Amazon Shareholders Almost Rejected Executive Pay: A Lesson for Leaders

Amazon shareholders almost voted down executive pay heres the brutal truth every leader should learn – Amazon shareholders almost voted down executive pay: here’s the brutal truth every leader should learn. This recent event sends a powerful message about the changing landscape of corporate governance and the growing influence of shareholders. It’s a story that deserves our attention, not just for its impact on Amazon but for the valuable insights it offers to leaders across industries.

The near-rejection of Amazon’s executive compensation packages sparked a wave of debate, highlighting the growing disconnect between executive pay and company performance in the eyes of shareholders. The vote revealed a significant level of shareholder dissatisfaction with the current approach to executive compensation, prompting a critical conversation about the need for greater transparency, accountability, and alignment between executive pay and shareholder interests.

The “Brutal Truth” for Leaders

The recent near-vote against Amazon’s executive compensation package by shareholders should serve as a stark wake-up call for leaders across all industries. This event underscores a growing tension between corporate governance and shareholder activism, a trend that will likely continue to shape the future of leadership.

The Amazon shareholder vote on executive pay wasn’t just a financial issue, it reflected a deeper societal shift. We’re living in what some call “the bad vibes economy” the bad vibes economy , where consumers are increasingly sensitive to ethical considerations and corporate responsibility.

This means leaders need to prioritize more than just profits; they need to cultivate a culture of empathy, transparency, and shared value creation, or risk facing the backlash of a discerning public.

