Bank of England Holds Rates at 5%, Propelling Pound to 2-Year Highs

Bank of england keeps rates at 5 propels pound to over 2 year highs – The Bank of England’s decision to maintain interest rates at 5% has sent shockwaves through the financial markets, propelling the Pound Sterling to its highest level in over two years. This bold move, driven by a complex interplay of economic factors, has sparked debate and speculation about the future direction of the UK economy.

The decision to keep rates steady signals the Bank’s commitment to combatting inflation, which remains a significant concern. This approach, while potentially dampening economic growth, is intended to maintain price stability and protect the value of the Pound. The impact of this decision on the UK economy, particularly in the context of global economic uncertainties, will be closely watched in the coming months.

The Bank of England’s Decision: Bank Of England Keeps Rates At 5 Propels Pound To Over 2 Year Highs

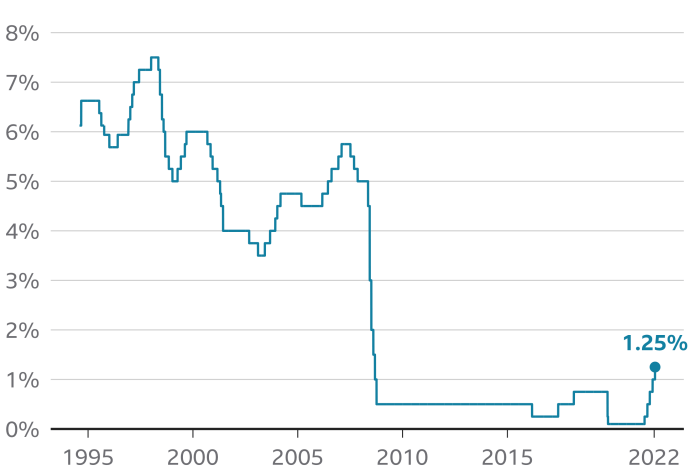

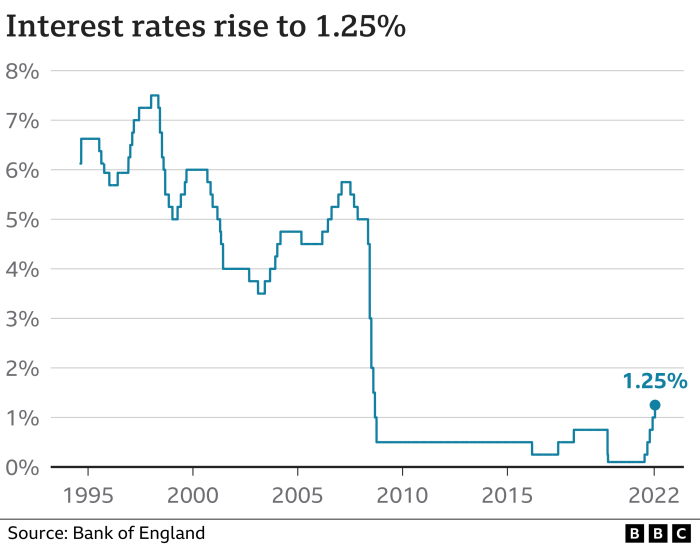

The Bank of England’s Monetary Policy Committee (MPC) has decided to keep interest rates at 5%, marking the 14th consecutive meeting where rates have remained unchanged. This decision comes despite recent economic data suggesting a potential slowdown in the UK economy.

Rationale Behind the Decision

The MPC’s decision to hold rates steady reflects a cautious approach to managing inflation, which remains stubbornly high. While the rate of inflation has begun to fall from its peak, it remains well above the Bank’s target of 2%. The MPC believes that maintaining interest rates at their current level will help to bring inflation back down to target in a sustainable manner.

The Bank of England’s decision to keep interest rates at 5% has sent the pound soaring to its highest level in over two years. This news comes as Omaze launches its latest monthly prize draw, offering a luxurious house in Devon worth £2 million – a tempting prospect for those looking to capitalize on the strong pound.

Whether it’s the allure of a stunning home or the potential for a lucrative investment, the current economic climate seems to be fueling both financial ambitions and dreams of a lavish lifestyle.

