Bitcoin Smarter: Key Advantages Explained

Bitcoin smarter key advantages – Bitcoin Smarter: Key Advantages Explained takes center stage, offering a compelling exploration of the digital currency’s unique attributes. This guide delves into the core features that make Bitcoin a compelling alternative to traditional financial systems.

Bitcoin’s decentralized nature, scarcity, and transparency are just a few of the advantages that have made it a global phenomenon. We’ll explore how these features contribute to Bitcoin’s security, value proposition, and potential for long-term growth. Prepare to discover how Bitcoin is empowering individuals, disrupting traditional finance, and paving the way for a more inclusive and accessible future.

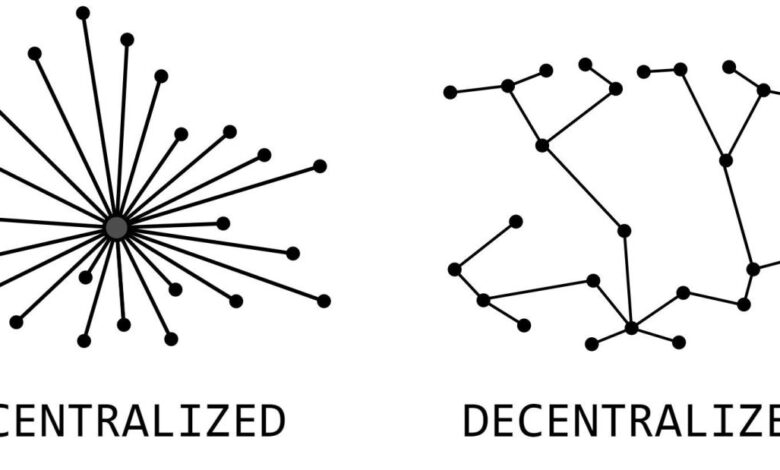

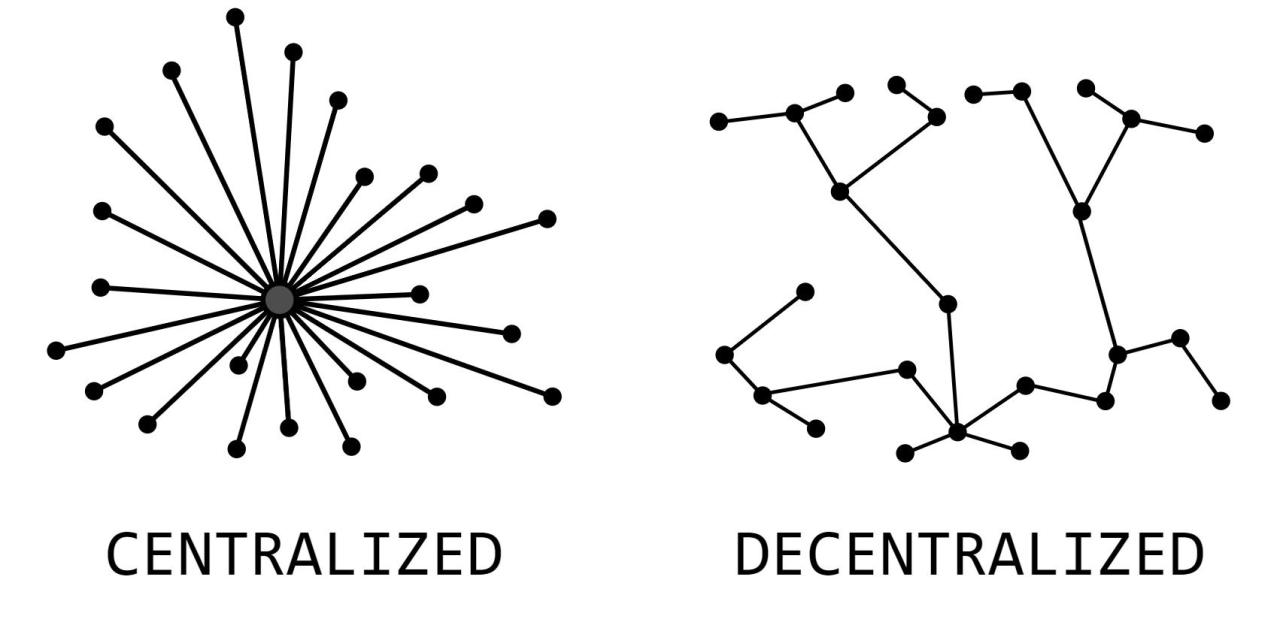

Decentralization and Security

Bitcoin’s decentralized nature is one of its most fundamental and defining features. It’s a cornerstone of its security, ensuring that no single entity controls the network. This inherent decentralization makes Bitcoin resistant to censorship, manipulation, and single points of failure, contributing to its robustness and longevity.

Decentralization in Bitcoin

Decentralization in Bitcoin refers to the distribution of power and control across a vast network of computers called nodes. These nodes are responsible for verifying and recording transactions on the Bitcoin blockchain, ensuring that no single entity holds absolute authority over the network.

Bitcoin’s decentralized nature and limited supply make it a potentially valuable asset, but understanding your financial standing is crucial before diving in. Take a moment to assess your financial health with this quiz and get personalized advice: where do you stand financially get a score on this quiz and our advice.

Once you have a clear picture, you can explore Bitcoin’s potential benefits, like its potential for long-term growth and its role in a diversified investment portfolio.

This distributed ledger technology (DLT) empowers a collective consensus, where decisions are reached through a decentralized and democratic process.

How Decentralization Enhances Security

- Resistance to Censorship:Bitcoin’s decentralized nature makes it highly resistant to censorship. Since no single entity controls the network, no individual or organization can arbitrarily block transactions or prevent users from accessing the Bitcoin network. This is a stark contrast to traditional financial systems, where centralized authorities can restrict access or impose limitations on transactions.

