Chinas Local Government Debt: A Hidden Drag on Economic Growth

Chinas local government debt problems are a hidden drag on economic growth – China’s local government debt problems are a hidden drag on economic growth, a ticking time bomb threatening the nation’s ambitious economic aspirations. The scale of this debt is staggering, with trillions of dollars borrowed by local governments to fund infrastructure projects, land development, and economic stimulus measures.

While these initiatives have fueled China’s remarkable economic rise, the mounting debt burden is now casting a shadow over its future.

The rapid accumulation of local government debt can be attributed to a combination of factors, including aggressive land sales, ambitious infrastructure projects, and a decentralized system that gives local governments considerable financial autonomy. However, this decentralized system has also led to a lack of transparency and accountability, making it difficult to assess the true extent of the debt problem.

The Scale and Scope of China’s Local Government Debt

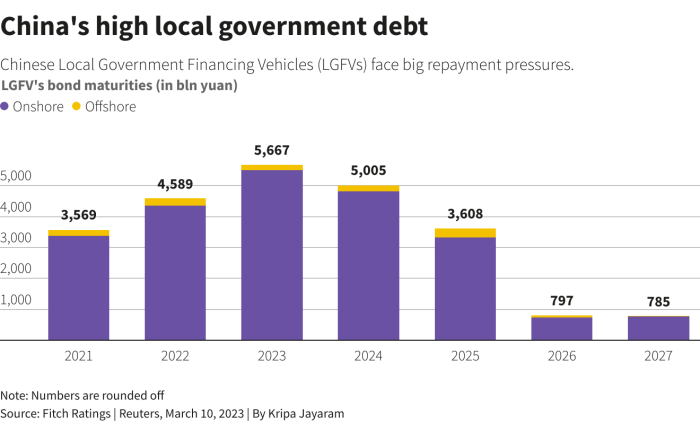

China’s local government debt has become a significant concern in recent years, raising questions about its potential impact on economic growth and financial stability. Understanding the scale and scope of this debt is crucial for assessing its implications and formulating effective policy responses.The magnitude of China’s local government debt has been steadily increasing over the past decade, fueled by infrastructure investment and rapid urbanization.

While official figures are not always transparent, estimates suggest that the total debt outstanding has reached trillions of dollars.

Debt Levels Across Provinces, Chinas local government debt problems are a hidden drag on economic growth

The distribution of local government debt is uneven across different provinces and regions within China. Some provinces, particularly those with strong economic growth and significant infrastructure development, have accumulated higher levels of debt. For instance, Guangdong, Jiangsu, and Zhejiang, which are among China’s most economically developed provinces, have relatively high levels of local government debt.

Conversely, provinces with slower economic growth and less infrastructure investment, such as Guizhou and Xinjiang, have generally lower debt levels.

Debt Concentration in Key Sectors

Local government debt in China is concentrated in several key sectors, reflecting the priorities of government investment and economic development. Infrastructure development, including transportation, energy, and water projects, accounts for a significant portion of local government debt. This reflects the government’s efforts to modernize infrastructure and support economic growth.Other sectors where local government debt is concentrated include real estate, urban development, and social services.

These sectors have been actively supported by local governments through investment and subsidies, contributing to the growth of local government debt.

Policy Responses to Local Government Debt: Chinas Local Government Debt Problems Are A Hidden Drag On Economic Growth

China’s government has recognized the risks associated with local government debt and has implemented a series of policies to address the issue. These policies aim to curb further debt accumulation, promote fiscal discipline, and mitigate potential financial risks.

Measures to Control Debt Growth

The Chinese government has implemented various measures to control the growth of local government debt. These measures include:

- Debt Quotas:The central government has imposed debt quotas on local governments, limiting their borrowing capacity. This measure aims to prevent excessive borrowing and ensure that debt levels remain manageable.

