Answering Ask Post Questions: I Bonds, Crypto, Bank Accounts

Answering ask post questions about i bonds crypto cons bank accounts – Answering ask post questions about I Bonds, cryptocurrency, and the pros and cons of bank accounts can be a daunting task, but it’s essential for navigating the complex financial landscape. From the safety and inflation protection of I Bonds to the high-risk, high-reward world of cryptocurrency, and the foundational stability of bank accounts, understanding these different financial tools is crucial for making informed decisions.

This post will delve into each of these topics, exploring their advantages, disadvantages, and how they can be incorporated into a well-rounded financial strategy. We’ll also provide tips for asking effective questions on online forums and evaluating the credibility of information you find online.

By the end of this discussion, you’ll have a clearer understanding of these different investment options and be better equipped to make smart financial choices.

I Bonds

In a world of economic uncertainty, safeguarding your savings is paramount. While traditional savings accounts offer a safe haven for your money, they often struggle to keep pace with inflation, eroding your purchasing power over time. Enter I Bonds, a unique investment offering from the U.S.

It’s been a busy week answering ask post questions about I bonds, crypto cons, and the best bank accounts to open. But I have to admit, I’m a little distracted by the news that Peter Navarro, ex-Trump White House adviser, has received a grand jury subpoena in the January 6th investigation.

This development certainly adds another layer to the ongoing legal proceedings. But back to the topic at hand, let’s get back to those financial questions!

Treasury that provides a compelling solution to this challenge.

I Bonds: A Safe Haven for Savings

I Bonds, or Series I Savings Bonds, are a type of savings bond that offer inflation protection, ensuring your investment keeps pace with rising prices. This unique feature makes I Bonds an attractive option for those seeking to preserve their savings and potentially grow their wealth in a volatile economic environment.

I Bonds Offer Inflation Protection, Answering ask post questions about i bonds crypto cons bank accounts

I Bonds provide a fixed interest rate for the first six months of your investment, followed by a variable interest rate that adjusts every six months based on the Consumer Price Index (CPI). This ensures that your investment keeps pace with inflation, safeguarding your purchasing power.

I Bonds Can Potentially Grow Your Wealth

While I Bonds offer inflation protection, they also have the potential to grow your wealth. The variable interest rate component of I Bonds means that your investment can potentially earn a higher return if inflation rises significantly. This can provide a valuable hedge against rising prices, allowing your savings to grow even in a challenging economic environment.

I Bonds Play a Crucial Role in a Diversified Portfolio

I Bonds can play a vital role in a diversified investment portfolio by mitigating inflation risk. By incorporating I Bonds into your portfolio, you can protect your savings from the eroding effects of inflation, ensuring that your overall investment strategy remains resilient in the face of economic uncertainty.

Real-World Examples of I Bond Performance

During periods of high inflation, I Bonds have demonstrated their effectiveness as a hedge against rising prices. For instance, during the 1970s, a period marked by significant inflation, I Bonds outperformed traditional savings accounts and many other investment options, providing investors with a valuable shield against the erosion of their purchasing power.

Cryptocurrency

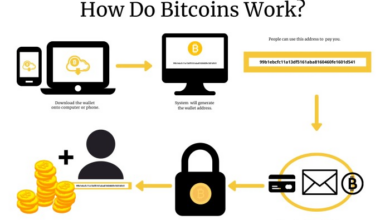

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of central banks. While they offer potential for high returns, they also come with significant risks due to their volatility and lack of regulation.

Volatility and Risk

The cryptocurrency market is known for its extreme volatility, with prices fluctuating rapidly and unpredictably. This volatility arises from several factors, including:* Limited adoption:Cryptocurrencies are still relatively new and have not yet gained widespread acceptance as a means of payment.

Speculative trading

Many investors view cryptocurrencies as a speculative asset, driving price fluctuations based on market sentiment rather than underlying fundamentals.

Lack of regulation

The lack of regulatory oversight in the cryptocurrency market creates uncertainty and increases the risk of scams and fraud.The volatility of cryptocurrency markets presents significant risks for investors. For example, the price of Bitcoin, the most popular cryptocurrency, has experienced dramatic swings in value.

In 2017, Bitcoin’s price surged to nearly $20,000, only to crash to below $4,000 in 2018. This volatility makes it challenging to predict future price movements and can lead to substantial losses for investors.

