Fake Aluminum Stocks: Chinas Commodities Funding in the Spotlight

Analysis fake aluminum stocks put perils of chinas commodities funding in spotlight – Fake aluminum stocks put perils of China’s commodities funding in the spotlight, revealing a complex web of market manipulation and financial risk. The recent surge in fake aluminum stocks, a trend driven by potential financial gains and market manipulation, has sent shockwaves through the global aluminum industry.

This deceptive practice, often involving the creation and distribution of counterfeit stock certificates, has not only impacted investors but also disrupted the supply chain and put businesses reliant on aluminum at risk.

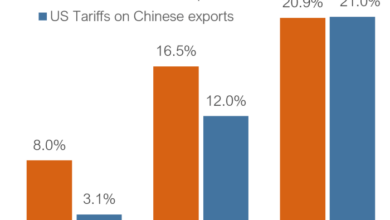

The heart of this issue lies in China’s significant role in global commodities funding. China’s financial influence on the aluminum market, while contributing to price stability and availability, also carries inherent risks. The intricate interplay between fake aluminum stocks and China’s commodities funding raises concerns about market volatility and manipulation, prompting calls for greater regulatory oversight and transparency.

Future Implications and Outlook: Analysis Fake Aluminum Stocks Put Perils Of Chinas Commodities Funding In Spotlight

The revelation of fake aluminum stocks and China’s commodities funding practices has exposed vulnerabilities within the global supply chain and financial markets. These practices raise significant concerns about market integrity, transparency, and the potential for future disruptions. It is crucial to understand the long-term implications of these events and explore strategies to mitigate associated risks.

Potential for Market Disruptions and Volatility

The presence of fake aluminum stocks and opaque funding practices can create significant uncertainty and volatility in the market. This uncertainty can lead to:

- Price Fluctuations:The discovery of fake aluminum stocks can distort market supply and demand dynamics, leading to unpredictable price swings. For example, the revelation of inflated aluminum inventory in China in 2015 caused a sharp decline in aluminum prices, impacting producers and consumers globally.

- Investor Confidence Erosion:The lack of transparency and potential for fraud can erode investor confidence in the commodities market, leading to reduced investment and liquidity. This can further exacerbate market volatility and hinder the development of a stable and efficient market.

- Supply Chain Disruptions:Fake aluminum stocks can disrupt the supply chain by introducing unreliable and potentially substandard materials. This can lead to production delays, quality issues, and reputational damage for companies relying on these materials.

Industry Adaptation and Risk Mitigation, Analysis fake aluminum stocks put perils of chinas commodities funding in spotlight

To address these challenges, the industry must take proactive steps to enhance transparency, strengthen regulations, and improve risk management practices:

- Enhanced Transparency and Verification:Implementing robust verification processes for commodities stocks and funding sources is essential to ensure authenticity and prevent fraudulent activities. This can involve stricter auditing standards, independent verification bodies, and improved data sharing across the supply chain.

- Strengthened Regulatory Frameworks:Governments and regulatory bodies need to strengthen existing regulations and develop new frameworks to address the specific challenges posed by fake aluminum stocks and opaque funding practices. This includes establishing clear guidelines for commodities trading, enhancing penalties for fraudulent activities, and promoting greater transparency in market operations.

- Improved Risk Management Practices:Companies involved in the commodities industry need to adopt robust risk management practices to mitigate the potential for fraud and market disruptions. This involves diversifying suppliers, conducting thorough due diligence, and implementing robust internal controls to ensure the integrity of their operations.

End of Discussion

The emergence of fake aluminum stocks and the complexities of China’s commodities funding highlight the fragility of global markets and the need for robust regulatory frameworks. As investors and businesses grapple with the consequences of market manipulation, the industry faces a crucial juncture.

Addressing these challenges requires collaborative efforts from regulators, market participants, and industry stakeholders to ensure a more transparent and resilient aluminum market. The future of the industry hinges on finding solutions that mitigate risks and promote ethical practices, ultimately restoring trust and stability to the global aluminum supply chain.

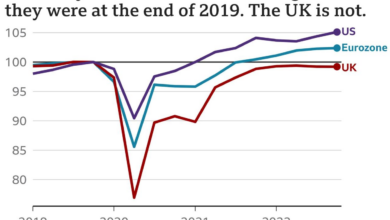

The recent analysis of fake aluminum stocks has thrown a spotlight on the risks associated with China’s commodities funding, highlighting a growing concern about the transparency and stability of the market. This situation, coupled with the broader economic uncertainties, reflects a sentiment that can be described as “the bad vibes economy” the bad vibes economy , where investors are increasingly wary of hidden risks and volatile markets.

The aluminum stock scandal serves as a stark reminder of the importance of robust regulatory frameworks and investor due diligence in navigating the complex world of commodities trading.

The analysis of fake aluminum stocks has put the perils of China’s commodities funding in the spotlight, highlighting the risks of unchecked speculation and opaque market practices. This story, unfortunately, echoes the heartbreaking situation of a Columbia graduate student brutally beaten in Manhattan, where his mother struggles for answers and justice.

The story of this student is a reminder that even in a bustling metropolis, vulnerability and injustice can exist, prompting us to reflect on the need for transparency and accountability in all spheres of life, including financial markets.

The recent analysis of fake aluminum stocks, highlighting the perils of China’s commodities funding, feels eerily similar to the isolation and abandonment being described in the upcoming hearings about former President Trump. It’s a stark reminder that even in the world of finance, where numbers are supposed to be the ultimate authority, deception and manipulation can thrive.

As we see with the testimony from former GOP lawmakers, former gop lawmaker hearings will paint a picture of trump as abandoned isolated and near solely responsible , the truth can be obscured, and the consequences can be devastating. Ultimately, the analysis of fake aluminum stocks serves as a stark reminder that vigilance and transparency are crucial to safeguarding against such financial manipulation.