OPEC Mulls When to Fire Its Last Oil Production Bullets

Analysis opec mulls when to fire its last oil production bullets – OPEC Mulls When to Fire Its Last Oil Production Bullets: The global oil market is bracing for a potential shift as OPEC, the Organization of the Petroleum Exporting Countries, contemplates a strategic move that could significantly impact global energy dynamics.

The cartel, which controls a substantial portion of the world’s oil production, is considering a reduction in output, a decision that could send shockwaves through oil prices and energy security.

This move is driven by a complex interplay of factors, including the ongoing global energy crisis, the desire to maintain market stability, and the influence of geopolitical tensions. The potential impact of this decision is multifaceted, with implications for oil prices, energy security, and the global economy as a whole.

It’s a high-stakes game, with both potential benefits and risks, and the consequences of OPEC’s actions will be felt far and wide.

Future Outlook for Oil Markets

The potential impact of OPEC’s decision to adjust oil production levels will have a significant influence on the future trajectory of global oil markets. This decision, coupled with other factors such as global economic growth, demand patterns, and geopolitical events, will shape the oil price landscape in the coming months and years.

Factors Influencing Future Oil Prices

Several key factors will influence the future trajectory of oil prices. These factors include:

- Global Economic Growth:A strong global economy typically translates to higher demand for oil, pushing prices upward. Conversely, a slowdown in economic growth could lead to reduced demand and lower prices.

- Demand Patterns:Shifts in global energy consumption patterns, such as the increasing adoption of electric vehicles and renewable energy sources, could impact oil demand in the long term.

- Geopolitical Events:Geopolitical tensions and conflicts, particularly in oil-producing regions, can disrupt supply chains and lead to price volatility.

- OPEC Policy:OPEC’s production decisions play a crucial role in determining global oil supply. Changes in production quotas or unexpected disruptions can significantly impact oil prices.

- Investment in Oil Production:Investment in new oil production projects can influence future supply. Reduced investment could lead to tighter supply conditions and higher prices.

- Technological Advancements:Technological advancements in oil extraction, such as fracking, can impact oil supply and production costs.

- Government Policies:Government policies, such as taxes and subsidies, can influence oil prices and consumption patterns.

Timeline of Key Events, Analysis opec mulls when to fire its last oil production bullets

The following timeline Artikels key events and developments that could impact oil markets in the coming months and years:

- Short Term (Next 6-12 Months):

- OPEC+ Meetings:OPEC+ meetings will continue to be closely watched for any changes in production quotas.

- Global Economic Outlook:Economic growth projections and any potential recessions could influence oil demand.

- Geopolitical Developments:Any escalating geopolitical tensions or conflicts in oil-producing regions could impact supply and prices.

- Medium Term (1-3 Years):

- Investment in Renewable Energy:Continued investment in renewable energy sources could lead to a gradual shift away from fossil fuels.

- Electric Vehicle Adoption:The increasing adoption of electric vehicles could reduce gasoline demand in the long term.

- Technological Advancements:Advancements in oil extraction technologies could impact supply and costs.

- Long Term (Beyond 3 Years):

- Climate Change Policies:Global efforts to address climate change could lead to stricter regulations on fossil fuel emissions, impacting oil demand and production.

- Energy Transition:The transition to a low-carbon economy could lead to a gradual decline in oil demand.

- Technological Innovation:Breakthroughs in energy storage and alternative fuels could significantly alter the energy landscape.

Forecast for Global Oil Markets

The future outlook for global oil markets is uncertain, but several factors suggest that oil prices will remain volatile in the coming years.