Economic Factors Influencing the Bank’s Stance, Bank of england keeps rates at 5 propels pound to over 2 year highs

Several economic factors are influencing the Bank’s decision.

The Bank of England’s decision to hold interest rates at 5% has sent the pound soaring to its highest level in over two years. While the markets digest this news, football fans are gearing up for the Champions League final, where Manchester City faces off against Inter Milan in a highly anticipated showdown.

With the pound at its strongest in years, perhaps this will be the perfect time for a celebratory trip to watch the match in person, or maybe even a trip to Italy to see the sights after the final whistle.

- Inflation:The Consumer Price Index (CPI) inflation rate has been falling, but it remains elevated at 7.9% in June 2023. The MPC believes that further tightening of monetary policy could lead to a sharp decline in economic activity and a significant increase in unemployment.

- Growth:The UK economy is expected to slow down in the coming months. The MPC believes that the current level of interest rates is appropriate given the outlook for economic growth.

- Labor Market:The labor market remains tight, with low unemployment and high wage growth. However, there are signs that the labor market is starting to cool, with fewer job vacancies being advertised. The MPC believes that this cooling will help to moderate wage growth and reduce inflationary pressures.

Potential Implications of the Decision on the UK Economy

The decision to hold rates steady could have a mixed impact on the UK economy.

The Bank of England keeping rates at 5% has propelled the pound to its highest point in over two years, a move that’s likely to impact everything from our daily shopping to travel plans. While the financial world is buzzing with this news, it’s hard not to be distracted by the latest celebrity gossip – like the sight of Shawn Mendes strolling along the beach dripping wet after a quick dip, as seen in this article.

But back to the economy, the Bank’s decision is a significant one, and its effects will be felt for months to come.

- Positive Implications:The decision to hold rates steady could help to support economic growth by keeping borrowing costs low for businesses and consumers. This could encourage investment and spending, boosting economic activity.

- Negative Implications:However, the decision to hold rates steady could also lead to continued high inflation, eroding the purchasing power of consumers and businesses. This could also lead to a weakening of the pound sterling, making imports more expensive.

Impact on the Pound Sterling

The Bank of England’s decision to keep interest rates at 5% has sent the Pound Sterling soaring to its highest level in over two years. This unexpected move, defying market expectations of a rate hike, has significantly impacted the currency’s value.

The Relationship Between Interest Rates and Currency Value

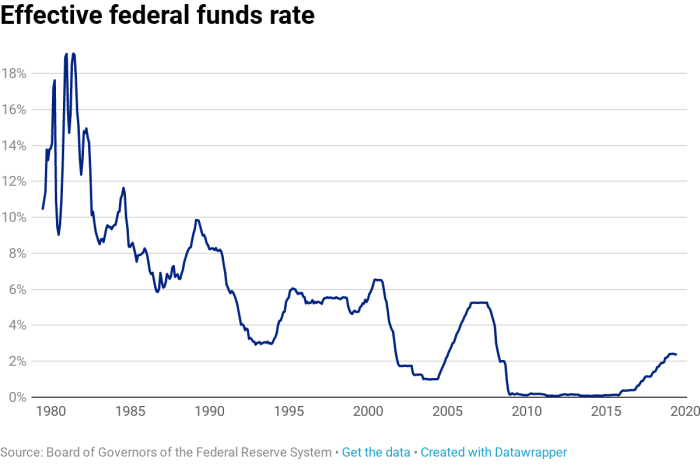

Interest rates play a crucial role in influencing a currency’s value. When interest rates rise, they make a country’s assets more attractive to foreign investors, leading to increased demand for the currency and appreciation. Conversely, lower interest rates can weaken a currency as investors seek higher returns elsewhere.

Current Exchange Rate Compared to Previous Highs and Lows

The Pound Sterling has surged against the US dollar, reaching its highest level since July 2021. The GBP/USD exchange rate has climbed above 1.30, a significant gain from its lows earlier this year.

