CNBC Daily Open: Tech May Not Lead in Rate Cuts

Cnbc daily open tech might not be the biggest beneficiary of rate cuts – CNBC Daily Open: Tech May Not Be the Biggest Beneficiary of Rate Cuts. While interest rate cuts often spark optimism in the tech sector, recent trends suggest a more nuanced picture. This article delves into the complexities of how rate cuts affect tech valuations, growth prospects, and performance, ultimately exploring why other sectors might see greater benefits.

Historically, tech stocks have often thrived during periods of rate cuts, fueled by increased investor appetite for growth-oriented companies. However, the current landscape is different. Despite recent rate cuts, tech stocks have struggled to regain their momentum, suggesting that other factors might be playing a more significant role in their performance.

Impact of Rate Cuts on Tech Sector: Cnbc Daily Open Tech Might Not Be The Biggest Beneficiary Of Rate Cuts

The tech sector is often considered to be sensitive to interest rate changes. This is because tech companies, especially those in the growth stage, rely heavily on debt financing to fund their operations and expansion. Lower interest rates make it cheaper for these companies to borrow money, which can boost their profitability and accelerate their growth.

CNBC’s Daily Open highlighted how tech might not be the biggest beneficiary of rate cuts, which got me thinking about the resilience of true community spirit. It reminded me of how AFC Wimbledon was born after Wimbledon FC left to become MK Dons, a story that exemplifies how a community can rebuild and redefine its identity.

Read more about how AFC Wimbledon was born after Wimbledon FC left to become MK Dons and how this powerful example shows that even in the face of change, passion and community can prevail. Just like tech might not be the sole beneficiary of rate cuts, there are other sectors and forces that can thrive despite economic shifts.

However, rising interest rates can have the opposite effect, making it more expensive for tech companies to borrow and potentially slowing their growth.

Impact of Rate Cuts on Tech Valuations, Cnbc daily open tech might not be the biggest beneficiary of rate cuts

Rate cuts can have a significant impact on the valuations of tech companies. When interest rates are low, investors are more willing to pay a premium for future growth prospects. This is because the cost of capital is lower, making it more attractive to invest in companies with high growth potential.

This can lead to higher valuations for tech companies, as investors are willing to pay more for their future earnings. Conversely, when interest rates rise, the cost of capital increases, making investors less willing to pay a premium for growth.

This can lead to lower valuations for tech companies, as their future earnings are discounted more heavily.

Historical Performance of Tech Stocks During Rate Cuts

Historically, tech stocks have tended to perform well during periods of rate cuts. For example, the Nasdaq Composite Index, which is heavily weighted towards tech stocks, rose significantly during the Federal Reserve’s easing cycle in 2001-2004 and again during the quantitative easing program that followed the 2008 financial crisis.

This is because rate cuts tend to stimulate economic growth, which can benefit tech companies by increasing demand for their products and services.

CNBC Daily Open and Tech Performance

The CNBC Daily Open is a segment on CNBC that provides a comprehensive overview of the stock market’s performance at the start of each trading day. This segment is highly significant for investors and traders, as it offers valuable insights into the market’s direction and potential trends.

The Daily Open covers a wide range of topics, including the latest economic data, earnings reports, and market news, providing a crucial starting point for understanding the market’s current state.The performance of tech stocks on the CNBC Daily Open has been a subject of intense scrutiny in recent months, particularly amidst the ongoing economic uncertainty and volatility.

Analyzing the recent performance of tech stocks on the CNBC Daily Open can provide valuable insights into the overall market sentiment and the specific factors driving tech sector performance.

Tech Stock Performance on the CNBC Daily Open

The performance of tech stocks on the CNBC Daily Open has been mixed in recent months, reflecting the broader market volatility and the specific challenges facing the tech sector. For example, in the first quarter of 2023, the Nasdaq Composite, a major index that tracks the performance of tech-heavy stocks, experienced a decline of 16.9%.

