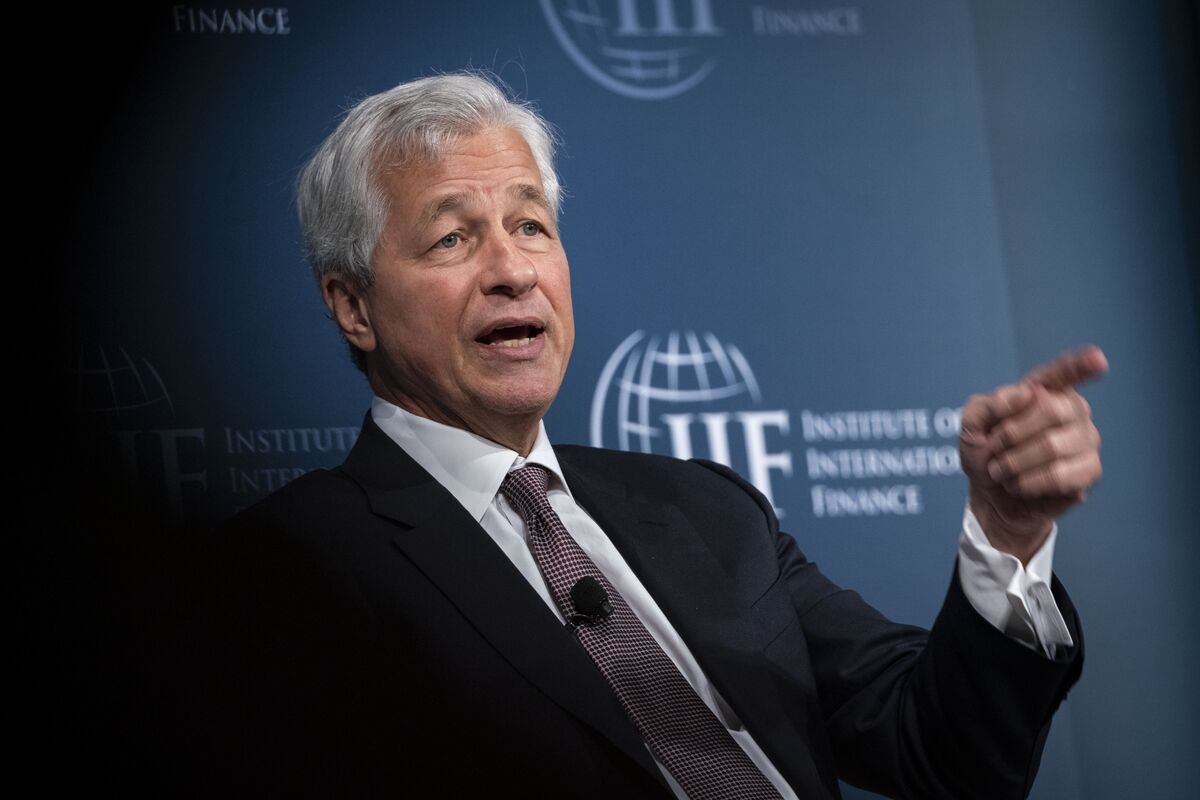

Analyzing Jamie Dimons Subtle Message to Regulators

Analysis jamie dimons subtle message to regulators – Analyzing Jamie Dimon’s subtle message to regulators, we delve into the recent statements made by the JPMorgan Chase CEO, uncovering his nuanced perspective on the current regulatory landscape and its impact on the financial industry. Dimon’s comments, delivered with his signature directness, have sparked debate and raised important questions about the future of financial regulation.

This analysis examines the context of his statements, exploring the potential implications for both the industry and the public.

From his perspective, navigating the complexities of the current regulatory environment presents a unique challenge for financial institutions. Dimon’s statements, while seemingly straightforward, carry a deeper message about the delicate balance between safeguarding the financial system and fostering innovation.

His insights into the impact of regulations on financial institutions provide valuable context for understanding the ongoing dialogue between the industry and regulators.

Regulatory Landscape and Trends

The financial industry operates within a complex and constantly evolving regulatory landscape. This dynamic environment shapes the decisions and strategies of key players like Jamie Dimon, CEO of JPMorgan Chase. Understanding the current regulatory landscape and its trends is crucial for comprehending Dimon’s subtle messages to regulators.