Bitcoin’s decentralized nature offers a unique advantage for financial independence, making it a valuable asset for those seeking greater control over their finances. This freedom can be particularly important for family caregivers, who often juggle demanding responsibilities with limited resources.

A recent article on 3 strategies for supporting family caregivers at work highlights the need for flexible work arrangements and supportive policies to ease the burden on these individuals. Just as Bitcoin empowers users with financial control, supporting caregivers with flexible work options empowers them to manage their responsibilities effectively and contribute to a more balanced life.

- Protection Against Single Points of Failure:Bitcoin’s decentralized architecture eliminates the risk of single points of failure. If one node or server goes offline, the network continues to function seamlessly, as other nodes take over its responsibilities. This inherent redundancy ensures the network’s resilience and prevents disruptions caused by outages or attacks on individual components.

- Enhanced Transparency and Accountability:The decentralized nature of Bitcoin fosters transparency and accountability. Every transaction on the Bitcoin blockchain is publicly recorded and visible to all participants. This open and immutable ledger eliminates the potential for manipulation or hidden transactions, fostering trust and confidence in the system.

Cryptography’s Role in Securing Bitcoin

Cryptography plays a vital role in securing Bitcoin transactions and protecting against fraud. Bitcoin utilizes advanced cryptographic techniques to ensure the integrity and authenticity of transactions.

- Digital Signatures:Each Bitcoin transaction is digitally signed using private keys, which are unique to each user. These digital signatures act as proof of ownership and authorization, preventing unauthorized transactions and ensuring the legitimacy of each transfer.

- Hashing:Bitcoin utilizes cryptographic hashing algorithms to create unique fingerprints for each transaction. These hashes are used to identify and verify transactions on the blockchain, preventing tampering and ensuring the immutability of the transaction record.

- Encryption:Bitcoin uses encryption to protect sensitive data, such as private keys and transaction details. This ensures that only authorized individuals can access and decrypt the information, safeguarding the network from unauthorized access and data breaches.

“Bitcoin is the first decentralized digital currency, meaning that it is not subject to control by any single entity or government. It is based on a peer-to-peer network, where users can send and receive bitcoins directly to each other without the need for a third party.”

