech Might Not Be The Biggest Beneficiary Of Rate Cuts

CNBC Daily Open is a popular morning business news program that often covers the technology sector. The show features a mix of live interviews, market analysis, and breaking news, providing viewers with insights into the latest trends and developments in the tech industry.

CNBC Daily Open’s Coverage of the Tech Sector

CNBC Daily Open frequently discusses the tech sector, especially when there are significant market movements or news events. The show’s coverage often includes:

- Analysis of Tech Stocks:CNBC Daily Open features market analysts and experts who provide their insights on the performance of major tech companies, such as Apple, Microsoft, and Amazon. They discuss factors like earnings reports, product launches, and industry trends.

- Interviews with Tech Executives:The show regularly interviews CEOs and other top executives from leading tech companies, getting their perspectives on the industry, their companies’ strategies, and the impact of macroeconomic factors.

- Discussions on Tech Trends:CNBC Daily Open covers emerging trends in the tech sector, such as artificial intelligence, cloud computing, and cybersecurity. They often feature experts and analysts who discuss the implications of these trends for businesses and investors.

Examples of CNBC Daily Open Segments Discussing Tech and Rate Cuts

CNBC Daily Open has devoted segments to discussing the impact of rate cuts on the tech sector. Recent examples include:

- “Tech Stocks Soar on Rate Cut Hopes” (July 2023):This segment discussed how tech stocks rallied on speculation that the Federal Reserve would cut interest rates to stimulate the economy. Analysts on the show argued that lower interest rates would benefit tech companies by reducing borrowing costs and making it easier for them to invest in growth initiatives.

- “Rate Cuts: Boon or Bust for Tech?” (August 2023):This segment explored the potential benefits and risks of rate cuts for the tech sector. Some experts argued that rate cuts could lead to a surge in tech investment, while others cautioned that the benefits might be limited if the broader economy remained weak.

Potential Biases or Perspectives

CNBC Daily Open is a business news program, and its coverage of the tech sector is often influenced by market trends and investor sentiment. While the show strives to provide balanced perspectives, it’s important to consider the following potential biases:

- Focus on Short-Term Market Movements:CNBC Daily Open’s coverage often emphasizes short-term market movements and investor reactions, which may not always reflect the long-term fundamentals of the tech sector.

- Emphasis on Growth Stocks:As a business news program, CNBC Daily Open tends to focus on growth stocks, which are often associated with the tech sector. This emphasis can sometimes lead to a more bullish perspective on tech companies.

- Influence of Advertising:CNBC Daily Open, like most business news programs, relies on advertising revenue. It’s possible that the show’s coverage of the tech sector could be influenced by its advertisers, who may have a vested interest in certain tech companies or trends.

Factors Affecting Tech Beyond Rate Cuts

While interest rate changes are a significant factor in the tech sector’s performance, other key factors play a crucial role in shaping the industry’s trajectory. These factors, often intertwined and constantly evolving, drive innovation, competition, and ultimately, the growth of tech companies.

The Role of Innovation

Innovation is the lifeblood of the tech sector. Constant advancements in technology drive new products, services, and business models, leading to market expansion and growth.

- Emerging Technologies:The development of cutting-edge technologies like artificial intelligence (AI), blockchain, and quantum computing, creates new opportunities and challenges for tech companies. Companies that successfully adapt and integrate these technologies gain a competitive edge.

- Product and Service Development:Continuous innovation in product and service offerings is essential for tech companies to stay relevant. Companies must constantly evolve and introduce new features and functionalities to meet changing customer needs and preferences.

- Research and Development (R&D):Investing in R&D is crucial for tech companies to maintain a competitive advantage. By allocating resources to research and development, companies can create new technologies, improve existing products, and stay ahead of the curve.

Competition in the Tech Industry

The tech industry is highly competitive, with numerous players vying for market share. This intense competition drives innovation, price wars, and a constant need for companies to differentiate themselves.

- Market Share Battles:Tech giants like Apple, Google, Amazon, and Microsoft engage in fierce competition for market share in various segments, including smartphones, cloud computing, and e-commerce.

- Disruptive Startups:The emergence of disruptive startups, often with innovative business models and technologies, can challenge established players and reshape the market landscape.

- Global Competition:The tech industry is increasingly global, with companies from various regions competing on a worldwide stage. This global competition fosters innovation and drives companies to expand their reach and adapt to different markets.

The Impact of Consumer Spending

Consumer spending is a significant driver of growth in the tech sector. The demand for tech products and services is directly linked to consumer confidence, disposable income, and overall economic conditions.

- Consumer Confidence:When consumers are optimistic about the economy, they are more likely to spend on discretionary items, including tech products. Conversely, economic uncertainty can lead to reduced spending on tech goods.

