Oil Executives Defend High Gas Prices at House Hearing

Blamed for high gas prices oil executives defend themselves at a house hearing – Oil executives faced a grilling at a recent House hearing, defending their role in the skyrocketing gas prices that are straining American wallets. The hearing brought to light the complex interplay of global events, corporate decisions, and consumer impact, leaving many wondering who is truly responsible for the pain at the pump.

Lawmakers, fueled by public frustration, pressed oil executives on their profit margins, production levels, and potential price manipulation. The executives, in turn, pointed to global factors like the war in Ukraine and increased demand as driving forces behind the price hikes, arguing that their hands were tied in a volatile market.

The Current State of Gas Prices: Blamed For High Gas Prices Oil Executives Defend Themselves At A House Hearing

The cost of gasoline has been a major concern for consumers and businesses alike, with prices fluctuating significantly in recent months. Understanding the current state of gas prices is crucial for navigating the economic landscape and making informed decisions.

Recent Trends and Fluctuations

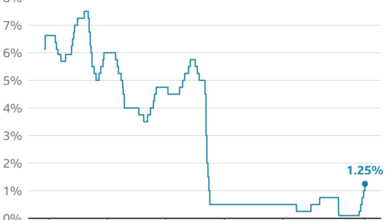

Gas prices have been on an upward trajectory since the beginning of 2023, driven by a combination of factors. The global demand for oil has increased as economies recover from the pandemic, while supply constraints, including the ongoing war in Ukraine and production cuts by OPEC+, have contributed to rising prices.

This has resulted in significant fluctuations in gas prices, with prices reaching record highs in certain regions.

Average Gas Prices Across Regions

The average gas price varies considerably across different regions of the United States. According to AAA, as of [Date], the national average price for regular gasoline is [Price]. However, there are significant regional disparities, with some states experiencing much higher prices than others.

For example, [State] has the highest average gas price at [Price], while [State] has the lowest at [Price]. These disparities are often attributed to factors such as state taxes, local market competition, and transportation costs.

Impact on Consumers and Businesses

High gas prices have a significant impact on consumers and businesses. For consumers, rising gas prices eat into disposable income, leaving less money for other expenses. This can lead to reduced spending on goods and services, impacting overall economic activity.

For businesses, higher fuel costs increase transportation expenses, which can be passed on to consumers in the form of higher prices or reduced profits. Additionally, high gas prices can lead to increased demand for fuel-efficient vehicles, potentially impacting the automotive industry.

Watching oil executives try to explain away sky-high gas prices at a House hearing feels a lot like trying to navigate a cluttered app store full of outdated, abandoned apps. Just like those apps, these executives seem stuck in the past, clinging to outdated practices and refusing to adapt to a changing world.

It’s time for a clean sweep, just like Apple needs to do with its App Store. Why Apple needs to evict old and unsupported app store apps Maybe then we’ll see some real progress in addressing the rising cost of fuel, and maybe then we’ll see some innovation in the tech world.

Potential Economic Consequences

The current state of gas prices has the potential to impact the economy in several ways. High gas prices can lead to inflation, as businesses pass on increased fuel costs to consumers. This can erode purchasing power and reduce consumer confidence, potentially leading to a slowdown in economic growth.

Additionally, high gas prices can impact the transportation sector, leading to higher shipping costs and potentially disrupting supply chains.

The Role of Oil Executives

Oil executives play a crucial role in the global energy industry, influencing the production, distribution, and pricing of oil and gas. Their decisions and actions have a significant impact on the energy landscape, including the price of gasoline.

Responsibilities and Influence of Oil Executives

Oil executives are responsible for managing various aspects of the oil and gas industry, including:

- Exploration and production of oil and gas resources.

- Refining and processing crude oil into gasoline and other products.

- Marketing and distribution of oil and gas products to consumers and businesses.

- Investing in research and development of new technologies and energy sources.

- Compliance with environmental regulations and safety standards.

Oil executives have significant influence over the supply and demand of oil and gas, which directly impacts gas prices. Their decisions regarding production levels, investments, and pricing strategies can influence the market dynamics and ultimately determine the price consumers pay at the pump.

Motivations and Objectives of Oil Executives

Oil executives are motivated by a variety of factors, including:

- Maximizing profits:Like any business, oil companies aim to maximize profits for their shareholders. This often involves striking a balance between maximizing production and maintaining high prices.

- Maintaining market share:Oil executives are also motivated to maintain or increase their company’s market share in the global energy market. This can involve strategic acquisitions, mergers, and investments.

- Long-term sustainability:Many oil executives recognize the need for long-term sustainability and are investing in renewable energy sources and alternative fuels.