Potential for High Returns and Losses

While the volatility of cryptocurrency markets poses risks, it also presents the potential for high returns. The rapid growth of the cryptocurrency market in recent years has attracted investors seeking to capitalize on this potential.* Successful investments:Some early investors in cryptocurrencies have realized significant profits, particularly those who bought Bitcoin or other cryptocurrencies at low prices and sold them at their peak.

Unsuccessful investments

However, many investors have also experienced losses, particularly those who bought cryptocurrencies at high prices and saw their value decline.The potential for high returns in the cryptocurrency market is driven by several factors, including:* Decentralization:Cryptocurrencies operate independently of central banks, which can make them more resistant to government interference and inflation.

Innovation

The cryptocurrency industry is constantly evolving, with new technologies and applications emerging regularly.

Growing adoption

The increasing adoption of cryptocurrencies as a means of payment and investment is driving demand and potentially increasing their value.However, the potential for high returns also comes with significant risks. The lack of regulation and the inherent volatility of the cryptocurrency market can lead to sudden and unpredictable price swings, potentially resulting in substantial losses.

Comparison with Traditional Assets

Investing in cryptocurrencies differs significantly from investing in traditional assets such as stocks and bonds.

Traditional Assets

Stocks

It’s been fascinating to see the variety of questions people have about i bonds, crypto, the cons of traditional bank accounts, and more. I’ve even had some ask about the implications of the growing trend of christian nationalism on the rise in some GOP campaigns on their personal finances.

It’s clear that people are seeking answers to complex questions, and I’m happy to share my thoughts and insights on these important topics.

Represent ownership in a company and provide investors with a share of its profits.

Bonds

Represent loans to a company or government, providing investors with fixed interest payments.

Cryptocurrencies

Digital assets

It’s been a busy week answering ask post questions about I bonds, crypto cons, and the best bank accounts for saving. But honestly, it’s hard to focus on those topics when you see the news about African Americans experiencing trauma after the Buffalo shooting, experts say.

It’s a stark reminder that financial security is just one piece of the puzzle when it comes to feeling safe and secure. I’m hoping to get back to answering those finance questions soon, but for now, my thoughts are with the victims and their families.

Cryptocurrencies are not backed by any physical assets or government guarantees.

Volatility

The cryptocurrency market is significantly more volatile than traditional markets.

Regulation

Traditional markets are subject to regulatory oversight, while the cryptocurrency market is largely unregulated.

| Feature | Traditional Assets (Stocks & Bonds) | Cryptocurrencies |

|---|---|---|

| Regulation | Highly regulated | Largely unregulated |

| Volatility | Generally less volatile | Highly volatile |

| Liquidity | Generally more liquid | Can be less liquid, especially for smaller cryptocurrencies |

| Risk | Moderate to high risk | High risk |

| Returns | Potentially moderate returns | Potentially high returns, but also high risk of losses |

While traditional assets offer greater stability and regulatory protection, cryptocurrencies present the potential for higher returns due to their decentralized nature and rapid growth. However, this potential for high returns comes with significantly higher risk, including volatility, lack of regulation, and the possibility of scams and fraud.

Bank Accounts

A stable and secure bank account is the foundation of managing your personal finances. It provides a safe and accessible place to store your money, pay bills, and make purchases. Understanding the different types of bank accounts available and choosing the right one for your needs can help you achieve your financial goals.

Types of Bank Accounts

Bank accounts come in various forms, each designed to cater to specific needs and financial goals. The most common types include:

- Checking Accounts:These accounts are designed for everyday transactions, such as paying bills, making purchases, and depositing paychecks. They offer easy access to funds through checks, debit cards, and online banking. Some checking accounts offer additional features like overdraft protection or interest-bearing balances.

- Savings Accounts:These accounts are ideal for saving money over time. They typically offer a higher interest rate than checking accounts, but they may have restrictions on withdrawals. Savings accounts are a good option for building an emergency fund, saving for a down payment on a house, or reaching other long-term financial goals.

- Money Market Accounts (MMAs):MMAs are a type of savings account that offers higher interest rates than traditional savings accounts, but they may have minimum balance requirements and restrictions on withdrawals. They are a good option for individuals who need a safe place to store larger sums of money and want to earn a higher rate of return.

Choosing the Right Bank Account

Selecting the right bank account depends on your individual needs and financial goals. Here are some factors to consider:

- Fees:Some banks charge monthly maintenance fees, transaction fees, or overdraft fees. Compare fees across different banks and choose an account with low or no fees.

- Interest Rates:If you are looking to earn interest on your savings, compare interest rates across different banks and choose an account with a competitive rate.

