Bronx DA Urges Credit Card Companies to Fight Ghost Guns

Bronx District Attorney urges credit card companies to cut ties with ghost gun sellers, a bold move aimed at curbing the rising tide of gun violence in the borough. The DA argues that credit card companies are inadvertently facilitating the purchase of ghost gun components, making it easier for criminals to obtain untraceable firearms.

This controversial call to action raises important questions about the role of financial institutions in gun violence and the legal implications of severing ties with ghost gun sellers.

Ghost guns, which are firearms assembled from parts purchased online or at gun shows, have become increasingly prevalent in recent years. They lack serial numbers, making them difficult to trace and often favored by criminals seeking to avoid detection.

The Bronx DA contends that credit card companies are unwittingly contributing to this problem by allowing transactions for ghost gun components. The DA’s statement highlights the complex interplay between financial institutions, gun violence, and the accessibility of firearms.

The Bronx District Attorney’s Statement

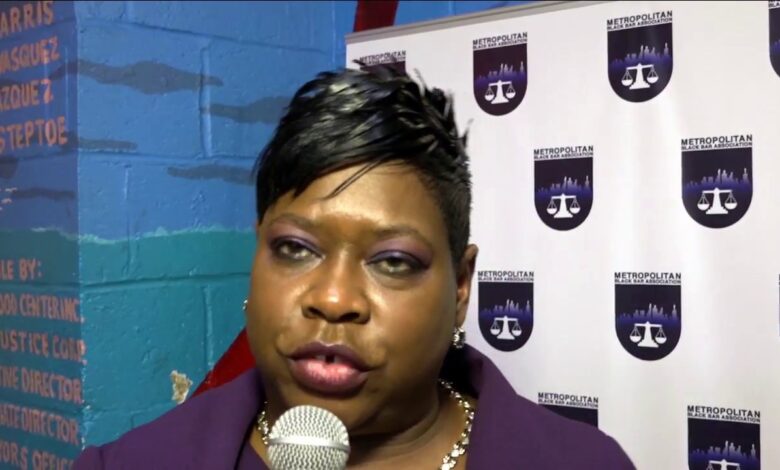

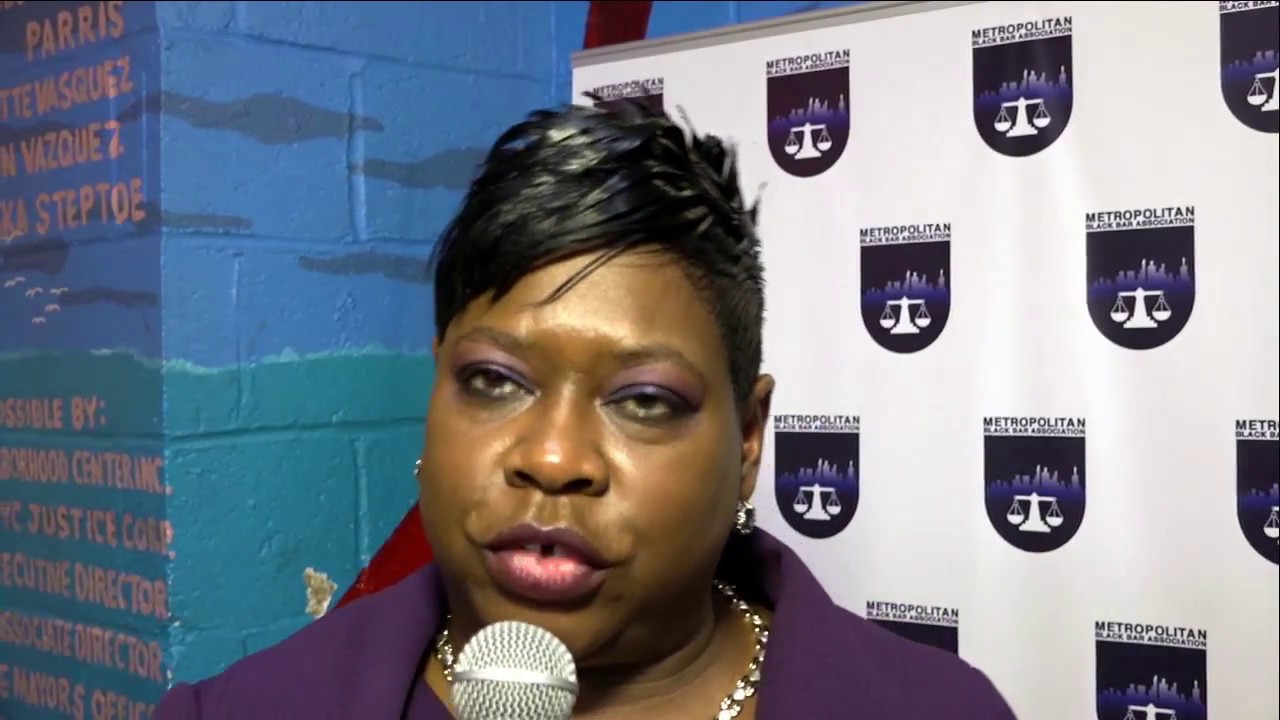

The Bronx District Attorney, Darcel D. Clark, has issued a strong statement urging credit card companies to sever ties with ghost gun sellers. This call for action is rooted in the alarming rise of ghost guns, which are firearms assembled from kits or parts without serial numbers, making them difficult to trace and contributing to gun violence.

Concerns Raised by the District Attorney

The District Attorney’s concerns are centered around the ease with which ghost gun kits can be purchased online and the role credit card companies play in facilitating these transactions.

The Bronx District Attorney’s call for credit card companies to cut ties with ghost gun sellers is a bold move in the fight against gun violence. It’s a reminder that the fight for justice requires innovative approaches, much like Justice Jackson’s return to a transformed Supreme Court, where she brings a fresh perspective and valuable experience.

Ultimately, the goal is the same: to create a safer and fairer society, one where gun violence is no longer a pervasive threat.

The Ease of Access