Shareholder Activism and Corporate Governance

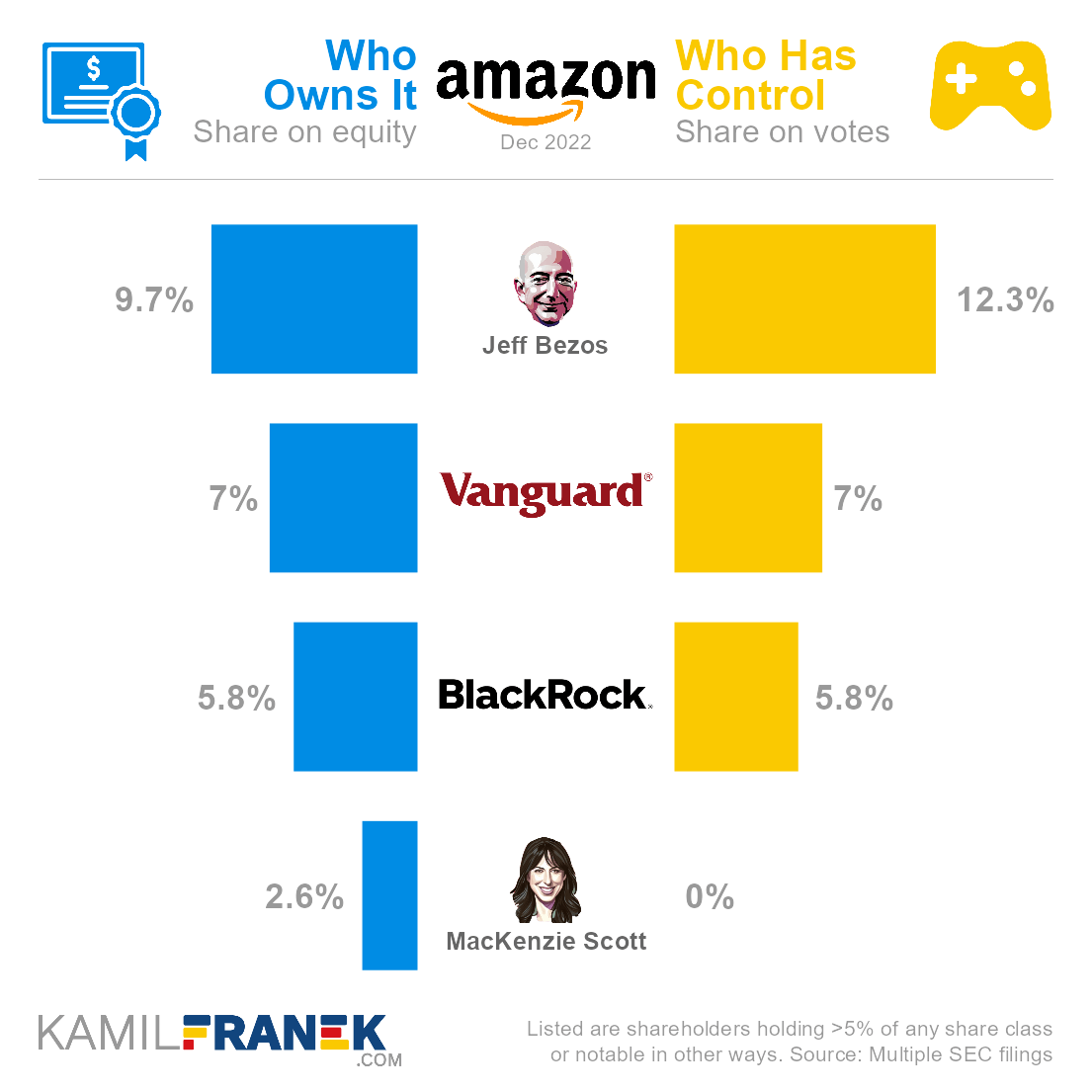

The Amazon vote highlights the increasing power of shareholders in demanding greater accountability from company executives. It signals a shift in the traditional power dynamics of corporate governance, where shareholders are no longer passively accepting executive compensation packages without scrutiny.

The Amazon shareholder vote on executive pay highlights a critical issue for leaders: aligning compensation with performance and shareholder value. While the vote was ultimately successful, the close call serves as a stark reminder that companies need to be transparent about how they’re addressing the current economic climate, especially with inflation surging globally.

This is further emphasized by President Biden’s upcoming visit to the Port of Los Angeles, where he’ll be discussing inflation as a global problem, biden to visit port of los angeles casting inflation as a global problem. Leaders need to be acutely aware of these broader economic trends and how they impact their own organizations and their employees.

This trend is driven by several factors:

- Increased shareholder activism:Investors are becoming more vocal and organized in their efforts to influence corporate decision-making, including executive compensation. This is fueled by the rise of activist investors and the growing accessibility of information about corporate performance.

- Focus on long-term value creation:Shareholders are increasingly prioritizing long-term value creation over short-term profits, leading them to question compensation structures that may not align with sustainable growth.

- Transparency and accountability:Shareholders are demanding greater transparency and accountability from companies regarding their compensation practices. This includes a clearer link between executive pay and company performance.

Aligning Executive Compensation with Company Performance

The Amazon vote underscores the importance of aligning executive compensation with company performance and shareholder interests. When there is a disconnect between executive pay and company performance, it can lead to:

- Loss of shareholder trust:Shareholders may feel that executives are being rewarded for poor performance or that their interests are not being prioritized.

- Erosion of company value:If executives are not incentivized to create long-term value, it can negatively impact the company’s financial performance and shareholder returns.

- Increased regulatory scrutiny:Regulators are increasingly scrutinizing executive compensation practices, particularly in cases where there is a lack of alignment with company performance.

Framework for Assessing and Adjusting Compensation Strategies, Amazon shareholders almost voted down executive pay heres the brutal truth every leader should learn

Leaders should proactively assess and adjust their compensation strategies to ensure alignment with company performance and shareholder interests. A framework for this process could include the following steps:

- Define clear performance metrics:Establish clear and measurable performance metrics that are aligned with the company’s long-term goals and shareholder interests.

- Link compensation to performance:Design a compensation structure that directly links executive pay to the achievement of these performance metrics.

- Transparency and communication:Be transparent with shareholders about the compensation structure and the rationale behind it.

- Regular review and adjustment:Regularly review and adjust the compensation structure to ensure it remains aligned with company performance and shareholder expectations.

“Executive compensation should be designed to incentivize long-term value creation, not short-term gains.”

Impact on Future Leadership Practices: Amazon Shareholders Almost Voted Down Executive Pay Heres The Brutal Truth Every Leader Should Learn

The near-rejection of Amazon’s executive pay plan by shareholders sends a powerful message about the evolving dynamics of corporate governance. It underscores the growing influence of shareholders in demanding accountability and transparency from company leadership, particularly regarding executive compensation. This situation has significant implications for future leadership practices, potentially shaping how companies approach executive pay and engage with their shareholders.

