Feds Aggressive Move Unlikely to Spark BOE Rate Cut

An aggressive fed move is unlikely to spur a surprise bank of england rate cut – Fed’s Aggressive Move Unlikely to Spark BOE Rate Cut sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The global economic landscape is a complex tapestry woven with threads of inflation, growth, and unemployment.

The recent aggressive moves by the Federal Reserve (Fed) to combat inflation have sent ripples through global financial markets, leaving many wondering about the potential implications for other central banks, particularly the Bank of England (BOE).

While the Fed has been tightening monetary policy, the BOE faces its own unique set of challenges. The UK economy is grappling with stubbornly high inflation, sluggish growth, and the looming threat of a recession. The BOE is caught in a delicate balancing act, trying to tame inflation without pushing the economy into a downturn.

The question on everyone’s mind is whether the BOE will follow the Fed’s lead and raise interest rates or take a different path, potentially opting for a surprise rate cut.

The Current Economic Landscape

The global economy is currently navigating a complex and uncertain terrain, marked by persistent inflationary pressures, slowing growth, and geopolitical tensions. While some economies are showing signs of resilience, others are grappling with the fallout from the pandemic and the ongoing war in Ukraine.

Global Inflation and Growth

Inflation remains a significant concern globally. The recent aggressive monetary tightening by central banks, including the Federal Reserve, has begun to cool demand and ease inflationary pressures in some regions. However, core inflation remains stubbornly high in many advanced economies, driven by persistent supply chain disruptions, strong labor markets, and elevated energy prices.

- The International Monetary Fund (IMF) projects global inflation to moderate to 6.5% in 2023, down from 8.8% in 2022. However, the IMF warns that the outlook remains uncertain, and inflation could remain elevated for longer than anticipated.

- The global growth outlook has also weakened. The IMF forecasts global GDP growth to slow to 2.9% in 2023, down from 3.4% in 2022. This slowdown reflects the impact of tighter monetary policy, the ongoing war in Ukraine, and persistent supply chain disruptions.

Impact of Fed Moves on Global Markets

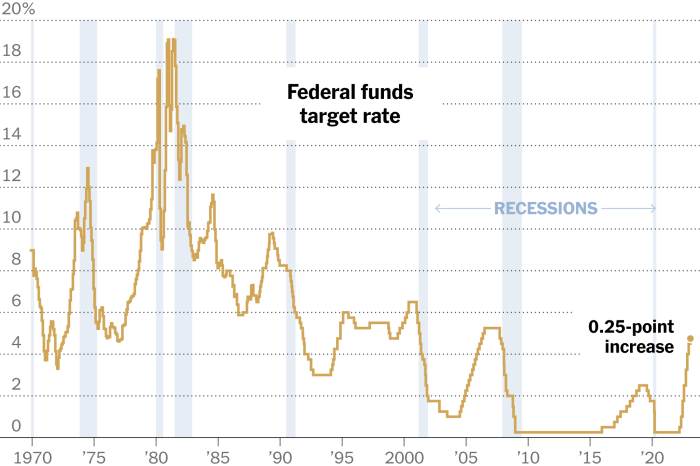

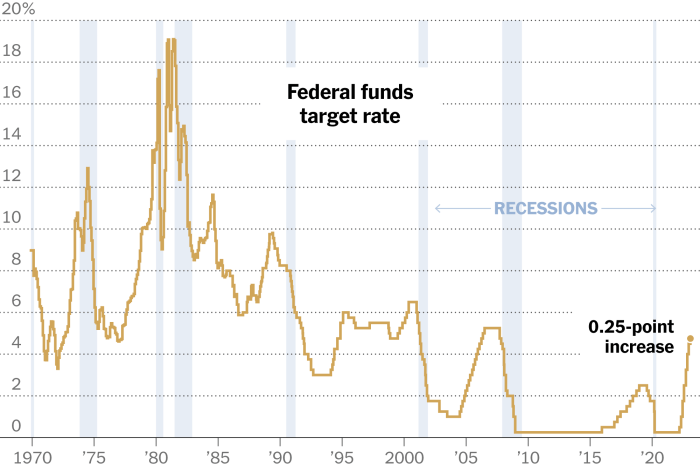

The Federal Reserve’s aggressive interest rate hikes have had a significant impact on global financial markets. The rapid rise in US interest rates has strengthened the US dollar, making it more expensive for other countries to borrow money and potentially leading to capital outflows from emerging markets.

