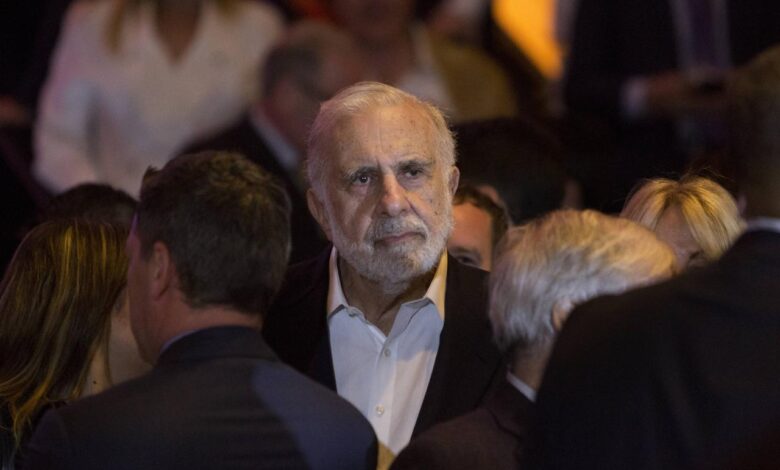

Carl Icahn Calls Out Wall Streets ESG Hypocrisy in McDonalds Letter

Carl icahn calls out wall street hypocrisy over esg investing in letter to mcdonalds shareholders – Carl Icahn calls out Wall Street hypocrisy over ESG investing in letter to McDonald’s shareholders – a statement that sent shockwaves through the financial world. Icahn, a renowned activist investor, launched a scathing critique of Wall Street’s approach to ESG (Environmental, Social, and Governance) investing, accusing them of prioritizing profits over genuine commitment to sustainability.

His letter, addressed to McDonald’s shareholders, directly challenged the fast-food giant’s embrace of ESG principles, arguing that the company’s focus on these issues is driven by Wall Street’s desire to appear virtuous rather than by genuine concern for environmental and social impact.

Icahn’s argument centers around the notion that Wall Street has turned ESG into a marketing tool, using it to attract investors who are increasingly interested in ethical investments. He argues that this approach often leads to superficial commitments to ESG principles, with companies prioritizing short-term gains over long-term sustainability.

Icahn’s letter sparked a debate about the true motivations behind ESG investing, raising questions about whether it is a genuine force for good or simply a trend driven by market forces.

Icahn’s Argument

Carl Icahn, a prominent activist investor, penned a scathing letter to McDonald’s shareholders, taking aim at Wall Street’s embrace of ESG investing and its perceived hypocrisy. He argued that ESG principles, while well-intentioned, are often used as a smokescreen for self-serving corporate agendas and financial gain.

Icahn’s Critique of Wall Street’s ESG Approach

Icahn contends that Wall Street’s adoption of ESG investing is largely driven by a desire to attract investors seeking “virtue signaling” opportunities rather than genuine commitment to sustainable practices. He points to the disconnect between corporations’ ESG pronouncements and their actual environmental and social impact, citing instances where companies tout their ESG credentials while engaging in practices that undermine these principles.

Icahn’s Concerns Regarding McDonald’s ESG Focus

Icahn specifically criticizes McDonald’s decision to prioritize ESG initiatives over shareholder value. He argues that the company’s focus on ESG principles, such as reducing its environmental footprint, has come at the expense of profitability and shareholder returns. He cites the example of McDonald’s decision to phase out paper straws, which he believes was driven by ESG considerations but resulted in increased costs and inconvenience for customers.

ESG Investing

ESG investing is a type of investing that considers environmental, social, and governance factors in addition to financial returns. This approach aims to align investments with values and contribute to a more sustainable future.

ESG Investing Principles

ESG investing is based on the idea that companies that prioritize environmental, social, and governance issues are likely to be more sustainable and profitable in the long term. The core principles of ESG investing are:

- Environmental: This principle focuses on a company’s impact on the environment, including its carbon emissions, resource consumption, and waste management practices. Investors may look for companies that are reducing their environmental footprint and promoting sustainable practices.

- Social: This principle considers a company’s social responsibility and its impact on its employees, customers, and communities. Investors may favor companies that promote diversity and inclusion, pay fair wages, and operate ethically.

- Governance: This principle focuses on a company’s corporate governance practices, including its board structure, executive compensation, and transparency. Investors may prefer companies with strong governance structures that ensure accountability and ethical decision-making.

Motivations Behind ESG Investing

There are various motivations behind ESG investing, both from the perspective of corporations and investors.

Corporate Perspective

- Enhanced Reputation: Companies that embrace ESG principles often enjoy a better public image and stronger brand loyalty, attracting customers and employees who value sustainability and social responsibility. This can lead to increased market share and revenue.

- Reduced Risk: By addressing environmental and social risks, companies can mitigate potential financial losses and reputational damage. For example, companies that reduce their carbon emissions may be less vulnerable to climate change-related regulations and risks.

