China-Mexico Freight Traffic Booms as Companies Evade US Trade War

China mexico freight traffic surges in trump biden tariff era as companies find ways to evade u s trade war – China-Mexico freight traffic surges in trump biden tariff era as companies find ways to evade u s trade war, a trend that has become increasingly apparent in recent years. The US-China trade war, characterized by escalating tariffs and trade tensions, has created a complex landscape for global businesses.

As companies grapple with the economic implications of the trade war, they have sought innovative strategies to mitigate its impact on their operations and bottom lines. One such strategy has involved shifting trade routes and logistics, leveraging the growing economic ties between China and Mexico.

This shift has resulted in a significant surge in freight traffic between China and Mexico, as companies seek to circumvent the US trade war and maintain access to American markets. The increase in freight traffic has created new opportunities for businesses in both China and Mexico, while also raising concerns about the potential long-term implications for the US economy and its global trade relationships.

Trade War Impact on Freight Traffic

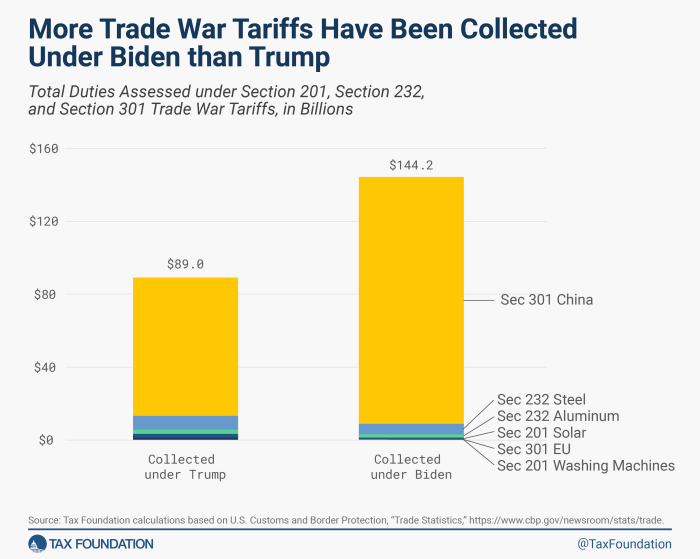

The US-China trade war, initiated by the Trump administration and continued by the Biden administration, has had a significant impact on freight traffic between China and Mexico. While the trade war aimed to reduce the trade deficit with China, it inadvertently led to a surge in freight traffic between China and Mexico as companies sought alternative routes to avoid US tariffs.