Bitcoin.org

Scarcity and Value

Bitcoin’s limited supply is a fundamental principle that underpins its value proposition. This inherent scarcity, coupled with the growing demand for Bitcoin as a store of value and a medium of exchange, contributes significantly to its potential for long-term price appreciation.

Bitcoin’s Limited Supply

Bitcoin’s scarcity is directly linked to its code, which restricts the total number of Bitcoins that can ever be created. The maximum supply of Bitcoin is capped at 21 million, a hard limit that cannot be changed. This finite supply ensures that Bitcoin cannot be inflated like traditional fiat currencies, which are subject to government intervention and potential manipulation.

Relationship Between Scarcity and Value

The scarcity of Bitcoin creates a unique economic dynamic, driving its value proposition. As demand for Bitcoin increases, its limited supply becomes increasingly valuable. This scarcity-driven value proposition is analogous to precious metals like gold, where limited supply and increasing demand have historically led to price appreciation.

Comparison to Traditional Fiat Currencies and Other Digital Assets

Unlike Bitcoin, traditional fiat currencies are subject to inflation, as governments can print more money to stimulate the economy. This can lead to a decrease in the purchasing power of fiat currencies over time. In contrast, Bitcoin’s limited supply ensures that its value is not diluted by inflation.

“Bitcoin is a finite resource, and its scarcity is a key driver of its value. As demand for Bitcoin grows, its value is likely to increase as its supply remains fixed.”

Bitcoin’s scarcity also distinguishes it from other digital assets. Many other cryptocurrencies have unlimited supply or have mechanisms that can increase their supply over time. This can undermine their value proposition, as an increase in supply can lead to a decrease in price.

Scarcity and Long-Term Price Appreciation

Bitcoin’s scarcity has been a significant factor in its price appreciation over the years. As more individuals and institutions recognize the value proposition of Bitcoin, demand has increased, leading to price gains. This dynamic is likely to continue in the long term, as the scarcity of Bitcoin becomes increasingly apparent.

“Bitcoin’s scarcity is a powerful economic force that is likely to drive its price appreciation in the long term. As the demand for Bitcoin continues to grow, its limited supply will become increasingly valuable.”

Bitcoin’s scarcity is a fundamental driver of its value proposition and is likely to continue to play a significant role in its price appreciation in the future.

Transparency and Auditability

Bitcoin’s transparency and auditability are fundamental features that contribute to its security and trust. This stems from its unique blockchain technology, which operates as a public and immutable ledger, recording every transaction.

Publicly Accessible Ledger

The Bitcoin blockchain is a distributed, public ledger that anyone can access and view. This transparency ensures that all transactions are open and verifiable, fostering accountability and trust within the network. Anyone with an internet connection can access a blockchain explorer, such as Blockchain.com or Blockchair.com, and view the entire history of Bitcoin transactions.

This accessibility allows users to verify the authenticity of transactions and track the movement of Bitcoin.

Immutability and Auditability

Once a Bitcoin transaction is confirmed and added to the blockchain, it is permanently recorded and cannot be altered or deleted. This immutability ensures that all transactions are secure and auditable. Anyone can verify the authenticity of a transaction by tracing its history on the blockchain, providing a reliable audit trail.

Benefits of Transparency and Auditability

- Enhanced Trust and Security:Transparency fosters trust in the Bitcoin network by allowing anyone to verify the validity of transactions and the ownership of Bitcoin. This transparency also enhances security, as any fraudulent activity would be immediately visible on the blockchain.

- Increased Accountability:The public nature of the blockchain promotes accountability, as all transactions are visible to everyone. This transparency discourages illicit activities and fosters a more responsible and ethical environment within the Bitcoin ecosystem.

- Improved Financial Transparency:Bitcoin’s transparency can contribute to increased financial transparency in various sectors. For example, businesses can use Bitcoin to track payments and ensure that transactions are recorded accurately and securely.

