Bank of England Holds Rates, Pound Surges to 2-Year High

Bank of england holds interest rates british pound rallies to more than two year high – Bank of England Holds Rates, Pound Surges to 2-Year High sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Bank of England’s recent decision to hold interest rates steady sent shockwaves through the financial world, particularly as it coincided with a remarkable surge in the value of the British pound.

This unexpected pairing has sparked a flurry of questions about the relationship between interest rates and currency value, and the potential implications for the UK economy.

The pound’s rally, reaching its highest point in over two years, can be attributed to several factors. The Bank of England’s decision to maintain interest rates at their current level, despite rising inflation, suggests a belief in the resilience of the UK economy.

This confidence, coupled with a weakening US dollar, has fueled the pound’s upward trajectory. Analysts are closely watching the situation, trying to decipher the long-term implications of this unexpected confluence of events.

The Bank of England’s Decision

The Bank of England’s Monetary Policy Committee (MPC) has decided to hold interest rates steady at 5% in its latest meeting. This decision comes amidst a backdrop of ongoing economic uncertainty, with inflation remaining stubbornly high and the UK economy facing the prospect of a recession.

Factors Influencing the Decision

The MPC’s decision to hold rates was likely influenced by a number of factors, including:

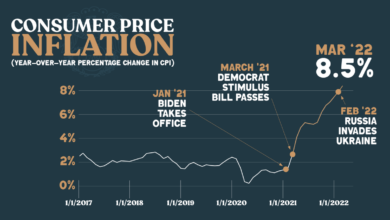

- Persistent Inflation:The UK’s inflation rate remains elevated, currently at 8.7%, well above the Bank’s 2% target. This persistent inflation has been driven by a combination of factors, including the ongoing energy crisis, supply chain disruptions, and strong demand.

- Economic Slowdown:The UK economy is facing a challenging period, with growth slowing significantly in recent months. The MPC is concerned about the impact of rising interest rates on consumer spending and business investment, which could further weaken the economy.

- Labor Market Strength:The UK labor market remains relatively strong, with unemployment low and wage growth picking up. However, the MPC is monitoring wage growth closely, as it could contribute to further inflationary pressures.

Potential Implications for the UK Economy, Bank of england holds interest rates british pound rallies to more than two year high

The MPC’s decision to hold rates steady has a number of potential implications for the UK economy:

- Continued Inflationary Pressures:Holding rates steady could allow inflation to remain elevated for longer, as it does not provide a strong signal to businesses and consumers that the Bank is committed to bringing inflation back to target.

- Potential for Recession:The decision to hold rates could also increase the risk of a recession, as it could further dampen economic activity.

- Impact on Borrowing Costs:The decision to hold rates steady could keep borrowing costs for businesses and consumers high, which could further stifle economic growth.

The British Pound’s Rally

The British pound has been on a tear in recent weeks, surging to its highest level against the US dollar in more than two years. This rally has been driven by a confluence of factors, including the Bank of England’s hawkish stance on interest rates, a weakening US dollar, and optimism about the UK economy.

Performance Against Other Currencies

The British pound’s gains have been widespread, with the currency strengthening against most major currencies. For instance, the pound has risen to its highest level against the euro since 2016, reaching €1.18 in early August. The pound has also gained ground against the Japanese yen, Swiss franc, and Australian dollar.

- The pound’s strength against the US dollar is particularly noteworthy, as the dollar has been weakening against most other currencies in recent months. This is partly due to the Federal Reserve’s more dovish stance on interest rates, as well as concerns about the US economy.

- The pound’s rally against the euro is also significant, as it reflects the relative strength of the UK economy compared to the eurozone. The UK economy has been performing better than expected, and the Bank of England is expected to raise interest rates further in the coming months.

The Bank of England’s decision to hold interest rates steady has sent the British pound soaring to its highest level in over two years. This positive economic news, however, shouldn’t overshadow the ongoing global challenges, such as the fight against HIV/AIDS, which continues to affect millions worldwide.