This decline was attributed to several factors, including rising interest rates, concerns about slowing economic growth, and the ongoing war in Ukraine. However, tech stocks have shown signs of resilience in recent weeks, with the Nasdaq Composite rebounding in the second quarter of 2023.

This rebound was fueled by positive earnings reports from some of the major tech companies, as well as a decline in inflation, which has eased pressure on the Federal Reserve to raise interest rates aggressively.

Comparison of Tech Stock Performance to Other Sectors

To understand the performance of tech stocks on the CNBC Daily Open, it is important to compare their performance to other sectors. In recent months, tech stocks have generally outperformed other sectors, such as energy and financials. This outperformance can be attributed to several factors, including the continued growth of the digital economy and the increasing reliance on technology in various industries.For example, in the first quarter of 2023, the S&P 500 Energy sector experienced a decline of 2.8%, while the S&P 500 Financials sector declined by 5.3%.

In contrast, the Nasdaq Composite, which is heavily weighted towards tech stocks, declined by 16.9%. This suggests that investors are more optimistic about the long-term prospects of the tech sector compared to other sectors.However, it is important to note that the performance of tech stocks can vary significantly depending on the specific company and the underlying industry.

Some tech companies, such as those in the semiconductor and cloud computing sectors, have been performing well, while others, such as those in the social media and e-commerce sectors, have been struggling.

Factors Affecting Tech Sector Growth

The tech sector is a dynamic and rapidly evolving industry, driven by a complex interplay of factors. These factors, in turn, influence the sector’s growth trajectory, making it essential to understand their impact. Rate cuts, a common monetary policy tool, can have a significant influence on these factors, ultimately affecting the tech sector’s performance.

Impact of Innovation and Technological Advancements

Innovation is the lifeblood of the tech sector, driving its growth and creating new opportunities. Continuous advancements in areas such as artificial intelligence (AI), cloud computing, and biotechnology fuel the development of new products, services, and business models. These advancements often lead to increased productivity, efficiency, and economic growth.

Rate cuts can indirectly support innovation by stimulating investment in research and development (R&D). Lower interest rates make it more attractive for companies to borrow money and invest in new technologies, potentially accelerating the pace of innovation within the sector.

Consumer Spending and Demand

Consumer demand is a key driver of growth in the tech sector. Tech products and services, such as smartphones, laptops, and streaming services, are increasingly integrated into daily life. Rate cuts can stimulate consumer spending by making it easier for individuals to borrow money and make large purchases.

This increased spending can translate into higher demand for tech products and services, benefiting tech companies. However, the impact of rate cuts on consumer spending can be complex and depends on various factors, such as consumer confidence, employment levels, and inflation.

Competition and Market Dynamics

The tech sector is highly competitive, with numerous companies vying for market share. This intense competition can drive innovation, lower prices, and improve product quality. Rate cuts can influence competition dynamics by affecting the cost of capital for tech companies.

While CNBC’s Daily Open discussed how tech might not be the biggest beneficiary of rate cuts, it’s hard to ignore the exciting news that broke over the weekend: Keke Palmer revealed she’s pregnant on Saturday Night Live. This heartwarming announcement certainly overshadowed the economic news for many, proving that sometimes, the most important things in life are those that touch our hearts.

Back to the topic of tech, though, it’s worth noting that while rate cuts might not directly benefit the sector, the long-term implications for the economy could have a ripple effect on tech companies.

Lower interest rates can make it easier for companies to raise funds and invest in growth initiatives, potentially leading to increased competition. However, rate cuts can also benefit larger, established companies with greater access to capital, potentially creating a more challenging environment for smaller startups and emerging players.

The CNBC Daily Open highlighted that tech might not be the biggest beneficiary of rate cuts, a sentiment echoed by the ongoing turmoil within the EU. Will Breton’s final salvo rock von der Leyen’s boat even further? This article delves into the potential consequences of this clash, which could further impact the economic landscape and influence how investors perceive the tech sector’s future prospects in light of rate cuts.

