Analysis: Nobody Knows How Long Inflation Will Last

Analysis nobody knows how long inflation will last thats life – Analysis: Nobody Knows How Long Inflation Will Last, that’s life. Inflation is a global economic phenomenon that has become a significant concern for individuals and businesses alike. While we’ve experienced periods of rising prices before, the current inflationary surge is particularly perplexing, leaving economists and policymakers grappling with its potential duration and consequences.

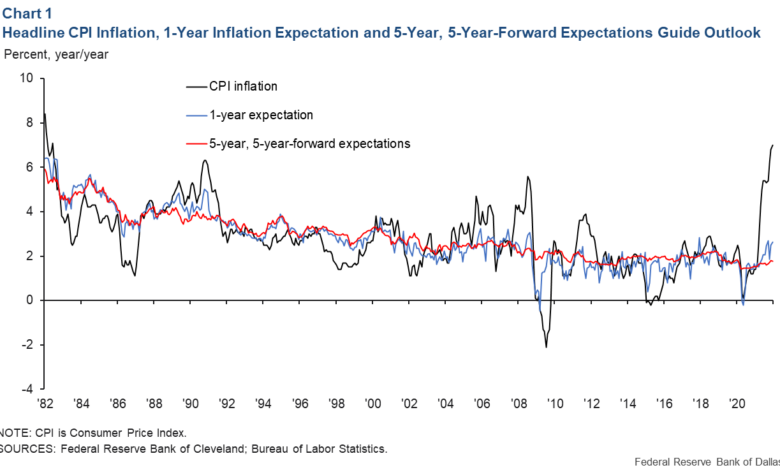

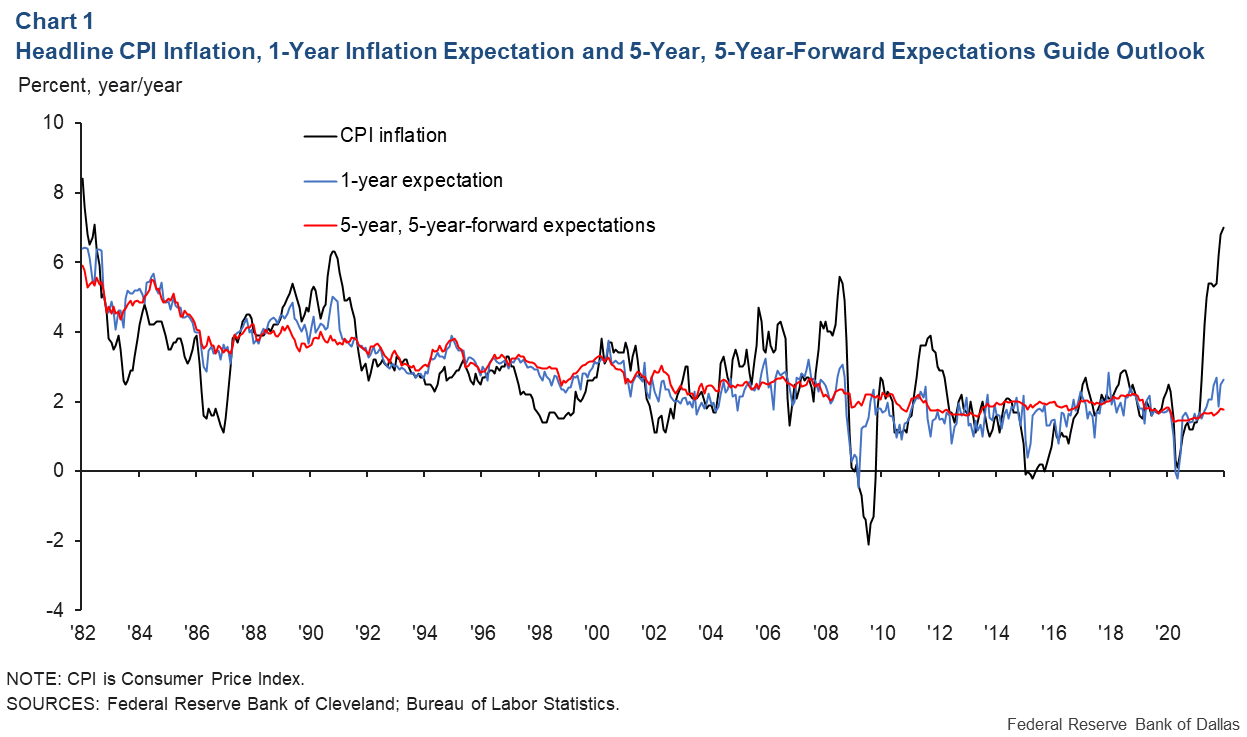

The current state of inflation is characterized by rising prices across various goods and services, fueled by factors like supply chain disruptions, increased energy costs, and robust consumer demand. However, the uncertainty surrounding its longevity stems from the interplay of these complex factors and the unpredictable nature of global events.