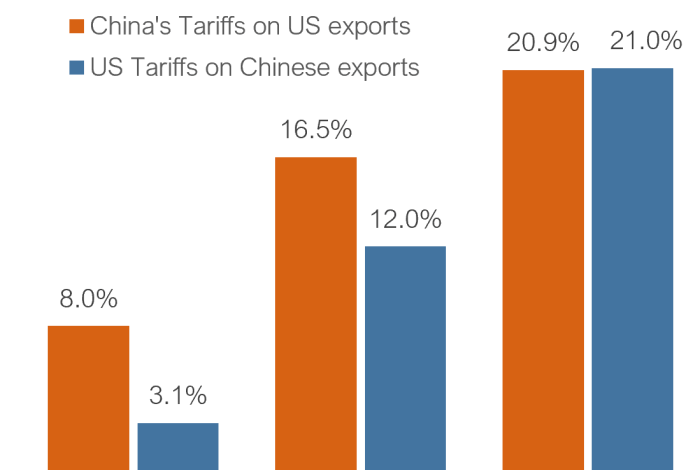

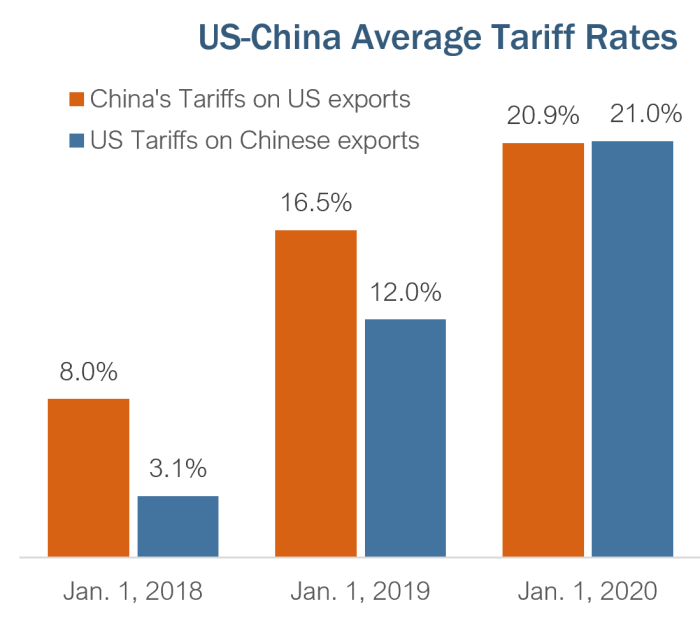

Trade Policies and Tariffs

The Trump administration imposed tariffs on a wide range of Chinese goods, including electronics, furniture, and machinery. These tariffs increased the cost of importing these goods into the US, making them less competitive. In response, many US companies began sourcing these goods from Mexico, where they could avoid the US tariffs.

The Biden administration has largely maintained the Trump-era tariffs, although it has made some minor adjustments.

Impact on Freight Traffic

The surge in freight traffic between China and Mexico is evident in various data points. For example, the volume of goods transported by rail between China and Mexico increased by over 50% between 2018 and 2020. Similarly, the number of container ships arriving at Mexican ports from China also saw a significant increase during this period.

This surge in freight traffic has also led to a rise in demand for logistics services in both countries.

The US-China trade war has significantly impacted freight traffic between China and Mexico.

Trade Routes and Logistics

The increased freight traffic has also led to the development of new trade routes and logistics networks between China and Mexico. Companies have been investing in infrastructure, such as rail lines and ports, to facilitate the movement of goods between the two countries.

This has also led to the growth of new logistics companies specializing in trans-Pacific shipping.

The surge in China-Mexico freight traffic during the Trump-Biden tariff era is a testament to the ingenuity of corporations in navigating trade wars. Companies are finding creative ways to circumvent tariffs, highlighting the immense power they wield in the global economy.

To get a better grasp on the scope of this corporate power, check out these corporate power facts and stats. This trend underscores the complex interplay between trade policy, corporate strategy, and the evolving landscape of global commerce.

Economic Impact

The surge in freight traffic has had a positive impact on the economies of both China and Mexico. It has created new jobs in the logistics sector and boosted economic activity in ports and transportation hubs. However, it has also led to increased congestion at ports and rail lines, which can delay shipments and increase costs for businesses.

Companies’ Strategies for Evading Trade War

The US-China trade war, characterized by escalating tariffs, has forced businesses to adapt and find innovative ways to navigate the complex trade landscape. Companies have adopted a range of strategies to minimize the impact of tariffs and maintain their supply chains, leading to significant shifts in freight traffic between China and Mexico.

Shifting Production and Sourcing

Companies have been actively relocating production facilities or sourcing components from alternative countries to avoid tariffs. This involves setting up new manufacturing plants in countries like Mexico, Vietnam, or India, which offer lower labor costs and favorable trade agreements with the US.

- Apple:The tech giant has shifted some of its iPhone production to India to reduce reliance on China.

- Ford Motor Company:Ford has relocated some of its production to Mexico to avoid tariffs on vehicles imported from China.

Using Third-Party Logistics Providers

Companies have increasingly turned to third-party logistics (3PL) providers to manage their supply chains and navigate trade barriers. These providers specialize in warehousing, transportation, and customs clearance, offering expertise in finding alternative routes and minimizing delays.

It’s fascinating how businesses adapt to trade wars, like the surge in China-Mexico freight traffic during the Trump-Biden tariff era. Companies are finding creative ways to evade the US trade war, but it seems even Elon Musk isn’t immune to legal battles.

Cards Against Humanity is suing SpaceX for $15 million , claiming the company illegally trespassed on their land. This whole situation highlights the complexities of international trade and the legal battles that can arise when companies try to push the boundaries.

- DHL:The logistics giant has expanded its operations in Mexico to handle increased freight traffic from China.

