Biden Should Take a Victory Lap as Stock Market Soars

Biden should take a victory lap as stock market sets record highs – a statement that’s sure to spark debate. The US economy is undeniably booming, with the stock market hitting record highs, unemployment at historic lows, and GDP growth exceeding expectations.

But is this all thanks to Biden’s policies, or are other factors at play? This article dives into the complex relationship between Biden’s economic policies and the soaring stock market, exploring the various contributing factors and analyzing the potential political implications of this economic success.

The current economic climate is a complex tapestry woven from a multitude of threads. Factors like global economic growth, technological advancements, and investor sentiment are undoubtedly playing a role in the stock market’s surge. However, it’s impossible to ignore the impact of Biden’s policies, particularly the American Rescue Plan, which injected trillions of dollars into the economy, and the infrastructure investments, which are stimulating economic activity and creating jobs.

These policies, along with the Federal Reserve’s accommodative monetary policy, have created a fertile ground for economic growth and corporate profitability, contributing to the stock market’s record highs.

The Economic Context

The recent record highs in the stock market have sparked a debate about the health of the US economy and the role of President Biden’s policies. While the stock market is often seen as a barometer of economic confidence, it’s crucial to consider other economic indicators to gain a comprehensive understanding of the current economic landscape.

The US economy has shown signs of resilience in recent months, with GDP growth exceeding expectations and the unemployment rate remaining low. However, inflation remains a significant concern, with consumer prices rising at a faster pace than in recent decades.

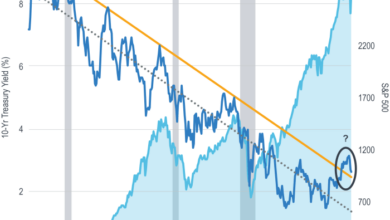

Historical Perspective on Stock Market Performance

Examining historical stock market performance during previous presidential administrations provides valuable context. While stock market performance is influenced by numerous factors, including global economic conditions and technological advancements, the actions of presidents and their economic policies can play a role.

- During President Clinton’s administration (1993-2001), the stock market experienced a significant bull run, fueled by technological advancements and a strong economy. The S&P 500 index rose by over 300% during this period.

- The stock market experienced a sharp decline during the Great Recession (2008-2009) under President Bush. However, the market recovered strongly during the Obama administration (2009-2017), with the S&P 500 index more than doubling in value.

- Under President Trump (2017-2021), the stock market continued its upward trajectory, reaching record highs. The S&P 500 index rose by over 50% during his term, largely driven by corporate tax cuts and deregulation.

Factors Contributing to Current Stock Market Highs

Several factors are contributing to the current stock market highs.

- The Federal Reserve’s accommodative monetary policy has played a significant role in supporting the stock market. Low interest rates and quantitative easing have made it cheaper for companies to borrow money, leading to increased investment and economic growth.

- Consumer confidence remains high, supported by a strong labor market and low unemployment. Consumers are spending more, boosting demand for goods and services, which benefits corporate earnings.

- Corporate earnings have been strong in recent quarters, driven by factors such as increased demand, supply chain improvements, and government stimulus measures.

Biden’s Economic Policies

The Biden administration has implemented a series of economic policies aimed at stimulating growth, addressing inequality, and tackling climate change. These policies have had a significant impact on the economy, including the stock market, and have been the subject of much debate.

The American Rescue Plan

The American Rescue Plan, signed into law in March 2021, was a $1.9 trillion stimulus package designed to mitigate the economic fallout from the COVID-19 pandemic. The plan included direct payments to individuals, enhanced unemployment benefits, funding for state and local governments, and support for businesses.

The American Rescue Plan is credited with helping to accelerate the economic recovery from the pandemic. It provided much-needed relief to households and businesses, and it helped to boost consumer spending and economic activity. However, the plan also contributed to inflation, as the influx of government spending increased demand for goods and services.

Infrastructure Investments

The Biden administration has made significant investments in infrastructure, including roads, bridges, broadband internet, and clean energy. The Infrastructure Investment and Jobs Act, signed into law in November 2021, allocated $1.2 trillion for infrastructure projects over the next decade.These investments are expected to create jobs, boost economic growth, and improve the competitiveness of the U.S.