We’ve seen historical examples of prolonged inflation periods, such as the stagflation of the 1970s, which had devastating effects on economies and societies. Understanding the potential impact of prolonged inflation is crucial for navigating the current economic landscape.

The Uncertainty of Inflation: Analysis Nobody Knows How Long Inflation Will Last Thats Life

Inflation, the persistent rise in the general price level of goods and services, has become a significant concern for global economies. While inflation is a natural part of economic cycles, its current trajectory and potential duration remain uncertain, raising anxieties among policymakers, businesses, and consumers alike.

Factors Contributing to Inflation’s Unpredictability

The unpredictability of inflation’s duration stems from a complex interplay of factors, making it difficult to forecast its path accurately.

Analysts can debate the trajectory of inflation, but the reality is, we’re all navigating a world of uncertainty. It’s like the situation with the potential for a Pelosi trip to Taiwan – a Pelosi trip to Taiwan would test China’s appetite for confrontation , and nobody can predict the outcome.

Just like inflation, geopolitical events are unpredictable, and we can only adapt and hope for the best.

- Supply Chain Disruptions:The COVID-19 pandemic caused widespread disruptions to global supply chains, leading to shortages of raw materials and finished goods. These shortages, coupled with increased demand, have contributed to price increases. The ongoing war in Ukraine has further exacerbated these supply chain disruptions, particularly for energy and agricultural commodities.

It’s funny how we obsess over economic predictions, trying to decipher when inflation will finally ease up. But in the grand scheme of things, it’s just another variable in the chaotic dance of life. Speaking of life’s little luxuries, I recently tried out Freshly’s meal delivery service for a week and was surprised by how convenient it was.

Perhaps focusing on small comforts amidst uncertainty is a better strategy than trying to predict the future.

- Monetary Policy:Central banks worldwide have implemented loose monetary policies, including low interest rates and quantitative easing, to stimulate economic growth during the pandemic. These policies have increased liquidity in the market, potentially fueling inflation. The timing and pace of monetary tightening to combat inflation are crucial considerations, as aggressive measures could slow economic growth.

- Consumer Demand:The pandemic led to a surge in consumer demand for goods and services, driven by pent-up savings and government stimulus packages. This increased demand, coupled with supply chain constraints, has contributed to price pressures. However, consumer spending patterns are evolving, with potential shifts towards services and away from goods, which could impact inflation dynamics.

- Geopolitical Factors:Global geopolitical tensions, such as the war in Ukraine, have contributed to energy price volatility and commodity price increases. These tensions can disrupt trade flows, create uncertainty, and impact economic activity, potentially influencing inflation.

Economic Perspectives on Inflation

Inflation, a persistent increase in the general price level of goods and services, is a complex economic phenomenon that has sparked numerous debates among economists. Different schools of thought offer varying perspectives on the causes, consequences, and potential remedies for inflation.

Understanding these diverse viewpoints is crucial for navigating the current inflationary landscape and forming informed opinions on the likely duration of this economic challenge.

Trying to predict how long inflation will last is like trying to catch a falling star – you just never know. It’s a constant dance of economic forces, and navigating it requires adaptability and resilience. Those are just two of the 10 most important leadership skills for the 21st century workplace and how to develop them , which are crucial in any environment, but especially in times of uncertainty.

Whether we’re talking about economic fluctuations or the ever-changing landscape of the modern workplace, the ability to lead through change is paramount.

Key Economic Schools of Thought on Inflation

The economic landscape is dotted with various schools of thought, each offering distinct perspectives on inflation. These schools differ in their emphasis on factors driving inflation, their preferred policy responses, and their views on the role of government intervention.

- Monetarists:This school, associated with economists like Milton Friedman, argues that inflation is primarily driven by excessive growth in the money supply. Monetarists advocate for strict control over the money supply to maintain price stability. They believe that inflation is a monetary phenomenon and that governments should focus on controlling the money supply to manage inflation.

- Keynesians:Keynesian economics, named after John Maynard Keynes, emphasizes the role of aggregate demand in driving inflation. This school argues that inflation can arise from excessive spending, which leads to increased demand for goods and services, exceeding the available supply. Keynesians advocate for government intervention through fiscal policies, such as increasing government spending or reducing taxes, to manage demand and inflation.

- Supply-Side Economists:Supply-side economics focuses on the role of supply constraints in driving inflation. They argue that inflation can occur when production costs rise due to factors like labor shortages, increased energy prices, or supply chain disruptions. Supply-side economists advocate for policies that promote economic growth and productivity, such as tax cuts for businesses and deregulation, to alleviate supply constraints and curb inflation.

- Structuralists:This school emphasizes the role of structural factors, such as monopolies, labor market rigidities, and government regulations, in contributing to inflation. Structuralists argue that these factors can create price distortions and reduce competition, leading to higher prices. They advocate for structural reforms to address these underlying issues and reduce inflationary pressures.

Arguments for and Against Prolonged Inflation

The debate on the duration of inflation is ongoing, with economists presenting compelling arguments on both sides.