- Ghost gun kits can be easily purchased online, often without background checks or age verification.

- These kits are readily available on various online platforms, making them accessible to individuals who may not be eligible to purchase firearms legally.

The Role of Credit Card Companies

- Credit card companies are enabling the purchase of these kits by processing payments for online transactions.

- This financial support, according to the District Attorney, contributes to the proliferation of ghost guns and poses a significant threat to public safety.

Legal and Ethical Arguments

The District Attorney’s call for action is supported by both legal and ethical arguments.

Legal Arguments

- The District Attorney argues that credit card companies have a legal obligation to prevent the use of their services for illegal activities.

- This obligation stems from federal laws that require financial institutions to implement measures to combat money laundering and other financial crimes.

Ethical Arguments

- The District Attorney emphasizes the ethical responsibility of credit card companies to prioritize public safety.

- By facilitating the purchase of ghost guns, credit card companies are contributing to a problem that results in gun violence and loss of life.

Ghost Guns and Their Impact

Ghost guns are a growing concern in the Bronx and across the country. They are firearms that are assembled from parts that can be purchased online or at gun shows, without any background checks or serial numbers. This makes them virtually untraceable, and therefore highly attractive to criminals.

The Prevalence of Ghost Guns in the Bronx, Bronx district attorney urges credit card companies to cut ties with ghost gun sellers

The Bronx District Attorney’s office has seen a significant increase in the number of ghost guns seized in recent years. In 2022, the office recovered over 100 ghost guns, a sharp increase from previous years. This trend is consistent with national data, which shows that ghost guns are becoming increasingly common across the country.

The Bronx District Attorney’s call for credit card companies to cut ties with ghost gun sellers is a bold move, and it’s interesting to see how this plays out in the world of finance. It’s a bit like watching Jared and Ivanka without the power or the masks – they’re still recognizable, but their impact is much less potent.