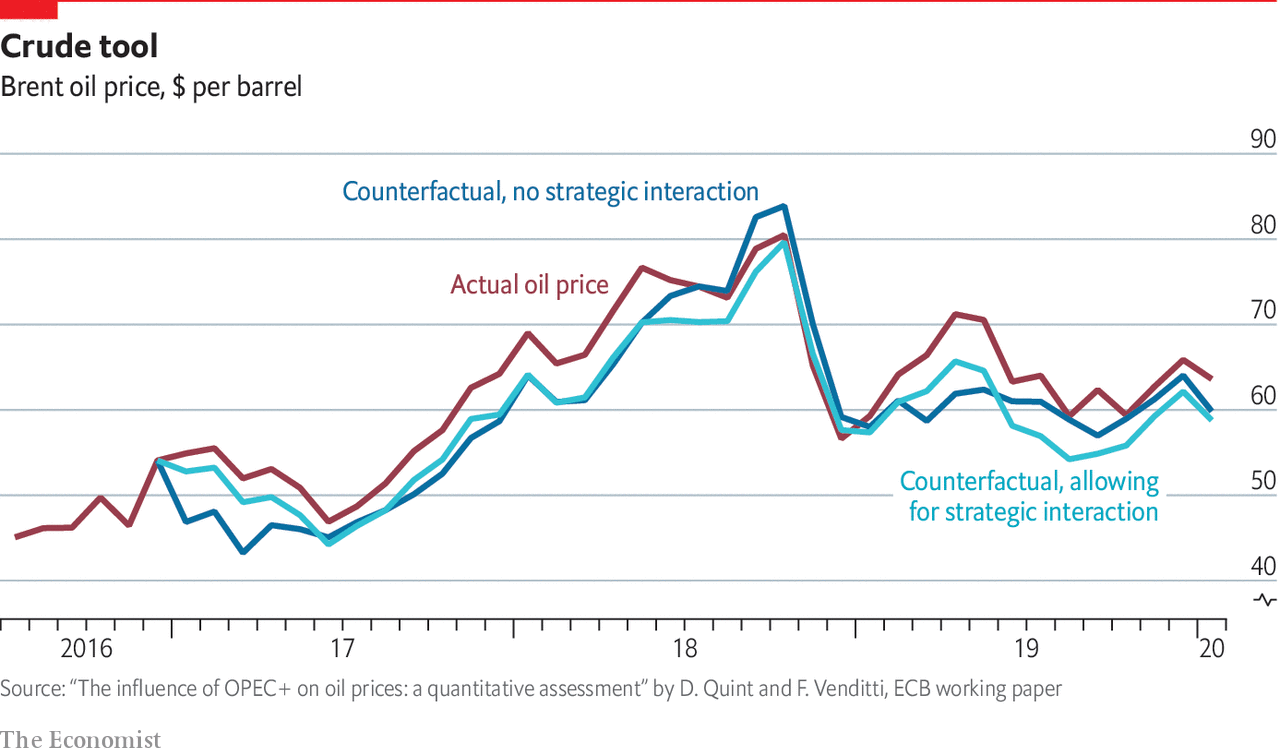

- OPEC’s Influence:OPEC’s production decisions will continue to play a significant role in shaping oil prices. While OPEC has shown a willingness to adjust production levels to maintain market stability, geopolitical events and member country dynamics could lead to unexpected disruptions.

- Global Economic Uncertainty:The global economy is facing numerous challenges, including inflation, supply chain disruptions, and geopolitical tensions. These factors could lead to fluctuations in oil demand and prices.

- Energy Transition:The transition to a low-carbon economy is expected to continue, leading to a gradual decline in oil demand in the long term. However, the pace of this transition is uncertain, and oil will likely remain a significant energy source for many years to come.

- Technological Advancements:Advancements in oil extraction technologies and alternative energy sources could impact oil supply and demand dynamics. However, the full impact of these advancements is still unfolding.

In conclusion, the future of oil markets is intertwined with global economic trends, geopolitical events, and the ongoing energy transition. While the long-term outlook for oil demand is uncertain, OPEC’s decisions and the evolving energy landscape will continue to shape the trajectory of oil prices in the coming years.

Wrap-Up: Analysis Opec Mulls When To Fire Its Last Oil Production Bullets

The question of when and how OPEC will pull the trigger on its last oil production bullets remains a subject of intense speculation. The decision will likely hinge on a delicate balancing act, weighing the potential benefits of increased prices against the risks of market volatility and geopolitical backlash.

The world watches with bated breath as OPEC navigates this complex landscape, a move that could shape the future of global energy for years to come.

The analysis of OPEC’s oil production strategy is fascinating, especially as they ponder the timing of their final reserves. It’s a complex situation with global implications. But if you’re looking for a career that’s more grounded, consider exploring the world of outdoor education – it’s a fulfilling path, and you can find helpful resources on how to get an outdoor education job.

Back to OPEC, their decisions will undoubtedly impact the global energy landscape for years to come.

It’s fascinating to see OPEC weighing its options on oil production, but the shift towards sustainable construction, like the one being spearheaded by firms who pledge to clean up construction with green net zero concrete , is a game-changer. This push for greener building practices could ultimately impact the demand for oil in the long run, forcing OPEC to recalibrate its strategy even further.

OPEC’s strategic oil production decisions are a balancing act, and the question of when to fire their last “bullets” is a complex one. It’s interesting to think about how the organization’s strategy compares to the current state of streaming giants like Netflix, who are also navigating a challenging landscape.

Netflix, for instance, is facing a similar need to make tough decisions, as they’ve recently announced their foray into advertising, netflix needs some help with ads. Just as OPEC must weigh the impact of their decisions on global markets, Netflix must consider the potential impact of their new ad-supported model on their subscriber base.

Ultimately, both OPEC and Netflix are facing the challenge of navigating a rapidly evolving environment, and their choices will shape the future of their respective industries.