The Feds Inflation Blunder: History Repeating Itself?

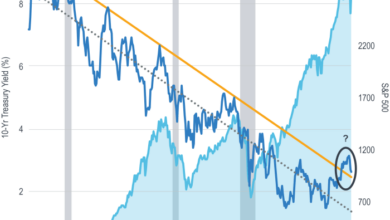

Analysis the fed hasnt fixed its worst blunder since the 1970s – Analysis of the Fed hasn’t fixed its worst blunder since the 1970s suggests we might be repeating history. The echoes of the 1970s inflation crisis are ringing loud today, raising questions about whether the Federal Reserve has learned from its past mistakes.

The economic policies implemented then, characterized by loose monetary policy and government spending, fueled a spiral of inflation that took years to tame. Today, we face a similar situation, with rising prices and concerns about the Fed’s ability to regain control.

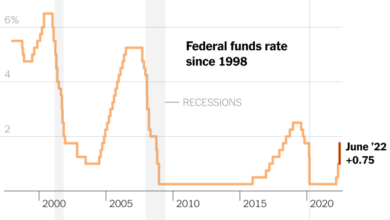

While the current economic landscape is distinct from the 1970s, the parallels are undeniable. The Fed’s response to the pandemic, characterized by aggressive quantitative easing and low interest rates, has created an environment ripe for inflation. This raises crucial questions about the Fed’s current approach and whether it’s sufficient to address the challenges ahead.

Alternative Approaches to Inflation Control

The Federal Reserve’s traditional approach to inflation control, primarily focused on raising interest rates, has faced growing criticism. This approach, while effective in the past, might not be sufficient in the current economic landscape. As a result, alternative approaches to inflation control are gaining attention.

The Fed’s failure to address the inflation crisis feels like a repeat of the 1970s, and it’s hard to ignore the parallel between the economic chaos and the political turmoil we’re seeing. It’s a reminder that even as we’re grappling with economic woes, we’re also witnessing a disturbing trend of political leaders prioritizing personal gain over the well-being of their constituents, like in the case of Trump’s support for a Saudi-backed golf tour amidst the anger of 9/11 families.

These events, both economic and political, are a stark reminder that we need strong leadership focused on solving real problems, not just personal agendas.

These approaches offer potential benefits and drawbacks that need to be carefully considered.

The Fed’s failure to address inflation effectively feels like a replay of the 1970s, a period of economic turmoil that still haunts us. While we grapple with these economic challenges, there’s a different battleground brewing in New York, where progressives are focusing their efforts on taking control of the state assembly.

This political struggle will likely have ripple effects on the national stage, and could influence how the Fed’s policies are ultimately received and implemented.

Alternative Monetary Policies

The Fed could consider several alternative monetary policies to combat inflation. These include:

- Price Level Targeting: Instead of focusing on interest rates, the Fed could directly target a specific inflation rate. This approach would involve setting a clear inflation goal and adjusting monetary policy to achieve it.

- Nominal GDP Targeting: This approach aims to stabilize the nominal GDP growth rate, which encompasses both inflation and real economic growth. The Fed would adjust monetary policy to ensure nominal GDP grows at a predetermined rate.

- Quantitative Easing (QE): QE involves the Fed injecting liquidity into the financial system by purchasing assets, like government bonds. This can lower long-term interest rates and stimulate economic activity.

- Negative Interest Rates: In extreme circumstances, the Fed could consider lowering interest rates below zero. This unconventional policy would aim to further stimulate borrowing and spending.

Pros and Cons of Alternative Approaches

Each alternative monetary policy carries its own set of advantages and disadvantages:

- Price Level Targeting:

- Pros: It provides a clear and transparent framework for inflation control, promoting price stability and long-term economic growth.

- Cons: It might be challenging to accurately predict and control inflation, and it could lead to unwanted volatility in interest rates.

- Nominal GDP Targeting:

- Pros: It considers both inflation and real economic growth, potentially leading to a more stable economy.

- Cons: It might be difficult to accurately measure and forecast nominal GDP, and it could create uncertainty about the Fed’s intentions.

- Quantitative Easing (QE):

- Pros: It can lower long-term interest rates, stimulate investment, and boost economic growth.

- Cons: It can lead to asset bubbles, inflation, and a decline in the value of the currency.

- Negative Interest Rates:

- Pros: It can encourage borrowing and spending, boosting economic activity.

- Cons: It can discourage saving, potentially leading to financial instability, and it could be ineffective in stimulating investment.