- Access to Capital: Investors are increasingly allocating capital to ESG-focused companies, creating a growing pool of funding available to these businesses. This can provide companies with access to capital at lower costs.

Investor Perspective

- Positive Impact: ESG investing allows investors to align their investments with their values and contribute to a more sustainable and equitable world. Investors may choose to invest in companies that are tackling climate change, promoting human rights, or improving social welfare.

- Financial Returns: While ESG investing is not solely about financial returns, studies have shown that companies with strong ESG practices often outperform their peers financially in the long term. This is because ESG factors can be linked to reduced risk, improved efficiency, and stronger stakeholder relationships.

- Risk Management: ESG investing can help investors manage risk by identifying and mitigating potential environmental, social, and governance risks that could impact their investments. This can lead to more stable and predictable returns.

Benefits of ESG Investing

ESG investing offers several potential benefits, including:

- Improved Financial Performance: Studies have shown that companies with strong ESG practices often outperform their peers financially. This is because ESG factors can be linked to reduced risk, improved efficiency, and stronger stakeholder relationships.

- Reduced Risk: By addressing environmental and social risks, companies can mitigate potential financial losses and reputational damage. For example, companies that reduce their carbon emissions may be less vulnerable to climate change-related regulations and risks.

- Enhanced Reputation: Companies that embrace ESG principles often enjoy a better public image and stronger brand loyalty, attracting customers and employees who value sustainability and social responsibility.

- Access to Capital: Investors are increasingly allocating capital to ESG-focused companies, creating a growing pool of funding available to these businesses. This can provide companies with access to capital at lower costs.

- Positive Social Impact: ESG investing can help to address pressing social and environmental challenges, such as climate change, poverty, and inequality. This can contribute to a more sustainable and equitable world.

Drawbacks of ESG Investing

While ESG investing offers several potential benefits, it also has some drawbacks:

- Data Challenges: Measuring and assessing ESG performance can be challenging, as there is no standardized framework or set of metrics. This can make it difficult for investors to compare companies and assess their ESG credentials.

- Greenwashing: Some companies may engage in “greenwashing” by exaggerating their ESG performance or making misleading claims. This can make it difficult for investors to identify genuine ESG leaders.

- Limited Investment Options: The number of companies that are actively addressing ESG issues is still relatively small. This can limit investment options for investors who are seeking to invest in companies with strong ESG credentials.

McDonald’s and ESG: Carl Icahn Calls Out Wall Street Hypocrisy Over Esg Investing In Letter To Mcdonalds Shareholders

McDonald’s has made significant strides in implementing ESG practices and initiatives, reflecting the growing importance of these factors for businesses and investors. The company’s efforts encompass various areas, including sustainable sourcing, employee well-being, and environmental conservation.

McDonald’s ESG Practices and Initiatives

McDonald’s has Artikeld its ESG commitments and progress in its annual Sustainability Report. Some key initiatives include:

- Sustainable Sourcing:McDonald’s aims to source 100% of its key ingredients sustainably by 2030. This includes sourcing beef from farms that meet specific sustainability standards, such as responsible land management and animal welfare practices.

- Reducing Environmental Impact:The company is working to reduce its environmental footprint through initiatives such as energy efficiency improvements in restaurants, reducing waste, and promoting sustainable packaging.

- Employee Well-being:McDonald’s focuses on creating a positive and inclusive work environment for its employees. This includes initiatives like providing training and development opportunities, promoting diversity and inclusion, and offering competitive wages and benefits.

Alignment with Icahn’s Criticisms, Carl icahn calls out wall street hypocrisy over esg investing in letter to mcdonalds shareholders

Icahn’s criticisms of McDonald’s ESG policies center around his belief that the company is prioritizing these initiatives over shareholder value. He argues that ESG initiatives are often driven by political agendas and can lead to increased costs for businesses. McDonald’s, however, maintains that its ESG initiatives are aligned with its business strategy and contribute to long-term value creation.

The company argues that sustainable sourcing practices improve supply chain resilience and reduce costs in the long run. Similarly, investments in energy efficiency and waste reduction can lead to cost savings and enhance operational efficiency.

Potential Impact of Icahn’s Letter

Icahn’s letter has raised concerns about the potential for shareholder activism to influence McDonald’s ESG strategy. While the company has not yet announced any changes to its ESG policies, the letter may prompt a re-evaluation of its approach and a more focused effort to communicate the value of its initiatives to shareholders.

Carl Icahn’s recent letter to McDonald’s shareholders, calling out Wall Street’s hypocrisy on ESG investing, is a timely reminder that corporate responsibility can sometimes be a facade. While Icahn focuses on the fast food giant, the broader debate on ESG investing is certainly relevant in California, where education is set to be spared from divisive statewide election battles this year.

It’s a welcome respite from the heated political discourse that often overshadows important policy discussions, allowing for a more focused dialogue on how to improve education outcomes. Icahn’s critique of ESG investing, though aimed at McDonald’s, could spark similar discussions in other sectors, prompting companies to be more transparent and accountable in their social and environmental commitments.