- FedEx:FedEx has also invested in infrastructure in Mexico to support the growing flow of goods between China and the US.

Utilizing Free Trade Agreements

Companies are taking advantage of existing free trade agreements to minimize tariffs. Mexico’s membership in the USMCA (United States-Mexico-Canada Agreement) allows for duty-free imports of certain goods from China.

The trade war between the US and China has been a rollercoaster ride for businesses, and many have found creative ways to navigate the tariffs. The surge in freight traffic between China and Mexico is a prime example, as companies shift production and logistics to avoid US tariffs.

However, even amidst these global economic shifts, the tragic news of young siblings killed as building collapses in Naples reminds us that human tragedy can strike anywhere, regardless of trade wars or global economic trends. This stark contrast highlights the complex realities of our world, where economic struggles and human suffering often intersect in unexpected ways.

- Nike:The sportswear company has leveraged the USMCA to import footwear and apparel from China to Mexico duty-free.

Employing “Tariff Engineering”

Companies are employing strategies like “tariff engineering” to reduce the impact of tariffs. This involves modifying product designs or sourcing components from countries with lower tariffs, making the final product eligible for lower import duties.

- Samsung:The electronics manufacturer has adjusted its product designs to avoid higher tariffs on certain components.

Increasing Inventory Levels

Companies are building up inventory levels in the US to avoid potential supply chain disruptions and tariff increases. This strategy, however, can lead to higher warehousing costs.

- Walmart:The retail giant has increased its inventory levels in the US to mitigate the impact of trade tensions.

Utilizing Transshipment Hubs

Companies are using transshipment hubs in countries like Mexico to break down shipments from China and re-export them to the US. This strategy helps reduce the volume of goods directly imported from China, thereby minimizing tariff exposure.

- Maersk:The shipping giant has expanded its transshipment operations in Mexico to facilitate the flow of goods from China to the US.

Shifting Trade Routes and Logistics

The US-China trade war has significantly impacted trade routes and logistics between China, Mexico, and the US. Companies have had to adapt their supply chains and logistics operations to navigate the tariffs and uncertainties, leading to a shift in trade patterns and the emergence of new trade routes.

Impact on Trade Routes

The trade war has led to a redirection of trade flows, with companies seeking alternative routes to avoid US tariffs. Some key changes include:

- Increased trade between China and Mexico:Mexico has become a hub for Chinese goods destined for the US market. Companies have shifted production to Mexico to take advantage of the US-Mexico-Canada Agreement (USMCA), which allows duty-free access to the US market for goods originating in Mexico.

- Growth in transpacific shipping routes:With increased trade between China and other Asian countries, transpacific shipping routes have seen a surge in activity. This has led to a rise in demand for shipping containers and port capacity in Asia.

- Shifting trade patterns within the US:Companies have shifted production facilities within the US to avoid tariffs. For example, some companies have moved manufacturing operations from California to Texas to take advantage of lower taxes and proximity to the Mexican border.

Companies’ Adaptation Strategies

Companies have adopted various strategies to navigate the trade war’s impact on logistics:

- Diversifying sourcing:Companies have diversified their sourcing to include suppliers in countries outside China, such as Vietnam, India, and Thailand.

- Nearshoring and reshoring:Some companies have brought production back to the US or moved it to nearby countries like Mexico to reduce reliance on Chinese suppliers.

- Inventory management optimization:Companies have implemented strategies to manage inventory levels effectively to mitigate the impact of potential disruptions in supply chains.

- Increased use of technology:Companies are leveraging technology such as blockchain and artificial intelligence to improve supply chain visibility and efficiency.

Efficiency and Cost Implications of Alternative Trade Routes

The choice of trade routes involves trade-offs between efficiency and cost:

- Sea freight:While sea freight is generally the most cost-effective option for large volumes, it can be slower than air freight. This can lead to longer lead times and increased inventory costs.

- Air freight:Air freight offers faster delivery times but is more expensive than sea freight. It is suitable for smaller volumes and time-sensitive shipments.

- Rail freight:Rail freight can be a cost-effective option for long-distance shipments within North America. However, it can be slower than truck transportation.

- Truck transportation:Truck transportation is a flexible option for shorter distances and can offer faster delivery times than rail freight. However, it can be more expensive than rail freight.