Key Regulatory Changes and Trends

The financial industry has witnessed significant regulatory changes in recent years, primarily driven by the aftermath of the 2008 financial crisis. These changes aim to enhance financial stability, protect consumers, and prevent future crises.

Notable Regulatory Changes

- Dodd-Frank Wall Street Reform and Consumer Protection Act (2010):This landmark legislation introduced sweeping reforms to the financial industry, including the creation of the Financial Stability Oversight Council (FSOC) to identify and address systemic risks, increased oversight of systemically important financial institutions (SIFIs), and enhanced consumer protection measures.

- Volcker Rule (2010):Prohibits banks from engaging in proprietary trading and restricts their investments in hedge funds and private equity funds. This rule aims to reduce the risk-taking activities of banks and limit their exposure to volatile markets.

- Basel III (2010-2019):A set of international regulatory standards designed to strengthen the global banking system by increasing capital requirements, improving liquidity, and reducing leverage. This framework aims to improve the resilience of banks and mitigate systemic risks.

Trends Shaping the Regulatory Landscape

- Increased Focus on Climate Change:Regulators are increasingly scrutinizing the financial risks associated with climate change, including physical risks (e.g., extreme weather events) and transition risks (e.g., policy changes and market shifts). Financial institutions are being asked to disclose their climate-related risks and develop strategies to mitigate them.

- Rise of Fintech and Digital Assets:The emergence of fintech companies and digital assets, such as cryptocurrencies, poses new challenges and opportunities for regulators. These technologies are disrupting traditional financial services and require new frameworks to ensure financial stability and consumer protection.

- Cybersecurity and Data Privacy:Cybersecurity threats and data privacy concerns are becoming increasingly significant for financial institutions. Regulators are enacting stricter rules to protect sensitive customer information and enhance the resilience of financial systems against cyberattacks.

Potential Implications of Dimon’s Message

Jamie Dimon’s subtle message to regulators, while seemingly innocuous, carries significant potential implications for the financial industry. His statements, aimed at influencing regulatory decisions and public opinion, could reshape the landscape of financial institutions and their operations.

Impact on Regulatory Decisions

Dimon’s message could significantly influence regulatory decisions. His arguments, if accepted, could lead to a shift in regulatory priorities and a reevaluation of existing regulations. For example, if he successfully argues for a more lenient approach to capital requirements, banks might enjoy greater flexibility in lending and investment activities, potentially leading to increased economic growth.

Jamie Dimon’s recent comments to regulators have sparked a lot of debate, but one thing’s for sure: he’s a master of the subtle message. While his words may seem innocuous, they often carry a deeper meaning. If you’re looking to learn more about how to navigate the complexities of the business world, check out these Amazon FBA courses – they might just give you the edge you need to succeed.

Understanding Dimon’s tactics, however, can be just as valuable, as it can help you understand the nuances of power and influence in the financial industry.

However, such a shift could also expose the financial system to greater risks, especially if it weakens safeguards against reckless lending practices.

Analyzing Jamie Dimon’s subtle messages to regulators requires a keen eye for detail, much like building strong relationships with instructional coaches. Just as effective coaching requires open communication and mutual respect, understanding Dimon’s veiled pronouncements involves recognizing the underlying motivations and navigating the complex web of financial regulations.

To build trust and foster collaboration, it’s crucial to actively listen and seek clarity, much like how to build relationships with instructional coaches. This approach, when applied to analyzing Dimon’s messages, can reveal valuable insights into the future direction of the financial industry.

Public Perception and Trust

Dimon’s message could also impact public perception and trust in the financial industry. If his arguments are seen as self-serving or advocating for deregulation at the expense of consumer protection, it could erode public confidence in the banking sector. Conversely, if his message resonates with the public and is perceived as a genuine effort to improve the financial system, it could bolster public trust in the industry.

Jamie Dimon’s recent message to regulators has sparked a lot of debate, with some seeing it as a subtle plea for more lenient oversight. It’s interesting to consider this in light of the personality traits shared by other influential figures like Elon Musk, Bill Gates, and Jack Dorsey, who all possess a strong drive for innovation and a willingness to push boundaries.

This article explores the common traits that these individuals share, which might shed light on Dimon’s approach and his desire to navigate the evolving regulatory landscape.