Global Accessibility and Portability: Bitcoin Smarter Key Advantages

Bitcoin’s global accessibility and portability are fundamental advantages that distinguish it from traditional financial systems. These attributes empower individuals and businesses worldwide to participate in a borderless financial network, fostering financial inclusion and facilitating efficient cross-border transactions.

Global Accessibility

Bitcoin’s decentralized nature ensures that anyone with an internet connection can access and use the network, regardless of their geographical location. This eliminates the need for intermediaries, such as banks or financial institutions, which often restrict access to financial services based on location or other factors.

- No Geographic Barriers:Bitcoin operates independently of national borders, allowing users in any part of the world to participate in the network. This is in stark contrast to traditional financial systems, which are often subject to regulations and restrictions that limit access to certain regions.

- Financial Inclusion:Bitcoin’s accessibility empowers individuals in underserved or unbanked communities to access financial services, promoting financial inclusion and economic empowerment. For instance, individuals in regions with limited access to traditional banking services can utilize Bitcoin to send and receive payments, store value, and participate in the global economy.

Cross-Border Transactions

Bitcoin’s portability allows for fast and efficient cross-border transactions, reducing the time and cost associated with traditional international payments. Bitcoin transactions are processed directly between users, eliminating the need for intermediaries and their associated fees.

- Speed and Efficiency:Bitcoin transactions are typically processed within minutes, compared to days or even weeks for traditional cross-border payments. This speed and efficiency can significantly benefit businesses and individuals engaged in international trade or remittances.

- Reduced Costs:Bitcoin transactions typically involve lower fees than traditional international payments, which can include bank transfer fees, currency exchange fees, and other intermediary charges. This cost-effectiveness makes Bitcoin an attractive alternative for individuals and businesses seeking to reduce their transaction expenses.

Financial Inclusion and Empowerment

Bitcoin’s decentralized nature and accessibility have the potential to empower individuals and communities who lack access to traditional financial services. This section explores how Bitcoin can facilitate financial inclusion and empower individuals worldwide.

Empowering Individuals and Communities

Bitcoin’s decentralized nature and accessibility have the potential to empower individuals and communities who lack access to traditional financial services. This can be particularly impactful in developing countries where traditional banking systems are often limited or inaccessible.

- Access to Financial Services:Bitcoin provides a low-cost and accessible alternative to traditional banking for individuals and communities without bank accounts. It allows them to store, send, and receive value without relying on intermediaries.

- Financial Independence:Bitcoin can empower individuals by giving them control over their finances. They can manage their money directly, without relying on banks or other financial institutions.

- Economic Opportunity:Bitcoin can create new economic opportunities for individuals and communities by enabling them to participate in the global economy. It can facilitate cross-border remittances and micro-payments, enabling entrepreneurship and financial growth.

Facilitating Cross-Border Remittances

Bitcoin’s global reach and low transaction fees make it an efficient and cost-effective solution for sending and receiving money across borders.

- Reduced Transaction Fees:Traditional remittance services often charge high fees, which can be a significant burden for individuals sending money to family and friends abroad. Bitcoin transactions typically have much lower fees, making it a more affordable option.

- Faster Transactions:Bitcoin transactions are typically processed much faster than traditional remittances, which can take days or even weeks. This can be crucial for individuals who need to send money urgently.

- Increased Transparency:Bitcoin transactions are transparent and auditable, providing a clear record of the transfer of funds. This can help to reduce fraud and ensure that money reaches its intended recipient.

Examples of Financial Inclusion in Developing Countries, Bitcoin smarter key advantages

Bitcoin is already being used to promote financial inclusion in developing countries.

- El Salvador:In 2021, El Salvador became the first country to adopt Bitcoin as legal tender. This move aims to provide financial inclusion for its citizens and promote economic growth.

- Kenya:M-Pesa, a mobile money platform in Kenya, has been successful in promoting financial inclusion. Bitcoin could potentially complement such platforms by offering a more global and decentralized alternative.

- Venezuela:Bitcoin has been used as a means of escape from hyperinflation and economic instability in Venezuela. It allows individuals to preserve their savings and access financial services that are not readily available through traditional channels.

