CEO Confidence Down, Inflation Up, Workers Still on Top

Ceo confidence is down inflation is up but workers are still on top – CEO confidence is down, inflation is up, but workers are still on top – this intriguing paradox sets the stage for an exploration of the current economic landscape. While businesses grapple with rising costs and uncertainty, employees are finding themselves in a position of power, with strong demand for labor driving up wages and boosting bargaining power.

This dynamic raises questions about the long-term implications for businesses, consumers, and the overall economy.

The recent surge in inflation has significantly impacted consumer behavior, forcing businesses to adapt their strategies to navigate the shifting landscape. The question remains: will this trend continue, and how will it shape the future of work and economic growth?

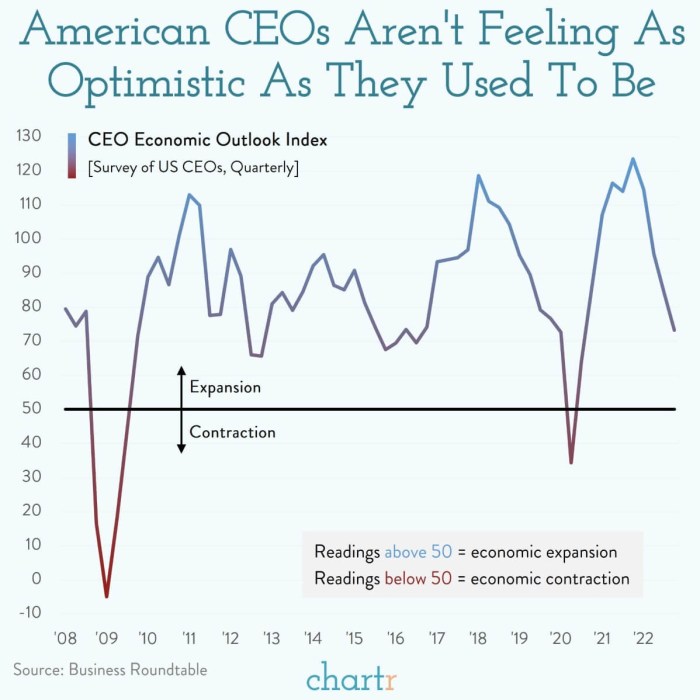

CEO Confidence and Economic Uncertainty

CEO confidence, a crucial indicator of business sentiment and future economic prospects, has been on a downward trajectory in recent months. This decline is fueled by a confluence of factors, including persistent inflation, rising interest rates, and geopolitical uncertainty.

It’s a strange time. CEO confidence is down, inflation is up, but workers are still on top. This economic climate is causing a lot of anxiety, and it’s understandable. But there are also some serious injustices happening that are getting lost in the noise.

This is what a loophole looks like says veteran who does not qualify for help under new burn pit law , a headline that speaks volumes about the struggles some face while others seemingly benefit. Maybe the focus should be on those who are truly struggling, not just the ones who have the power to shape the narrative.

The Impact of Inflation on CEO Confidence

Inflation, a persistent rise in the general price level of goods and services, has a significant impact on business decisions and CEO confidence. When inflation is high, businesses face several challenges:

- Increased Costs:Rising prices for raw materials, labor, and other inputs put pressure on profit margins.

- Uncertainty in Planning:High inflation makes it difficult for businesses to accurately forecast future costs and revenues, hindering long-term planning and investment decisions.

- Consumer Spending:Inflation erodes purchasing power, leading to a decline in consumer demand, which in turn affects businesses’ revenue streams.

Comparing the Current Economic Landscape with Past Periods of High Inflation

While the current inflationary environment shares similarities with past periods of high inflation, there are also key differences that impact CEO sentiment:

- Globalized Supply Chains:The current inflationary pressures are exacerbated by global supply chain disruptions, which were not as prevalent in previous periods of high inflation.

- Technological Advancements:The rapid pace of technological innovation and adoption provides businesses with more tools to mitigate inflationary pressures and enhance efficiency.

- Central Bank Response:Central banks are taking aggressive measures to combat inflation, such as raising interest rates, which can impact business borrowing costs and economic growth.

The Impact of Inflation on Consumer Behavior: Ceo Confidence Is Down Inflation Is Up But Workers Are Still On Top

Inflation, a persistent increase in the general price level of goods and services, is a complex economic phenomenon with significant implications for consumer behavior. Rising inflation erodes purchasing power, forcing consumers to make tough choices about their spending priorities. This has a ripple effect across various sectors of the economy, influencing business strategies and overall economic growth.

The Impact of Inflation on Consumer Spending Patterns

Rising inflation directly affects consumer spending patterns by reducing their purchasing power. As prices increase, consumers have less money available to spend on goods and services. This leads to a decline in demand, particularly for discretionary items such as travel, entertainment, and luxury goods.

Consumers may also shift their spending towards essential goods like food, housing, and healthcare, as these items are considered necessities. For example, a study by the Bureau of Labor Statistics found that in 2022, the consumer price index (CPI) for food rose by 10.4%, while the CPI for energy increased by 14.6%.

This significant increase in prices for essential goods has forced many consumers to cut back on spending in other areas.