- Arguments for Prolonged Inflation:

- Persistently High Demand:Some economists argue that strong consumer demand, fueled by pent-up savings and robust economic growth, could continue to drive inflation.

- Supply Chain Disruptions:Ongoing supply chain bottlenecks, exacerbated by the war in Ukraine and geopolitical tensions, could continue to limit production and push up prices.

- Wage-Price Spiral:Rising inflation could lead to a wage-price spiral, where higher wages to compensate for inflation lead to further price increases, perpetuating the cycle.

- Arguments Against Prolonged Inflation:

- Tightening Monetary Policy:Central banks around the world are aggressively raising interest rates to curb inflation. These measures could slow economic growth and reduce demand, ultimately dampening inflationary pressures.

- Easing Supply Chain Pressures:As global supply chains gradually recover, production capacity is expected to increase, potentially easing supply constraints and moderating price increases.

- Shifting Consumer Behavior:Consumers may start to cut back on spending in response to higher prices, reducing demand and easing inflationary pressures.

Opinions of Prominent Economists on the Duration of Inflation

- Larry Summers, a former U.S. Treasury Secretary,has expressed concerns about the potential for persistent inflation, warning that the current economic environment is reminiscent of the 1970s. Summers believes that the combination of strong demand, supply chain disruptions, and a tight labor market could lead to a sustained period of inflation.

- Janet Yellen, the current U.S. Treasury Secretary,has argued that inflation is likely to moderate in the coming months as supply chain bottlenecks ease and demand cools. Yellen believes that the Federal Reserve’s aggressive interest rate hikes will help to bring inflation under control.

- Paul Krugman, a Nobel Prize-winning economist,has cautioned against overreacting to short-term inflationary pressures, arguing that the current surge in prices is largely driven by temporary factors. Krugman believes that inflation will likely moderate as these factors dissipate.

The Impact of Inflation on Individuals and Businesses

Inflation, a persistent increase in the general price level of goods and services, can have a significant impact on both individuals and businesses. As prices rise, the purchasing power of individuals diminishes, while businesses face challenges in managing costs and maintaining profitability.

The Challenges Faced by Individuals

Inflation directly affects individuals by eroding their purchasing power. As prices rise, individuals need to spend more money to acquire the same goods and services. This can lead to a decrease in the standard of living, especially for those on fixed incomes or with limited financial resources.

- Rising Living Costs:Inflation drives up the cost of essential items like food, housing, transportation, and healthcare, putting a strain on household budgets. For example, a recent study by the Consumer Price Index (CPI) showed that the cost of groceries has risen by 10% in the past year, significantly impacting families with limited income.

- Decreased Purchasing Power:With rising prices, individuals have less purchasing power, meaning they can buy fewer goods and services with the same amount of money. This can limit their ability to save for future expenses, such as retirement or education.

- Increased Debt Burden:As prices rise, individuals may find themselves needing to borrow more money to cover expenses, leading to increased debt burdens and higher interest payments.

Strategies for Businesses to Mitigate Inflation

Businesses face unique challenges during periods of inflation. Rising input costs, such as raw materials and labor, can eat into profit margins, forcing them to make difficult decisions to maintain profitability.

- Price Adjustments:Businesses can adjust prices to reflect rising costs, but this must be done carefully to avoid losing customers. It is important to consider the elasticity of demand for the products or services offered and to ensure that price increases are in line with market expectations.

- Cost-Cutting Measures:Businesses can implement cost-cutting measures to mitigate the impact of inflation. This can include streamlining operations, negotiating better deals with suppliers, and reducing waste. For example, a manufacturing company could explore using more efficient production methods or sourcing materials from lower-cost suppliers.

- Innovation and Value Creation:Businesses can focus on innovation and value creation to differentiate themselves in the market and maintain customer loyalty. This could involve developing new products or services that meet changing consumer needs or offering value-added services that justify higher prices.

Long-Term Consequences of Prolonged Inflation, Analysis nobody knows how long inflation will last thats life

Prolonged inflation can have significant long-term consequences for economic growth and social stability. It can lead to uncertainty and instability in the economy, making it difficult for businesses to plan for the future and for individuals to save and invest.

- Reduced Investment:High inflation can discourage investment, as businesses become hesitant to invest in new projects or expand operations due to uncertainty about future returns.

- Economic Instability:Prolonged inflation can lead to economic instability, as it can create a cycle of rising prices, wage demands, and further price increases. This can create a spiral of economic uncertainty and disrupt normal economic activity.

- Social Unrest:High inflation can lead to social unrest, as individuals struggle to cope with rising living costs and decreased purchasing power. This can create a climate of dissatisfaction and instability, potentially leading to social unrest and political instability.

Concluding Remarks

The question of how long inflation will last remains a central economic debate. While no one has a crystal ball, understanding the contributing factors, economic perspectives, and potential impacts of prolonged inflation is crucial for informed decision-making. As we navigate this uncertain terrain, staying informed, adapting strategies, and advocating for responsible policies will be paramount in mitigating the challenges and harnessing opportunities that lie ahead.