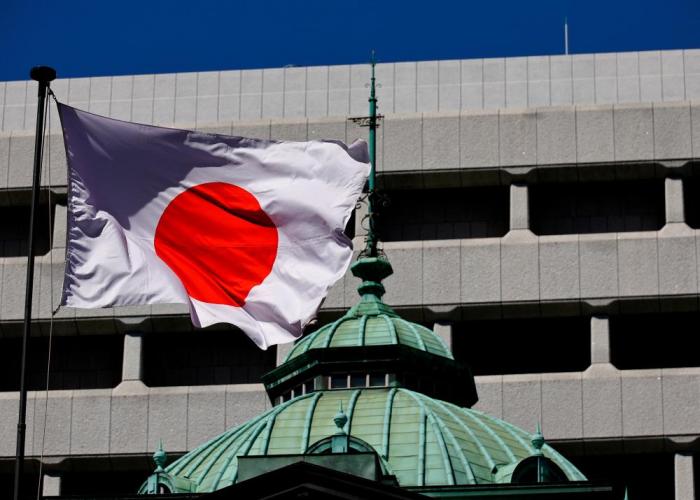

Bank of Japan Holds Steady, Cautiously Navigating Normalization

Bank of Japan keeps benchmark interest rate steady as it treads cautiously on normalizing policy. The Bank of Japan (BOJ) has once again opted to maintain its benchmark interest rate, signaling a cautious approach to policy normalization. This decision comes amidst a complex economic landscape in Japan, where inflation remains subdued and growth is showing signs of resilience.

The BOJ’s decision reflects its commitment to supporting economic recovery while navigating the delicate balance of managing inflation expectations and ensuring financial stability.

The BOJ’s cautious stance on policy normalization is a testament to the unique challenges facing the Japanese economy. While other major central banks have aggressively raised interest rates to combat inflation, the BOJ has maintained a more accommodative policy, reflecting its concerns about the potential impact of rapid tightening on the country’s fragile economic recovery.

Bank of Japan’s Decision and Context

The Bank of Japan (BOJ) has once again opted to keep its benchmark interest rate steady, demonstrating its commitment to a cautious approach to policy normalization. This decision comes amidst a backdrop of persistent inflation and a fragile economic recovery in Japan.

Economic Conditions in Japan

The Japanese economy is navigating a complex landscape. While inflation has been elevated, it remains below the BOJ’s 2% target. The recent surge in energy prices has contributed to inflationary pressures, but the underlying demand remains subdued. This is evident in the sluggish growth of consumer spending and business investment.

The Bank of Japan’s decision to keep its benchmark interest rate steady reflects a cautious approach to normalizing policy, much like the way we need to be cautious about global threats. A recent report revealed that an Iranian agent warned the US of an impending Al-Qaeda attack here , highlighting the need for vigilance in a world facing complex and evolving challenges.

Just as the Bank of Japan is navigating a delicate balance between economic growth and inflation, so too must we be aware of the ever-present dangers and act accordingly.

The BOJ’s decision to maintain the current policy stance reflects its assessment of these economic realities.

Rationale for the Cautious Approach

The BOJ’s cautious approach to policy normalization stems from a number of factors:

- Uncertainty surrounding global economic outlook:The ongoing war in Ukraine, rising global interest rates, and supply chain disruptions have created significant uncertainty in the global economic environment. This uncertainty makes it difficult for the BOJ to accurately assess the impact of any policy changes on the Japanese economy.

- Fragile domestic economic recovery:While the Japanese economy is recovering from the pandemic, the pace of recovery remains uneven. The BOJ is concerned about prematurely tightening monetary policy, which could stifle the nascent economic recovery.

- Impact on the yen:The BOJ is also mindful of the impact of any policy changes on the yen. A rapid appreciation of the yen could hurt Japanese exporters and undermine the country’s economic competitiveness.