Hypothetical Scenario: Implementing Nominal GDP Targeting

Imagine a scenario where the Fed implements nominal GDP targeting. The Fed sets a target of 5% nominal GDP growth. If actual nominal GDP growth falls below 5%, the Fed would lower interest rates to stimulate economic activity. Conversely, if nominal GDP growth exceeds 5%, the Fed would raise interest rates to curb inflation.In this scenario, the Fed would prioritize stabilizing the nominal GDP growth rate, aiming for a balance between inflation and real economic growth.

This approach could lead to a more stable economy, with lower inflation and consistent economic growth. However, it also carries risks. For instance, if the Fed’s forecasts are inaccurate, the policy could lead to unintended consequences.

The Future of Inflation and the Fed’s Role: Analysis The Fed Hasnt Fixed Its Worst Blunder Since The 1970s

Predicting the future trajectory of inflation is a complex task, fraught with uncertainty. However, understanding the key factors that could influence inflation, both domestically and internationally, can provide insights into potential scenarios. This analysis will explore these factors and assess the Fed’s potential role in shaping the future of inflation and its impact on the economy.

Factors Influencing Future Inflation, Analysis the fed hasnt fixed its worst blunder since the 1970s

The future of inflation will be influenced by a complex interplay of domestic and international factors. These include:

- Supply Chain Dynamics:Ongoing disruptions to global supply chains, exacerbated by geopolitical tensions, can lead to higher prices for goods and services. The extent to which these disruptions ease will significantly impact inflation.

- Energy Prices:Volatility in global energy markets, particularly for oil and natural gas, directly affects consumer prices and business costs. The ongoing war in Ukraine and geopolitical tensions have contributed to rising energy prices, adding to inflationary pressures.

- Labor Market Conditions:A tight labor market, characterized by low unemployment and high demand for workers, can lead to wage pressures. These pressures can contribute to inflation if businesses pass on increased labor costs to consumers.

- Consumer Demand:Consumer spending plays a crucial role in driving inflation. If consumers are confident about the economy and have ample disposable income, they are more likely to spend, potentially leading to higher demand and prices.

- Government Policies:Fiscal and monetary policies can have a significant impact on inflation. Expansionary fiscal policies, such as increased government spending, can contribute to inflationary pressures. Monetary policies, such as interest rate adjustments, can influence borrowing costs and consumer spending, ultimately impacting inflation.

- Geopolitical Risks:Global events, such as wars, political instability, and trade disputes, can disrupt supply chains, increase commodity prices, and create uncertainty in financial markets, all of which can contribute to inflation.

The Fed’s Role in Shaping Future Inflation

The Federal Reserve has a critical role to play in managing inflation and ensuring price stability. The Fed’s primary tool for controlling inflation is monetary policy, which involves adjusting interest rates and the money supply.

- Interest Rate Adjustments:The Fed can raise interest rates to slow down economic activity and reduce demand, thereby curbing inflation. Conversely, lowering interest rates can stimulate economic growth but can also lead to higher inflation. The Fed’s decisions on interest rate adjustments are based on its assessment of economic conditions, including inflation, unemployment, and economic growth.

- Quantitative Easing (QE):During periods of economic crisis, the Fed can use QE to inject liquidity into the financial system by purchasing government bonds and other assets. QE can lower interest rates and stimulate borrowing and investment, potentially leading to higher inflation. The Fed’s decision to use QE is based on the severity of the economic crisis and the need to provide additional stimulus.

- Communication and Transparency:The Fed’s communication about its monetary policy stance and economic outlook is crucial for influencing market expectations and shaping investor behavior. Clear and transparent communication can help to anchor inflation expectations and ensure that the Fed’s policies are effectively transmitted to the economy.

Conclusive Thoughts

The Fed’s current inflation fight is a critical test of its ability to learn from history. The potential consequences of unchecked inflation are severe, impacting businesses, consumers, and investors alike. While the Fed has tools at its disposal, the effectiveness of its current approach remains uncertain.

It’s time for a serious evaluation of alternative strategies, including a more proactive stance on monetary policy and a focus on long-term stability. The future of the economy hangs in the balance, and the Fed’s actions will have a profound impact on our collective prosperity.

It’s hard to focus on the Fed’s latest missteps when there’s a cocktail competition going on! While the Fed grapples with its worst blunder since the 1970s, the Tales of the Cocktail announces top four finalists for the 16th annual spirited awards , a celebration of creativity and artistry in the world of cocktails.

It’s a reminder that even in times of economic uncertainty, there’s still room for joy and celebration, and that the Fed’s blunders, while serious, don’t have to overshadow all the good things in life.