Bank of England Keeps Rates at 5%, Propels Pound to 2-Year Highs

Bank of england keeps rates at 5 propels pound to over 2 year highs – Bank of England Keeps Rates at 5%, Propels Pound to 2-Year Highs – The Bank of England’s decision to hold interest rates steady at 5% has sent shockwaves through the financial markets, with the pound sterling surging to its highest level in over two years.

This unexpected move has sparked a flurry of speculation and analysis, leaving investors and businesses alike wondering about the implications for the UK economy.

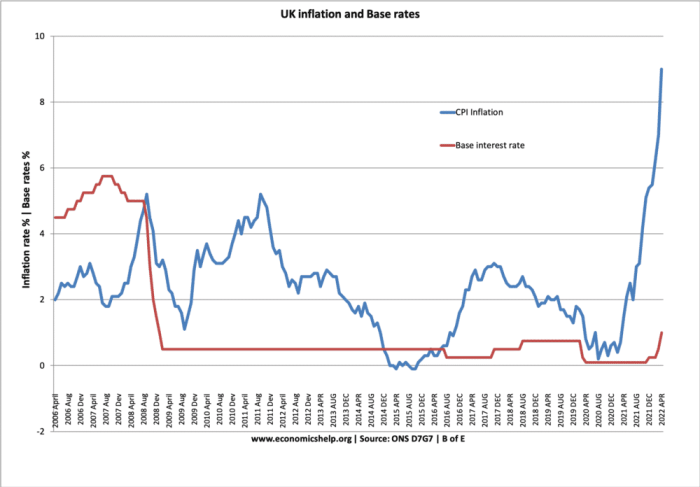

The decision to maintain rates at 5% signals the Bank of England’s continued commitment to combating inflation, even as the UK economy faces potential headwinds. This move has been met with mixed reactions, with some analysts praising the Bank’s hawkish stance while others express concerns about the potential impact on growth.

The strength of the pound, fueled by the interest rate decision, has provided a temporary boost to the UK economy, but the long-term implications remain to be seen.

The Bank of England’s Decision

The Bank of England’s decision to keep interest rates at 5% has sent shockwaves through the financial markets, propelling the pound to its highest level in over two years. This move comes amidst a period of intense economic uncertainty, with inflation still stubbornly high and the UK economy teetering on the brink of recession.

Reasons Behind the Decision

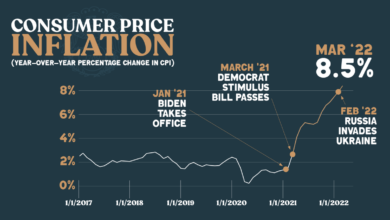

The Bank of England’s decision to maintain interest rates at 5% is a reflection of the complex economic landscape facing the UK. While inflation has shown signs of easing, it remains significantly above the Bank’s target of 2%. Additionally, the UK economy is grappling with a number of challenges, including a cost-of-living crisis, rising energy prices, and a weakening global economic outlook.

These factors have led the Bank to adopt a cautious approach, opting to hold rates steady in order to assess the impact of previous rate hikes and monitor the evolving economic situation.

Potential Implications on the UK Economy

The Bank of England’s decision to keep interest rates at 5% could have a number of implications for the UK economy.

The Bank of England’s decision to hold interest rates at 5% has propelled the pound to its highest level in over two years, a move that reflects the current economic climate and the ongoing debate about the role of monetary policy.

To understand the broader context of these decisions, it’s helpful to consider the underlying economic philosophy at play, often referred to as neoliberalism. For a deeper dive into this ideology and its impact on global economies, check out a primer on neoliberalism.

Ultimately, the Bank of England’s decision highlights the complex interplay between economic theory, policy implementation, and market dynamics, shaping the future of the British pound and the global financial landscape.

- Impact on Inflation:Maintaining interest rates at 5% could help to further curb inflation by dampening consumer demand and slowing down economic growth. However, it’s important to note that this approach carries the risk of pushing the economy into a recession.

- Impact on Borrowing Costs:Keeping interest rates high could lead to increased borrowing costs for businesses and individuals, potentially hindering investment and economic growth.

- Impact on the Housing Market:Higher interest rates can make it more expensive for individuals to obtain mortgages, potentially leading to a slowdown in the housing market.