Factors Driving the Pound’s Appreciation

Several factors contribute to the Pound’s recent appreciation:

- The unexpected decision to hold interest rates at 5%:This move, defying market expectations of a rate hike, surprised investors and fueled speculation about a potential shift in the Bank’s monetary policy stance. This has boosted confidence in the Pound.

- Resilient UK economy:Recent economic data suggests that the UK economy is proving more resilient than initially anticipated. This positive outlook has strengthened the Pound’s appeal.

- Weakening US dollar:The US dollar has been weakening in recent months due to concerns about the US economy and the Federal Reserve’s aggressive rate hikes. This has provided further support for the Pound’s gains.

Market Reactions

The Bank of England’s decision to maintain interest rates at 5% sent ripples through the financial markets, prompting a range of reactions from investors, analysts, and economists. The pound sterling surged to its highest level in over two years, reflecting market sentiment about the UK’s economic prospects.

Financial Analyst Responses

Financial analysts largely welcomed the Bank of England’s decision, citing the need for continued vigilance in the face of persistent inflation. Many analysts believe that the current rate level is appropriate given the current economic conditions. Some analysts expressed concerns about the potential for a recession, while others remained optimistic about the UK’s economic outlook.

“The Bank of England is walking a tightrope, trying to balance the need to tame inflation with the risks of pushing the economy into recession. Maintaining rates at 5% for now seems like a prudent approach, but the situation remains delicate.”

[Financial Analyst Name], [Financial Institution]

Impact on Stock Markets and Bond Yields

The decision to keep rates unchanged had a mixed impact on stock markets and bond yields. The FTSE 100, the UK’s main stock index, initially rose on the news, but later retreated, suggesting investor uncertainty about the economic outlook. Bond yields, which move inversely to prices, also exhibited mixed movements.

“The stock market’s reaction was somewhat muted, reflecting the ongoing uncertainty about the future path of interest rates. Bond yields also showed mixed movements, with some sectors experiencing a slight increase while others remained relatively stable.”

[Financial Analyst Name], [Financial Institution]

Potential Risks and Uncertainties

The current market conditions are marked by several risks and uncertainties. The ongoing war in Ukraine, global supply chain disruptions, and the potential for further interest rate hikes in the coming months all contribute to an environment of volatility.

“The global economic outlook remains uncertain, with the war in Ukraine, rising energy prices, and potential for further interest rate increases all contributing to a volatile environment. Investors need to be cautious and monitor developments closely.”

[Economist Name], [Economic Research Institute]

Economic Outlook

The Bank of England’s decision to maintain interest rates at 5% reflects a complex economic landscape in the UK. While the decision aims to tame inflation, it also highlights the delicate balancing act between curbing price rises and supporting economic growth.

Impact on Inflation

The Bank of England’s decision to hold rates at 5% signals a cautious approach to tackling inflation. While the decision acknowledges the persistent inflationary pressures, it also reflects concerns about the potential impact of further rate hikes on economic activity.

The Bank anticipates that inflation will gradually decline over the coming months, but the pace of this decline remains uncertain.

Economic Forecasts

The Bank of England’s latest economic forecasts project a challenging period ahead for the UK economy. The Bank expects GDP growth to remain sluggish in the coming quarters, with the UK economy expected to enter a mild recession in the latter half of 2023.

This forecast reflects the ongoing pressures from high inflation, rising interest rates, and the global economic slowdown.

Key Challenges and Opportunities

The UK economy faces a number of significant challenges in the coming months, including:

- High Inflation:Persistent high inflation continues to erode household purchasing power and weighs on consumer confidence.

- Rising Interest Rates:Higher interest rates increase borrowing costs for businesses and households, potentially dampening investment and consumer spending.

- Global Economic Slowdown:The global economic slowdown poses a significant risk to the UK economy, particularly through its impact on exports and investment.

Despite these challenges, the UK economy also presents some key opportunities:

- Strong Labor Market:The UK labor market remains relatively strong, with low unemployment and continued wage growth.

- Government Investment:The government has announced significant investment plans in areas such as infrastructure and clean energy, which could boost economic growth in the long term.

- Technological Advancements:The UK remains a leader in technology and innovation, offering potential for growth in sectors such as artificial intelligence and cybersecurity.