Government Policies and Regulations

Government policies and regulations can significantly impact the tech sector. Policies related to data privacy, cybersecurity, and antitrust can influence the operating environment for tech companies. Rate cuts, while primarily affecting monetary policy, can indirectly influence government policies.

For example, lower interest rates can lead to increased economic activity, which may encourage governments to pursue policies that promote innovation and technological advancement. Conversely, economic concerns stemming from rate cuts could lead to tighter regulations or a more cautious approach to tech sector development.

Global Economic Conditions

The tech sector is increasingly globalized, with companies operating across multiple countries. Global economic conditions, such as exchange rates, trade policies, and geopolitical risks, can impact the sector’s performance. Rate cuts can affect global economic conditions by influencing interest rate differentials and exchange rates.

For example, lower interest rates in one country can make its currency less attractive to investors, leading to depreciation. This can impact tech companies by making their products more expensive in foreign markets or reducing their profits from overseas operations.

Alternative Beneficiaries of Rate Cuts

While the tech sector might not be the biggest beneficiary of rate cuts, other sectors stand to gain more significantly from lower borrowing costs. These sectors, often characterized by their sensitivity to interest rates and their ability to leverage capital effectively, could experience a surge in investment and growth.

Growth Potential of Alternative Sectors

Rate cuts typically benefit sectors with high debt levels or those reliant on capital-intensive projects. Lower interest rates reduce borrowing costs, making these projects more financially viable. This leads to increased investment, expansion, and ultimately, higher economic activity.

- Real Estate: A decrease in interest rates can lead to a surge in demand for housing and commercial real estate. Lower mortgage rates make homeownership more affordable, while lower borrowing costs encourage businesses to invest in new construction and expansion.

- Infrastructure: Rate cuts can stimulate investment in infrastructure projects, such as roads, bridges, and utilities. These projects are often capital-intensive and require long-term financing. Lower borrowing costs make these projects more attractive, leading to increased economic activity and job creation.

- Energy: The energy sector, particularly oil and gas production, can benefit from lower interest rates. Lower borrowing costs can encourage exploration and production, leading to increased energy supply and potentially lower energy prices.

- Consumer Discretionary: Rate cuts can boost consumer spending on discretionary items, such as automobiles, furniture, and travel. Lower borrowing costs make it easier for consumers to finance large purchases, leading to increased demand in these sectors.

Rationale for Outperformance

The rationale for the potential outperformance of these sectors lies in their sensitivity to interest rates and their ability to leverage capital effectively.

- Real Estate: The housing market is highly sensitive to interest rates. Lower mortgage rates make homes more affordable, leading to increased demand and higher prices.

- Infrastructure: Infrastructure projects are often financed through long-term bonds, making them highly sensitive to interest rate changes. Lower interest rates reduce the cost of borrowing, making these projects more attractive to investors.

- Energy: Exploration and production in the energy sector are capital-intensive activities. Lower borrowing costs make it more affordable to invest in new projects, potentially leading to increased production and lower energy prices.

- Consumer Discretionary: Consumer spending on discretionary items is often influenced by interest rates. Lower borrowing costs make it easier for consumers to finance large purchases, leading to increased demand.

Investor Strategies in a Rate Cut Environment

Rate cuts are a powerful tool used by central banks to stimulate economic growth. When interest rates fall, borrowing becomes cheaper, which encourages businesses to invest and consumers to spend. This can lead to increased economic activity and potentially higher stock prices.

However, not all sectors benefit equally from rate cuts. Investors need to carefully consider their investment strategies and portfolio allocation in a rate cut environment.

Portfolio Strategies for Rate Cuts

Investors considering rate cuts need to develop a portfolio strategy that aligns with their risk tolerance and investment goals. This strategy should consider the potential benefits and risks associated with rate cuts.

- Growth-Oriented Stocks:Rate cuts can fuel economic growth, which benefits companies with strong growth prospects. Investors with a higher risk tolerance might consider allocating a larger portion of their portfolio to growth-oriented stocks, particularly in sectors like technology, consumer discretionary, and healthcare, which tend to be more sensitive to economic growth.

