Chinas Ultra-Rich Outpace US Growth in Last 10 Years

Chinas ultra rich population sees dramatic growth in last 10 years outpacing the u s report shows – China’s Ultra-Rich Outpace US Growth in Last 10 Years, a new report reveals. This dramatic surge in wealth, outpacing even the United States, paints a fascinating picture of China’s economic transformation and its implications for global power dynamics. The report delves into the factors driving this rapid wealth accumulation, analyzing key demographics, and exploring the impact on China’s economy and society.

From booming tech industries to surging real estate markets, China’s ultra-wealthy have benefited from a decade of remarkable economic growth. The report sheds light on the sources of this wealth, including entrepreneurship, inheritance, and investments, and compares the wealth distribution in China to that of the United States.

It also examines the influence of China’s ultra-rich on consumer spending patterns and the potential social implications of this wealth concentration.

China’s Ultra-Wealthy Growth: Chinas Ultra Rich Population Sees Dramatic Growth In Last 10 Years Outpacing The U S Report Shows

The past decade has witnessed a dramatic surge in China’s ultra-rich population, outpacing even the growth seen in the United States. This burgeoning wealth has reshaped China’s economic landscape and sparked global interest in understanding the factors driving this phenomenon.

It’s fascinating to see how China’s ultra-rich population has exploded in the last decade, outpacing even the US. This growing wealth is reflected in the latest luxury prize draw from Omaze , offering a stunning 2 million pound house in Devon.

It seems like the world’s wealthiest are increasingly looking for unique experiences and extravagant assets, and China’s economic boom is driving this trend.

Growth of China’s Ultra-Rich Population

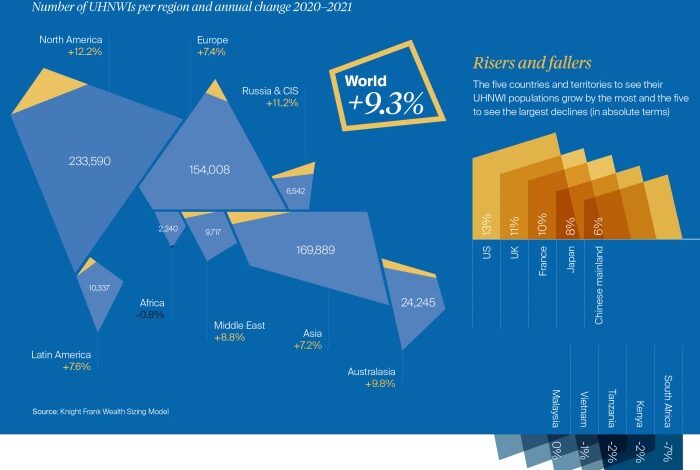

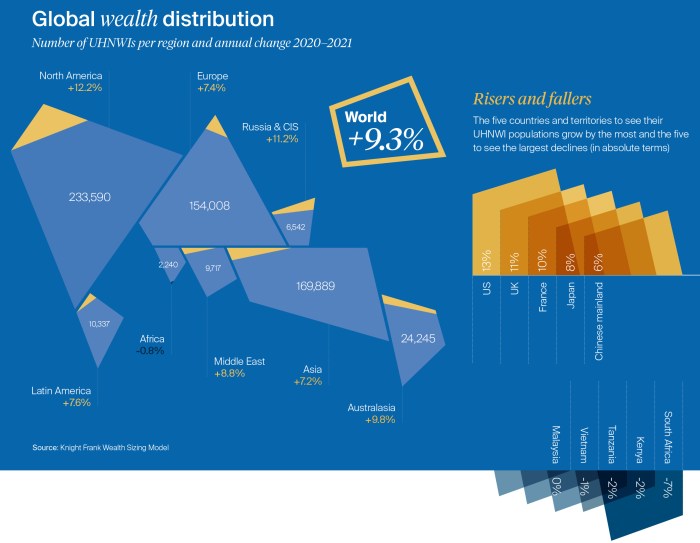

A recent report revealed a significant increase in the number of high-net-worth individuals (HNWIs) in China. The report, which analyzed data from 2012 to 2022, showed that the number of HNWIs in China has grown at a much faster rate than in the United States.

It’s fascinating to see how China’s ultra-rich population has exploded in the last decade, outpacing even the US, but sometimes I need a break from all the financial news. That’s when I turn to the excitement of the Champions League! The return of this legendary competition, with its thrilling matches and captivating storylines, always provides a welcome escape.

This week’s matchup between Manchester City and Inter Milan, champions league returns with goals galore ahead of manchester city vs inter marquee wednesday showdown , promises to be a real nail-biter. Of course, after the game, it’s back to the world of finance and the growth of China’s elite.

It’s a strange juxtaposition, but it’s the reality we live in.

This rapid growth is attributed to several key factors, including:

- China’s robust economic growth: China’s sustained economic expansion over the past few decades has created a favorable environment for wealth creation. This growth has been fueled by factors such as government investment in infrastructure, technological advancements, and a growing middle class.

It’s fascinating to see how China’s ultra-rich population has exploded in the last decade, outpacing even the US. This shift in wealth distribution begs the question: what impact will this have on the global economy and society? It reminds me of the inspiring story of Maddy Cusack, a young footballer whose legacy will be a voice for girls in the sport, maddy cusack footballers legacy will be a voice for girls.