While Biden might be tempted to take a victory lap as the stock market sets record highs, the reality on the ground is a bit more complicated. The ongoing strike by Boeing workers, now in its second week, highlights the ongoing economic challenges that many Americans face, even as the market booms.

Boeing has sweetened its labor proposal in a “best and final offer,” according to reports , but it remains to be seen if this will be enough to end the strike and bring relief to those directly affected. Ultimately, a strong economy needs to benefit all Americans, not just those who own stocks.

economy. They are also expected to reduce greenhouse gas emissions and promote clean energy.

Tax Policies, Biden should take a victory lap as stock market sets record highs

The Biden administration has implemented a number of tax policies, including raising the corporate tax rate, expanding the child tax credit, and increasing taxes on high-income earners. These policies are designed to reduce income inequality and fund government programs.The tax policies have had a mixed impact on the stock market.

It’s tempting to say Biden should take a victory lap as the stock market sets record highs, but remember, the economy is a complex beast. Sometimes, a good economy is just a sign of good times, like when Sinéad O’Connor was booed offstage and Kris Kristofferson came to her defense – a moment of solidarity that transcended the music industry.

The stock market might be booming, but we need to look beyond the numbers and understand the underlying factors that contribute to its performance.

Some investors have been concerned about the potential impact of higher corporate taxes on corporate profits, while others have welcomed the expansion of the child tax credit, which could boost consumer spending.

Comparison with Previous Administrations

The economic policies of the Biden administration differ significantly from those of the Trump administration. The Trump administration focused on tax cuts and deregulation, while the Biden administration has prioritized government spending on infrastructure, social programs, and climate change.The Trump administration’s tax cuts, while popular with businesses and investors, are widely seen as having contributed to the widening of income inequality.

The Biden administration’s tax policies are designed to address this issue by increasing taxes on high-income earners and expanding social programs.The Trump administration’s deregulation efforts were aimed at reducing government oversight of businesses. The Biden administration has taken a more interventionist approach, seeking to regulate industries such as energy and healthcare.

Alternative Perspectives

While the stock market’s record highs might seem like a direct result of Biden’s policies, it’s crucial to consider alternative perspectives and acknowledge that other factors are likely at play. Attributing the market’s performance solely to one administration’s actions can be a simplification of a complex economic landscape.

It’s tempting to say Biden should take a victory lap as the stock market hits record highs, but maybe we should all take a step back and appreciate the excitement of the Presidents Cup. The competition is fierce, but as always, Team USA is dominating.

Perhaps some changes are needed to make the competition more even ? Either way, a healthy stock market and exciting sporting events are good news for everyone, so let’s celebrate the wins while they last!

Concerns About Market Sustainability

The current stock market rally has been fueled by a confluence of factors, including low interest rates, robust corporate earnings, and a surge in consumer spending. However, there are legitimate concerns about the sustainability of these highs.

- Inflation: The rising cost of goods and services is a significant concern, as it erodes consumer purchasing power and can lead to higher interest rates, potentially impacting corporate profitability and stock valuations.

- Rising Interest Rates: The Federal Reserve’s efforts to combat inflation by raising interest rates could slow economic growth and make borrowing more expensive for businesses, potentially leading to a decline in corporate investment and stock prices.

- Geopolitical Risks: Global events like the ongoing war in Ukraine, tensions with China, and supply chain disruptions create uncertainty and volatility in the market, making it difficult to predict future performance.

Other Factors Influencing the Stock Market

It’s essential to acknowledge that the stock market is influenced by various factors beyond government policies.

- Global Economic Growth: The global economy’s recovery from the pandemic, particularly in emerging markets, has contributed to a positive outlook for businesses and investors.

- Technological Advancements: Innovations in areas like artificial intelligence, cloud computing, and electric vehicles are driving growth in specific sectors, attracting investor interest and boosting stock valuations.

- Investor Sentiment: Market sentiment plays a significant role, with investor confidence and optimism influencing trading decisions and driving stock prices. This can be influenced by factors like economic data, corporate earnings, and news events.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, plays a crucial role in influencing the stock market through its monetary policy tools. By adjusting interest rates and implementing quantitative easing measures, the Fed can impact the overall economy and, in turn, investor sentiment and stock prices.