- Value Stocks:Rate cuts can also boost the value of undervalued companies. Value stocks often have lower price-to-earnings ratios and are considered more stable. Investors seeking a more conservative approach might allocate a portion of their portfolio to value stocks, which are often found in sectors like financials, energy, and industrials.

- Diversification:Diversification is crucial in any market environment, but it is especially important during periods of economic uncertainty. Investors should spread their investments across different asset classes, sectors, and geographies to mitigate risk.

- Active Management:Rate cuts can create volatility in the market, making it more challenging for investors to identify winning stocks. Active management, where investors actively buy and sell stocks based on market conditions, can be beneficial in this environment. However, it requires a deep understanding of the market and a willingness to make timely decisions.

Tech Stock Recommendations

The tech sector is often a significant beneficiary of rate cuts due to its growth potential and reliance on debt financing. Here are some tech stocks to consider:

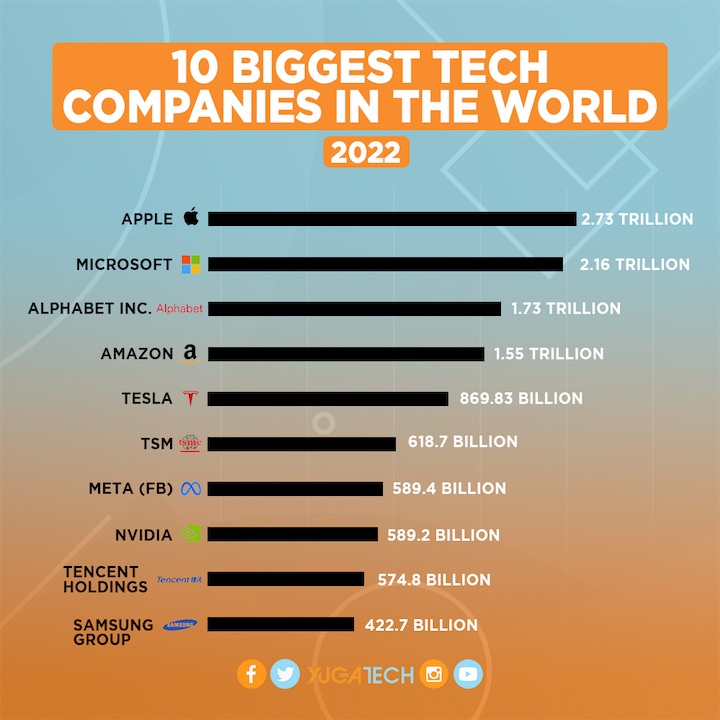

- Amazon (AMZN):Amazon is a dominant player in e-commerce, cloud computing, and digital advertising. Its strong growth prospects and ability to generate cash flow make it an attractive investment during rate cuts.

- Microsoft (MSFT):Microsoft is a leader in software, cloud computing, and gaming. Its diversified revenue streams and strong balance sheet make it a resilient investment in a rate cut environment.

- Apple (AAPL):Apple is a global leader in consumer electronics, software, and services. Its brand recognition, loyal customer base, and strong financial performance make it a solid investment option.

Portfolio Organization

When organizing a portfolio for a rate cut environment, investors should consider their risk tolerance and investment goals.

- High-Risk Tolerance:Investors with a high-risk tolerance can allocate a larger portion of their portfolio to growth-oriented stocks, including those in the tech sector. This approach can potentially generate higher returns but also carries a higher risk of losses.

- Moderate Risk Tolerance:Investors with a moderate risk tolerance can diversify their portfolio across different asset classes and sectors. They might consider allocating a portion of their portfolio to growth stocks, value stocks, and fixed-income securities.

- Low Risk Tolerance:Investors with a low-risk tolerance should focus on more conservative investments, such as fixed-income securities and value stocks. This approach provides stability and income but may generate lower returns.