- Impact on the Pound:The Bank of England’s decision to keep interest rates at 5% has already boosted the pound, making it more expensive for businesses to import goods and services. This could lead to higher prices for consumers and potentially impact the UK’s trade balance.

The Bank of England’s decision to keep interest rates at 5% has sent the pound soaring to its highest level in over two years. It seems like everyone’s looking for a safe haven right now, and the UK’s currency is benefiting from that.

Meanwhile, news of a boy not being prosecuted for his involvement in riots due to the wrath of his parents boy not prosecuted over riots due to wrath of parents is raising eyebrows, highlighting the complex interplay of societal pressures and legal consequences.

It’s a reminder that even in times of economic turmoil, the ripple effects of individual actions can be felt far and wide.

Impact on the Pound Sterling: Bank Of England Keeps Rates At 5 Propels Pound To Over 2 Year Highs

The Bank of England’s decision to keep interest rates at 5% has sent the pound sterling soaring to its highest levels in over two years. This move has been interpreted by investors as a sign that the Bank is committed to tackling inflation, boosting confidence in the UK economy and driving demand for the pound.

Pound Sterling’s Performance Against Other Currencies

The pound sterling’s surge has been particularly notable against other major currencies, including the euro and the US dollar. The pound has gained over 5% against the euro since the start of the year, reaching its highest level since February 2021.

The Bank of England’s decision to hold interest rates at 5% has sent the pound soaring to its highest level in over two years. This move, coupled with a strong economic outlook, has investors feeling bullish about the UK’s future.

While I’m focused on the financial news, I can’t help but be excited about the future of the Philadelphia Flyers, especially their defensive corps, as discussed in this excellent analysis from The Hockey Writers: flyers future defensive corps is already in good hands the hockey writers latest news analysis more.

It seems like both the pound and the Flyers are poised for a strong performance in the coming months.

Against the US dollar, the pound has gained over 3% since the start of the year, reaching its highest level since June 2021.

Factors Contributing to the Pound Sterling’s Strength

Several factors have contributed to the pound sterling’s recent strength, including:

- The Bank of England’s commitment to tackling inflation.By keeping interest rates at 5%, the Bank of England is signaling its determination to bring inflation under control. This has boosted investor confidence in the UK economy and increased demand for the pound.

- Stronger-than-expected economic data.Recent economic data for the UK has been relatively strong, suggesting that the economy is more resilient than previously thought. This has further boosted investor confidence and driven demand for the pound.

- Weakening of the euro.The euro has been weakening against other major currencies, including the pound, due to concerns about the eurozone’s economic outlook. This has made the pound more attractive to investors.

Market Reactions and Analysis

The Bank of England’s decision to keep interest rates at 5% sent shockwaves through the financial markets, triggering a significant surge in the value of the pound sterling. The currency climbed to its highest level in over two years, reflecting market sentiment and investor confidence in the UK economy.

Market Reactions and Analyst Views

The decision to maintain interest rates at 5% was met with mixed reactions from market analysts and economists. Some analysts argued that the decision signaled the Bank’s confidence in the UK economy’s resilience despite the ongoing inflationary pressures. Others expressed concerns about the potential for the Bank to fall behind the curve in tackling inflation, particularly as other major central banks continue to raise interest rates.

“The Bank of England’s decision to hold rates steady suggests that they are confident that inflation is starting to come down,”

said one analyst, highlighting the potential for a cooling effect on inflation.

“However, there is a risk that the Bank may be too optimistic, and that inflation could remain stubbornly high for longer than expected,”

warned another analyst, emphasizing the potential for further rate hikes in the future. The pound’s surge was attributed to several factors, including the Bank’s decision to keep rates at 5%, indicating a strong economic outlook, and a weakening dollar. The dollar’s weakness was fueled by concerns about the US economy, which was seen as a positive factor for the pound.

Potential Implications for Investors and Businesses

The Bank of England’s decision to maintain interest rates at 5% has significant implications for investors and businesses operating in the UK. The decision reflects the Bank’s ongoing efforts to combat inflation, but it also carries potential consequences for various sectors of the economy.

Impact on Investors

The decision to hold rates steady provides a degree of certainty for investors, as it signals that the Bank is not planning an immediate shift towards a more aggressive tightening stance. However, the elevated interest rate environment continues to influence investment decisions.