- Addressing climate change:Some oil executives are actively working to reduce their company’s environmental footprint and contribute to efforts to combat climate change.

Arguments Presented by Oil Executives

When defending their actions regarding gas prices, oil executives often cite the following arguments:

- Global oil market dynamics:Oil executives often point to factors beyond their control, such as global supply and demand, geopolitical tensions, and economic conditions, as major influences on gas prices.

- Investment in new technologies:They emphasize their investments in new technologies, such as renewable energy and carbon capture, as evidence of their commitment to sustainability and reducing reliance on fossil fuels.

- Competition and market forces:Oil executives often argue that competition within the industry and market forces, such as supply and demand, play a significant role in determining gas prices.

- Government regulations:Some oil executives point to government regulations, such as taxes and environmental regulations, as contributing factors to higher gas prices.

The House Hearing and Public Scrutiny

The House hearing on gas prices, held in July 2022, was a highly anticipated event, drawing significant public attention. Lawmakers grilled oil executives about their role in the rising gas prices, demanding explanations and accountability.

It’s been a week of high-stakes hearings, with oil executives facing the heat for soaring gas prices. Meanwhile, a different kind of pressure is being applied to retail giants like Dollar General and Dollar Tree, as a senator publicly criticized their working conditions.

It’s a reminder that while we’re grappling with the cost of living, the fight for fair treatment and decent wages extends far beyond the gas pump.

Key Points Discussed During the Hearing

The hearing was dominated by a heated exchange between lawmakers and oil executives, with accusations and justifications flying back and forth. Several key points emerged:

- Profiteering Accusations:Lawmakers accused oil companies of price gouging and taking advantage of the situation to increase profits. They pointed to record profits reported by major oil companies during a time of high gas prices, suggesting that companies were not passing on savings to consumers.

- Supply and Demand:Oil executives defended their actions, arguing that the rising gas prices were a result of global supply chain disruptions, increased demand, and geopolitical tensions. They emphasized the role of the war in Ukraine and the subsequent sanctions on Russia, a major oil producer.

- Production Levels:Lawmakers also questioned oil executives about their production levels, arguing that they were not producing enough oil to meet the current demand. Executives countered that they were operating at near-capacity levels and that increasing production would take time.

- Alternative Energy Sources:The hearing also touched upon the need to invest in alternative energy sources, such as renewable energy, to reduce dependence on fossil fuels. Oil executives acknowledged the importance of renewable energy but argued that it would take time to transition to a fully renewable energy system.

It’s a wild week in politics, with oil executives facing the heat for high gas prices at a House hearing, while over in Ohio, the final days of the MAGA Senate primary are heating up. The candidates are vying for the support of voters who are deeply concerned about the economy and the direction of the country, a sentiment that likely echoes in the halls of Congress where those gas prices are a hot topic.

The primary race is a microcosm of the larger national conversation, and it’s worth checking out inside the final days of Ohio’s MAGA senate primary to see how it’s playing out. The outcome of this primary, and the national conversation about gas prices, will have a significant impact on the 2024 elections.

Concerns Raised by Lawmakers

Lawmakers expressed several key concerns regarding the high gas prices and the role of oil executives:

- Consumer Burden:Lawmakers expressed deep concern about the impact of high gas prices on American consumers, particularly low-income families and those who rely heavily on their vehicles for transportation. They emphasized the financial strain and hardship caused by the rising costs.

- Lack of Transparency:Lawmakers questioned the lack of transparency in the oil industry, alleging that companies were not being open about their pricing practices and profit margins. They demanded greater accountability and disclosure of information to consumers.

- Anti-Competitive Practices:Some lawmakers accused oil companies of engaging in anti-competitive practices, such as manipulating supply chains and suppressing competition, to maintain high prices. They called for investigations into these practices.

- Climate Change:The hearing also highlighted the need to address climate change, with some lawmakers urging the oil industry to transition to cleaner energy sources to reduce carbon emissions. They argued that continued reliance on fossil fuels would exacerbate the climate crisis.

Potential Consequences of the Hearing, Blamed for high gas prices oil executives defend themselves at a house hearing

The House hearing on gas prices had significant potential consequences for the oil industry and its executives:

- Increased Regulatory Scrutiny:The hearing could lead to increased regulatory scrutiny of the oil industry, with lawmakers pushing for stricter oversight of pricing practices, production levels, and environmental impact. This could result in new regulations and enforcement measures.

- Public Pressure:The hearing brought the issue of gas prices to the forefront of public discourse, raising awareness of the problem and increasing public pressure on oil companies to address the issue. This could lead to boycotts, protests, and other forms of public action.