Impact on the Japanese Economy

The Bank of Japan’s decision to maintain its benchmark interest rate at its current ultra-low level, while a sign of caution, could have significant implications for the Japanese economy in both the short and long term. This decision reflects the central bank’s careful balancing act between supporting economic growth and managing inflation.

Short-Term Effects

The decision to maintain the current monetary policy stance could provide continued support for economic growth in the short term. Low interest rates encourage businesses to invest and consumers to spend, leading to increased economic activity. This could be particularly beneficial for sectors reliant on borrowing, such as construction and real estate.

However, it’s important to note that prolonged low interest rates could also contribute to asset bubbles, particularly in the real estate market, which could pose risks to financial stability in the future.

Long-Term Effects

The long-term effects of the decision on the Japanese economy are more complex and uncertain. Maintaining a low interest rate environment for an extended period could hinder the Bank of Japan’s ability to effectively manage inflation in the future. It could also lead to a weakening of the yen, making imports more expensive and potentially fueling inflationary pressures.

Moreover, persistent low interest rates might discourage saving and investment, ultimately impacting long-term economic growth.

While the Bank of Japan carefully navigates the path toward normalizing its monetary policy, it seems the world is captivated by a different kind of news cycle altogether. Diddy’s white party photos, which have resurfaced in the wake of his arrest indictment, have sparked widespread discussion and speculation.

Meanwhile, the Bank of Japan’s cautious approach reflects a complex economic landscape where inflation remains a concern, but aggressive policy shifts could disrupt fragile growth.

Impact on Inflation

The Bank of Japan’s decision to maintain its ultra-low interest rate policy could further exacerbate the challenges in achieving its 2% inflation target. The current environment of low interest rates and a weak yen might contribute to imported inflation, as the cost of imported goods rises.

This could potentially push inflation higher, although it remains unclear whether it will reach the Bank of Japan’s target.

The Bank of Japan’s decision to keep its benchmark interest rate steady reflects a cautious approach to normalizing monetary policy. It’s a bit like how the symbiotes in Marvel Comics, from the weakest to the strongest, all named symbiotes in marvel comics history ranked weakest to strongest , evolve and adapt to their environment.

The BoJ, like a symbiote, is carefully monitoring the economic landscape and adapting its strategies to achieve sustainable growth.

Impact on Growth

While the decision to maintain low interest rates might provide a short-term boost to economic growth, it could also have negative long-term implications. Low interest rates could lead to a decrease in the attractiveness of savings, potentially hindering investment and economic growth.

The potential for asset bubbles and financial instability also poses a risk to future growth.

Impact on the Yen

The decision to keep interest rates low could weaken the yen further, as investors seek higher returns in other currencies. A weaker yen can benefit export-oriented businesses by making their products more competitive in international markets. However, it can also lead to higher import prices, contributing to inflation and potentially hurting consumers.

Comparison with Other Central Banks: Bank Of Japan Keeps Benchmark Interest Rate Steady As It Treads Cautiously On Normalizing Policy

The Bank of Japan’s decision to maintain its ultra-loose monetary policy stands in contrast to the actions of other major central banks, which have been steadily raising interest rates to combat inflation. This divergence reflects the unique economic circumstances and policy priorities of Japan.

Interest Rate Policy Comparisons

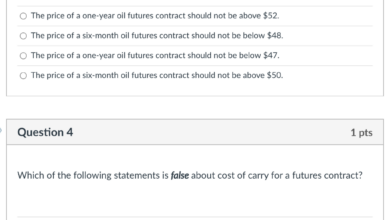

The following table summarizes the current interest rate policies of major central banks, highlighting the differences in their approaches:

| Central Bank | Benchmark Interest Rate | Policy Stance |

|---|---|---|

| Bank of Japan | -0.1% (policy rate) | Ultra-loose |

| Federal Reserve (US) | 5.00-5.25% (federal funds rate) | Restrictive |

| European Central Bank | 3.75% (deposit facility rate) | Restrictive |

Reasons for Divergent Policies

The Bank of Japan’s cautious approach to policy normalization is driven by several factors, including:

- Persistent Deflationary Pressures:Unlike the US and Europe, Japan has struggled with deflation for decades, characterized by a sustained decline in prices. This makes the Bank of Japan hesitant to raise interest rates, fearing it could exacerbate deflationary pressures.