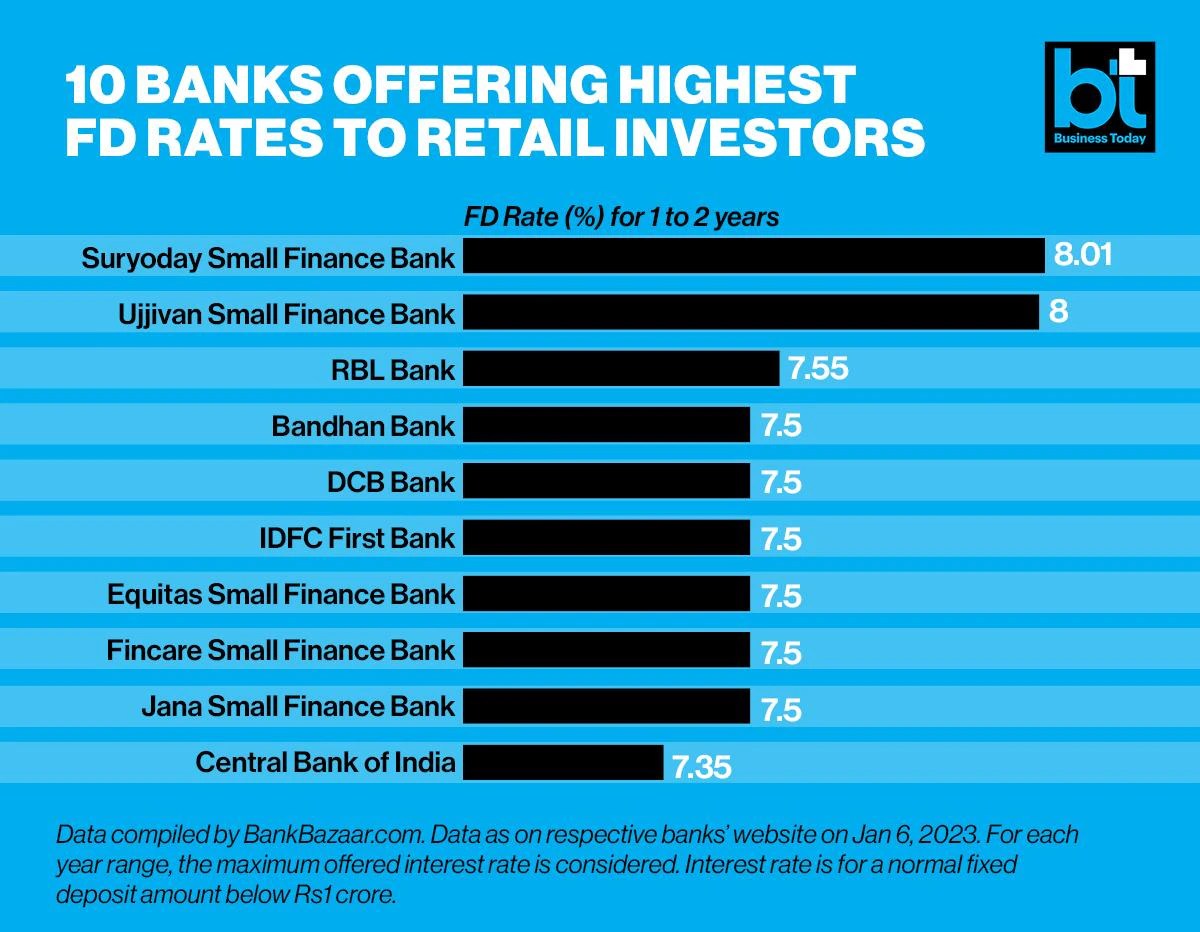

- Fixed-Income Investments:Investors holding fixed-income securities, such as bonds, may see a continued decline in their value due to rising interest rates. As interest rates rise, the value of existing bonds falls to reflect the higher returns available on newly issued bonds.

- Equities:The higher interest rate environment can impact equity markets in several ways. It can increase the cost of borrowing for companies, potentially slowing down economic growth and corporate earnings. However, a strong pound can also attract foreign investment into UK equities.

- Currency Trading:The rise in the pound against other currencies can benefit investors who hold sterling-denominated assets or have investments in foreign markets that they wish to convert back to pounds.

