Analyzing Stagflation: Why Its a Worry Now

Analysis whats stagflation and why is it such a worry now – Analyzing stagflation and why it’s such a worry now, we’re diving into a complex economic phenomenon that’s making headlines. Remember the 1970s? High inflation, sluggish growth, and rising unemployment? That’s stagflation, and while it may seem like a relic of the past, it’s a serious concern in today’s world.

We’ll explore what it is, what causes it, and why it’s a significant threat to economies and individuals alike.

Imagine a world where prices are skyrocketing, but the economy is barely growing. That’s the reality of stagflation. It’s a dangerous combination of inflation and stagnation, and it can have devastating consequences. We’ll examine the historical context, the factors that contribute to it, and the potential impact on businesses, consumers, and global markets.

What is Stagflation?: Analysis Whats Stagflation And Why Is It Such A Worry Now

Stagflation is a complex economic phenomenon that combines the negative aspects of both inflation and recession, leading to a stagnant economy with rising prices. This unique economic condition poses a significant challenge to policymakers and can have a detrimental impact on individuals and businesses.

Key Characteristics of Stagflation

Stagflation is characterized by a combination of factors:

- High Inflation:Prices for goods and services rise rapidly, eroding purchasing power and making it difficult for individuals to maintain their living standards.

- Slow Economic Growth:The economy stagnates or experiences very low growth, leading to high unemployment and limited job opportunities. This can be reflected in factors like a decline in GDP growth, sluggish investment, and reduced consumer spending.

- High Unemployment:With slow economic growth, businesses may be reluctant to hire new employees or even lay off existing workers, resulting in a rise in unemployment.

Historical Context of Stagflation, Analysis whats stagflation and why is it such a worry now

Stagflation is not a new phenomenon and has occurred throughout history, often triggered by specific events or circumstances.

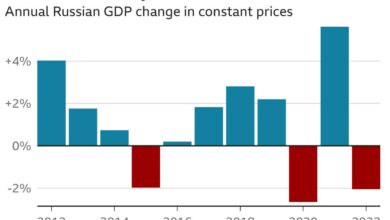

- 1970s:The 1970s witnessed a significant period of stagflation in many developed economies, particularly in the United States. This was primarily attributed to the oil crisis of 1973, which led to a surge in energy prices and a subsequent slowdown in economic activity.

- 1980s:While the 1980s saw some recovery from the stagflation of the previous decade, many countries continued to grapple with high inflation and unemployment, particularly in the early years of the decade.

- Recent Examples:In recent years, several countries have experienced periods of stagflation or stagflationary pressures, often due to factors such as global supply chain disruptions, rising energy prices, and the impact of the COVID-19 pandemic.

Comparison of Stagflation with Other Economic Scenarios

Understanding the distinction between stagflation and other economic scenarios is crucial for analyzing its implications.

- Inflation:Inflation refers to a general increase in the price level of goods and services over time. Unlike stagflation, inflation does not necessarily imply a decline in economic growth or an increase in unemployment.

- Recession:A recession is characterized by a significant decline in economic activity, typically defined as two consecutive quarters of negative GDP growth. While stagflation also involves slow economic growth, it is distinguished by the presence of high inflation.

Final Thoughts

As we wrap up our exploration of stagflation, it’s clear that this economic beast is not to be taken lightly. It’s a complex issue with far-reaching consequences, and it’s essential to understand its dynamics to navigate the economic landscape. While the future is uncertain, by understanding the causes, consequences, and potential solutions, we can better prepare for the challenges ahead.

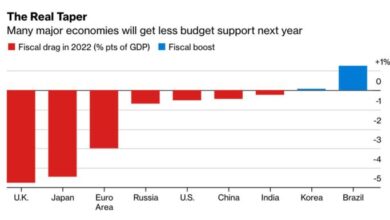

Stagflation, that dreaded combination of high inflation and stagnant economic growth, is a serious concern because it undermines both consumer confidence and business investment. The current global situation, exacerbated by the war in Ukraine, only amplifies these worries. The conflict has disrupted supply chains, driven up energy prices, and cast a shadow of uncertainty over the future, as explored in this insightful article ukraine and the problem of futurelessness.

This uncertain future, coupled with rising prices, makes it incredibly difficult to plan for the future, both on a personal and a macroeconomic level. As a result, stagflation becomes even more worrisome, threatening to stall global economic recovery and further exacerbate existing inequalities.

Stagflation, the dreaded combination of high inflation and slow economic growth, is a real concern for many. It’s like trying to juggle a flaming torch while balancing on a tightrope – one misstep and things can go terribly wrong. But while economists are busy crunching numbers, I was busy trying out a new meal delivery service – Freshly.

It’s a small escape from the larger economic worries, but even in these times, it’s important to find some balance, right? And maybe, just maybe, a little bit of healthy food can help us weather the economic storm.

Stagflation, that dreaded combination of high inflation and stagnant economic growth, is a serious worry right now. It’s a complex issue, and understanding its roots is crucial. To get some insights, I recently stumbled upon a transcript of Dr.

Henning Tiemeier’s analysis on the current economic climate , which provides a valuable perspective on the factors driving stagflation and potential solutions. His insights, coupled with ongoing economic data analysis, will help us better navigate this challenging economic landscape.