- Features:Consider the features that are important to you, such as mobile banking, online bill pay, overdraft protection, or ATM access.

- Minimum Balance Requirements:Some banks require a minimum balance to avoid fees. Choose an account with a minimum balance that you can comfortably maintain.

Ask Post Questions

Navigating the world of finance can be overwhelming, especially when faced with complex decisions about investments, savings, or even everyday banking. This is where online forums and communities come in handy. They offer a platform for individuals to connect, share experiences, and seek guidance from others who have encountered similar situations.

Benefits of Online Forums

Online forums provide a valuable resource for seeking information and guidance on financial matters. Here are some key benefits:

- Access to a Diverse Range of Perspectives:Forums bring together individuals from various backgrounds and experiences, offering a wide array of perspectives on financial topics. This diversity can help you gain a more comprehensive understanding of different approaches and strategies.

- Real-Life Experiences and Insights:Many forum users share their personal experiences, successes, and challenges, providing valuable insights that go beyond theoretical knowledge. These firsthand accounts can help you make informed decisions based on real-world scenarios.

- Support and Community:Forums create a sense of community, where users can connect with others facing similar financial challenges. This can provide emotional support and encouragement during times of uncertainty or difficulty.

- Cost-Effective Information:Seeking guidance from financial professionals can be expensive. Forums offer a cost-effective way to access valuable information and insights from experienced individuals without incurring professional fees.

Formulating Effective Questions

To maximize the benefits of online forums, it’s essential to ask questions that are clear, concise, and informative. Here are some tips for formulating effective questions:

- Be Specific:Avoid broad or vague questions. Instead, focus on specific areas of interest or concerns. For example, instead of asking “How do I invest my money?”, ask “What are some low-risk investment options for someone with a long-term investment horizon?”

- Provide Context:Include relevant information about your situation, such as your age, income, risk tolerance, and financial goals. This context helps forum users provide more tailored and relevant advice.

- Use Clear and Concise Language:Avoid jargon or technical terms that may not be understood by everyone. Use plain language to ensure your question is accessible to a wider audience.

- Be Respectful and Professional:Maintain a respectful tone and avoid making personal attacks or offensive comments. Remember that you’re interacting with a community of individuals with diverse viewpoints.

Evaluating the Credibility of Sources

While online forums can be a valuable resource, it’s important to exercise caution and evaluate the credibility of sources. Not all information shared online is accurate or reliable. Consider the following factors when assessing the credibility of sources:

- Reputation and Experience:Look for users who have established a reputation for providing helpful and accurate information. Check their post history and see if they have any relevant experience or qualifications in finance.

- Objectivity and Bias:Be aware of potential biases or conflicts of interest. Some users may promote specific products or services, so it’s important to consider their motivations.

- Supporting Evidence:Look for users who back up their claims with supporting evidence, such as research, data, or reputable sources. Avoid relying on anecdotal evidence or opinions without any basis.

- Multiple Perspectives:Don’t rely on just one source. Seek out information from multiple users and compare their perspectives to gain a more balanced understanding of the topic.

Navigating the Financial Landscape: Answering Ask Post Questions About I Bonds Crypto Cons Bank Accounts

Investing your hard-earned money can be daunting, with countless options and strategies to choose from. Understanding the pros and cons of different investment avenues is crucial for making informed financial decisions. This guide will help you navigate the financial landscape by comparing and contrasting three popular investment choices: I Bonds, cryptocurrencies, and traditional bank accounts.

Comparing Investment Options

This table provides a comprehensive comparison of I Bonds, cryptocurrencies, and traditional bank accounts, highlighting their key features, risk levels, potential returns, and other important factors.

| Asset Class | Risk Level | Potential Return | Key Features |

|---|---|---|---|

| I Bonds | Low | Inflation-protected, variable interest rate |

|

| Cryptocurrencies | High | Potentially high returns, but also high volatility |

|

| Traditional Bank Accounts | Very Low | Low interest rates, FDIC insured |

|

Epilogue

As you navigate the world of finance, remember that there’s no one-size-fits-all approach. The best strategy will depend on your individual risk tolerance, financial goals, and time horizon. By understanding the nuances of I Bonds, cryptocurrencies, and bank accounts, you can make informed decisions that align with your unique needs and aspirations.

Don’t hesitate to ask questions, seek guidance from trusted sources, and remember that continuous learning is essential in the ever-evolving financial landscape.