Economic and Political Implications

The surge in China-Mexico freight traffic, a direct consequence of the US-China trade war, has profound economic and political implications for all three nations involved. This shift in trade routes and the strategies companies employ to circumvent tariffs have created a complex web of economic benefits and challenges, while also altering the geopolitical landscape.

Economic Implications for China and Mexico

The surge in China-Mexico freight traffic has created a significant economic opportunity for both countries.

- China:The shift in trade routes has provided China with a new market for its goods, particularly in the US. This has boosted Chinese exports and helped offset the losses incurred due to US tariffs. The increased demand for Chinese goods has also stimulated economic growth in China, particularly in manufacturing and logistics sectors.

- Mexico:Mexico has benefited from the increased demand for its manufacturing services. Chinese companies have increasingly been setting up manufacturing facilities in Mexico to take advantage of lower labor costs and proximity to the US market. This has led to job creation and economic growth in Mexico, particularly in the manufacturing and logistics sectors.

However, there are also potential economic drawbacks:

- China:The dependence on Mexico as a transshipment hub for US-bound goods could make China vulnerable to potential disruptions in the Mexican economy or political instability. Furthermore, the reliance on Mexico could limit China’s ability to diversify its export markets.

- Mexico:While the surge in freight traffic has boosted economic growth, it has also raised concerns about potential environmental damage and the strain on Mexico’s infrastructure. Additionally, Mexico could become increasingly reliant on China for its economic growth, potentially limiting its ability to develop its own industries.

Political Ramifications for the US

The surge in China-Mexico freight traffic has created a complex political landscape for the US.

- US-China Relations:The trend underscores the effectiveness of China’s strategy to circumvent US tariffs and maintain its market share in the US. This could further strain US-China relations and make it more difficult to reach a trade agreement.

- US-Mexico Relations:While the US benefits from the influx of goods from Mexico, the increased reliance on Mexico as a transshipment hub could create tensions. The US might face pressure to address Mexican concerns about border security and immigration, potentially impacting its relationship with Mexico.

Global Trade and Geopolitical Landscape

The surge in China-Mexico freight traffic has broader implications for global trade and the geopolitical landscape.

- Global Trade:The trend reflects the increasing interconnectedness of the global economy and the growing importance of regional trade blocs. It also highlights the challenges of managing global trade in a multipolar world, where countries are increasingly pursuing their own economic interests.

- Geopolitical Landscape:The shift in trade routes could potentially lead to the formation of new alliances and the reshaping of global power dynamics. China’s growing influence in Latin America, facilitated by its economic ties with Mexico, could challenge US dominance in the region.

Future Outlook and Trends: China Mexico Freight Traffic Surges In Trump Biden Tariff Era As Companies Find Ways To Evade U S Trade War

The surge in China-Mexico freight traffic during the US-China trade war is likely to continue, driven by the ongoing global trade dynamics and the evolving landscape of international supply chains. This trend presents both opportunities and challenges for businesses operating within this trade corridor, and its long-term implications for the relationship between the US, China, and Mexico remain significant.

Potential Challenges and Opportunities for Businesses, China mexico freight traffic surges in trump biden tariff era as companies find ways to evade u s trade war

The increased trade between China and Mexico presents both challenges and opportunities for businesses operating in this trade corridor.

- Increased Competition:As more companies seek to leverage this route, competition for resources and market share will intensify. Businesses will need to adapt their strategies to remain competitive, including exploring new markets, diversifying their product offerings, and improving operational efficiency.

- Supply Chain Disruptions:The trade war has highlighted the fragility of global supply chains. Companies will need to develop strategies to mitigate risks, such as diversifying suppliers, building up inventory, and exploring alternative shipping routes.

- Logistics Complexity:Managing the logistics of shipping goods between China and Mexico can be complex, requiring specialized expertise in customs clearance, documentation, and transportation. Businesses will need to invest in logistics capabilities and partnerships to navigate these challenges effectively.

- Growing Demand for Skilled Labor:The increasing volume of trade will create a demand for skilled labor in various sectors, including logistics, manufacturing, and transportation. Businesses will need to invest in training and development programs to meet this demand.