The Fed’s Monetary Policy Tools

The Fed employs several monetary policy tools to influence the stock market. These tools include:

- Interest Rates:The Fed sets the federal funds rate, which is the interest rate that banks charge each other for overnight loans. By raising interest rates, the Fed makes it more expensive for businesses to borrow money, which can slow economic growth and potentially dampen stock market performance.

Conversely, lowering interest rates can stimulate economic activity and boost stock prices.

- Quantitative Easing (QE):QE involves the Fed buying government bonds and other securities to increase the money supply. This can lower interest rates and encourage borrowing and investment, potentially leading to higher stock prices.

The Fed’s Current Stance and Potential Impact

The current stance of the Federal Reserve is influenced by various economic factors, including inflation, economic growth, and labor market conditions. The Fed’s goal is to maintain price stability and promote maximum employment. To achieve these goals, the Fed may adjust its monetary policy in response to changing economic conditions.

- Inflation:High inflation can erode purchasing power and lead to uncertainty in the economy. In response, the Fed may raise interest rates to curb inflation and potentially slow down economic growth, which could impact stock prices.

- Economic Growth:Strong economic growth can be positive for the stock market, as businesses tend to invest and expand during periods of prosperity. The Fed may lower interest rates to stimulate economic growth, potentially boosting stock prices.

- Labor Market Conditions:A strong labor market with low unemployment can lead to higher consumer spending and business confidence, which can support stock market performance. The Fed may adjust its monetary policy to support a healthy labor market.

The Fed’s Potential Response to Stock Market Performance

While the Fed’s primary focus is on maintaining price stability and promoting maximum employment, it may consider the stock market’s performance when making monetary policy decisions.

- Stock Market Bubbles:The Fed may take steps to address potential stock market bubbles, which can be associated with excessive speculation and unsustainable valuations. This could involve raising interest rates or other measures to cool down the market.

- Market Volatility:The Fed may also respond to significant stock market volatility, especially if it suggests broader economic concerns. It may consider adjusting monetary policy to stabilize the market and provide confidence to investors.

Political Implications: Biden Should Take A Victory Lap As Stock Market Sets Record Highs

The stock market’s performance, particularly when it reaches record highs, can have significant political implications. A robust stock market is often associated with economic prosperity, which can boost public opinion of the incumbent administration and enhance voter confidence. Conversely, a struggling stock market can create economic uncertainty and negatively impact the political landscape.

Impact on Public Opinion and Voter Confidence

A thriving stock market can positively impact public opinion and voter confidence in the current administration. When the stock market performs well, it often signifies a strong economy, leading to increased consumer spending, job creation, and overall economic well-being.

This positive economic climate can translate into higher approval ratings for the incumbent administration, as voters associate economic prosperity with competent leadership. For example, during the 2020 presidential election, the stock market’s performance was a significant factor in the political landscape.

Despite the COVID-19 pandemic, the stock market recovered quickly, reaching record highs in late 2020. This economic recovery, coupled with other factors, contributed to President Trump’s strong performance in key swing states, particularly in the Midwest.

Influence on the Political Landscape

A strong stock market can influence the political landscape in several ways. It can affect the balance of power in Congress, as voters tend to reward the party in power during times of economic prosperity. This can lead to increased support for the incumbent party in congressional elections, potentially strengthening their majority in the House or Senate.

Furthermore, a robust stock market can make it more difficult for the opposition party to gain ground. Voters are often hesitant to change administrations during periods of economic growth, as they may fear disrupting the positive economic momentum. This can create a challenging environment for the opposition party, making it more difficult for them to mount a successful challenge in the next election.

Leveraging the Stock Market’s Performance

The Biden administration can leverage the stock market’s performance to promote its agenda and bolster its political standing. They can use the positive economic indicators associated with a strong stock market to highlight their policies’ success and emphasize their commitment to economic growth.

For example, the administration can point to the stock market’s record highs as evidence of their economic policies’ effectiveness. They can use this success to argue for continued support for their agenda, including initiatives related to infrastructure, clean energy, and social programs.

They can also use the positive economic climate to encourage investment and job creation, further solidifying their economic record.