Asia Pacific Markets Rise After South Koreas Inflation Hits 42-Month Low

Asia pacific markets mostly rise after south koreas inflation rate hits 42 month low – Asia Pacific markets mostly rise after South Korea’s inflation rate hits a 42-month low, signaling a potential shift in economic sentiment across the region. This news comes as a breath of fresh air, particularly for South Korea, which has been grappling with rising inflation for the past few years.

The decline in inflation could potentially boost consumer spending and business confidence, leading to a more optimistic economic outlook.

While South Korea’s inflation rate has eased, it’s important to note that the global economic landscape remains uncertain. Factors like the ongoing war in Ukraine and persistent supply chain disruptions continue to exert pressure on economies worldwide. However, the positive news from South Korea suggests that some economies in the Asia Pacific region might be showing signs of resilience.

South Korea’s Inflation Rate

South Korea’s inflation rate hitting a 42-month low is a significant development, signaling a potential easing of price pressures and a shift towards a more stable economic environment. This decline has positive implications for both consumers and businesses, as it can boost purchasing power and encourage investment.

Factors Contributing to the Decline

The decline in South Korea’s inflation rate is attributed to several factors.

The news of South Korea’s inflation rate hitting a 42-month low has certainly boosted the Asia Pacific markets, but it’s a stark contrast to the tragedy that unfolded on a 40-meter yacht in the Caribbean. Autopsies have revealed the cause of death for the NYC lawyer and his wife killed in the wreck , leaving a somber note amidst the positive economic news.

The rising markets and the tragic accident are a reminder of the world’s complexities, with moments of both triumph and sorrow playing out simultaneously.

- Cooling Global Commodity Prices:The global decline in commodity prices, particularly for energy and food, has significantly contributed to the easing of inflationary pressures in South Korea. As global supply chains stabilize and demand moderates, the cost of these essential commodities has fallen, impacting consumer prices.

The Asia Pacific markets mostly rose after South Korea’s inflation rate hit a 42-month low, indicating a potential shift towards economic stability in the region. However, a looming concern for the region remains China’s housing market, which is experiencing a prolonged downturn.

A recent report by JPMorgan suggests that the housing market crash is far from over, as highlighted in this article: jpmorgan economist says chinas housing market crash is still not over. The impact of this downturn on the broader Asia Pacific region is still being assessed, but it’s a factor that investors and policymakers will be closely monitoring.

- Weakening Consumer Demand:Despite a recent rebound, consumer spending remains subdued in South Korea, reflecting concerns about economic uncertainty and rising interest rates. This reduced demand has put downward pressure on prices.

- Monetary Policy Tightening:The Bank of Korea has been actively raising interest rates to curb inflation. These rate hikes have made borrowing more expensive, slowing down economic activity and dampening price increases.

- Government Measures:The South Korean government has implemented measures to stabilize prices, such as releasing strategic oil reserves and providing subsidies for essential goods. These interventions have helped to contain inflationary pressures.

Comparison with Other Asia Pacific Economies

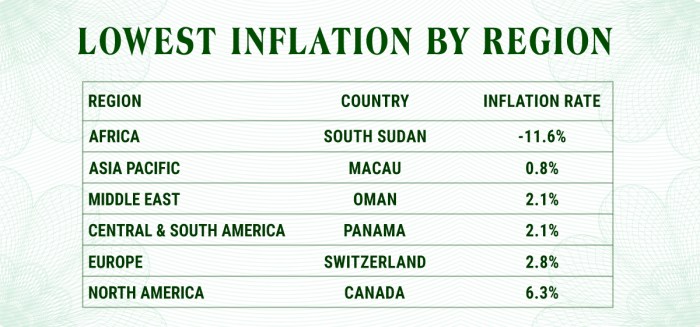

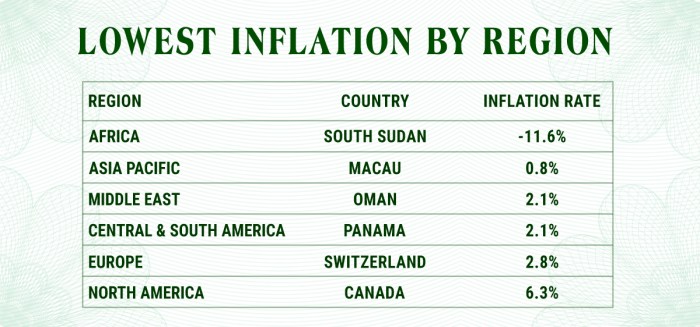

South Korea’s inflation rate decline contrasts with the situation in other major economies in the Asia Pacific region. While some countries, such as Japan, have experienced deflationary pressures, others, like India and Vietnam, are still grappling with high inflation. The diverse economic conditions and policy responses across the region contribute to these varying inflation trends.

It’s been a good week for the Asia Pacific markets, with most seeing a rise after South Korea’s inflation rate hit a 42-month low. It reminds me of Selena Gomez’s graceful reaction to losing her Emmy nomination – selena gomez had the perfect reaction to losing an emmy because she practiced – she acknowledged the work she put in and still celebrated the successes of others.

Just like the markets, sometimes things don’t go your way, but it’s important to keep a positive outlook and recognize the progress that’s been made.

“The decline in South Korea’s inflation rate is a positive sign for the economy, but it is important to monitor the situation closely and be prepared for potential shifts in the global economic environment.”