Behavior of Financial Institutions

Dimon’s message could significantly influence the behavior of financial institutions. If regulators adopt a more lenient approach based on his arguments, banks might be emboldened to take on more risk, potentially leading to increased lending and investment activity. However, this could also increase the likelihood of financial instability and exacerbate systemic risk.

Examples and Real-Life Cases

For instance, in the aftermath of the 2008 financial crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted to regulate the financial industry and prevent future crises. However, some argue that these regulations have been too stringent and have hampered economic growth.

Dimon’s message could be interpreted as an attempt to influence the regulatory landscape and potentially loosen some of these restrictions. Another example is the debate surrounding the Basel III capital adequacy requirements. Some argue that these requirements are too burdensome and stifle lending activity, while others argue that they are necessary to ensure financial stability.

Dimon’s message could influence the direction of this debate and potentially lead to a revision of these requirements.

Perspectives on Dimon’s Message

Jamie Dimon’s message to regulators, while subtle, has sparked a range of reactions and interpretations across different stakeholders. The potential implications of his statements, particularly regarding the evolving regulatory landscape, have generated considerable discussion and debate.

Reactions of Regulators

Regulators, responsible for overseeing the financial industry, have approached Dimon’s message with a mix of caution and consideration. Some regulators have acknowledged the potential challenges posed by the evolving financial landscape, particularly the increasing influence of technology and the rise of non-traditional players.

However, they have also stressed the importance of maintaining a robust regulatory framework to ensure financial stability and protect consumers.

“While we recognize the need for innovation in the financial sector, we must ensure that any changes do not compromise the safety and soundness of our financial system.”

[Insert name of regulator or regulatory body]

Perspectives of Industry Analysts

Industry analysts, who closely follow the financial sector, have offered a variety of perspectives on Dimon’s message. Some analysts have interpreted his statements as a call for a more flexible regulatory approach, one that acknowledges the changing nature of finance.

Others have cautioned that any relaxation of regulations could lead to increased risk-taking and potential instability.

“Dimon’s message is a clear indication that the financial industry is undergoing a significant transformation. Regulators need to be prepared to adapt to these changes.”

[Insert name of industry analyst]

Public Opinion

The public’s reaction to Dimon’s message has been mixed. Some members of the public have expressed concerns about the potential impact of deregulation on their financial security. Others have argued that a more flexible regulatory approach could foster innovation and economic growth.

“I’m worried that any changes to regulations could make the financial system less stable and put my savings at risk.”

[Insert a fictional individual representing public opinion]

Areas of Agreement and Disagreement, Analysis jamie dimons subtle message to regulators

There are areas of both agreement and disagreement surrounding Dimon’s statements. Many stakeholders agree that the financial industry is evolving rapidly and that regulators need to be prepared to adapt. However, there is disagreement on the extent to which regulations should be relaxed or tightened.

Some argue that a more flexible approach is necessary to encourage innovation and growth, while others believe that strong regulations are essential to protect consumers and ensure financial stability.

“The key is to find a balance between fostering innovation and protecting consumers.”

[Insert name of expert or stakeholder]

Future Considerations: Analysis Jamie Dimons Subtle Message To Regulators

Jamie Dimon’s message to regulators has significant long-term implications for the financial landscape. The potential ramifications extend beyond immediate regulatory responses and could shape the future of financial institutions, market dynamics, and investor behavior.

Potential Long-Term Implications of Dimon’s Message

The potential long-term implications of Dimon’s message can be categorized into various aspects, each with its own set of possible outcomes. The table below presents a structured overview of these potential impacts and their corresponding outcomes.

| Potential Impact | Possible Outcomes |

|---|---|

| Increased Regulatory Scrutiny |

|

| Shift in Investment Strategies |

|

| Changes in Market Dynamics |

|

| Impact on Innovation |

|

Last Recap

Jamie Dimon’s message to regulators serves as a reminder of the ongoing dialogue between the financial industry and those who oversee it. His comments highlight the complexities of balancing innovation with regulatory oversight, underscoring the importance of finding solutions that benefit both the industry and the public.

As we move forward, understanding the nuances of this dialogue is crucial for navigating the future of the financial landscape. Dimon’s message, though subtle, carries significant weight, prompting further discussion and analysis as the financial industry continues to evolve.