Innovation and Emerging Applications

Bitcoin’s decentralized and secure nature provides a fertile ground for innovation, extending its reach beyond simple payments to encompass a vast array of emerging applications. These applications leverage the unique features of the Bitcoin blockchain to create new possibilities across various sectors.

Bitcoin’s decentralized nature is a key advantage, as it’s not subject to government control or manipulation. This aspect is particularly relevant now, as the news broke that Manchin and Schumer announced a surprise deal on climate, health care, and tax packages.

This deal, while potentially positive for many, highlights the importance of having a financial system that operates independently of political influence. Bitcoin’s resistance to censorship and manipulation further reinforces its appeal as a secure and reliable store of value.

Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is a rapidly growing sector built on the Bitcoin blockchain, aiming to revolutionize traditional financial services. DeFi applications offer a range of services, including lending, borrowing, trading, and asset management, without relying on intermediaries like banks.

DeFi platforms allow users to directly interact with each other, eliminating the need for centralized institutions and reducing transaction costs.

- Lending and Borrowing:Users can lend their Bitcoin to earn interest or borrow Bitcoin by providing collateral. Platforms like BlockFi and Nexo facilitate this process, offering competitive interest rates and flexible loan terms.

- Trading:Decentralized exchanges (DEXs) allow users to trade cryptocurrencies directly with each other, without the need for a centralized exchange. Uniswap and SushiSwap are popular examples of DEXs that leverage the Bitcoin blockchain for secure and transparent trading.

- Asset Management:DeFi platforms provide tools for managing digital assets, such as automated portfolio management and yield farming. These platforms allow users to earn passive income by strategically allocating their Bitcoin across various DeFi applications.

Investment and Portfolio Diversification

Bitcoin’s potential as an investment asset has garnered significant attention, with investors exploring its role in diversifying portfolios. Understanding Bitcoin’s investment characteristics and its potential for both risk and reward is crucial for informed decision-making.

Bitcoin’s Investment Potential

Bitcoin’s price volatility is a prominent feature, influenced by various factors including:

- Market Sentiment and Speculation:Investor confidence and speculative trading activities can drive significant price fluctuations.

- News and Events:Regulatory announcements, technological advancements, and macroeconomic events can impact market sentiment and Bitcoin’s price.

- Supply and Demand:The limited supply of Bitcoin and its growing adoption in various sectors contribute to its price dynamics.

- Adoption and Usage:Increased adoption by businesses, institutions, and individuals fuels demand and can influence price appreciation.

Bitcoin’s potential for long-term returns is often discussed, with some analysts suggesting it could be a valuable hedge against inflation or a store of value. However, its price volatility and lack of intrinsic value pose significant risks.

Comparing Bitcoin to Other Asset Classes

Bitcoin’s investment characteristics can be compared to other asset classes, such as stocks, bonds, and real estate:

- Stocks:Stocks represent ownership in companies and offer potential for capital appreciation and dividend income. They generally carry higher risk than bonds but have the potential for higher returns. Bitcoin shares some similarities with stocks, as its price is influenced by market sentiment and demand.

However, Bitcoin does not generate dividends or represent ownership in a specific company.

- Bonds:Bonds are debt securities that offer fixed interest payments and a return of principal at maturity. They are generally considered less risky than stocks but also offer lower potential returns. Bitcoin’s volatility makes it a significantly different investment than bonds, which are typically more stable.

- Real Estate:Real estate is a tangible asset that can provide rental income and appreciation potential. It is generally considered a long-term investment with relatively low liquidity. Bitcoin’s digital nature and potential for rapid price fluctuations make it a distinct investment from real estate.

Final Conclusion

In conclusion, Bitcoin’s key advantages extend far beyond its potential for financial gain. It represents a paradigm shift in how we think about money, security, and global access. As Bitcoin continues to evolve, its innovative features are poised to reshape the financial landscape, empowering individuals and businesses worldwide.

Whether you’re a seasoned investor or a curious newcomer, understanding these key advantages is crucial to navigating the exciting world of Bitcoin.