It is possible that McDonald’s may increase its transparency regarding its ESG investments and their impact on financial performance. The company may also engage in more dialogue with investors to address concerns and build consensus around its ESG priorities.

Carl Icahn’s call out of Wall Street hypocrisy over ESG investing in his letter to McDonald’s shareholders is a fascinating example of how financial motivations can sometimes clash with social responsibility. It reminds me of the incredible stories of resilience and solidarity found in inside the secret network of women who performed abortions before Roe , where individuals risked everything to help others in a time of great need.

Perhaps Icahn’s bold stance on ESG investing will inspire similar acts of defiance in the face of corporate greed, reminding us that true change often comes from unexpected sources.

Wall Street’s Role

Wall Street has played a significant role in promoting ESG investing, often framing it as a win-win for both investors and the environment. However, the motivations and practices of Wall Street in this domain have raised concerns about potential conflicts of interest and the true impact of their approach to ESG.

Carl Icahn’s call out of Wall Street hypocrisy over ESG investing in his letter to McDonald’s shareholders is a stark reminder that financial motivations can often overshadow genuine social concerns. It’s a similar situation to how influencers hype crypto without disclosing their financial ties, as highlighted in this recent article , leading to potential harm for unsuspecting investors.

Ultimately, both scenarios expose the need for greater transparency and accountability in financial markets, ensuring that investors are making informed decisions based on genuine information.

Potential Conflicts of Interest

Wall Street’s involvement in ESG investing raises concerns about potential conflicts of interest. Investment banks, asset managers, and other financial institutions often promote ESG strategies while also engaging in activities that may not align with ESG principles. For example, a bank may offer green bonds while simultaneously financing fossil fuel projects.

This creates a potential conflict of interest, where the financial interests of the institution may outweigh the environmental and social goals of ESG investing.

Comparison of Perspectives

Icahn’s criticism of Wall Street’s ESG practices aligns with the views of some who argue that ESG investing has become a marketing tool for financial institutions to attract investors and generate fees, rather than a genuine commitment to sustainability. Critics point to the lack of standardized metrics and the potential for “greenwashing,” where companies make exaggerated or misleading claims about their ESG performance.

However, others argue that Wall Street’s involvement in ESG is crucial for driving capital towards sustainable investments and promoting corporate accountability. They emphasize the importance of market forces and investor pressure in influencing corporate behavior.

Impact and Implications

Icahn’s letter to McDonald’s shareholders, while seemingly focused on a single company, carries significant implications for the broader ESG investing landscape. It has sparked a debate about the effectiveness and motivations behind ESG investing, potentially leading to increased scrutiny and adjustments in corporate ESG strategies.

Potential Impact on ESG Investing Landscape

Icahn’s argument challenges the notion that ESG investing is purely driven by ethical considerations. By highlighting the potential conflicts of interest and the influence of Wall Street in shaping ESG agendas, he raises concerns about the integrity and transparency of ESG investing practices.

This critique could lead to a reevaluation of ESG investing strategies, potentially prompting investors to:

- Scrutinize the underlying metrics and methodologies used to assess ESG performance.

- Demand greater transparency from companies and asset managers regarding their ESG commitments and actions.

- Shift their focus towards more tangible and measurable ESG factors, such as environmental impact and social responsibility.

This increased scrutiny could also lead to a more nuanced understanding of ESG investing, recognizing that it can be a complex and multifaceted approach with varying motivations.

Implications for Future Corporate ESG Strategies

Icahn’s letter emphasizes the need for companies to prioritize shareholder value and financial performance alongside their ESG commitments. This perspective suggests that corporations should focus on ESG initiatives that demonstrably contribute to long-term profitability and sustainability.

- Companies may need to develop more robust and transparent ESG reporting frameworks to demonstrate the tangible benefits of their ESG initiatives to investors.

- They may also need to align their ESG strategies with their core business operations and ensure that these initiatives are integrated into their overall strategic planning.

This shift in focus could lead to a more practical and results-oriented approach to ESG, with companies prioritizing initiatives that generate tangible value for both shareholders and society.

Increased Scrutiny and Debate

Icahn’s letter has ignited a public debate about the role of ESG investing in corporate governance and shareholder value. This debate is likely to intensify, with investors, policymakers, and corporations engaging in discussions about:

- The appropriate balance between financial performance and ESG considerations.

- The role of ESG ratings and frameworks in assessing corporate performance.

- The potential for ESG investing to be used for political or ideological agendas.

This increased scrutiny and debate will likely lead to a more rigorous examination of ESG investing practices, promoting greater transparency, accountability, and ultimately, a more robust and effective approach to sustainable investing.

Conclusion

Icahn’s bold move has ignited a crucial conversation about the role of ESG in corporate decision-making. His argument, though controversial, has brought to light the potential for hypocrisy and superficiality within the ESG movement. The debate surrounding Icahn’s letter highlights the need for a more nuanced understanding of ESG investing, one that prioritizes genuine impact over marketing.

The future of ESG investing, and its ability to drive positive change, hinges on addressing these concerns and ensuring that corporations are held accountable for their commitments to sustainability.