Consequences of Ignoring Shareholder Concerns

Companies that fail to address shareholder concerns regarding executive pay risk facing several consequences, ranging from reputational damage to legal challenges.

- Reputational Damage:Public scrutiny and negative media attention can significantly impact a company’s brand image, potentially leading to a decline in customer trust and loyalty. This can be especially detrimental for companies that rely heavily on public perception, such as those in the retail or consumer goods sectors.

For example, the recent backlash against Starbucks due to its CEO’s compensation package, despite the company’s overall financial performance, illustrates how public opinion can negatively impact a brand.

- Investor Dissatisfaction:Shareholders, particularly institutional investors with significant holdings, may withdraw their investments or actively oppose company proposals, including future executive compensation packages. This can make it challenging for companies to secure necessary funding for growth and expansion. For example, in 2018, a group of institutional investors led by the California Public Employees’ Retirement System (CalPERS) successfully pressured ExxonMobil to adopt a more shareholder-friendly approach to executive compensation, highlighting the power of collective action by institutional investors.

- Legal Challenges:In some cases, shareholders may pursue legal action against companies they believe are engaging in excessive or unjustified executive compensation practices. These lawsuits can be costly and time-consuming, diverting resources away from core business operations. For instance, in 2019, shareholders of Tesla filed a lawsuit against the company and its CEO, Elon Musk, alleging that his compensation package was excessive and lacked transparency.

Comparing Amazon’s Situation to Other Cases

The Amazon situation mirrors a growing trend of shareholder activism concerning executive pay. Several other companies have faced similar challenges in recent years, highlighting the increasing scrutiny of executive compensation practices.

- Apple:In 2020, Apple faced shareholder pressure over its CEO Tim Cook’s compensation package, which was significantly higher than the average CEO pay in the tech sector. While the company ultimately defended its decision, the shareholder vote revealed a growing concern about the disconnect between executive pay and company performance.

- Netflix:In 2022, Netflix shareholders expressed dissatisfaction with the company’s CEO Reed Hastings’ compensation package, citing concerns about the company’s declining stock price and its failure to meet subscriber growth targets. This led to a significant reduction in Hastings’ compensation for the following year.

- General Electric:In 2017, General Electric faced a shareholder rebellion over its CEO John Flannery’s compensation package, which was deemed excessive given the company’s declining performance. The shareholder vote resulted in a significant reduction in Flannery’s compensation and highlighted the importance of aligning executive pay with company performance.

Evolving Role of Shareholders

The Amazon situation underscores the evolving role of shareholders in corporate decision-making. Shareholders are increasingly demanding a greater say in corporate governance, particularly regarding executive compensation. This trend is driven by several factors, including:

- Increased Investor Awareness:Shareholders are becoming more informed about corporate governance practices and are more willing to hold companies accountable for their actions. This is partly due to the availability of online resources and increased media coverage of corporate governance issues.

- Rise of ESG Investing:Environmental, social, and governance (ESG) investing is gaining popularity, with investors increasingly considering factors beyond financial returns when making investment decisions. This has led to a greater emphasis on corporate responsibility and transparency, including executive compensation practices.

- Technological Advancements:Online platforms and social media have empowered shareholders to organize and communicate with each other more effectively, facilitating collective action and increasing their influence on corporate decision-making.

End of Discussion

The Amazon shareholder vote serves as a stark reminder that leaders must prioritize aligning executive compensation with company performance and shareholder expectations. It’s a wake-up call for businesses to rethink their compensation strategies, fostering a culture of transparency and accountability, and ensuring that executive pay reflects the true value they bring to the organization.

By embracing these principles, leaders can navigate the evolving landscape of corporate governance and build sustainable success for their companies.

The Amazon shareholder vote on executive pay is a stark reminder that aligning incentives with performance is crucial. While the company ultimately navigated the situation, it highlights the importance of transparency and accountability. This resonates with the recent news that the Ministry of Home Affairs in India is setting norms for tackling crypto-related crimes, mha body issues norms for crypto related crimes.

Both situations emphasize the need for clear guidelines and strong governance to manage evolving landscapes, whether it’s the complex world of executive compensation or the rapidly growing crypto ecosystem.