[Name of Economist or Financial Expert]

Impact on Asia Pacific Markets

South Korea’s inflation rate hitting a 42-month low is a positive sign for the broader Asia Pacific region. It suggests that inflationary pressures are easing, which could boost economic growth and consumer spending. This development has the potential to positively impact various sectors and industries within the Asia Pacific markets.

Impact on Consumer Discretionary Sector

The decline in inflation is likely to benefit the consumer discretionary sector, as consumers have more disposable income. This could lead to increased spending on non-essential goods and services, such as travel, entertainment, and dining. For example, airlines, hotels, and restaurants could experience an uptick in demand.

Economic Outlook for South Korea

The recent decline in South Korea’s inflation rate to a 42-month low is a positive sign for the country’s economic outlook. This easing of inflationary pressures could provide a much-needed boost to consumer spending and business confidence, paving the way for a more robust economic recovery.

Impact on Consumer Spending

The decline in inflation could encourage consumers to spend more. When prices rise, consumers tend to cut back on spending, as their purchasing power diminishes. However, with inflation easing, consumers can expect to see more value for their money, leading to increased spending on goods and services.

This rise in consumer spending can have a positive ripple effect throughout the economy, stimulating demand and supporting businesses.

Regional Economic Trends: Asia Pacific Markets Mostly Rise After South Koreas Inflation Rate Hits 42 Month Low

The Asia Pacific region has emerged as a global economic powerhouse, exhibiting robust growth and resilience in recent years. The region’s economic performance has been driven by a combination of factors, including strong domestic demand, increasing trade, and technological advancements.

However, the region’s economic outlook is not without its challenges, including rising inflation, geopolitical tensions, and the ongoing impact of the COVID-19 pandemic.

Economic Performance of Different Countries in the Asia Pacific

The economic performance of different countries in the Asia Pacific region varies significantly. Some countries, such as China, India, and Vietnam, have experienced rapid economic growth in recent years. These countries have benefited from strong domestic demand, increasing investment, and a growing middle class.

Other countries, such as Japan, South Korea, and Australia, have experienced more moderate economic growth, but they remain important players in the global economy.

- Chinais the world’s second-largest economy and has been a major driver of global economic growth for decades. The country’s economic growth has been fueled by its manufacturing sector, which has benefited from low labor costs and a large domestic market.

However, China’s economy is facing challenges, including slowing growth, rising debt levels, and trade tensions with the United States.

- Indiais the world’s fastest-growing major economy, with a projected growth rate of over 7% in 2023. India’s economic growth has been driven by its young population, a growing middle class, and increasing investment in infrastructure. However, India’s economy faces challenges, including poverty, inequality, and a lack of infrastructure.

- Japanis a developed economy with a highly sophisticated manufacturing sector. However, Japan’s economy has been struggling with deflation and slow growth for several years. The country’s aging population and high levels of government debt are also challenges.

- South Koreais a developed economy with a strong manufacturing sector. South Korea’s economy has been impacted by the global semiconductor shortage and rising inflation. However, the country’s economy is expected to rebound in the coming years, driven by strong exports and a growing domestic market.

- Australiais a developed economy with a strong mining sector. Australia’s economy has benefited from high commodity prices in recent years. However, the country’s economy is vulnerable to fluctuations in commodity prices and global economic conditions.

Factors Influencing Economic Growth and Stability in the Asia Pacific

The economic growth and stability of the Asia Pacific region are influenced by a number of factors, including:

- Global Economic Conditions:The Asia Pacific region is closely integrated with the global economy. Global economic downturns can have a significant impact on the region’s economies. For example, the 2008 financial crisis led to a sharp decline in economic activity in many Asia Pacific countries.

- Trade:Trade is a major driver of economic growth in the Asia Pacific region. The region is home to some of the world’s busiest shipping ports and is a major exporter of manufactured goods. However, trade tensions between major economies can have a negative impact on the region’s economies.

- Investment:Investment is another key driver of economic growth in the Asia Pacific region. The region is attracting significant foreign direct investment, which is helping to fund infrastructure development and create new jobs. However, investment can be volatile and can be affected by factors such as political instability and economic uncertainty.

- Technology:Technological advancements are playing an increasingly important role in the Asia Pacific economy. The region is home to some of the world’s leading technology companies, and innovation is driving economic growth in many sectors.

- Demographics:The Asia Pacific region is home to a large and growing population. This demographic trend is creating opportunities for economic growth, but it also poses challenges, such as the need for more jobs and infrastructure.

Global Market Implications

South Korea’s inflation news has the potential to ripple through global markets, influencing trade, investment, and economic sentiment. The decline in inflation, coupled with a stable economic outlook, can be seen as a positive sign for the global economy, particularly in Asia Pacific.

Impact on International Trade and Investment, Asia pacific markets mostly rise after south koreas inflation rate hits 42 month low

The news of South Korea’s decreasing inflation can boost investor confidence and attract more foreign investment. A stable economic environment with controlled inflation encourages businesses to expand operations and invest in new ventures. This can lead to increased trade activity between South Korea and its global partners, fostering economic growth and job creation.

Potential Spillover Effects

The positive news from South Korea can have a spillover effect on other economies in the region. For example, a stronger South Korean economy can increase demand for goods and services from neighboring countries, stimulating their economic growth. Furthermore, a decline in inflation in South Korea can influence other countries to adopt similar policies, contributing to a more stable and interconnected economic environment in Asia Pacific.