Learn more about the global AIDS epidemic and how we can work together to combat this disease. Returning to the UK economy, the pound’s strength is a welcome sign, suggesting confidence in the country’s financial stability.

Factors Contributing to the Rally

Several key factors have contributed to the British pound’s recent rally.

The Bank of England holding interest rates steady sent the British pound soaring to its highest point in over two years. It’s a sign of confidence in the UK economy, but it also highlights the complex interplay between global events and domestic markets.

This kind of economic stability is something that college sports are struggling with, as evidenced by the ongoing legal battle over athlete compensation, exemplified by what Reggie Bush’s NIL lawsuit means for the NCAA, USC, and the Pac-12.

Ultimately, the future of both the UK economy and college athletics depends on finding solutions that create a sustainable and equitable playing field for everyone involved.

- The Bank of England’s hawkish stance on interest rates has been a major driver of the pound’s strength. The Bank has raised interest rates aggressively in recent months, and it is expected to continue doing so in the coming months.

This is making the pound more attractive to investors, as they can earn a higher return on their investments in the UK.

- A weakening US dollar has also helped to boost the pound. The US dollar has been declining against most other currencies in recent months, due to concerns about the US economy and the Federal Reserve’s more dovish stance on interest rates.

This has made the pound relatively more attractive to investors.

- Optimism about the UK economy has also contributed to the pound’s rally. The UK economy has been performing better than expected in recent months, and there are signs that the economy is starting to recover from the COVID-19 pandemic. This has boosted investor confidence in the UK economy, leading to increased demand for the pound.

The Relationship Between Interest Rates and Currency Value

Interest rates and currency value are intertwined in a complex dance. When a central bank, like the Bank of England, raises interest rates, it makes holding that currency more attractive to investors. This is because they can earn a higher return on their investment in the form of interest.

Impact of Interest Rate Changes on Currency Value

The Bank of England’s decision to raise interest rates likely played a significant role in the British pound’s recent rally. Higher interest rates make the pound more appealing to investors, leading to increased demand for the currency and pushing its value higher.

Impact of Interest Rate Changes on Different Currencies

The impact of interest rate changes on currency values can vary depending on several factors:* Economic Strength:A strong economy with robust growth and low inflation tends to attract more foreign investment, leading to a stronger currency.

Political Stability

A stable political environment fosters confidence in a country’s economy and its currency.

Monetary Policy

Central banks play a key role in influencing currency values through their monetary policy decisions, including interest rate adjustments.

Global Economic Conditions

Global economic events and trends can also impact currency values. For example, a global recession might weaken demand for a particular currency.

The Bank of England holding interest rates steady has boosted the British pound to its highest point in over two years, a sign of confidence in the UK economy. This confidence, however, is often overshadowed by larger global issues, like the way certain countries are using the “war on terror” as a blanket justification for sweeping military aid under the anti terrorism rug.

It’s a complex world, and the pound’s rally might be a sign of positive economic indicators, but it’s important to remember that the global landscape is far from stable.

The relationship between interest rates and currency value is not always straightforward and can be influenced by various factors. However, generally, higher interest rates tend to strengthen a currency.

Market Reactions and Analyst Perspectives

The Bank of England’s decision to raise interest rates sent shockwaves through financial markets, prompting a mixed bag of reactions from investors, traders, and economists. While the decision was largely anticipated, the magnitude of the rate hike and the accompanying hawkish tone from the central bank caught some by surprise.

This section explores the diverse perspectives on the impact of the Bank of England’s decision and how it is likely to shape the future of the British economy.

Market Reactions

The market reactions to the Bank of England’s decision were multifaceted, reflecting the diverse interests and expectations of different market participants. Here’s a breakdown of how various players responded:

- Investors: Equity markets initially reacted negatively to the rate hike, with the FTSE 100 index experiencing a dip. However, the subsequent rally in the British pound, fueled by the hawkish stance of the Bank of England, provided some support to the stock market.