Strategies for Businesses to Mitigate the Impact of Inflation

Businesses are facing the challenge of navigating a volatile economic environment characterized by rising inflation. To mitigate the impact of inflation on their operations and customer base, businesses are implementing various strategies:

- Price Optimization:Businesses are carefully adjusting their pricing strategies to balance maintaining profitability with attracting customers. This involves strategies like cost-plus pricing, value-based pricing, and dynamic pricing, where prices fluctuate based on market demand and supply.

- Cost Reduction:Businesses are actively seeking ways to reduce their operating costs to maintain margins. This includes streamlining operations, negotiating better deals with suppliers, and exploring alternative sources of raw materials.

- Product Innovation:Businesses are focusing on developing innovative products and services that offer greater value to consumers. This can involve introducing new features, improving quality, or creating more affordable alternatives to existing products.

- Marketing and Promotion:Businesses are adapting their marketing strategies to emphasize value and affordability. This includes promoting discounts, loyalty programs, and special offers to attract customers and maintain sales.

Impact of Inflation on Different Sectors of the Economy

Inflation affects different sectors of the economy in varying degrees. Here’s a table outlining the potential impact of inflation on different industries:

| Sector | Impact of Inflation | Examples |

|---|---|---|

| Consumer Discretionary | High impact, as consumers tend to cut back on discretionary spending during periods of inflation. | Restaurants, travel, entertainment, retail |

| Consumer Staples | Moderate impact, as consumers still need to buy essential goods like food, beverages, and household items. | Grocery stores, supermarkets, pharmacies |

| Energy | High impact, as rising energy prices can significantly impact production costs and consumer spending. | Oil and gas companies, utilities |

| Healthcare | Moderate impact, as healthcare is considered an essential service, but inflation can still affect the cost of medical supplies and services. | Hospitals, pharmaceutical companies, medical device manufacturers |

| Technology | Low impact, as technology companies often have pricing power and can pass on costs to consumers. | Software companies, hardware manufacturers, internet service providers |

Long-Term Economic Outlook and Policy Implications

The current economic climate is characterized by a confluence of factors that present both challenges and opportunities. High inflation, concerns about an economic slowdown, and ongoing geopolitical uncertainties are all contributing to a sense of economic volatility. Understanding the potential long-term implications of these trends and exploring potential policy responses is crucial for navigating this complex environment.

Potential Long-Term Implications

The current economic climate raises several questions about the long-term outlook. One key concern is the potential for sustained high inflation. While central banks are actively working to bring inflation under control, the persistence of supply chain disruptions, labor shortages, and geopolitical tensions could contribute to persistent inflationary pressures.

If inflation remains elevated for an extended period, it could erode purchasing power, dampen consumer spending, and lead to a cycle of wage-price spirals. Another significant concern is the potential for an economic slowdown. High inflation, rising interest rates, and geopolitical uncertainty are all factors that could weigh on economic growth.

A prolonged slowdown could lead to job losses, reduced investment, and a decline in living standards.

Policy Responses to Address Economic Challenges, Ceo confidence is down inflation is up but workers are still on top

Governments and central banks have a range of policy tools at their disposal to address the current economic conditions. Central banks are primarily focused on controlling inflation through monetary policy. This typically involves raising interest rates to make borrowing more expensive, thereby slowing economic activity and reducing demand.

Governments can also play a role in addressing economic challenges through fiscal policy. This could involve measures such as increased government spending on infrastructure or social programs, or tax cuts to stimulate economic activity. However, the effectiveness of these measures can be limited by factors such as government debt levels and the potential for crowding out private investment.

Challenges and Opportunities for Businesses

Businesses are facing a complex and uncertain economic environment. High inflation is eroding profit margins, while rising interest rates are making it more expensive to borrow money. Supply chain disruptions and labor shortages are also adding to the challenges.

However, there are also opportunities for businesses that are able to adapt to the changing conditions. Businesses can navigate these uncertainties by:

- Focusing on cost efficiency: Businesses can improve their efficiency by streamlining operations, reducing waste, and negotiating better prices with suppliers.

- Investing in innovation: Innovation can help businesses to develop new products and services that meet evolving consumer needs, create new markets, and differentiate themselves from competitors.

- Building a strong workforce: Businesses need to invest in training and development to attract and retain skilled employees. They should also prioritize employee well-being and create a positive work environment.

- Embracing digital transformation: Digital technologies can help businesses to improve their efficiency, reach new customers, and adapt to changing market conditions.

It’s a curious time in the economy. CEO confidence is down, inflation is up, but workers seem to be holding their own. This disconnect is playing out in the retail sector, with companies like Best Buy seeing sales decline as consumers tighten their belts.

A recent report highlights the impact of inflation on consumer spending at Best Buy , demonstrating how even a seemingly resilient workforce can be affected by broader economic trends. Whether this shift in consumer behavior is temporary or a sign of things to come remains to be seen, but it certainly adds another layer of complexity to the current economic landscape.

It’s a strange time in the economy. CEO confidence is down, inflation is up, but workers are still on top. Maybe that’s why there’s been such a surge in plant-based milk alternatives, but it’s important to remember that most plant milks are lower in key micronutrients than cows milk , so be sure to supplement your diet accordingly.

Ultimately, though, it’s good to see that despite the economic uncertainty, people are still finding ways to take care of themselves and their families.