- Weak Economic Growth:Japan’s economy has grown at a sluggish pace for years, hampered by an aging population, low productivity, and structural reforms. Raising interest rates could further dampen economic activity and hinder growth.

- Yen Weakness:A rising interest rate differential between Japan and other major economies could strengthen the US dollar and weaken the Japanese yen, making imported goods more expensive and potentially fueling inflation. The Bank of Japan aims to maintain a weak yen to support exports and economic growth.

Policy Objectives

The Bank of Japan’s primary policy objectives are to achieve price stability and sustainable economic growth. While the US and Europe prioritize controlling inflation as their top objective, the Bank of Japan faces the unique challenge of combating deflation while also fostering economic growth.

Future Outlook and Challenges

The Bank of Japan’s decision to maintain its current policy stance has left the market pondering the future trajectory of monetary policy in Japan. While the bank remains committed to achieving its 2% inflation target, several key factors will likely shape its future policy decisions, presenting both opportunities and challenges.

Factors Influencing Future Policy Decisions, Bank of japan keeps benchmark interest rate steady as it treads cautiously on normalizing policy

The Bank of Japan’s future policy decisions will be influenced by a complex interplay of economic indicators and global developments.

- Inflation Trajectory:The Bank of Japan closely monitors inflation trends to gauge the effectiveness of its monetary policy. A sustained increase in inflation, driven by factors like rising energy prices or strong consumer demand, could prompt the bank to consider tightening monetary policy.

Conversely, persistent deflationary pressures could necessitate further easing measures.

- Economic Growth:Japan’s economic growth outlook remains uncertain, impacted by factors like global economic conditions, supply chain disruptions, and the ongoing pandemic. The bank will likely adjust its policy stance based on the strength of economic growth, aiming to maintain a healthy balance between stimulating growth and controlling inflation.

- Global Monetary Policy:The Bank of Japan’s policy decisions are also influenced by the actions of other major central banks. As global central banks move towards tightening monetary policy, the Bank of Japan will need to consider the potential spillover effects on the Japanese economy and adjust its policy accordingly.

- Yen Exchange Rate:The yen’s exchange rate is a crucial factor for the Bank of Japan, as a weakening yen can fuel inflation by making imports more expensive. The bank may intervene in the foreign exchange market to manage the yen’s volatility and ensure its stability.

Challenges in Navigating Policy Normalization

The Bank of Japan faces several challenges in navigating the path to policy normalization.

- Inflation Expectations:Japan has a long history of deflation, which has resulted in low inflation expectations among consumers and businesses. Raising interest rates too quickly could dampen economic activity and further solidify deflationary expectations.

- Government Debt:Japan has one of the highest levels of government debt in the developed world. Raising interest rates could significantly increase the cost of servicing this debt, potentially straining government finances.

- Global Economic Uncertainty:The global economic outlook remains uncertain, with risks such as geopolitical tensions, supply chain disruptions, and the potential for further pandemic outbreaks. This uncertainty makes it challenging for the Bank of Japan to predict the impact of its policy decisions.

Potential Risks and Opportunities

The Bank of Japan’s current policy stance presents both potential risks and opportunities for the Japanese economy.

- Risk of Asset Bubbles:Maintaining ultra-low interest rates for an extended period could contribute to asset bubbles, particularly in the real estate and stock markets. This could lead to financial instability if these bubbles burst.

- Opportunity for Economic Growth:Low interest rates can stimulate investment and economic growth. By maintaining a supportive monetary policy, the Bank of Japan can create an environment conducive to business expansion and job creation.