Is the Fed Losing Control of Inflation?

Analysis the fed is losing control over the inflation narrative – Is the Fed losing control over the inflation narrative? This question has become increasingly relevant as inflation persists, defying the Federal Reserve’s initial pronouncements of it being “transitory.” While the Fed initially cited factors like supply chain disruptions as temporary contributors to price increases, the reality on the ground tells a different story.

Persistent inflation, impacting everything from groceries to gasoline, has raised concerns about the Fed’s ability to manage the situation.

The Fed’s narrative was built on the assumption that inflation would be short-lived, a temporary consequence of pandemic-related economic disruptions. However, a closer look at key economic indicators reveals a more persistent trend. The consumer price index (CPI) has remained stubbornly high, and the Fed’s attempts to curb inflation through interest rate hikes have yet to fully materialize in a decline.

The rising cost of living is impacting consumers and businesses alike, leading to a growing sense of uncertainty and economic anxiety.

The Fed’s Policy Response

The Federal Reserve (Fed) has been actively trying to combat inflation by implementing a series of policy actions, primarily focused on raising interest rates. These measures aim to cool down the economy and bring inflation back to its 2% target.

Interest Rate Hikes, Analysis the fed is losing control over the inflation narrative

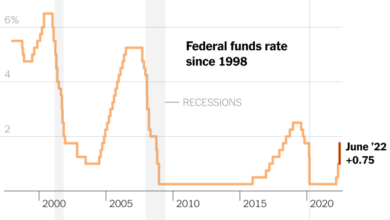

The Fed has aggressively raised interest rates since early 2022. This strategy aims to make borrowing more expensive for businesses and consumers, slowing down economic activity and reducing demand. The Fed’s target federal funds rate has risen from near zero in March 2022 to over 5% in May 2023.

Effectiveness of Policy Actions

The effectiveness of the Fed’s policy response in curbing inflation is still being debated. While inflation has cooled somewhat from its peak in 2022, it remains elevated above the Fed’s target. Some argue that the Fed’s actions are starting to have a noticeable impact, pointing to the slowdown in economic growth and the decline in consumer spending.

Others argue that the Fed’s actions are too little, too late, and that inflation will remain stubbornly high for some time.

Potential Side Effects

The Fed’s aggressive rate hikes have also raised concerns about potential side effects on the economy. Higher interest rates can lead to slower economic growth, potentially pushing the economy into a recession. They can also make it more difficult for businesses to invest and for consumers to afford homes and other major purchases.

Comparison to Previous Periods of High Inflation

The Fed’s current policy response to high inflation is similar in some ways to its response during previous periods of high inflation. In the 1970s and 1980s, the Fed also raised interest rates aggressively to combat inflation. However, the current situation is also different in some key ways.

For example, the current inflation surge is driven by supply chain disruptions and strong consumer demand, while the inflation of the 1970s and 1980s was largely driven by energy price shocks. This means that the Fed’s current response may need to be tailored differently to address the specific causes of the current inflation surge.

Closure: Analysis The Fed Is Losing Control Over The Inflation Narrative

The Fed’s battle against inflation is far from over. The effectiveness of its current policy response remains to be seen, and the potential consequences of its actions on the economy are still unfolding. The path forward is fraught with challenges, and the Fed’s ability to regain control of the inflation narrative will depend on its agility in navigating a complex economic landscape.

The question remains: can the Fed successfully tame inflation, or will we be living with its consequences for years to come?

The Fed’s struggles to control inflation are a complex issue, and it’s fascinating to see how these economic trends impact other sectors. For instance, the recent news of digital health platform Parallel Learning securing $20 million in Series A funding to support students with learning differences shows how investment flows to areas perceived as resilient, even amidst economic uncertainty.

While the Fed grapples with inflation, the education sector continues to innovate and adapt, demonstrating the enduring importance of investing in human capital.

The Fed’s narrative about inflation is crumbling, with rising prices showing no signs of slowing down. It’s becoming increasingly clear that the Fed’s actions aren’t having the desired effect, and even Sen Kevin Cramer would likely agree that something needs to change.

Sen Kevin Cramer would likely advocate for a more aggressive approach, perhaps even a return to the old gold standard. This raises a serious question: is the Fed losing control of the inflation narrative, or is it simply a matter of time before the economy adapts to the new reality?

It’s fascinating to see how the Fed’s struggle to control inflation is playing out in the political arena. While the economic implications are certainly significant, the issue is also taking center stage in the upcoming Georgia Senate race, where abortion rights have become a major talking point.

As seen in how abortion is already animating the senate race in georgia , this issue is likely to influence voter turnout and ultimately impact the outcome of the election. The connection between economic concerns and social issues highlights the complex landscape of American politics, where the Fed’s actions can ripple out and affect the national conversation in unexpected ways.