Perhaps these two stories, though seemingly unrelated, both speak to the importance of breaking barriers and paving the way for future generations. Ultimately, the growth of China’s ultra-rich population will undoubtedly have ripple effects, and it’s crucial to consider how we can ensure that these changes benefit everyone, not just the select few.

- Entrepreneurial spirit: China’s entrepreneurial ecosystem has flourished, leading to the emergence of numerous successful businesses and tech giants. This entrepreneurial drive has fueled wealth creation and propelled many individuals into the ultra-wealthy category.

- Government policies: The Chinese government has implemented policies that encourage investment and entrepreneurship, creating an environment conducive to wealth accumulation.

Industries and Sectors Contributing to Wealth Creation, Chinas ultra rich population sees dramatic growth in last 10 years outpacing the u s report shows

The rapid growth in China’s ultra-wealthy population has been driven by several industries and sectors, including:

- Technology: China’s tech sector has experienced phenomenal growth, with companies like Alibaba, Tencent, and ByteDance becoming global giants. This growth has created immense wealth for founders, investors, and employees.

- Real Estate: The Chinese real estate market has witnessed a surge in property values, particularly in major cities like Beijing and Shanghai. This has created wealth for real estate developers and investors.

- Manufacturing: China remains a global manufacturing powerhouse, with companies in industries like automotive, electronics, and textiles generating significant wealth.

Key Demographics and Wealth Distribution

China’s ultra-wealthy population, defined as those with a net worth of at least $30 million, has witnessed a dramatic surge in recent years. This growth is not only a reflection of China’s robust economic development but also reveals a unique demographic and wealth distribution pattern within the country.

Understanding these aspects is crucial for comprehending the dynamics of wealth accumulation and its implications for the Chinese economy and society.

Demographics of China’s Ultra-Rich

The demographics of China’s ultra-rich population present a fascinating picture. The majority of China’s ultra-wealthy are men, reflecting a historical trend of male dominance in business and finance. However, the number of female ultra-high-net-worth individuals (UHNWIs) is increasing, indicating a shift in the gender dynamics of wealth creation.

The average age of China’s ultra-rich is also decreasing, suggesting a younger generation of entrepreneurs and investors is driving the growth in wealth. The geographic distribution of China’s ultra-rich is heavily concentrated in major economic hubs like Beijing, Shanghai, and Shenzhen.

These cities offer access to financial markets, business opportunities, and a concentration of high-net-worth individuals. However, the number of UHNWIs is also growing in smaller cities and provincial areas, reflecting the increasing wealth creation in non-traditional economic centers.

Sources of Wealth for China’s Ultra-Rich

The sources of wealth for China’s ultra-rich are diverse and reflect the country’s economic transformation. Entrepreneurship remains a primary driver of wealth creation, with many UHNWIs building their fortunes through successful businesses in various sectors, including technology, real estate, and manufacturing.

Inheritance also plays a significant role, as family businesses and assets are passed down through generations. Investments, particularly in the stock market, real estate, and private equity, are also a major source of wealth for China’s ultra-rich.

Wealth Distribution Among China’s Ultra-Rich

China’s ultra-wealthy population is characterized by a significant concentration of wealth at the top. This is reflected in the high Gini coefficient, which measures income inequality. While the number of UHNWIs is growing, the wealth gap between the richest and the rest of the population is also widening.

Table of Key Demographics and Wealth Distribution Data Points

| Category | Data Point |

|---|---|

| Gender | Male dominance, but increasing number of female UHNWIs |

| Age | Decreasing average age, indicating younger generation of entrepreneurs and investors |

| Geographic Distribution | Concentrated in major economic hubs, but growing in smaller cities and provincial areas |

| Sources of Wealth | Entrepreneurship, inheritance, investments (stock market, real estate, private equity) |

| Wealth Distribution | Significant concentration of wealth at the top, reflected in high Gini coefficient |

Impact on the Chinese Economy and Society

The rapid growth of China’s ultra-rich population has profound implications for the country’s economy and society. Their increased wealth not only fuels economic expansion but also shapes consumer trends and social dynamics.

Impact on Economic Development

The burgeoning wealth of China’s ultra-rich has a significant impact on the country’s economic development. Their investments in various sectors, including real estate, technology, and luxury goods, contribute to job creation, economic growth, and technological advancement. The rise of domestic entrepreneurs and investors further strengthens the Chinese economy.

Influence on Consumer Market and Spending Patterns

China’s ultra-rich have a considerable influence on the country’s consumer market and spending patterns. Their penchant for luxury goods, high-end services, and unique experiences drives demand in these sectors, boosting economic activity and creating new business opportunities. The growing demand for personalized services and experiences also encourages innovation and diversification within the consumer market.

Social Implications of Wealth Concentration

The concentration of wealth among China’s ultra-rich raises concerns about income inequality and social mobility. While economic growth is undeniable, the disparity between the wealthy elite and the general population can lead to social unrest and economic instability.

“The widening gap between the rich and the poor is a serious challenge for China. It can undermine social stability and hinder economic progress.”

Li Keqiang, Chinese Premier

The concentration of wealth can also hinder social mobility, making it more challenging for individuals from lower socioeconomic backgrounds to climb the social ladder. This can lead to a lack of opportunity and exacerbate existing inequalities.