The DA’s strategy could potentially cripple the ghost gun market by making it harder for these weapons to be purchased, but only time will tell if it’s truly effective.

The rise of ghost guns is directly tied to the increase in gun violence, especially in the Bronx. They are often used in shootings and other crimes, making them a serious public safety threat.

The Role of Credit Card Companies in Facilitating Ghost Gun Purchases

Credit card companies play a significant role in facilitating the purchase of ghost gun components. Many online retailers that sell ghost gun parts accept credit cards, making it easy for individuals to purchase these components without raising any red flags.

This is a serious problem because it allows criminals to easily obtain the materials they need to build ghost guns.

The Bronx District Attorney’s call for credit card companies to sever ties with ghost gun sellers is a crucial step in combating gun violence. It’s a reminder that even seemingly mundane aspects of our lives can have a profound impact on public safety.

Similar to the challenges faced by teachers who find themselves in job-sharing situations, like those discussed on this forum , addressing these issues requires a multi-faceted approach. By cutting off financial support for ghost gun sellers, we can create a safer environment for everyone.

Legal and Ethical Considerations: Bronx District Attorney Urges Credit Card Companies To Cut Ties With Ghost Gun Sellers

The Bronx District Attorney’s call for credit card companies to sever ties with ghost gun sellers raises significant legal and ethical questions. This action, while seemingly aimed at reducing gun violence, presents a complex landscape of legal implications and potential ethical dilemmas.

Legal Implications of Severing Ties

The legal implications of credit card companies severing ties with ghost gun sellers are multifaceted. It’s important to understand the potential legal challenges that could arise from such a move.

- Antitrust Concerns:Credit card companies may face antitrust scrutiny if their actions are perceived as colluding to restrict competition among ghost gun sellers. This could be argued as a form of price-fixing or market manipulation, violating antitrust laws. For example, a group of credit card companies acting in unison to block ghost gun sellers could be seen as a concerted effort to stifle competition, which is illegal under antitrust laws.

- First Amendment Rights:Ghost gun sellers could argue that severing ties with credit card companies violates their First Amendment rights to free speech and commerce. They might claim that this action restricts their ability to operate their businesses and communicate with potential customers.

- Due Process Concerns:Ghost gun sellers might argue that they are being denied due process by being cut off from financial services without proper legal proceedings. They might claim that credit card companies are acting as judge and jury, without affording them the opportunity to defend themselves.

Potential Legal Challenges

Ghost gun sellers or their suppliers might launch legal challenges against credit card companies, citing various legal arguments:

- Breach of Contract:Ghost gun sellers might argue that credit card companies are breaching existing contracts by refusing to process their transactions.

- Discrimination:They could argue that credit card companies are discriminating against them based on their business model, which could be viewed as a violation of equal protection under the law.

- Unfair Trade Practices:Ghost gun sellers might allege that credit card companies are engaging in unfair trade practices by using their market power to harm their business.

Ethical Considerations

The role of credit card companies in gun violence raises significant ethical concerns.

- Corporate Social Responsibility:Credit card companies have a responsibility to operate ethically and consider the social impact of their actions. Their involvement in facilitating transactions for ghost gun sellers could be seen as contributing to gun violence.

- Public Safety:Credit card companies have a responsibility to prioritize public safety. By facilitating transactions for ghost gun sellers, they may be indirectly contributing to gun violence and endangering the public.

- Moral Obligation:Some argue that credit card companies have a moral obligation to refuse to process transactions for products that are associated with harm, such as ghost guns.

Closing Summary

The Bronx DA’s call for credit card companies to cut ties with ghost gun sellers has ignited a debate about the role of financial institutions in combating gun violence. While the legal and ethical implications of such a move are complex, it underscores the need for a multi-pronged approach to addressing the issue of ghost guns.

By raising awareness and promoting responsible practices, credit card companies can play a crucial role in preventing the proliferation of these dangerous weapons. This move is a reminder that the fight against gun violence requires collaboration across multiple sectors, and financial institutions have a responsibility to act in the interest of public safety.