- Fiscal Responsibility Laws:China has introduced fiscal responsibility laws that require local governments to adhere to strict fiscal discipline and manage their finances responsibly. These laws promote transparency and accountability in local government finances.

- Debt Swap Programs:The government has initiated debt swap programs, where local government debt is exchanged for longer-term, lower-interest bonds. This helps to reduce the immediate debt burden and lower financing costs.

- Tightening Credit Access:The government has tightened credit access for local governments, making it more difficult for them to borrow funds. This measure aims to slow down the pace of debt accumulation and prevent risky lending practices.

Strategies to Mitigate Debt Risks

The government has implemented strategies to mitigate the risks associated with local government debt. These strategies include:

- Asset Securitization:Local governments have been encouraged to securitize their assets, such as land and infrastructure, to generate revenue and reduce debt levels. This approach allows them to monetize their assets and raise funds without relying heavily on borrowing.

- Public-Private Partnerships (PPPs):The government has promoted PPPs, where private sector investors contribute capital and expertise to infrastructure projects. This approach helps to reduce the financial burden on local governments and leverages private sector resources.

- Financial Stress Tests:The government has conducted financial stress tests to assess the resilience of local governments to economic shocks. This helps to identify potential vulnerabilities and develop appropriate mitigation measures.

- Early Warning Systems:The government has established early warning systems to monitor local government debt levels and identify potential risks. These systems provide timely information for policymakers to take preventive action.

Future Policy Interventions

While the government has taken significant steps to address local government debt, future policy interventions will be crucial to manage the issue effectively. Potential future policy interventions include:

- Strengthening Fiscal Discipline:Further strengthening fiscal discipline and promoting transparency in local government finances will be essential to prevent future debt accumulation. This could involve implementing stricter budget controls, enhancing oversight mechanisms, and promoting greater accountability.

- Promoting Sustainable Revenue Sources:The government should encourage local governments to develop sustainable revenue sources, such as property taxes and user fees, to reduce their reliance on borrowing. This would help to ensure long-term fiscal sustainability.

- Improving Debt Management Practices:Enhancing debt management practices, including risk assessment, debt restructuring, and debt monitoring, will be critical to managing local government debt effectively. This would involve developing standardized debt management frameworks and providing training to local government officials.

- Addressing Underlying Economic Issues:Addressing underlying economic issues, such as low growth and high unemployment, will be crucial to reduce the pressure on local governments to borrow. This could involve implementing structural reforms to promote economic growth and create more job opportunities.

China’s local government debt problems are a ticking time bomb for the economy, a hidden drag on growth that could easily explode into a full-blown crisis. It’s a similar situation to the fantasy football landscape, where players like Saquon Barkley and DK Metcalf are currently underperforming but could be poised for a breakout.

Just like those players might be “buy low” candidates, China’s government needs to act decisively to address the debt problem before it becomes a major obstacle to sustainable economic growth. Check out this article for more insights on fantasy football players to watch this week.

China’s local government debt problems are a hidden drag on economic growth, as they divert resources away from productive investments. It’s like a team with a great quarterback like Bryce Young, but struggling with a weak offensive line – the potential is there, but the execution suffers.

Just like the Panthers, China needs to address its debt issues to truly unleash its economic potential. Meanwhile, you can check out this great article on five reasons Panthers QB Bryce Young should still be starting for some positive news on the football front.

China’s local government debt problems are a hidden drag on economic growth, much like a slow leak in a tire. It’s not immediately apparent, but over time it can lead to a major issue. The same can be said about the growing concerns regarding police safety in the UK, as highlighted in this recent article about Sir Mark Rowley’s statement on the rising number of police officers being injured.

Just like a leaky tire, declining public trust and increasing violence against officers can erode the foundation of a strong and effective law enforcement system, impacting overall economic stability in the long run. While China’s debt issues might seem like a separate problem, the ripple effects of a weakened economy can be felt globally, making it crucial to address these hidden challenges before they become overwhelming.