Long-term investors, particularly those with a focus on the UK economy, may view the rate hike as a positive signal of economic stability and growth.

- Traders: Currency traders were quick to capitalize on the Bank of England’s decision, driving the British pound to its highest level in over two years. The pound’s appreciation reflected the market’s confidence in the Bank’s commitment to controlling inflation and its potential to attract foreign investment.

However, short-term traders might have taken advantage of the initial volatility in the market, profiting from the fluctuations in currency values.

- Economists: While most economists acknowledged the need for the Bank of England to address inflationary pressures, some expressed concerns about the potential impact of higher interest rates on economic growth. The decision could potentially slow down borrowing and investment, particularly for businesses, leading to a slowdown in economic activity.

However, others argued that the rate hike was necessary to prevent inflation from spiraling out of control and ultimately jeopardizing the long-term health of the economy.

Analyst Perspectives

Leading economic analysts have offered a range of perspectives on the implications of the Bank of England’s decision. Here are some prominent views:

- “The Bank of England’s decision is a necessary step in the fight against inflation, but it will likely come at the cost of slower economic growth. Businesses and consumers will face higher borrowing costs, which could dampen spending and investment.”– [Analyst Name], Chief Economist at [Institution Name]

- “The hawkish tone from the Bank of England is a clear signal that they are committed to bringing inflation under control. This should provide some reassurance to investors and businesses that the central bank is taking the necessary steps to maintain stability in the economy.”– [Analyst Name], Senior Economist at [Institution Name]

- “The pound’s rally is a positive sign, indicating that investors are confident in the Bank of England’s ability to manage inflation. However, it remains to be seen how long this confidence will last, as the global economic outlook remains uncertain.”– [Analyst Name], Currency Strategist at [Institution Name]

| Market Participant | Reaction | Perspective |

|---|---|---|

| Investors | Mixed

|

Long-term investors may see the rate hike as a positive signal of economic stability and growth, while short-term investors might be more cautious. |

| Traders | Strong

|

Traders profited from the initial volatility in the market and the pound’s appreciation, driven by the Bank of England’s hawkish stance. |

| Economists | Mixed

|

Opinions vary on the long-term impact of the rate hike, with some emphasizing its necessity in fighting inflation and others expressing concerns about its potential to slow down economic activity. |

Potential Future Implications: Bank Of England Holds Interest Rates British Pound Rallies To More Than Two Year High

The Bank of England’s decision to raise interest rates has significant implications for the UK economy. The impact will be felt across various aspects, including inflation, economic growth, and employment. The decision also influences the value of the British pound, which is likely to be affected in the near future.

Impact on Inflation

The primary objective of raising interest rates is to curb inflation. By making borrowing more expensive, consumers and businesses are likely to spend less, thereby reducing demand and slowing down price increases. However, the effectiveness of this strategy depends on several factors, including the magnitude of the rate hike, the level of consumer confidence, and the global economic environment.

Impact on Economic Growth

Higher interest rates can have a dampening effect on economic growth. Businesses may find it more expensive to invest and expand operations, leading to slower job creation and reduced consumer spending. The impact on economic growth will depend on the extent to which businesses and consumers are sensitive to interest rate changes.

Impact on Employment

The impact of higher interest rates on employment is complex and depends on various factors. While some sectors may experience job losses due to reduced investment and consumer spending, others may benefit from a stronger pound, which could boost exports.

The overall impact on employment will likely be a mix of positive and negative effects, depending on the specific industry and its sensitivity to interest rates.

Impact on the British Pound

The recent rally in the British pound is a direct consequence of the Bank of England’s decision to raise interest rates. Higher interest rates make the pound more attractive to foreign investors, leading to increased demand and appreciation of the currency.

However, the sustainability of this appreciation will depend on various factors, including the global economic outlook, the trajectory of inflation, and the future course of monetary policy.