- Disposable Income:Consumer spending on tech products is also influenced by disposable income. As incomes rise, consumers have more money to spend on tech goods, driving demand and growth in the sector.

- Technological Adoption:The adoption of new technologies by consumers is a key factor driving growth in the tech sector. As new technologies become more affordable and accessible, consumer adoption increases, leading to higher demand for tech products and services.

Factors Affecting Tech Performance: A Summary

| Factor | Impact on Tech Companies |

|---|---|

| Innovation | New products, services, and business models; competitive advantage |

| Competition | Innovation, price wars, differentiation; market share battles, disruptive startups, global competition |

| Consumer Spending | Demand for tech products and services; consumer confidence, disposable income, technological adoption |

Potential Beneficiaries of Rate Cuts

While tech companies might not be the biggest beneficiaries of rate cuts, other sectors stand to gain significantly. This is because rate cuts often lead to increased borrowing and spending, which can boost certain industries.

Impact on Different Sectors

Rate cuts can have a diverse impact on various sectors. While tech companies may experience a short-term boost due to increased consumer spending, other sectors might see more substantial long-term benefits.

- Real Estate:Rate cuts directly impact mortgage rates, making homeownership more affordable. This can lead to increased demand for housing, benefiting real estate developers, construction companies, and related industries.

- Consumer Discretionary:As interest rates decline, consumers have more disposable income, leading to increased spending on non-essential goods and services. This can benefit retailers, travel companies, and entertainment industries.

- Manufacturing:Lower borrowing costs can encourage businesses to invest in new equipment and expand operations, boosting manufacturing output and creating jobs.

- Energy:Rate cuts can stimulate investment in energy projects, particularly in renewable energy sources, which require significant upfront capital. This can benefit companies involved in solar, wind, and other renewable energy technologies.

Examples of Beneficiary Companies

Here are some examples of companies in different sectors that could benefit from rate cuts:

- Real Estate:D.R. Horton (DHI), Lennar (LEN), PulteGroup (PHM)

- Consumer Discretionary:Amazon (AMZN), Home Depot (HD), Nike (NKE)

- Manufacturing:General Electric (GE), Caterpillar (CAT), Boeing (BA)

- Energy:Tesla (TSLA), First Solar (FSLR), NextEra Energy (NEE)

Tech’s Long-Term Outlook

The tech sector’s long-term growth potential extends far beyond the immediate impact of rate cuts. The sector’s inherent dynamism, driven by constant innovation and technological advancements, ensures a robust future.

Technological Advancements and Their Impact

Technological advancements are the lifeblood of the tech sector, constantly reshaping the industry landscape and creating new opportunities.

- Artificial Intelligence (AI):AI is rapidly evolving, permeating various industries, from healthcare to finance, and driving growth in areas like machine learning, natural language processing, and computer vision. Companies leveraging AI are poised to lead the charge in innovation and efficiency, impacting everything from personalized experiences to automated processes.

- Cloud Computing:The cloud has become the backbone of modern businesses, enabling scalable and flexible infrastructure, data storage, and software solutions. Companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform are leading the charge in this rapidly growing market, catering to diverse needs and driving digital transformation across industries.

- Internet of Things (IoT):The interconnectedness of devices is transforming industries, creating a vast network of data and opportunities for innovation. Companies are developing smart devices, sensors, and connected systems that enhance efficiency, productivity, and user experiences, driving growth in areas like smart homes, industrial automation, and healthcare.

- 5G and Beyond:The rollout of 5G networks is enabling faster data speeds, lower latency, and greater connectivity, paving the way for new technologies and applications. Companies are developing innovative solutions for virtual reality, augmented reality, and the metaverse, fueled by the power of 5G and the promise of future advancements in wireless communication.

Challenges and Opportunities

While the tech sector presents a promising future, it also faces challenges and opportunities that will shape its trajectory.

- Cybersecurity:As technology advances, so do cyber threats, demanding robust security measures to protect data and systems. Companies are investing heavily in cybersecurity solutions, from advanced threat detection to data encryption, to ensure the integrity and safety of their operations and user information.

- Regulation and Privacy:The growing use of technology raises concerns about data privacy and ethical considerations. Companies are navigating evolving regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), to ensure compliance and responsible data handling.

- Talent Acquisition and Retention:The tech industry is fiercely competitive, demanding a skilled workforce to drive innovation. Companies are facing challenges in attracting and retaining top talent, investing in training and development programs, and fostering a culture of innovation to remain competitive.

- Sustainability:Technology’s impact on the environment is a growing concern, prompting companies to adopt sustainable practices and reduce their carbon footprint. Companies are exploring renewable energy sources, efficient data centers, and responsible waste management to contribute to a more sustainable future.