Impact on Businesses

The Bank of England’s decision to maintain interest rates at 5% will have a mixed impact on UK businesses.

- Borrowing Costs:Higher interest rates increase borrowing costs for businesses, potentially leading to reduced investment in new projects, expansion, or hiring.

- Consumer Spending:Elevated interest rates can dampen consumer spending as higher borrowing costs make it more expensive to finance purchases like cars and homes. This could impact businesses in sectors reliant on consumer spending.

- Exports:A stronger pound can make UK exports less competitive in global markets. This could negatively affect businesses that rely heavily on international sales.

- Inflation:The Bank of England’s primary objective is to control inflation, and maintaining interest rates at 5% is intended to help bring inflation down. This could benefit businesses by providing a more stable economic environment.

Impact on Different Sectors of the Economy

The table below illustrates the potential effects of the Bank of England’s decision on different sectors of the economy:| Sector | Potential Impact ||—|—|| Financial Services| Higher interest rates can boost profits for banks and other financial institutions, as they can charge higher interest on loans.

|| Real Estate| Higher interest rates can make mortgages more expensive, potentially slowing down house price growth. || Manufacturing| A stronger pound can make UK exports less competitive, potentially hurting manufacturers that rely on international sales. || Retail| Higher interest rates can dampen consumer spending, potentially impacting retailers that rely on discretionary purchases.

|| Tourism| A stronger pound can make the UK a more expensive destination for foreign tourists, potentially impacting tourism businesses. |

Looking Ahead

The Bank of England’s decision to maintain interest rates at 5% has sent ripples through the financial markets, pushing the pound sterling to its highest levels in over two years. However, the path ahead remains uncertain, with a number of factors poised to influence the trajectory of both the pound and interest rates in the coming months.

Future Events Impacting the Pound and Interest Rates

The pound sterling and interest rates are sensitive to a range of economic and political events. Here is a timeline of potential future events that could significantly impact their movement:

- UK Inflation Data:The Bank of England’s monetary policy decisions are heavily influenced by inflation data. Future inflation reports, particularly the Consumer Price Index (CPI) and the Retail Price Index (RPI), will be closely watched to gauge the effectiveness of current interest rates in curbing inflation.

If inflation proves more persistent than anticipated, the Bank may be forced to raise rates further. Conversely, if inflation shows signs of easing, the Bank may consider holding rates steady or even cutting them.

- UK Economic Growth:The UK’s economic performance is another key factor influencing the pound and interest rates. If the UK economy shows signs of slowing down, it could put downward pressure on the pound and potentially lead to a pause or even a reduction in interest rate hikes.

Conversely, strong economic growth could bolster the pound and support the Bank’s hawkish stance on interest rates.

- Global Economic Outlook:The UK economy is intertwined with the global economy. A global economic downturn or recession could negatively impact the UK, leading to a weakening pound and potentially prompting the Bank of England to adopt a more accommodative monetary policy stance.

Conversely, a robust global economy could benefit the UK and support the pound.

- Political Developments:Political developments in the UK, such as the outcome of upcoming elections or changes in government policy, can also influence the pound and interest rates. For example, a change in government policy towards fiscal austerity could lead to a stronger pound and potentially support higher interest rates.

Conversely, political instability or uncertainty could weaken the pound and make the Bank of England more cautious in its policy decisions.

UK Economic Trajectory

The UK economy faces a number of challenges, including high inflation, rising interest rates, and the ongoing cost-of-living crisis. The Bank of England has projected that the UK economy will enter a recession in the latter half of 2023, with GDP expected to contract by 0.5% in 2023 and 0.25% in 2024.

However, the actual trajectory of the UK economy will depend on a number of factors, including the severity of the global economic slowdown, the pace of inflation, and the effectiveness of government policies.

Bank of England’s Future Policy Moves, Bank of england keeps rates at 5 propels pound to over 2 year highs

The Bank of England’s future policy moves will be heavily influenced by the evolving economic landscape. If inflation remains stubbornly high, the Bank may be forced to raise interest rates further to bring it under control. However, if inflation shows signs of easing and the UK economy weakens, the Bank may be more cautious in its policy decisions and potentially pause or even reduce interest rate hikes.

The Bank’s ultimate goal is to achieve a sustainable level of inflation while also supporting economic growth.