- Investor Concerns:The hearing could also raise concerns among investors, who may be hesitant to invest in oil companies if they perceive a high risk of regulatory action or negative public perception. This could impact the industry’s financial performance.

- Shift in Energy Policy:The hearing could influence the direction of energy policy, with lawmakers potentially pushing for greater investment in renewable energy sources and less reliance on fossil fuels. This could have a long-term impact on the oil industry.

The Economic and Political Context

The current gas price situation is not solely determined by the actions of oil executives. A complex interplay of economic and political factors contributes to the volatility and upward pressure on prices. Understanding these broader influences is crucial to grasp the full picture and develop effective policy responses.

Global Events and Oil Production

The war in Ukraine has significantly impacted global oil production and prices. Russia, a major oil exporter, has faced sanctions, leading to disruptions in supply chains and concerns about future production. This has contributed to a tightening of the global oil market, pushing prices higher.

Additionally, the conflict has heightened geopolitical tensions, further adding to uncertainty and price volatility.

The Political Implications of Gas Prices

The high gas prices have significant political implications. They have a direct impact on consumer spending, inflation, and public opinion. Rising gas prices can erode public support for the government, particularly during election cycles.

The gas price issue has the potential to become a key political issue, influencing policy decisions and the outcome of elections.

The public demands action from policymakers to address the problem. This can lead to pressure for increased regulation of the oil industry, exploration of alternative energy sources, or government intervention in the market.

Potential Solutions and Future Outlook

The high gas prices have sparked a national conversation about potential solutions. While the current situation is complex and multifaceted, several strategies are being proposed to address the issue. These solutions range from government interventions to industry practices and consumer behavior changes.

Understanding the feasibility and potential impact of each solution is crucial to navigating this complex issue.

Government Interventions

Government intervention plays a significant role in shaping the energy landscape. Policymakers can implement various measures to influence gas prices, supply, and demand.

- Strategic Petroleum Reserve (SPR) Releases:The U.S. government can release oil from its strategic reserves to increase supply and potentially lower prices. However, the effectiveness of this strategy is debatable, as it is a temporary measure with limited impact on long-term trends.

- Tax Incentives and Subsidies:Government incentives can encourage investments in renewable energy sources, potentially reducing dependence on fossil fuels and mitigating price fluctuations. However, the effectiveness of such programs depends on their scale and implementation.

- Price Controls:Price controls aim to regulate the price of gasoline, but they can lead to shortages and unintended consequences, such as black markets and reduced investment in the oil industry.

- Antitrust Regulations:Addressing potential market manipulation by oil companies can ensure fair competition and prevent price gouging. However, such regulations require careful consideration to avoid stifling innovation and investment in the industry.

Industry Practices

The oil industry itself can play a role in addressing high gas prices.

- Increased Production:Boosting oil production can help increase supply and potentially lower prices. However, this requires significant investment and time, and may not be feasible in the short term.

- Improving Efficiency:Optimizing refining processes and reducing operational costs can help lower production costs and potentially lead to lower gas prices.

- Investment in Renewable Energy:Oil companies can invest in renewable energy sources to diversify their portfolio and reduce their reliance on fossil fuels.

- Transparency and Accountability:Increased transparency in pricing practices and supply chain information can help build public trust and potentially prevent price manipulation.

Consumer Behavior Changes

Individual consumers can also contribute to mitigating high gas prices.

- Fuel Efficiency:Choosing fuel-efficient vehicles or practicing eco-driving techniques can reduce fuel consumption and lower overall costs.

- Public Transportation and Carpooling:Utilizing public transportation or carpooling options can reduce individual dependence on personal vehicles.

- Reducing Driving:Consolidating errands and reducing unnecessary driving can contribute to lower fuel consumption.

- Alternative Transportation:Exploring alternative modes of transportation like cycling or walking can reduce reliance on gasoline-powered vehicles.

Long-Term Outlook

The future of gas prices is influenced by several factors, including global energy demand, technological advancements, and political stability.

- Global Energy Demand:As the global population grows and economies develop, the demand for energy, including gasoline, is likely to increase. This could potentially lead to higher gas prices.

- Technological Advancements:Innovations in renewable energy technologies and electric vehicles could reduce dependence on fossil fuels and potentially lower gas prices.

- Political Stability:Geopolitical events and conflicts can significantly impact oil production and prices. Increased stability in oil-producing regions could lead to more predictable prices.

Ending Remarks

The hearing provided a platform for both sides of the gas price debate to present their arguments. While no concrete solutions emerged, the discussion highlighted the urgent need for a comprehensive approach to addressing the issue. The future of gas prices remains uncertain, but the hearing served as a stark reminder of the complex web of factors influencing this critical aspect of the American economy.