- The strengthening dollar has also contributed to higher import prices in other countries, further fueling inflation.

- The Fed’s actions have also increased the risk of a global recession, as higher interest rates can slow economic activity.

Implications of a Surprise Bank of England Rate Cut

A surprise rate cut by the Bank of England would be a significant development and could have several implications for the UK economy.

- A rate cut would signal that the Bank of England is more concerned about the UK’s economic outlook than previously thought. This could lead to a weakening of the pound sterling, which could make imports more expensive and potentially fuel inflation.

- A rate cut could also lead to lower borrowing costs for businesses and consumers, potentially stimulating economic activity. However, it could also encourage more borrowing and potentially lead to an increase in household debt.

The Fed’s Monetary Policy Stance: An Aggressive Fed Move Is Unlikely To Spur A Surprise Bank Of England Rate Cut

The Federal Reserve (Fed) has embarked on an aggressive path of interest rate hikes, aiming to curb inflation and bring it back to its 2% target. This hawkish stance reflects the Fed’s determination to address the persistent inflationary pressures that have gripped the US economy.

Rationale for Aggressive Interest Rate Hikes

The Fed’s rationale for aggressive interest rate hikes stems from its assessment of the current economic landscape. Inflation has remained stubbornly high, exceeding the Fed’s target for an extended period. This persistent inflation has eroded purchasing power, fueled uncertainty, and threatened to become entrenched in the economy.

The Fed believes that by raising interest rates, it can cool down demand, slow down economic growth, and ultimately bring inflation under control.

Potential Risks and Benefits of the Fed’s Aggressive Approach

The Fed’s aggressive approach carries both potential risks and benefits. On the one hand, rapid interest rate hikes could potentially trigger a recession. By making borrowing more expensive, the Fed risks dampening investment and consumer spending, leading to a slowdown in economic activity.

Additionally, the Fed’s actions could destabilize financial markets, as investors adjust to the new interest rate environment. On the other hand, the Fed’s aggressive approach could be successful in curbing inflation, restoring price stability, and ultimately creating a more sustainable economic environment.

By acting decisively, the Fed aims to prevent inflation from becoming entrenched, which could lead to even more severe economic consequences.

The Fed’s Communication Strategy and its Impact on Market Expectations, An aggressive fed move is unlikely to spur a surprise bank of england rate cut

The Fed’s communication strategy plays a crucial role in shaping market expectations and influencing investor behavior. Through press conferences, statements, and other public pronouncements, the Fed aims to provide transparency and clarity about its policy intentions. By clearly articulating its goals, the Fed seeks to manage market expectations and minimize volatility.

However, the Fed’s communication strategy is not without its challenges. The Fed’s actions and pronouncements can sometimes be interpreted differently by market participants, leading to uncertainty and volatility. Additionally, the Fed’s communication strategy is subject to the complexities of economic forecasting and the evolving nature of economic conditions.

While the market’s buzzing about the possibility of a surprise Bank of England rate cut, I’m not convinced an aggressive Fed move would be the catalyst. It’s more likely to see a measured response, considering the current economic climate. But hey, at least we have something else to think about – Heinz and Walkers teaming up for a new mayo flavour ! Whether it’s terrifying or brilliant, it’s certainly a conversation starter.

Back to the Bank of England, I think we’ll see a more cautious approach than a sudden shift in rates.

While an aggressive Fed move might seem like it could push the Bank of England into a surprise rate cut, I’m not so sure. The economic landscape is complex, and the BoE is likely to be more focused on domestic factors.

Plus, the recent success of “Glass Onion,” which sharpens the “Knives Out” formula, as CNN points out , shows that there’s still a strong appetite for clever, suspenseful stories. Perhaps the BoE is waiting for a similar twist in the economic narrative before making any major moves.

While an aggressive Fed move might not immediately trigger a surprise Bank of England rate cut, the global economic landscape is constantly shifting. It’s a reminder that even amidst seemingly stable situations, life can take unexpected turns, just like seeing Diddy in good spirits smoking and chatting with a fan days before his arrest.

The Bank of England will undoubtedly consider a multitude of factors, including global inflation trends and the potential impact on the UK economy, before making any significant policy decisions.